- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for Fiscal Years 2025-2026 (May 2025)

2025年05月22日

文字サイズ

- 小

- 中

- 大

1.Negative Growth of 0.7% on an Annualized Basis in the January–March Quarter of 2025

Real GDP for the January–March quarter of 2025 recorded negative growth for the first time in four quarters, declining by 0.2% from the previous quarter (down 0.7% on an annualized basis).

While exports of goods and services declined by 0.6% from the previous quarter, imports of goods and services significantly increased by 2.9%, partly due to a rebound from the previous quarter’s decline. As a result, external demand made a negative contribution of 0.8% (down 3.3% on an annualized basis), substantially dragging down overall growth.

Although capital investment sharply rose by 1.4% from the previous quarter—supported by strong corporate earnings—private consumption remained flat due to the impact of high prices. Consequently, domestic demand increased for the first time in two quarters, although this was insufficient to offset the decline in external demand.

Real GDP for FY 2024 increased by 0.8% compared to the previous year (0.6% in FY 2023), and nominal GDP grew by 3.7% (4.9% in FY 2023), marking four consecutive years of positive growth for both. The GDP deflator also rose by 2.9% (4.2% in FY 2023), achieving a positive reading for the third consecutive year.

While exports of goods and services declined by 0.6% from the previous quarter, imports of goods and services significantly increased by 2.9%, partly due to a rebound from the previous quarter’s decline. As a result, external demand made a negative contribution of 0.8% (down 3.3% on an annualized basis), substantially dragging down overall growth.

Although capital investment sharply rose by 1.4% from the previous quarter—supported by strong corporate earnings—private consumption remained flat due to the impact of high prices. Consequently, domestic demand increased for the first time in two quarters, although this was insufficient to offset the decline in external demand.

Real GDP for FY 2024 increased by 0.8% compared to the previous year (0.6% in FY 2023), and nominal GDP grew by 3.7% (4.9% in FY 2023), marking four consecutive years of positive growth for both. The GDP deflator also rose by 2.9% (4.2% in FY 2023), achieving a positive reading for the third consecutive year.

(Impact of Trump’s Tariffs)

Since President Trump took office in January 2025, the US has introduced various tariff policies. At present, Japan faces a 10% reciprocal tariff, in addition to an extra 25% tariff on automobiles, auto parts, steel, and aluminum. Although reciprocal tariffs were initially scheduled to increase from 10% to 24% for Japan, a 90-day postponement was announced on April 9.

Since President Trump took office in January 2025, the US has introduced various tariff policies. At present, Japan faces a 10% reciprocal tariff, in addition to an extra 25% tariff on automobiles, auto parts, steel, and aluminum. Although reciprocal tariffs were initially scheduled to increase from 10% to 24% for Japan, a 90-day postponement was announced on April 9.

