- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for the Fiscal Years 2022 to 2024 (February 2023)

Japan’s Economic Outlook for the Fiscal Years 2022 to 2024 (February 2023)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

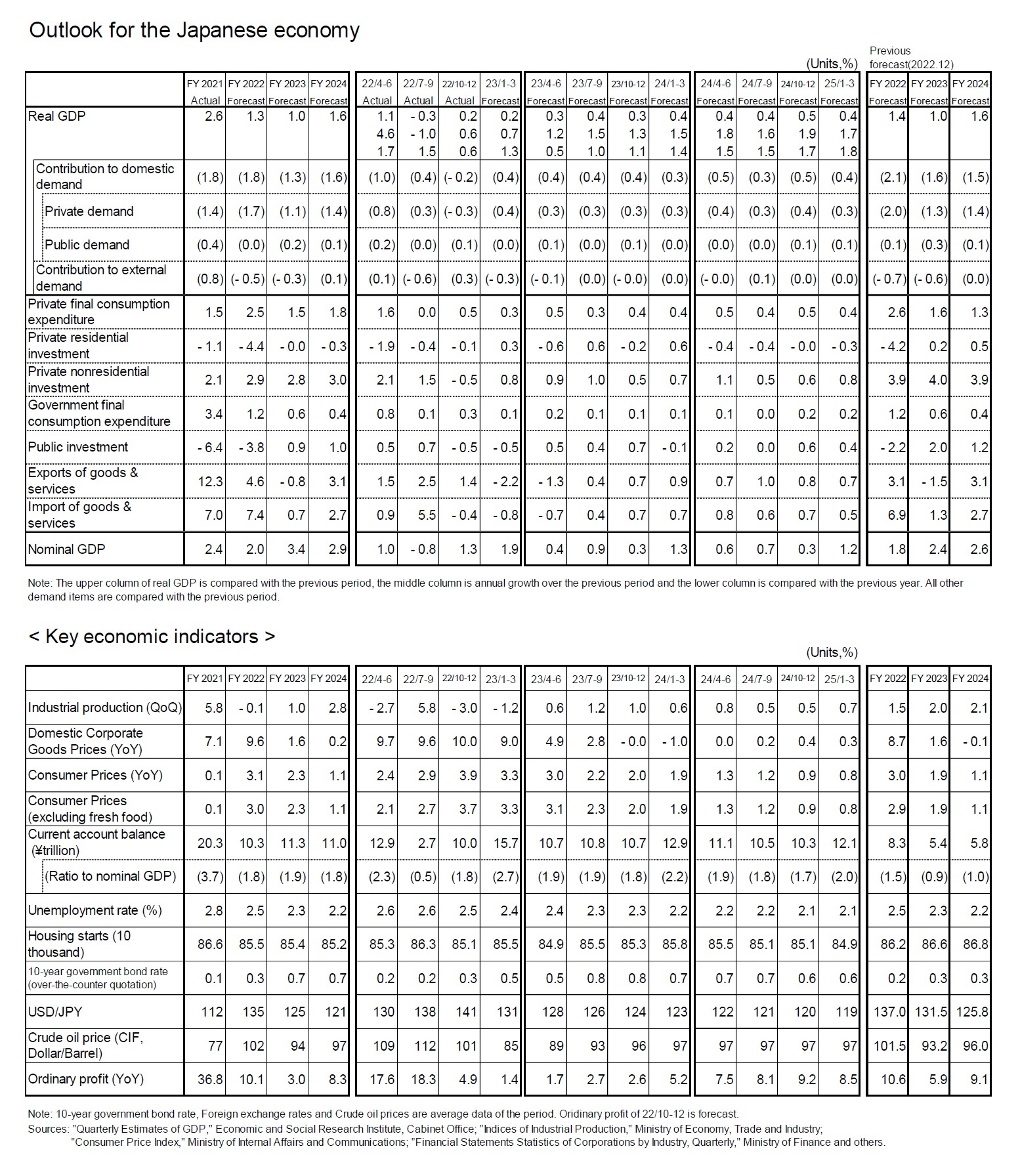

2. Real GDP growth rate expected to be 1.3% in FY 2022, 1.0% in FY 2023, and 1.6% in FY 2024

Consumer spending is still on the rise, but the pace of price increases has led to some sluggish growth.

