- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Economic Outlook for Fiscal Years 2023 and 2024 (May 2023)

2023年05月23日

文字サイズ

- 小

- 中

- 大

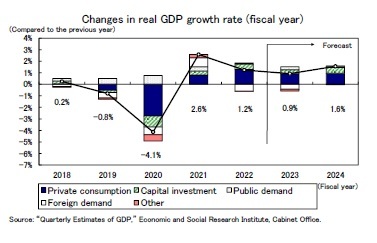

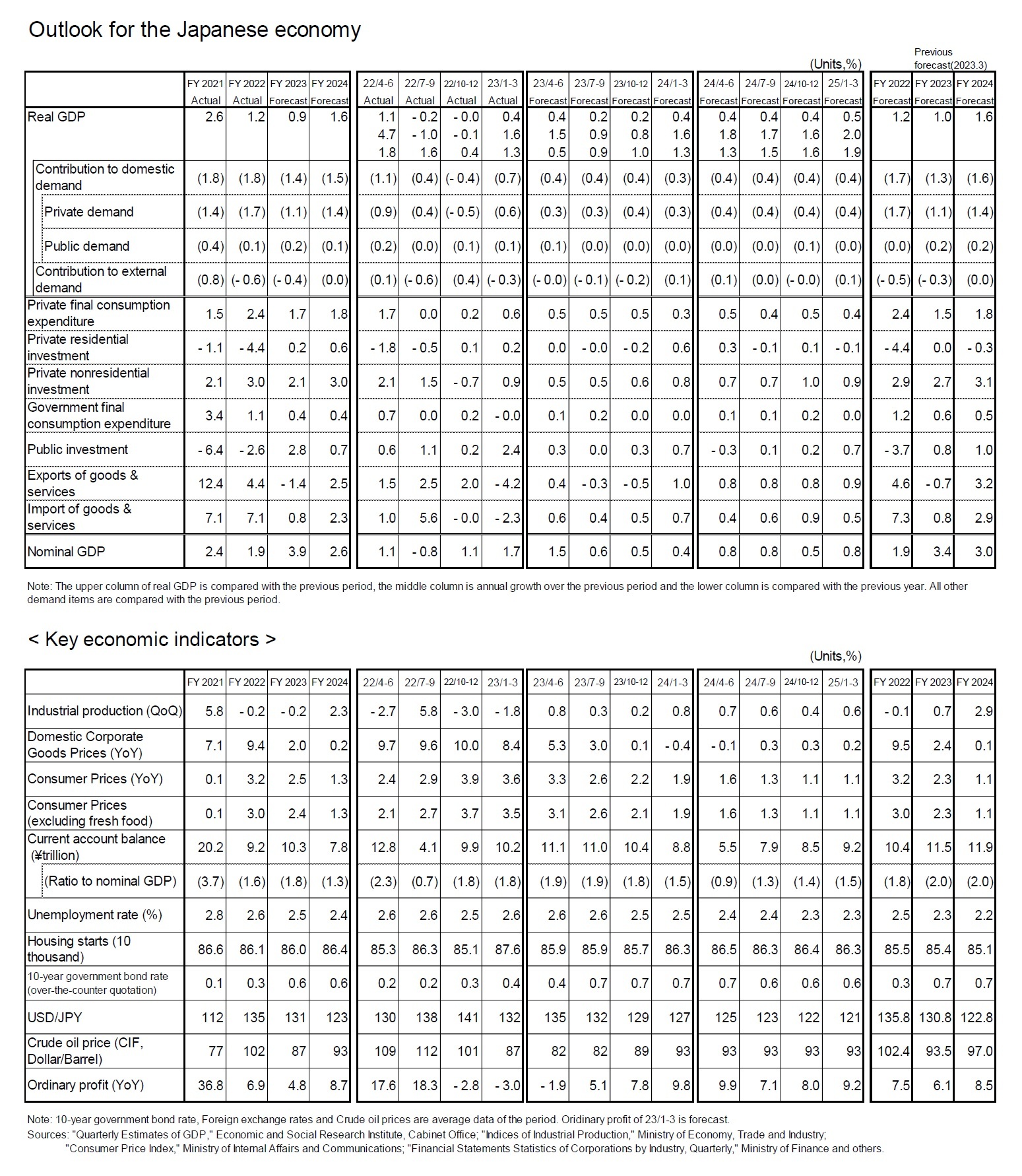

2.Real growth rate is forecast to be 0.9% in FY2023 and 1.6% in FY2024.