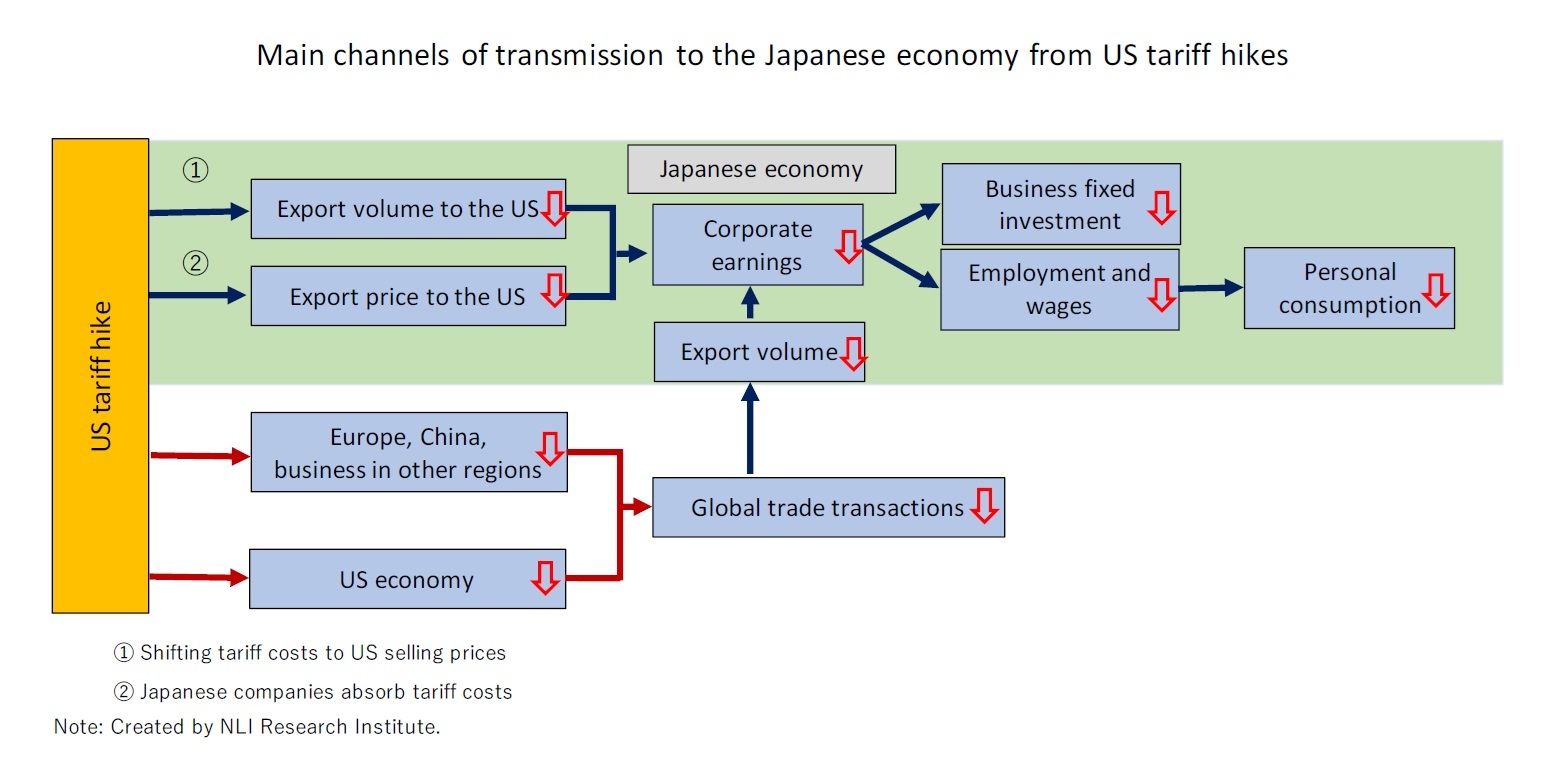

US tariff hikes affect the Japanese economy through various channels. First, they reduce the price competitiveness of Japanese exports against domestically produced goods in the US, resulting in lower export volumes, which in turn deteriorates Japan’s domestic production and corporate earnings. While cutting export prices might soften the decline in export volume, it would reduce export revenues and thus damage corporate profits.

Moreover, global economic slowdown and the reduced trade volume due to US tariff hikes might further reduce Japan’s exports. In addition, deteriorating corporate earnings and rising uncertainty surrounding trade policy might curb capital investment and wage hikes. A downturn in the corporate sector might spill over to the household sector, heightening the risk of weakening personal consumption due to deteriorating employment and income conditions.

Furthermore, financial market turmoil such as falling stock prices could undermine corporate and consumer sentiment and depress domestic demand. The worsening earnings of overseas affiliates of Japanese companies could also negatively affect domestic corporate profits through reduced direct investment income.

These negative effects of US tariff hikes could spread widely through various channels and are likely to emerge with a time lag.

Japan’s exports to the US amounted to ¥21.3 trillion in 2024, accounting for 19.9% of Japan’s total exports (equivalent to 3.5% of nominal GDP). Among this amount, automobiles and auto parts—which are subject to the 25% additional tariff—accounted for ¥7.3 trillion, or 34.1% of total exports to the US.

In terms of the US trade deficit by country/region, Japan ranks sixth after China, the EU, Mexico, Vietnam, and Taiwan. Of Japan’s ¥8.6 trillion trade surplus with the US in 2024, the majority comes from transportation equipment (¥7.0 trillion), general machinery (¥2.9 trillion), and electrical machinery (¥1.6 trillion), while deficits were recorded in mineral fuels (−¥1.9 trillion), food (−¥1.6 trillion), and chemical products (−¥0.8 trillion).