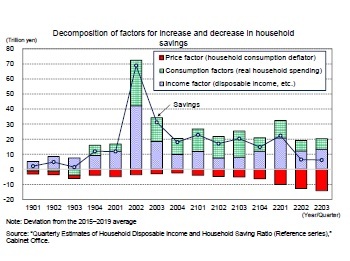

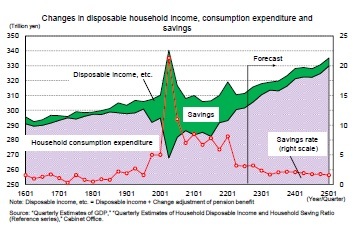

As noted above, household savings remain at a high level, but they are gradually approaching pre-COVID-19 crisis levels. When the gap between household savings during the COVID-19 crisis and normal times (2015–2019 average) is broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditure), and price factors (household consumption deflator), the decline in consumption levels, various support measures such as special fixed benefits and Go To Travel, and the recovery of employee compensation have contributed to the increase in savings. However, the accelerating pace of price increases has led to a fall in savings. In the July–September quarter of 2022, household savings were 6.2 trillion yen (seasonally adjusted and annualized) higher than normal, but lower consumption levels and an increase in disposable income pushed up 20.1 trillion yen, while price increases pushed down 13.9 trillion yen.

As noted above, household savings remain at a high level, but they are gradually approaching pre-COVID-19 crisis levels. When the gap between household savings during the COVID-19 crisis and normal times (2015–2019 average) is broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditure), and price factors (household consumption deflator), the decline in consumption levels, various support measures such as special fixed benefits and Go To Travel, and the recovery of employee compensation have contributed to the increase in savings. However, the accelerating pace of price increases has led to a fall in savings. In the July–September quarter of 2022, household savings were 6.2 trillion yen (seasonally adjusted and annualized) higher than normal, but lower consumption levels and an increase in disposable income pushed up 20.1 trillion yen, while price increases pushed down 13.9 trillion yen.

Looking ahead, inflation will continue to drive down savings, while higher wage increases and higher disposable income growth will drive up savings. This forecast assumes that the household savings rate will decline from 3.1% in the most recent period (July–September 2022) to the upper 1% range at the end of the fiscal year 2024, approaching the level it was at prior to the COVID-19 crisis (1.2% of the 2015–2019 average).

Looking ahead, inflation will continue to drive down savings, while higher wage increases and higher disposable income growth will drive up savings. This forecast assumes that the household savings rate will decline from 3.1% in the most recent period (July–September 2022) to the upper 1% range at the end of the fiscal year 2024, approaching the level it was at prior to the COVID-19 crisis (1.2% of the 2015–2019 average).

