- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

1.Positive growth of 3.1% on an annualized basis in the April-June quarter of 2024

Exports of goods and services increased by 1.4% from the previous quarter, marking the first increase in the last two quarters; however, this was outpaced by a 1.7% rise in imports of goods and services, resulting in a -0.1% (annualized -0.4%) drag on external demand growth. The recovery in automobile production in the April-June quarter of 2024 from the previous quarter, driven by the easing of the certification fraud issue, contributed to boosting private consumption and capital investment.

The positive growth in the April-June quarter of 2024 is largely a reaction to the sharp decline in the previous quarter (-2.3% on an annualized basis), and the economy does not appear to have fully emerged from this back-and-forth pattern. In particular, the household sector has faced significant challenges since the COVID-19 pandemic. Although private consumption and residential investment increased in the April-June quarter of 2024, their levels remained lower (-1.1% and -12.0%, respectively) than the pre-COVID-19 levels (2019 average). To confirm a sustained recovery in the Japanese economy, the trends identified in the July-September quarter and onward must be closely monitored.

The Japanese yen continued to decline with reference to the US dollar due to the widening interest rate differential between the two countries, with the yen weakening to approximately 160 yen per dollar from the end of June to early July 2024. However, the yen began to appreciate against the dollar in mid-July as a reaction to factors such as the slowdown in the US consumer price index and the declaration by Donald Trump to correct the strong dollar. The Bank of Japan raised its policy rate on July 31, while the US employment report for July significantly undershot expectations and raised concerns of a possible US recession. These factors led to a sharp appreciation of the yen to 140 yen per dollar.

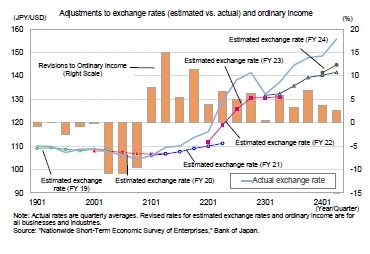

According to the June 2024 BOJ Tankan survey, the FY2024 current profit plan (all sizes, all industries) predicts a decrease of 7.5% year-over-year, with the assumed exchange rate for FY2024 set at ¥144.77 to the dollar across all sizes and industries. Since 2021, the actual exchange rate has been weaker than the assumed rate, resulting in upward revisions to earnings forecasts. For example, the assumed exchange rate for FY2023 was originally ¥131.72 to the dollar (as of March 2023), whereas the actual exchange rate was greater than 10 yen weaker than this figure (¥144.6 to the dollar FY2023 average) This resulted in a significant upward revision of current profits from the initially forecasted -2.6% to a revised 12.4% year-over-year.

According to the June 2024 BOJ Tankan survey, the FY2024 current profit plan (all sizes, all industries) predicts a decrease of 7.5% year-over-year, with the assumed exchange rate for FY2024 set at ¥144.77 to the dollar across all sizes and industries. Since 2021, the actual exchange rate has been weaker than the assumed rate, resulting in upward revisions to earnings forecasts. For example, the assumed exchange rate for FY2023 was originally ¥131.72 to the dollar (as of March 2023), whereas the actual exchange rate was greater than 10 yen weaker than this figure (¥144.6 to the dollar FY2023 average) This resulted in a significant upward revision of current profits from the initially forecasted -2.6% to a revised 12.4% year-over-year.Although the current exchange rate is slightly weaker than the assumed rate, once the actual rate surpasses the assumed rate, the risk of downward revisions to corporate earnings increases.

This forecast assumes that the US will begin lowering interest rates in September 2024 while Japan raises its policy rate (unsecured overnight call rate) from the current 0.25% to 0.75% by the end of FY2025, leading to yen appreciation to 136 yen to the dollar by the end of FY2025.

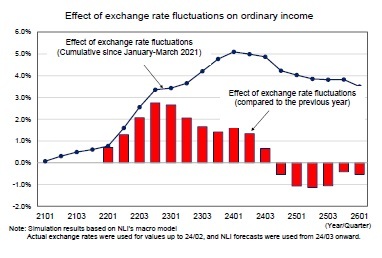

This forecast assumes that the US will begin lowering interest rates in September 2024 while Japan raises its policy rate (unsecured overnight call rate) from the current 0.25% to 0.75% by the end of FY2025, leading to yen appreciation to 136 yen to the dollar by the end of FY2025.Using our macroeconomic model, we estimate that the impact of exchange rate fluctuations on current profits from 2021 onward has consistently positive due to yen depreciation. However, this cumulative boost is expected to peak in the January-March quarter of 2024, begin to decline, and become negative on a year-over-year basis from the October-December 2024 quarter onward.

Since 2021, exports have remained relatively flat despite the significant depreciation of the yen. This stagnation is partially the result of a slowdown in overseas economies, supply constraints such as semiconductor shortages, and the shutdown of automobile plants due to the certification fraud issue. In addition, exports may have become less sensitive to exchange rate fluctuations. For example, companies previously tended to lower contract currency prices during periods of yen depreciation to boost export volumes and expand their overseas market share. However, during the current yen depreciation phase, which bottomed out in the April-June quarter of 2020, the export price index in contract currency terms has continued to rise, indicating that companies are maintaining prices to secure revenue in value terms as opposed to increasing export volumes.

The increase in price competitiveness due to yen depreciation did not lead to a significant rise in export volumes; therefore, the downward pressure on export volumes from yen appreciation is also expected to be limited. The major determinant of future exports will more likely be the income factor, namely the growth rate of overseas economies.