(Growth will continue to be supported by domestic demand)

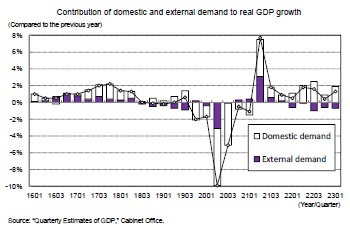

The reason why the Japanese economy as a whole has avoided a backslide even as exports and production have remained weak against the backdrop of the slowdown in overseas economies is that domestic demand has remained resilient. Considering the contribution that domestic and external demand have made to real GDP growth (y/y), it can be seen that external demand has been pushing down the growth rate since the January–March quarter of 2022, while domestic demand has continued to make a positive contribution since the April–June quarter of 2021.

The reason why the Japanese economy as a whole has avoided a backslide even as exports and production have remained weak against the backdrop of the slowdown in overseas economies is that domestic demand has remained resilient. Considering the contribution that domestic and external demand have made to real GDP growth (y/y), it can be seen that external demand has been pushing down the growth rate since the January–March quarter of 2022, while domestic demand has continued to make a positive contribution since the April–June quarter of 2021.

Indeed, while external demand is deteriorating, domestic demand remains resilient, as evidenced by the business sentiment of firms. The DI for the manufacturing sector (all sizes), which is strongly influenced by exports, peaked at +6 in the December 2021 survey and then declined, turning negative at -4 in the March 2023 survey, while the DI for the non-manufacturing sector (all sizes), which is more closely linked to domestic demand, turned positive in the June 2022 survey and has since risen to +12 in the March 2023 survey.

Indeed, while external demand is deteriorating, domestic demand remains resilient, as evidenced by the business sentiment of firms. The DI for the manufacturing sector (all sizes), which is strongly influenced by exports, peaked at +6 in the December 2021 survey and then declined, turning negative at -4 in the March 2023 survey, while the DI for the non-manufacturing sector (all sizes), which is more closely linked to domestic demand, turned positive in the June 2022 survey and has since risen to +12 in the March 2023 survey.The Japanese economy is expected to continue to grow primarily as a result of domestic demand, as exports are not expected to be the driving force of the economy in the foreseeable future due to sluggish overseas economies. In the April–June quarter of 2023, exports of goods and services are expected to grow at an annualized rate of 1.5%, roughly the same as that seen in the January–March quarter, as domestic demand, mainly private consumption, will remain firm.