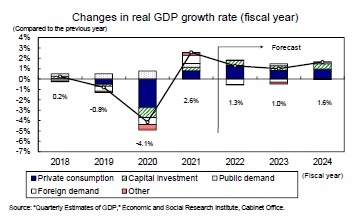

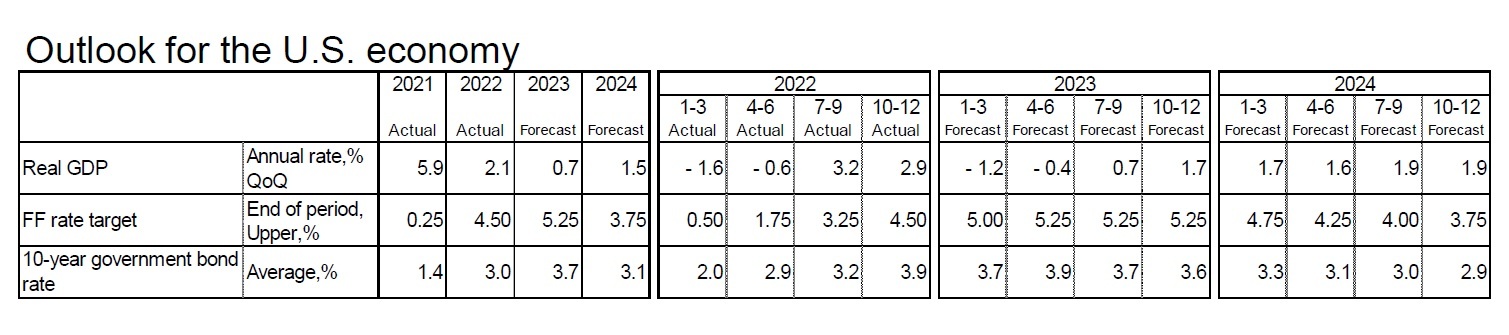

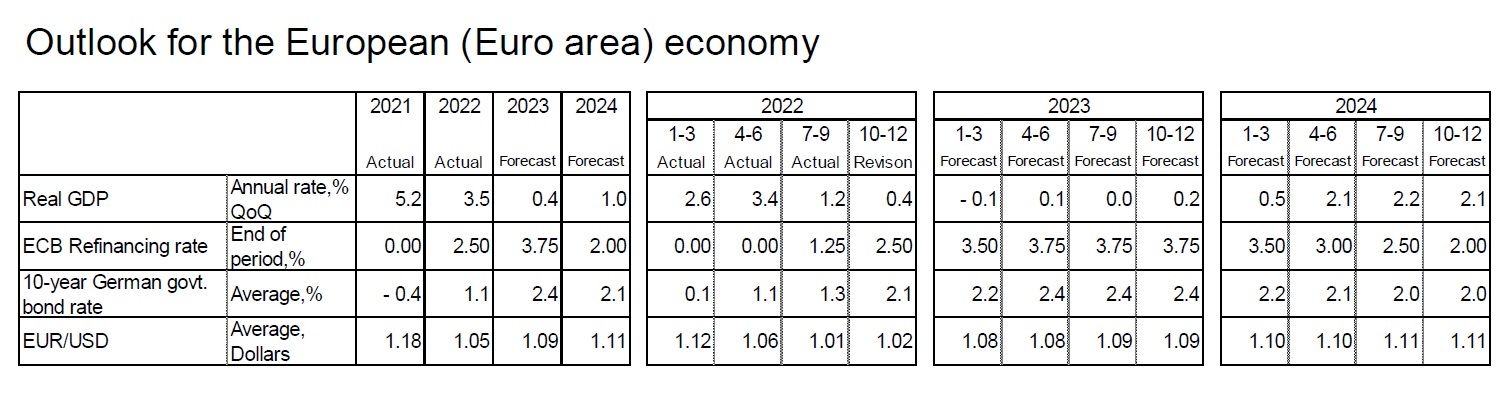

In the October–December quarter of 2022, real GDP growth rate barely maintained a positive trend at an annualized rate of 0.6% from the previous quarter because private consumption grew at a higher rate (which was due in part to a boost from nationwide travel assistance) and because external demand provided a boost to the growth rate (although capital investment, which had been strong, declined for the first time in three quarters). In the January–March quarter of 2023, the economy is expected to continue at a low annualized rate of 0.7% from the previous quarter because exports will start to decline while Europe and the United States will experience negative growth and domestic demand (mainly private consumption) will remain firm. After entering FY 2023, although exports are not expected to continue to drive the economy, the economic recovery, particularly in domestic demand, including private consumption and capital investment, will continue.

Real GDP growth rate is expected to be 1.3% in FY 2022, 1.0% in FY 2023, and 1.6% in FY 2024. In FY 2023, growth will decline primarily as a result of exports falling against a backdrop of slowing overseas economies. In FY 2024, growth will be higher as exports start to grow again in response to a rebound in overseas economies, while domestic demand will remain resilient.

