- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

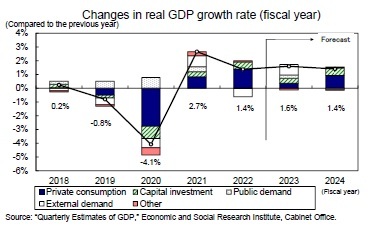

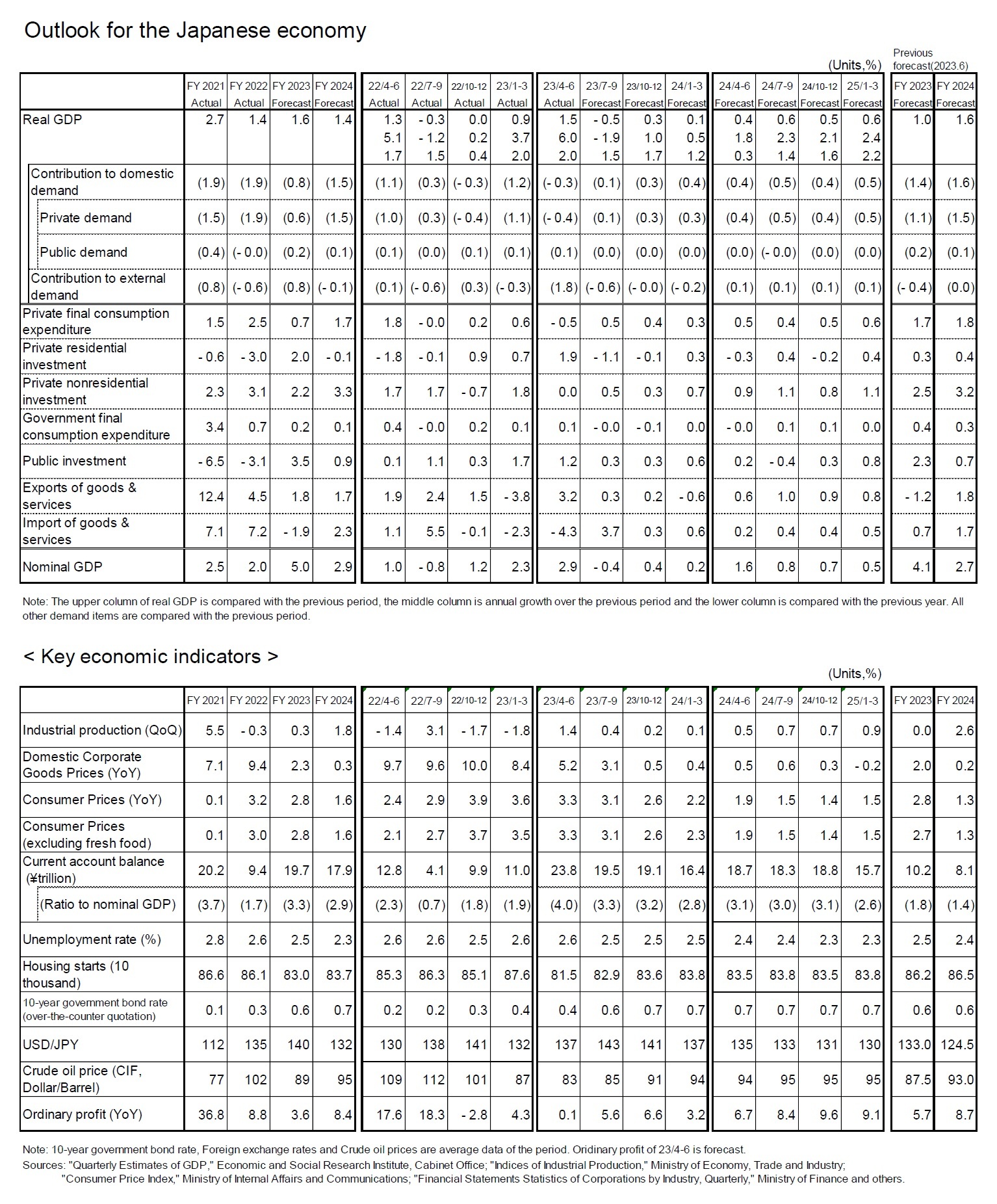

2.Real GDP growth rate is projected to be 1.6% in FY 2023 and 1.4% in FY 2024

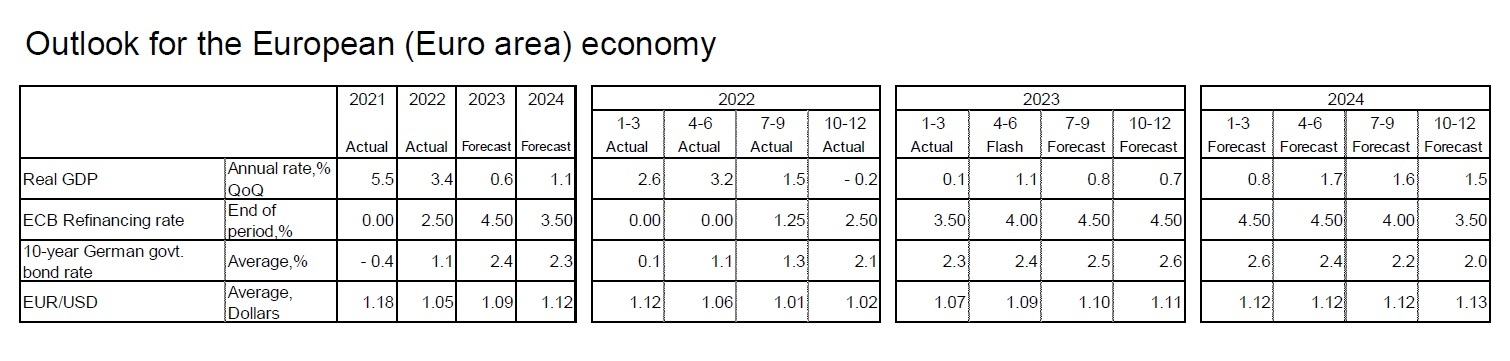

Although foreign demand played a pivotal role in propelling growth during the April-June quarter of 2023, the substantial increase in exports was primarily a response to the contraction witnessed in the January-March quarter. Looking ahead, exports of goods are likely to remain sluggish due to the slowdown in overseas economies, although exports of services will continue to increase from the July-September quarter, mainly as a result of inbound tourist demand. Exports are not expected to be the driving force of the economy in the near term. On the other hand, capital investment will continue to increase on the back of high levels of corporate earnings, while private consumption will recover, especially in face-to-face services, as socioeconomic activities normalize. Thus, the Japanese economy is expected to continue to grow, primarily as a consequence of domestic demand.

In the July-September quarter of 2023, real GDP is expected to decline for the first time in four quarters to -1.9% (annualized q-o-q). Imports will increase sharply in response to the decline in the April-June quarter (-4.3% from the previous quarter), whereas exports will remain low, and external demand will significantly depress the growth rate. Although domestic demand such as private consumption will remain resilient, negative growth will be unavoidable due to the large drop in external demand.