In terms of overseas economic conditions, US real GDP growth is expected to slow from 2.5% in 2024 to 1.6% in 2025, partly due to the cumulative effects of monetary tightening. In contrast, real GDP growth in the Eurozone (0.4% year-over-year in 2023), is expected to gradually recover to 0.7% in 2024 and 1.4% in 2025, although a strong recovery is not anticipated. China's real GDP growth accelerated from 3.0% in 2022 to 5.2% in 2023 due to the cancellation of the zero-COVID policy; however, this growth is expected to decelerate to 4.8% in 2024 and 4.3% in 2025, reflecting the ongoing slowdown in the real estate market. Overall, overseas economies are expected to recover moderately through FY2025, although the growth rates will remain at low levels.

The global adjustment in IT-related goods appears to be reaching a turning point, which is an encouraging sign. For example, global semiconductor sales, which have been declining year-over-year since the summer of 2019 and bottomed out in the spring of 2023, are now showing double-digit growth year-over-year. In addition, the domestic balance of shipments and inventories of electronic components and devices (shipments year-over-year minus inventories year-over-year) was positive in the July-September quarter of 2023 for the first time in eight quarters and remained positive for the next four consecutive quarters. Although export growth is unlikely to accelerate significantly due to continued low growth in overseas economies, the recovery trend is expected to continue, especially in IT-related goods. The GDP statistics relating to the exports of goods and services are forecasted to rise moderately by 2.0% year-over-year in FY2024 and 2.8% in FY2025.

According to the "Status of Spring Wage Hike Demands and Compensation Results of Major Private Corporations" released by the Ministry of Health, Labour and Welfare on August 2, 2024, the wage increase rate for 2024 was 5.33%. This corresponds to a 1.73 percentage point boost from the 3.60% reported in 2023, marking the first time since 1991 (5.65%) that the rate has exceeded 5%. Furthermore, RENGO's "2024 Spring Wage Struggle Final Response Tabulation Results" states that the average wage increase in 2024 was 5.10% and the "portion of wage increase" that corresponded to the base increase was 3.56% (2.12% in 2023).

The real wage growth rate (nominal wages adjusted for consumer prices) has been negative since April 2022, but turned positive in June 2024, marking the first positive figure in two years and three months. However, this June turnaround was mainly due to a significant 7.6% year-over-year increase in special cash earnings, while regular cash earnings (scheduled earnings plus overtime earnings) remained negative, with a -1.1% year-over-year change in real terms. Most summer bonuses are paid in June and July; however, according to the Monthly Labour Survey, more establishments paid their summer bonuses in June compared to the previous year, which may have contributed to the high growth in special cash earnings in June. Special payroll growth is expected to slow significantly in July and possibly result in negative real wage growth.

Real wage growth is predicted to stabilize and become positive from October to December 2024 onward, as the results of the 2024 Spring Wage Negotiations are reflected, with nominal wage growth (total cash earnings) led by scheduled earnings expected to be in the 3% range year-over-year. Meanwhile, the consumer price index (excluding imputed rent), which is currently approximately 3%, is expected to approach 2% range. The current forecast assumes that the wage hike rate in the 2025 Spring Wage Negotiations will slow to 4.50%, which is lower than the 2024 rate, but higher than that of 2023 (3.60%). Although yen appreciation will dampen corporate earnings growth, the continued strong sense of labor shortages in the corporate sector and the high consumer price index are expected to boost the wage hike rate.

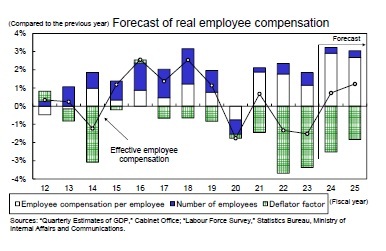

Nominal employee compensation increased by 1.9% year-over-year in FY2023, marking the third consecutive year of growth. However, real employee compensation declined by 1.5% year-over-year for the second consecutive year due to high consumer price inflation. Nominal employee compensation is expected to maintain strong growth by increasing 3.2% year-over-year in FY2024 and 3.1% year-over-year in FY2025. Similarly, real employee compensation is forecasted to increase 0.7% year-over-year in FY2024, the first increase in three years, and 1.2% year-over-year in FY2025, supported by a slower rate of price increases.

Nominal employee compensation increased by 1.9% year-over-year in FY2023, marking the third consecutive year of growth. However, real employee compensation declined by 1.5% year-over-year for the second consecutive year due to high consumer price inflation. Nominal employee compensation is expected to maintain strong growth by increasing 3.2% year-over-year in FY2024 and 3.1% year-over-year in FY2025. Similarly, real employee compensation is forecasted to increase 0.7% year-over-year in FY2024, the first increase in three years, and 1.2% year-over-year in FY2025, supported by a slower rate of price increases.

(2024年08月26日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月04日

今週のレポート・コラムまとめ【10/28-10/31発行分】 -

2025年10月31日

交流を広げるだけでは届かない-関係人口・二地域居住に求められる「心の安全・安心」と今後の道筋 -

2025年10月31日

ECB政策理事会-3会合連続となる全会一致の据え置き決定 -

2025年10月31日

2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ -

2025年10月31日

保険型投資商品の特徴を理解すること(欧州)-欧州保険協会の解説文書

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!