- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

1.6.0% annualized positive growth in April-June quarter 2023 from the previous quarter

Exports increased by 3.2% from the previous quarter, while imports decreased by -4.3% over the same period. This boosted the growth rate significantly, with foreign demand contributing 1.8% from the previous quarter (7.2% annualized). Exports of goods and services rose by 3.3% from the previous quarter due to the easing of supply chain constraints, particularly for automobiles, while services also increased by 2.9% from the previous quarter, primarily thanks to a recovery in inbound tourist demand following the relaxation and removal of border measures.

By contrast, private consumption fell for the first time in three quarters (-0.5% from the previous quarter) due to the impact of inflation, while capital investment remained flat (0.0% from the previous quarter), resulting in the first decline in domestic demand in two quarters (-0.3% from the previous quarter).

During the April-June quarter of 2023, growth exceeded initial expectations, primarily driven by an upswing in foreign demand. However, the increase in exports was largely a response to the decline experienced in the January-March quarter, while the significant fall in imports can be viewed as a reflection of sluggish domestic demand. Overall, then, the economy is not as strong as the growth rate indicates.

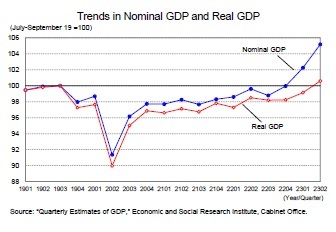

Nominal GDP increased for the third consecutive quarter at 2.9% from the previous quarter (12.0% annualized), while the GDP deflator was 1.4% from the previous quarter and 3.4% y-o-y. The domestic demand deflator was boosted by a 0.5% from the previous quarter due to the spread of price transfers from higher import prices, and a -3.2% decline from the previous quarter in the import deflator, reflecting the drop in oil prices, which was less than the 0.7% growth in the export deflator. This pushed up the GDP deflator.

The level of real GDP in the April-June quarter of 2023 was 0.6% higher than the pre-COVID-19 peak (July-September quarter of 2019). Nominal GDP also significantly outpaced real growth for three consecutive quarters: the October-December 2022 quarter (4.9% annualized q-o-q), the January-March quarter (9.5% annualized q-o-q), and the April-June quarter (12.0% annualized q-o-q). The April-June quarter of 2023, meanwhile, was 5.2% higher than the pre-COVID-19 peak (July-September quarter 2019).

The level of real GDP in the April-June quarter of 2023 was 0.6% higher than the pre-COVID-19 peak (July-September quarter of 2019). Nominal GDP also significantly outpaced real growth for three consecutive quarters: the October-December 2022 quarter (4.9% annualized q-o-q), the January-March quarter (9.5% annualized q-o-q), and the April-June quarter (12.0% annualized q-o-q). The April-June quarter of 2023, meanwhile, was 5.2% higher than the pre-COVID-19 peak (July-September quarter 2019).

Exports grew strongly in the April-June quarter of 2023, which in turn boosted growth. However, it remains questionable as to whether this rate of export recovery is sustainable.

In the April-June quarter, the real exports of the Bank of Japan increased by 2.7% from the previous quarter, representing the first increase in three quarters. In terms of goods, while automotive-related exports grew strongly due to the easing of supply constraints, information-related exports continued to decline thanks to weak global demand for semiconductor-related goods; similarly, capital goods and intermediate goods also experienced a weakening trend. The global PMI, a gauge of global business confidence, has long maintained a level above the neutral mark of 50 for the non-manufacturing sector. However, more recently, it has declined due to a lull in pent-up demand and has remained below 50 for the manufacturing sector since September 2022. More broadly, the global manufacturing cycle, which has a significant impact on Japan's exports, is experiencing an ongoing downtrend.

Our forecasts indicate that the U.S. economy will fall to almost zero growth, with an annual growth rate of 0.3% (annualized q-o-q) in the October-December quarter of 2023 and -0.4% (annualized q-o-q) in the January-March quarter of 2024. This anticipated slowdown is attributed to the cumulative effects of monetary tightening. Meanwhile, in the Eurozone, growth will remain below 1% from the latter half of 2023 to the early half of 2024, although it is unlikely to enter negative territory. In addition, China will see its real GDP growth rate increase to the 5% range in 2023 following the end of its zero-COVID-19 policy from the 3.0% observed in 2022. However, it is then predicted to decline to the 4% range in 2024.

As a result, the growth rate of the overseas economy, weighted by Japan's export weights, will slow significantly from approximately 6% in 2021 to around 3% in 2022, after which it will start to grow again at around 3% in 2023 and 2024—which is below the average growth rate of around 4%, observed since 1980.