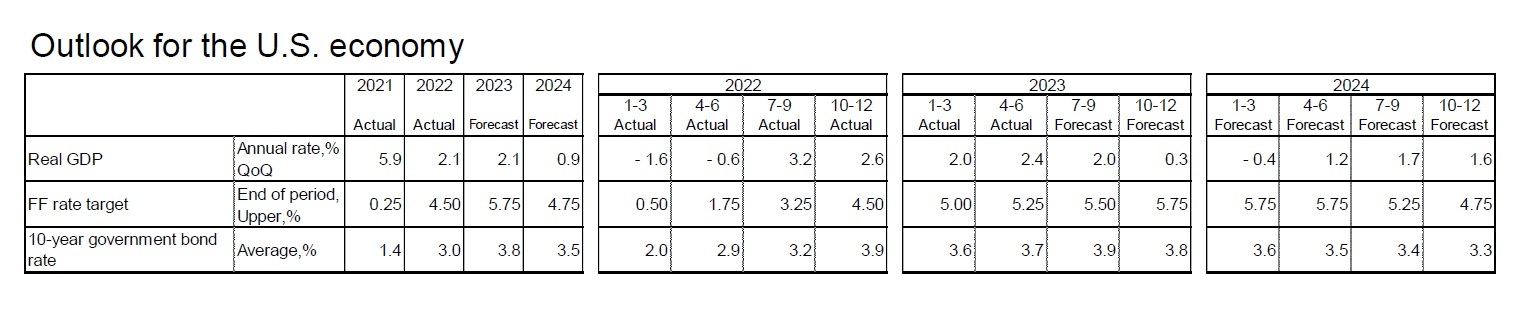

In the January-March quarter of 2024, when the U.S. economy is expected to experience slight negative growth, Japan’s annual growth rate will be in the low zero-percent range, mainly due to a decline in exports. However, after the start of fiscal 2024, when the overseas economy is expected o rebound, the growth rate will increase mainly thanks to a recovery in exports.

In the January-March quarter of 2024, when the U.S. economy is expected to experience slight negative growth, Japan’s annual growth rate will be in the low zero-percent range, mainly due to a decline in exports. However, after the start of fiscal 2024, when the overseas economy is expected o rebound, the growth rate will increase mainly thanks to a recovery in exports.Real GDP growth rate is projected to be 1.6% in FY 2023 and 1.4% in FY 2024. In FY 2024, while exports are expected to remain low, imports will outpace exports, reflecting the strength of domestic demand. This means that external demand is expected to make a small negative contribution to the growth rate. On the other hand, domestic demand is expected to slow down in FY 2023, mainly due to sluggish private consumption growth on the back of lower real incomes. Meanwhile, in FY 2024, domestic demand growth is likely to accelerate again because consumption growth will increase on the back of higher real incomes and capital investment will remain firm.

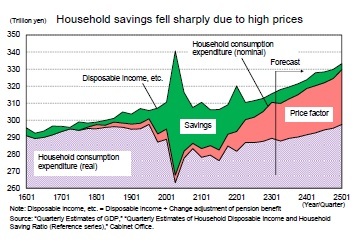

Private consumption in the April-June quarter of 2023 declined for the first time in three quarters, falling by 0.5% from the previous quarter. This decline can be attributed to factors such as the decrease in real purchasing power due to inflation. Additionally, the household savings rate has converged toward a standard level, and the stimulus from the reduction in the savings rate seems to have reached its limit, resulting in sluggish consumption.

The household savings rate, which averaged 1.2% from 2015–2019 prior to the onset of the COVID-19 pandemic, jumped to 21.4% in the April-June quarter of 2020. This substantial increase was a result of two key factors: the pronounced reduction in consumption following the declaration of a state of emergency in April 2020, and a significant rise in disposable income owing to the provision of special fixed benefits.

The variance in household savings from the normal level (2015–2019 average) in the January-March quarter of 2023 can be broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditures), and price factors (household consumption deflator). The increase in disposable income by 16.6 trillion yen, due to various COVID-19 related support measures by the government, as well as an increase in employer compensation, is a factor boosting savings. In addition, a decline in the level of real household consumption expenditure boosted savings by 4.7 trillion yen. Having said this, the greatly accelerated pace of price inflation has reduced savings by -19.8 trillion yen. As a result, household savings, which increased to 72.9 trillion yen (seasonally adjusted, annualized) in the April-June quarter of 2020, have declined to near normal levels of 5.0 trillion yen in the January-March quarter of 2023 (up by 1.5 trillion yen from the 2015–2019 average).

