- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)

Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

1.Economic Performance in the July–September Quarter of 2023

This decline was accompanied by a second consecutive quarter of private consumption remaining muted (−0.0% from the previous quarter) due to the adverse impact of high prices. Simultaneously, there were declines in both business fixed investment (−0.6% from the previous quarter) and private residential investment (−0.1% from the previous quarter), resulting in a downturn across all components of domestic private demand.

Although exports increased for the second successive quarter (up 0.5% from the previous quarter), imports surged for the first time in three quarters with an increase of 1.0%, surpassing export growth. This led to a negative foreign demand contribution to growth of −0.1% from the previous quarter (−0.5% on an annualized basis).

The negative growth, reflects, in part, the significant expansion observed in the April–June quarter (4.5% on an annualized basis). What is concerning, however, is the stagnation seen in domestic private demand, including in consumption and business fixed investment, despite the normalization of socioeconomic activities.

While nominal GDP had its first decline in four quarters (−0.0% from the previous quarter; −0.2% on an annualized basis), the nominal GDP growth rate was higher than the real GDP growth rate. This is seen in the GDP deflator’s rise of 0.5% from the previous quarter (as compared to 1.4% in the April–June quarter) and a substantial 5.1% increase from the previous year (against 3.5% in the April–June quarter). The growth in the GDP deflator was driven by a 0.3% increase in the domestic demand deflator from the previous quarter (versus 0.7% in the April–June quarter) and a 2.8% surge in the export deflator, which surpassed the growth in the import deflator (1.9% from the previous quarter), contributing to the boost in the GDP deflator.

Despite global economic growth holding steady at around 3%, based on our estimates, global trade volume has, exhibited a consistent downward trend since its year-on-year decline in the October–December quarter of the previous year. The non-manufacturing sector has displayed signs of recovery, attributed partly to pent-up demand in the post-COVID-19 period. However, a full-scale rebound is impeded by ongoing stagnation in the manufacturing sector resulting from IT-related inventory adjustments and other factors. While the global Purchasing Managers’ Index (PMI) indicates business confidence for the non-manufacturing sector above the neutral level of 50, the manufacturing sector has remained below that level since September 2022.

We expect the U.S. real GDP from 4.9% on an annualized basis in the July–September quarter of 2023 to 1.0%in the October–December quarter of 2023 and 0.4% in the January–March quarter of 2024. Meanwhile, the Eurozone which grew at -2.0 on an annualized basis from the previous quarter, is expected to sustain near-zero growth at 0.3% year-on-year in the October–December quarter of 2023. Despite China’s real GDP growth being expected to rise from 3.0% in 2022 to the 5% range in 2023, it is anticipated to dip to the 4% range in 2024 and 2025.

Consequently, the rate of growth of the global economy, calculated based on Japan’s export weights, is projected to decelerate significantly from approximately 6% in 2021 to around 3% from 2023 to 2025, remaining below the average rate of 4% achieved since 1980. In line with this trend, Japan’s exports are expected to taper from 4.5% in FY 2022 to 3.2% in FY 2023, further declining to 1.8% in FY 2024 and slightly rebounding to 2.4% in FY 2025. This signifies that exports are unlikely to drive the economy in the foreseeable future.

The government recently approved “Comprehensive Economic Measures to End Deflation Completely” and proposed additional general account expenditures of 13.1 trillion yen for the FY 2023 supplementary budget. These measures are intended to address multiple issues, including protecting against high prices, promoting sustainable wage increases, encouraging domestic investment, addressing population decline, and bolstering national resilience and disaster prevention.

The government’s estimation of a 1.2% boost in potential real GDP per year over the next three years might be overly optimistic. The size of the supplementary budget has been shrinking since FY 2021, and it is likely that the budget may not be fully utilized, given the significant unspent amounts in previous fiscal years.

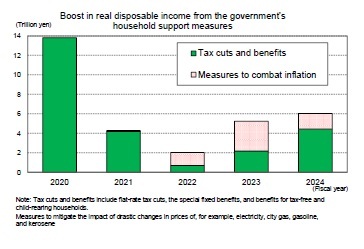

However, measures such as reductions in income and inhabitant taxes, additional benefits for low-income earners, and enhanced efforts to reduce electricity, city gas, gasoline, and kerosene costs are expected to contribute to increases in household’s real disposable incomes. These initiatives are estimated to elevate real disposable income by 5.2 trillion yen in FY 2023 and by 6.0 trillion yen in FY 2024.

Nonetheless, the temporary nature of tax cuts and benefits might limit their impact on consumption compared to more permanent increases in income, like wage hikes. Past analyses by the Cabinet Office indicate that previous flat-rate benefits and regional development coupons had a consumption-boosting effect of approximately 20 to 30% of the benefit amount. Despite combined income and inhabitant tax cuts and benefits amounting to around 5 trillion yen, the anticipated boost to personal consumption might reach only around 0.4%, equivalent to 0.2% of GDP.