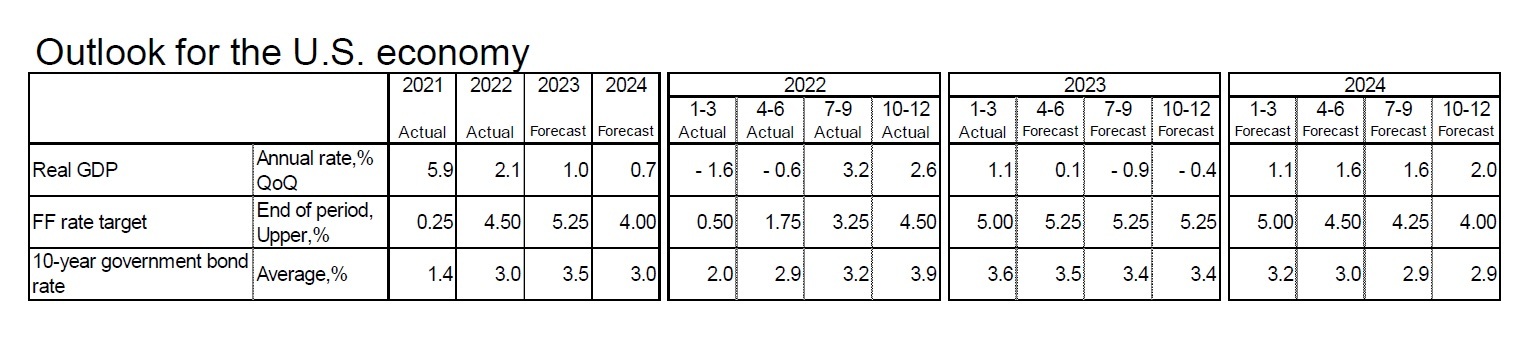

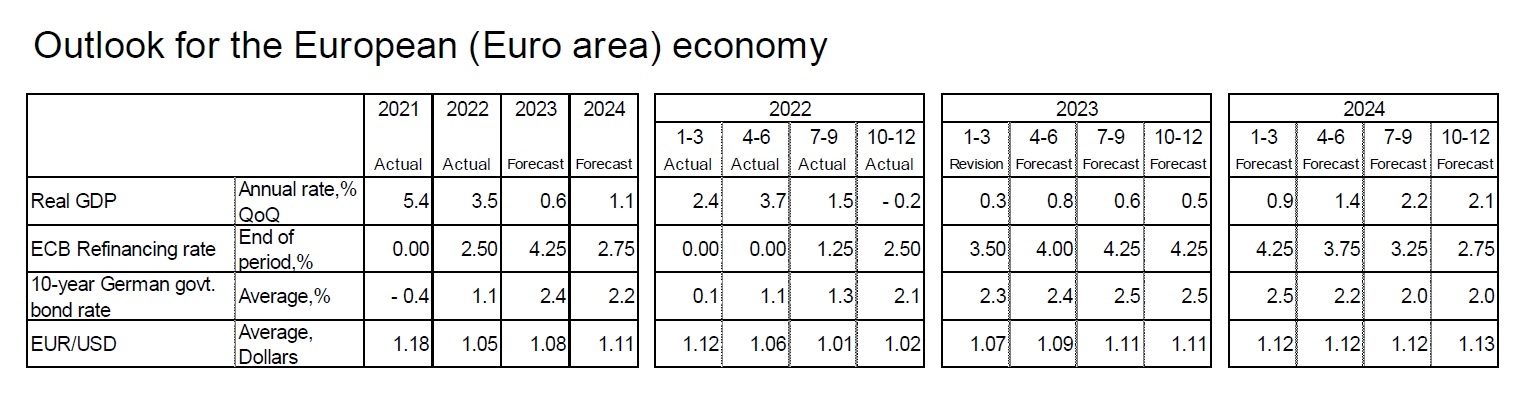

The growth rate will decelerate once to the zero percent level in the second half of 2023 when exports begin to decline due to the U.S. recession, but, after 2024, when the overseas economy is expected to recover, the growth rate will increase mainly due to a surge in exports.

Real GDP growth is projected to be 0.9% in FY2023 and 1.6% in FY2024. At present, our main scenario is that the U.S. recession will remain mild and Japan will maintain its recovery trend. However, if the U.S. recession becomes severe, Japan's exports will suffer a significant downturn thanks to the deterioration of the global economy, and a recession will become inevitable for Japan as well.

Real GDP in the January–March quarter of 2023 is 1.3% above the pre-COVID-19 level (October–December 2019) but 1.5% below the most recent peak (July–September 2019). We expect real GDP to recover to the level of the most recent peak in the April–June 2024 quarter. It took more than five years (22 quarters) for the level of real GDP to recover from its most recent peak at the time of the global financial crisis, and it is increasingly likely that it will take a comparable amount of time for the economy to recover from the current COVID-19 pandemic.