Real GDP growth rate is expected to be 1.3% in FY 2022, 1.0% in FY 2023, and 1.6% in FY 2024. In FY 2023, growth will decline primarily as a result of exports falling against a backdrop of slowing overseas economies. In FY 2024, growth will be higher as exports start to grow again in response to a rebound in overseas economies, while domestic demand will remain resilient.For now, the main scenario is that negative growth in the United States and the euro area will remain modest, while the recovery trend in Japan will be maintained. However, if the recession in the United States and the euro area intensifies, a recession in Japan will become inevitable.

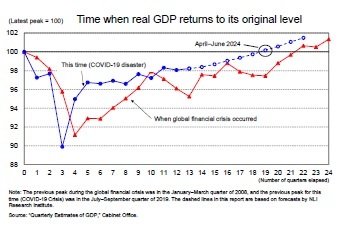

In the October–December quarter of 2022, real GDP was 1.0% above its pre-COVID-19 crisis level (October–December 2019) but 1.8% below its most recent peak (July–September 2019). We expect real GDP to recover its most recent peak level only in the April–June quarter of 2024. It took more than 5 years (22 quarters) for real GDP levels to return to their previous peak during the global financial crisis, and it now seems likely that it will take a comparable length of time for this to happen in respect to the COVID-19 crisis.

In the October–December quarter of 2022, real GDP was 1.0% above its pre-COVID-19 crisis level (October–December 2019) but 1.8% below its most recent peak (July–September 2019). We expect real GDP to recover its most recent peak level only in the April–June quarter of 2024. It took more than 5 years (22 quarters) for real GDP levels to return to their previous peak during the global financial crisis, and it now seems likely that it will take a comparable length of time for this to happen in respect to the COVID-19 crisis.

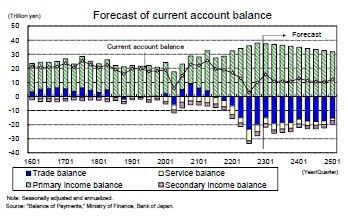

Current account balance, which peaked at 25.6 trillion yen (seasonally adjusted and annualized) in the April–June quarter of 2021, continued to decline, before increasing from 2.7 trillion yen in the July-September quarter of 2022 to 10 trillion yen in the October–December quarter. The narrowing of the trade deficit due to a decline in the value of imports following a pause in the rise in crude oil prices and the depreciation of the yen, and the narrowing of the deficit in the services balance caused primarily by an improvement in the travel balance following the relaxation of border measures, contributed to the expansion of current account balance's surplus.

As for the outlook for current account balance, it is likely that the trade balance will remain in a deep deficit, with the increase in the value of imports coming to a halt and exports remaining sluggish as overseas economies undergo a slowdown. The service balance, meanwhile, is likely to see a further easing of border measures in response to the change in the classification of the COVID-19 virus under the Infectious Diseases Act to Category 5, while the trend of narrowing the deficit, especially in regard to travel, is expected to continue. However, the primary income balance has expanded to the upper 30 trillion yen level on an annual basis on the back of a large amount of net foreign assets and a weak yen, but the surplus is expected to shrink slightly, albeit at a high level, because the yen continues to strengthen during the forecast period.

Until the end of the fiscal year 2024, which is when the forecast period will close, it is likely that the trade and services balance deficits will be supplemented by a high primary income balance surplus. Current account balance is expected to contract significantly from 20.3 trillion yen (3.7% of nominal GDP) in FY 2021 to 10.3 trillion yen (1.8%) in FY 2022, followed by 11.3 trillion yen (1.9%) in FY 2023 and 11 trillion yen (1.8%) in FY 2024, remaining around 10 trillion yen.

Until the end of the fiscal year 2024, which is when the forecast period will close, it is likely that the trade and services balance deficits will be supplemented by a high primary income balance surplus. Current account balance is expected to contract significantly from 20.3 trillion yen (3.7% of nominal GDP) in FY 2021 to 10.3 trillion yen (1.8%) in FY 2022, followed by 11.3 trillion yen (1.9%) in FY 2023 and 11 trillion yen (1.8%) in FY 2024, remaining around 10 trillion yen.