After growing at a high 12.4% y/y in FY 2021, Japan's exports slowed to 4.5% y/y in FY 2022. This trajectory is projected to continue, with a further deceleration to 1.8% y/y in FY 2023 and 1.7% y/y in FY 2024. From this, it is evident that exports will not be the driving force of the economy in the foreseeable future.

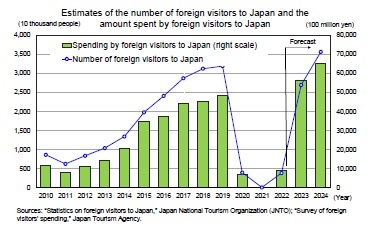

Inbound tourist demand had virtually disappeared thanks to the COVID-19 pandemic. However, it has been enjoying a rapid recovery following the phased relaxation of border measures since October 2022 and their elimination at the end of April 2023. In June 2023, the number of inbound visitors to Japan stood at 2,073,300, marking a 28.0% decline from the same month in 2019. Then, adjusted for seasonal variations by the Institute, this figure rebounded to exceed more than 90% of the pre-COVID-19 level (2019 average).

The number of visitors to Japan from China, which accounted for around 30% of the total before the COVID-19 disaster, remains at a low level of 24% compared to the same month in 2019. However, with the Chinese government lifting the ban on group travel to Japan on August 10, the number of Chinese visitors to Japan is likely to surge in the future.

Furthermore, with inbound tourist demand approaching pre-COVID-19 levels, it appears that potential supply constraints, such as shortages of workforce personnel and lodging facilities, could become more serious in the future. According to the Ministry of Economy, Trade, and Industry's "Tertiary Industry Activity Index," the activity index for the lodging industry fell sharply to roughly 20% of its pre-COVID-19 level in the April-June quarter of 2020, when the state of emergency was first declared. However, it has since gradually recovered to a figure above its pre-COVID-19 level. By contrast, the number of workers in the lodging industry, after falling sharply in response to the drop in demand, has continued to move sideways, remaining at approximately 80% of the 2019 level as of the April-June quarter of 2023. In addition to the risk of supply constraints hampering the recovery of demand, this could lead to a further steep rise in lodging rates, which have already risen markedly.

More pronounced within the scope of recovery than the actual number of foreign visitors to Japan is the volume of travel expenditures made by these visitors. According to the Japan Tourism Agency's "Survey of Trends in Foreign Traveler Spending in Japan," the value of travel spending by foreigners visiting Japan during the April-June quarter of 2023 was 1.2052 trillion yen. Although this figure marks a decline of 4.9% from the equivalent period in 2019, the reduction is notably less severe than the -26.7% drop in the count of foreign visitors to Japan during the same timeframe. This is a trend that has continued since the October-December quarter of 2021, when the survey and publication of the Survey of Spending Trends by Foreign Visitors to Japan resumed, after having been suspended due to the COVID-19 disaster.

Per capita consumption expanded because the yen has become weaker since the pre-COVID-19 period, while the proportion of business and other visitors with longer stays has increased as a result of the sharp decline in the number of tourists with relatively short stays. Of these, the average length of stay is expected to shorten due to the rapid increase in the number of tourists. However, the effect of the weaker yen’s contribution is likely to persist into the future.

With the completion of the border measures, the number of inbound foreign visitors will continue to recover in the future and is likely to surpass the pre-COVID-19 period level (31.88 million in 2019) in terms of monthly annualized number by the end of 2023. Although the number of inbound travelers is not expected to reach a new annual record high until 2024, the government's goal of increasing inbound travel spending to 5 trillion yen by 2023 will likely be achieved as the weak yen continues to push up per capita spending.

With the completion of the border measures, the number of inbound foreign visitors will continue to recover in the future and is likely to surpass the pre-COVID-19 period level (31.88 million in 2019) in terms of monthly annualized number by the end of 2023. Although the number of inbound travelers is not expected to reach a new annual record high until 2024, the government's goal of increasing inbound travel spending to 5 trillion yen by 2023 will likely be achieved as the weak yen continues to push up per capita spending.

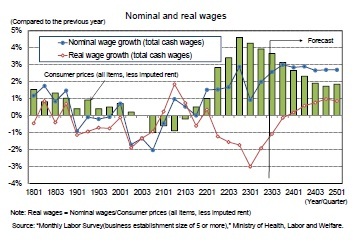

According to the "Status of Spring Wage Hike Demands and Compensation Results for Major Private Sector Firms" released by the Ministry of Health, Labour, and Welfare on August 4, 2023, the wage increase rate for 2023 was 3.60%—1.40 percentage points higher than the 2.20% rate in 2022. In addition, the "portion of wage increases," which corresponds to base increases excluding regular salary increases as calculated by RENGO, was 2.12% (0.63% in 2022).