Nonetheless, the temporary nature of tax cuts and benefits might limit their impact on consumption compared to more permanent increases in income, like wage hikes. Past analyses by the Cabinet Office indicate that previous flat-rate benefits and regional development coupons had a consumption-boosting effect of approximately 20 to 30% of the benefit amount. Despite combined income and inhabitant tax cuts and benefits amounting to around 5 trillion yen, the anticipated boost to personal consumption might reach only around 0.4%, equivalent to 0.2% of GDP.

In 2023’s Spring Labor Offensive, the rate of wage increases reached 3.60%, marking the highest level in 30 years, according to data from the Ministry of Health, Labour, and Welfare. Looking at the environment surrounding the spring labor offensive in 2024, labor supply and demand have remained tight, with the ratio of job offers to applicants remaining well above 1 and the unemployment rate in the mid 2% range. Ordinary profits are at a record high level and consumer prices have remained high. The conditions for continued wage hikes appear favorable.

RENGO raised its demand for a wage increase in the 2023 spring offensive to around 5%; this level is higher than the previous year’s demand of around 4% (including the portion equivalent to regular salary increases). Their basic plan for the 2024 spring offensive suggests a slight increase in demand to 5% or more. We anticipate a 3.70% wage increase rate for the 2024 Spring Offensive, slightly exceeding the increase in the previous year.

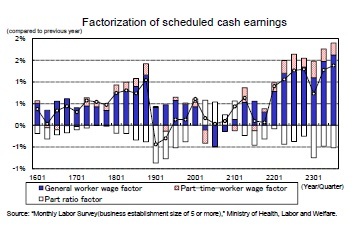

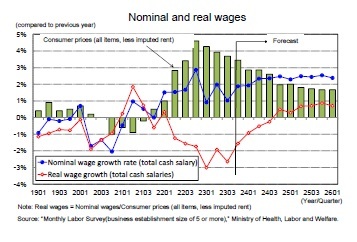

Compared to the previous year, nominal wages showed growth of 2.0% in the April–June quarter of 2023 and 1.0% in the July–September quarter of 2023, which is low despite the fact that the spring wage increase rate in 2023 was the highest in 30 years. Stagnation in non-scheduled cash earnings, reflective of sluggish production activities, and a rising proportion of part-time workers with lower wages have subdued average wage growth.

Compared to the previous year, nominal wages showed growth of 2.0% in the April–June quarter of 2023 and 1.0% in the July–September quarter of 2023, which is low despite the fact that the spring wage increase rate in 2023 was the highest in 30 years. Stagnation in non-scheduled cash earnings, reflective of sluggish production activities, and a rising proportion of part-time workers with lower wages have subdued average wage growth.

However, according to the Labour Force Survey by the Statistics Bureau of Internal Affairs and Communications, there has been a decline in the ratio of non-regular to all employees for two consecutive quarters – April–June and July–September of 2023. The decline in this ratio in recent quarters indicates a potential halt in the increase of part-time workers, while special cash earnings are expected to rise as a result of robust corporate earnings. Moreover, as production activities recover, non-scheduled cash earnings are anticipated to pick up gradually. Nonetheless, real wages have been declining since April 2022 due to accelerated consumer price inflation, and it is anticipated that the rate of change in real wages will only turn positive in the latter half of FY2024 when the inflation rate is projected to drop below 2%.

However, according to the Labour Force Survey by the Statistics Bureau of Internal Affairs and Communications, there has been a decline in the ratio of non-regular to all employees for two consecutive quarters – April–June and July–September of 2023. The decline in this ratio in recent quarters indicates a potential halt in the increase of part-time workers, while special cash earnings are expected to rise as a result of robust corporate earnings. Moreover, as production activities recover, non-scheduled cash earnings are anticipated to pick up gradually. Nonetheless, real wages have been declining since April 2022 due to accelerated consumer price inflation, and it is anticipated that the rate of change in real wages will only turn positive in the latter half of FY2024 when the inflation rate is projected to drop below 2%.

(2023年11月22日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月14日

マレーシアGDP(2025年7-9月期)~内需は底堅く、外需は純輸出が改善 -

2025年11月14日

保険と年金基金における各種リスクと今後の状況(欧州 2025.10)-EIOPAが公表している報告書(2025年10月)の紹介 -

2025年11月14日

中国の不動産関連統計(25年10月)~販売が一段と悪化 -

2025年11月14日

英国GDP(2025年7-9月期)-前期比0.1%で2四半期連続の成長減速 -

2025年11月14日

家計消費の動向(二人以上世帯:~2025年9月)-「メリハリ消費」継続の中、前向きな変化の兆しも

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!