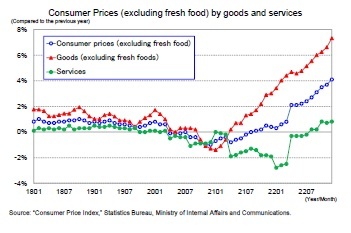

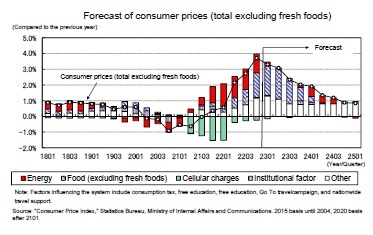

Consumer prices (total CPI excluding fresh foods, hereafter core CPI) rose 4.0% in December 2022—the highest increase in 41 years since December 1981—which was mainly due to higher energy and food prices.

While the rise in energy prices has plateaued at a high level, which is due in part to the government's measures to ease the burden on the economy, the pace of increase in food prices (excluding fresh foods) has accelerated. In the past, most of the increase in prices was caused by the rise in commodity prices, which was driven by the rise in resource and grain prices and the rise in import prices in response to the depreciation of the yen; however, since the summer of 2022, service prices have also increased slightly.

While the rise in energy prices has plateaued at a high level, which is due in part to the government's measures to ease the burden on the economy, the pace of increase in food prices (excluding fresh foods) has accelerated. In the past, most of the increase in prices was caused by the rise in commodity prices, which was driven by the rise in resource and grain prices and the rise in import prices in response to the depreciation of the yen; however, since the summer of 2022, service prices have also increased slightly.

By contrast, utilities have applied for increases from April, and, if approved, electricity prices will rise again significantly. High oil prices and a pause in the yen's decline have put a brake on rising import prices, which have been the main cause of inflation. However, a renewed rise in energy prices due to higher electricity prices is likely to boost prices. Energy prices, which include electricity, gas, gasoline, and kerosene, are expected to decline for a time in February 2023 but then increase in June and increase once more in October when the easing of the burden is reduced.

With U.S. interest rate hikes coming to an end in the first half of 2023, it has been forecast that the dollar-yen rate will remain on a strong trajectory and that oil prices, which peaked in the middle of 2022, will rise only moderately. Therefore, it is expected that there will be less movement to pass on the cost of raw materials to prices after FY 2023. Meanwhile, the pace of increase in service prices, which are currently growing in the zero percent range, will gradually increase in response to higher wage increases.

With U.S. interest rate hikes coming to an end in the first half of 2023, it has been forecast that the dollar-yen rate will remain on a strong trajectory and that oil prices, which peaked in the middle of 2022, will rise only moderately. Therefore, it is expected that there will be less movement to pass on the cost of raw materials to prices after FY 2023. Meanwhile, the pace of increase in service prices, which are currently growing in the zero percent range, will gradually increase in response to higher wage increases.Core CPI inflation is expected to be 3.0% y/y in FY 2022, 2.3% y/y in FY 2023, and 1.1% y/y in FY 2024.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2023年02月22日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/19 | 消費者物価(全国25年8月)-コアCPIは9ヵ月ぶりの3%割れ、年末には2%程度まで鈍化する見通し | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/17 | 貿易統計25年8月-関税引き上げの影響が顕在化し、米国向け自動車輸出が数量ベースで大きく落ち込む | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月17日

EUの金融システムのリスクと脆弱性(2025秋)-欧州の3つの金融監督当局の合同委員会報告書 -

2025年10月17日

日本における「老衰死」増加の背景 -

2025年10月17日

選択と責任──消費社会の二重構造(1)-欲望について考える(2) -

2025年10月17日

首都圏の中古マンション価格~隣接する行政区単位での価格差は?~ -

2025年10月17日

「SDGs疲れ」のその先へ-2015年9月国連採択から10年、2030年に向け問われる「実装力」

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for the Fiscal Years 2022 to 2024 (February 2023)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for the Fiscal Years 2022 to 2024 (February 2023)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!