The spring wage increase rate for 2023 reached its highest point in 30 years. Additionally, it marked the first instance since 1980 that the rate of wage increases improved by 1% compared to the preceding year.1

The scheduled cash earnings for general workers, closely tied to the outcomes of the spring offensive, increased from 1.3% y/y in the January-March quarter to 1.7% y/y in the April-June quarter of 2023. However, this improvement was relatively modest compared to the base increase in the spring offensive of 2023, which increased significantly from around 0.5% to around 2% y/y. This is because the first payment of revised wages is not made in April, the beginning of the new fiscal year, but in May or, for many companies, even later.

Growth in scheduled cash earnings for general workers is likely to increase to the 2% level in the July-September quarter of 2023. In addition, scheduled cash earnings per hour for part-time workers is expected to continue to grow at a high rate, reflecting the growing perception of labor shortages among firms. However, the rising ratio of part-time workers will continue to contribute to the fall in average wages for workers as a whole.

Non-scheduled cash earnings are expected to continue to increase as the economy continues to normalize. Special cash earnings, on the other hand, grew at a high 4.6% y/y in 2022 (of which salaries paid as bonuses grew 2.4% y/y in summer 2022 and 3.2% y/y at the end of 2022). However, growth will slow down in 2023, reflecting the recent standstill in the improvement of corporate earnings. Total cash earnings, which include scheduled cash earnings plus non-scheduled cash earnings and special cash earnings, are expected to continue to grow at a rate of 2% from FY 2023 to FY 2024.

Real wage growth has been negative year-on-year since April 2022, primarily thanks to the accelerating pace of consumer price inflation. Although nominal wage growth will increase in the future, the decline in real wages is likely to continue for some time because the rate of consumer price inflation will remain high. Real wage growth is not expected to become positive until after 2024, when the rate of consumer price inflation is expected to slow down.

Real wage growth has been negative year-on-year since April 2022, primarily thanks to the accelerating pace of consumer price inflation. Although nominal wage growth will increase in the future, the decline in real wages is likely to continue for some time because the rate of consumer price inflation will remain high. Real wage growth is not expected to become positive until after 2024, when the rate of consumer price inflation is expected to slow down.The current forecast assumes that the spring wage hike rate in 2024 will be 3.40%, marking a slight deceleration in growth compared to 2023 but still remaining in the 3% range. Although corporate earnings growth will decline, especially in the manufacturing sector, due to sluggish exports, the high rate of consumer price inflation will help to raise the wage hike rate.

In FY 2022, nominal employment compensation increased for the second consecutive year at 2.0% y-o-y, but real employment compensation decreased at -1.7% y-o-y due to the accelerated pace of consumer price inflation. In FY2024, real employment compensation is expected to increase to 1.6% y-o-y as the pace of price inflation slows, while nominal employment compensation continues to grow at a high rate of 3.2% y-o-y.

1 Since the survey was first conducted in 1965, the highest year-to-year difference of 12.8% (1973: 20.1% to 1974: 32.9%) was recorded in 1974, during the inflationary period of the first oil crisis.

(2023年08月22日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

関連レポート

- 2023・2024年度経済見通し(23年8月)

- QE速報:4-6月期の実質GDPは前期比1.5%(年率6.0%)の高成長-実質GDPの水準はコロナ禍前のピークを上回る

- 2023年4-6月期の実質GDP~前期比0.8%(年率3.1%)を予測~

- 雇用関連統計23年6月-宿泊・飲食サービス業の就業者数がコロナ禍前に近づく

- 鉱工業生産23年6月-4-6月期は3四半期ぶりの増産だが、前期の落ち込みは取り戻せず

- 消費者物価(全国23年7月)-補助率縮小に、円安、原油高が重なり、ガソリン、灯油価格は8月以降に大幅上昇へ

- ASEANの貿易統計(8月号)~6月の輸出は中国向けが改善も、域内向けが落ち込み前年割れ続く

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月07日

中国の貿易統計(25年10月)~輸出、輸入とも悪化。対米輸出は減少が続く -

2025年11月07日

英国金融政策(11月MPC公表)-2会合連続の据え置きで利下げペースは鈍化 -

2025年11月06日

世の中は人間よりも生成AIに寛大なのか? -

2025年11月06日

働く人の飲酒量とリスク認識:適正化に気づくのはどのような人か -

2025年11月06日

Meta、ByteDanceのDSA違反の可能性-欧州委員会による暫定的見解

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023) 】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023) のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!