Real GDP in the January–March quarter of 2023 is 1.3% above the pre-COVID-19 level (October–December 2019) but 1.5% below the most recent peak (July–September 2019). We expect real GDP to recover to the level of the most recent peak in the April–June 2024 quarter. It took more than five years (22 quarters) for the level of real GDP to recover from its most recent peak at the time of the global financial crisis, and it is increasingly likely that it will take a comparable amount of time for the economy to recover from the current COVID-19 pandemic.

(Outlook for inflation)

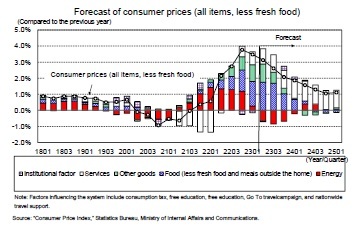

Consumer prices (total, excluding fresh food; hereinafter core CPI) rose by 4.2% y/y in January 2023, the highest growth in 41 years and 4 months since September 1981, primarily as a consequence of higher energy and food prices, before falling sharply to 3.1% y/y in February, mainly due to government measures designed to ease the burden of electricity and city gas bills. However, the underlying upward pressure on prices has further increased, as the pace of increase in the CPI ( excluding fresh food and energy) has accelerated significantly.

Core CPI growth will likely increase in April due to the fiscal year's price increases across a wide range of items, before slowing to around 3% in May, mainly due to an accelerating decline in electricity prices as a result of the reduction in the levy for promoting renewable energy generation.

The implementation of electricity rate hikes applied for by electric power companies and the reduction of the government's burden mitigation measures in October will push up electricity prices, but energy prices are likely to remain negative year-on-year due to the compression of price hikes compared to the original application and the decline in fuel prices, including crude oil and LNG, which are likely to remain negative year-on-year.

On the other hand, food (excluding fresh food) is increasingly shifting higher raw material costs to prices, with the rate of increase in March 2023 at 8.2%, exceeding the growth of food and beverage in the domestic corporate goods price (7.0% y/y in April 2023), which is upstream of the consumer price index. Based on the already-published results for Tokyo wards in April, it is highly probable that the inflation rate of food (excluding fresh food) will accelerate to the 9% level in April.

However, the rise in import prices, which had been the main cause of high prices, has since halted due to a lull in the rise in crude oil prices and the depreciation of the yen. As a result, the rate of increase in goods prices is expected to slow down in the future as the trend of passing on raw material costs to prices gradually weakens.

Consumer prices (total, excluding fresh food; hereinafter core CPI) rose by 4.2% y/y in January 2023, the highest growth in 41 years and 4 months since September 1981, primarily as a consequence of higher energy and food prices, before falling sharply to 3.1% y/y in February, mainly due to government measures designed to ease the burden of electricity and city gas bills. However, the underlying upward pressure on prices has further increased, as the pace of increase in the CPI ( excluding fresh food and energy) has accelerated significantly.

Core CPI growth will likely increase in April due to the fiscal year's price increases across a wide range of items, before slowing to around 3% in May, mainly due to an accelerating decline in electricity prices as a result of the reduction in the levy for promoting renewable energy generation.

The implementation of electricity rate hikes applied for by electric power companies and the reduction of the government's burden mitigation measures in October will push up electricity prices, but energy prices are likely to remain negative year-on-year due to the compression of price hikes compared to the original application and the decline in fuel prices, including crude oil and LNG, which are likely to remain negative year-on-year.

On the other hand, food (excluding fresh food) is increasingly shifting higher raw material costs to prices, with the rate of increase in March 2023 at 8.2%, exceeding the growth of food and beverage in the domestic corporate goods price (7.0% y/y in April 2023), which is upstream of the consumer price index. Based on the already-published results for Tokyo wards in April, it is highly probable that the inflation rate of food (excluding fresh food) will accelerate to the 9% level in April.