The variance in household savings from the normal level (2015–2019 average) in the January-March quarter of 2023 can be broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditures), and price factors (household consumption deflator). The increase in disposable income by 16.6 trillion yen, due to various COVID-19 related support measures by the government, as well as an increase in employer compensation, is a factor boosting savings. In addition, a decline in the level of real household consumption expenditure boosted savings by 4.7 trillion yen. Having said this, the greatly accelerated pace of price inflation has reduced savings by -19.8 trillion yen. As a result, household savings, which increased to 72.9 trillion yen (seasonally adjusted, annualized) in the April-June quarter of 2020, have declined to near normal levels of 5.0 trillion yen in the January-March quarter of 2023 (up by 1.5 trillion yen from the 2015–2019 average).

Private consumption is forecast to grow 0.7% y/y in FY 2023 and 1.7% y/y in FY 2024. The continued decline in real incomes due to the persistently high rate of price inflation in FY 2023 will suppress consumption growth, while the increase in real incomes due to the decline in the rate of price inflation in FY 2024 will boost consumption growth. In FY2024, consumption growth is expected to receive a boost from a rise in real income, driven by a decrease in the rate of price inflation.

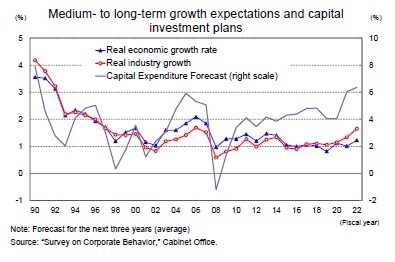

Capital investment is expected to remain stable, with a growth rate of 2.2% y/y in FY 2023 and 3.3% y/y in FY 2024.

A major influence on medium- to long-term capital investment trends is the expected growth rate of companies. One of the reasons why the expected growth rate has been sluggish for a long time can be attributed to the fact that many corporate managers have believed that a shrinking domestic market is inevitable under a declining population.

According to the Cabinet Office's " Survey on Business Behavior," the outlook for real economic growth for companies over the next three years remains low, at just 1.2% (surveyed in FY 2022). However, the outlook for real growth in industry demand, which had been lower than the outlook for real economic growth for 18 consecutive years since FY 1999, has exceeded the real economic growth rate since FY 2017, rising to 1.6% in FY 2022. In line with this, the outlook for capital investment also increased to 6.4% in FY 2022 (the annual average for the next three years and the highest level in approximately 30 years). The fact that industry demand growth expectations are improving is a positive factor in the outlook for capital investment.

According to the Cabinet Office's " Survey on Business Behavior," the outlook for real economic growth for companies over the next three years remains low, at just 1.2% (surveyed in FY 2022). However, the outlook for real growth in industry demand, which had been lower than the outlook for real economic growth for 18 consecutive years since FY 1999, has exceeded the real economic growth rate since FY 2017, rising to 1.6% in FY 2022. In line with this, the outlook for capital investment also increased to 6.4% in FY 2022 (the annual average for the next three years and the highest level in approximately 30 years). The fact that industry demand growth expectations are improving is a positive factor in the outlook for capital investment.

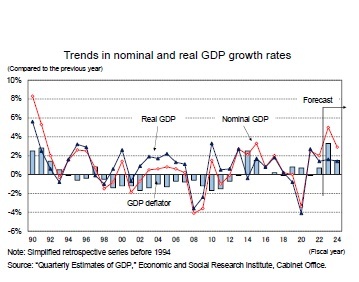

(Nominal GDP growth rate in FY 2023 set to be the highest it has been in 32 years)