However, the rise in import prices, which had been the main cause of high prices, has since halted due to a lull in the rise in crude oil prices and the depreciation of the yen. As a result, the rate of increase in goods prices is expected to slow down in the future as the trend of passing on raw material costs to prices gradually weakens.

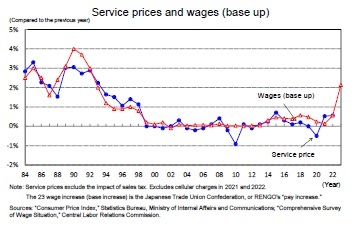

Meanwhile, service prices, which had continued to fall, began to rise in August 2022 before reaching 1.5% y/y in March 2023. Service prices are highly linked to wages, but, at present, the main cause of the rise in service prices is the dramatic increase in general food service (7.6% y/y in March 2023), which accounts for a high proportion of raw material costs among services. However, it is expected that there will be a further increase in the shift of increased labor costs to prices as a result of wage hikes; taking into account that base increases in 2023 are expected to be around 2%, the rate of service price increases is likely to rise to the 2% level after the start of the fiscal year 2023. The pace of future service price increases is likely to be very fast given the absence of price increases for an extended period of time.

Meanwhile, service prices, which had continued to fall, began to rise in August 2022 before reaching 1.5% y/y in March 2023. Service prices are highly linked to wages, but, at present, the main cause of the rise in service prices is the dramatic increase in general food service (7.6% y/y in March 2023), which accounts for a high proportion of raw material costs among services. However, it is expected that there will be a further increase in the shift of increased labor costs to prices as a result of wage hikes; taking into account that base increases in 2023 are expected to be around 2%, the rate of service price increases is likely to rise to the 2% level after the start of the fiscal year 2023. The pace of future service price increases is likely to be very fast given the absence of price increases for an extended period of time.

The core CPI growth rate will slow from the current 3% level to the upper 2% level over the summer but will remain high at the 2% level until around the end of 2023. We expect the core CPI growth rate to fall below the BOJ's price target of 2% after the beginning of 2024, when the pace of increase in food and other goods prices will surely slow as the impact of falling import prices spreads amid the continued decline in energy prices.

The core CPI growth rate will slow from the current 3% level to the upper 2% level over the summer but will remain high at the 2% level until around the end of 2023. We expect the core CPI growth rate to fall below the BOJ's price target of 2% after the beginning of 2024, when the pace of increase in food and other goods prices will surely slow as the impact of falling import prices spreads amid the continued decline in energy prices.Most of the price increases in FY2022 were caused by rises in goods prices, primarily energy and food (excluding fresh food and eating out), but in FY2023 goods prices and services prices will contribute roughly the same amount, followed by a shift to service-centered price increases in FY2024.

Core CPI growth is projected to be 3.0% y/y in FY2022, followed by 2.4% y/y in FY2023 and 1.3% y/y in FY2024.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2023年05月23日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/24 | 消費者物価(全国25年9月)-コアCPI上昇率は拡大したが、先行きは鈍化へ | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/22 | 貿易統計25年9月-米国向け自動車輸出が数量ベースで一段と落ち込む。7-9月期の外需寄与度は前期比▲0.4%程度のマイナスに | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月29日

生活習慣病リスクを高める飲酒の現状と改善に向けた対策~男女の飲酒習慣の違いに着目して -

2025年10月29日

地域イベントの現実と課題-渋谷のハロウィンをイベントとして運営できるか- -

2025年10月28日

試練の5年に踏み出す中国(前編)-「第15次五カ年計画」の5年間は、どのような5年か -

2025年10月28日

地域医療連携推進法人の現状と今後を考える-「連携以上、統合未満」で協力する形態、その将来像は? -

2025年10月28日

東宝の自己株式取得-公開買付による取得

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Economic Outlook for Fiscal Years 2023 and 2024 (May 2023)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Economic Outlook for Fiscal Years 2023 and 2024 (May 2023)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!