(Nominal GDP growth rate in FY 2023 set to be the highest it has been in 32 years)The growth rate of nominal GDP continues to outpace that of real GDP. This divergence is driven by a pronounced rise in the GDP deflator, which is attributed to the escalation of the domestic demand deflator stemming from the propagation of higher import prices into domestic prices, the decline of import deflator, which is a deduction from GDP, mirroring the fall in oil prices. After increasing from 3.4% in the April-June quarter to 4.6% y/y in the July-September quarter, it is widely expected to peak out, but the GDP deflator in FY 2023 will be 3.3% y/y, a significant acceleration from the 0.7% y/y in FY 2022. As a result, nominal GDP growth rate in FY 2023 is expected to be 5.0%, the highest it has been in 32 years since FY 1991 (5.3%).2

2 Based on simplified retrospective series of GDP statistics.

Consumer Prices (excluding fresh food, hereinafter core CPI) grew to 4.2% y/y in January 2023 (the highest growth in 41 years and 4 months since September 1981) and has remained in the low 3% range since February due to government measures to ease the burden of electricity and city gas bills. However, the core core CPI (excluding fresh food and energy) has increased to the upper 4% range, further increasing the underlying upward pressure on prices.

The rise in import prices, which previously stood as the main cause of inflation, has now come to a halt. In July 2023, import prices were significantly negative (-14.1% y/y). Therefore, the rate of increase in goods prices is expected to slow down in the future as the trend to pass on raw material costs to prices gradually weakens.

On the other hand, while service prices have increased to the mid-1% range, base increases, which are highly linked to service prices, were around 2% in 2023. The pace of increase is likely to accelerate further in the future as the trend to pass on increased labor costs to prices spreads. T Moreover, given the extended time period over which prices have remained static, the pace of future service price increases is likely to be very fast.

The core CPI growth rate will slow from the current 3% level to the upper 2% level after the fall of 2023, but it will not fall below the BOJ's price target of 2% until after the beginning of 2024. This shift will occur when the deceleration in the rate of goods price growth becomes evident, owing to the diffusion of the impact from declining import prices, coinciding with the continual decrease in energy prices.

The core CPI growth rate will slow from the current 3% level to the upper 2% level after the fall of 2023, but it will not fall below the BOJ's price target of 2% until after the beginning of 2024. This shift will occur when the deceleration in the rate of goods price growth becomes evident, owing to the diffusion of the impact from declining import prices, coinciding with the continual decrease in energy prices.In regard to goods and services, most of the price increases in FY 2022 were caused by rises in goods, primarily energy and food (excluding fresh food and eating out). However, from FY 2023 to FY 2024, the focus of price increases will gradually shift from goods to services.

Core CPI is projected to be 2.8% y/y in FY 2023 and 1.6% y/y in FY 2024, after 3.0% y/y in FY 2022, and core core CPI is projected to be 3.7% y/y in FY 2023 and 1.3% y/y in FY 2024, after 2.2% y/y in FY 2022.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2023年08月22日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

関連レポート

- 2023・2024年度経済見通し(23年8月)

- QE速報:4-6月期の実質GDPは前期比1.5%(年率6.0%)の高成長-実質GDPの水準はコロナ禍前のピークを上回る

- 2023年4-6月期の実質GDP~前期比0.8%(年率3.1%)を予測~

- 雇用関連統計23年6月-宿泊・飲食サービス業の就業者数がコロナ禍前に近づく

- 鉱工業生産23年6月-4-6月期は3四半期ぶりの増産だが、前期の落ち込みは取り戻せず

- 消費者物価(全国23年7月)-補助率縮小に、円安、原油高が重なり、ガソリン、灯油価格は8月以降に大幅上昇へ

- ASEANの貿易統計(8月号)~6月の輸出は中国向けが改善も、域内向けが落ち込み前年割れ続く

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月06日

世の中は人間よりも生成AIに寛大なのか? -

2025年11月06日

働く人の飲酒量とリスク認識:適正化に気づくのはどのような人か -

2025年11月06日

Meta、ByteDanceのDSA違反の可能性-欧州委員会による暫定的見解 -

2025年11月06日

財政赤字のリスクシナリオ -

2025年11月06日

老後の住宅資産の利活用について考える

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023) 】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023) のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!