The key assumptions regarding tariff policy in this outlook are as follows:

(1) Reciprocal tariffs will remain at an average of 10% from July 2025 onwards.

(2) Tariffs on Chinese products will be 30%.

(3) For Canada and Mexico, USMCA-compliant products will remain tariff-free, while non-compliant products will be subject to a 10% tariff.

(4) Steel, aluminum, and automobiles will face a 25% tariff, and semiconductors and pharmaceuticals will see tariffs raised to 25% during the July–September quarter of 2025.

(5) China will impose a 10% retaliatory tariff.

(6) Other countries/regions will not implement retaliatory tariffs against the US.

After turning positive around the end of 2023, global trade volume had gradually strengthened. However, ahead of the US tariff hikes, a rush in exports led to an acceleration in growth to about 4% in early 2025. Global trade volume is likely to shrink after April 2025, when the US began full-scale tariff increases.

Moreover, global economic slowdown and the reduced trade volume due to US tariff hikes might further reduce Japan’s exports. In addition, deteriorating corporate earnings and rising uncertainty surrounding trade policy might curb capital investment and wage hikes. A downturn in the corporate sector might spill over to the household sector, heightening the risk of weakening personal consumption due to deteriorating employment and income conditions.

Furthermore, financial market turmoil such as falling stock prices could undermine corporate and consumer sentiment and depress domestic demand. The worsening earnings of overseas affiliates of Japanese companies could also negatively affect domestic corporate profits through reduced direct investment income.

These negative effects of US tariff hikes could spread widely through various channels and are likely to emerge with a time lag.

Japan’s exports to the US amounted to ¥21.3 trillion in 2024, accounting for 19.9% of Japan’s total exports (equivalent to 3.5% of nominal GDP). Among this amount, automobiles and auto parts—which are subject to the 25% additional tariff—accounted for ¥7.3 trillion, or 34.1% of total exports to the US.

In terms of the US trade deficit by country/region, Japan ranks sixth after China, the EU, Mexico, Vietnam, and Taiwan. Of Japan’s ¥8.6 trillion trade surplus with the US in 2024, the majority comes from transportation equipment (¥7.0 trillion), general machinery (¥2.9 trillion), and electrical machinery (¥1.6 trillion), while deficits were recorded in mineral fuels (−¥1.9 trillion), food (−¥1.6 trillion), and chemical products (−¥0.8 trillion).

The key assumptions regarding tariff policy in this outlook are as follows:

(1) Reciprocal tariffs will remain at an average of 10% from July 2025 onwards.

(2) Tariffs on Chinese products will be 30%.

(3) For Canada and Mexico, USMCA-compliant products will remain tariff-free, while non-compliant products will be subject to a 10% tariff.

(4) Steel, aluminum, and automobiles will face a 25% tariff, and semiconductors and pharmaceuticals will see tariffs raised to 25% during the July–September quarter of 2025.

(5) China will impose a 10% retaliatory tariff.

(6) Other countries/regions will not implement retaliatory tariffs against the US.

After turning positive around the end of 2023, global trade volume had gradually strengthened. However, ahead of the US tariff hikes, a rush in exports led to an acceleration in growth to about 4% in early 2025. Global trade volume is likely to shrink after April 2025, when the US began full-scale tariff increases.

Looking ahead to the overseas economies that influence Japanese exports, inflation triggered by tariff hikes is expected to suppress domestic demand, leading US real GDP growth to significantly slow from 2.8% in 2024 to 1.4% in 2025 and 1.1% in 2026. In China, where the scale of tariff hikes is larger than in other countries/regions, economic stimulus measures will only partially offset the negative effects. Thus, real GDP growth is expected to sharply slow from 5.0% in 2024 to 4.6% in 2025 and 3.7% in 2026. Meanwhile, the euro area’s growth rate is projected to edge down from 0.9% in 2024 to 0.8% in 2025 but subsequently recover to 1.0% in 2026, supported by fiscal expansion related to defense and infrastructure. Overall, global economic growth is projected to remain subdued through the forecast horizon of 2026.

Looking ahead to the overseas economies that influence Japanese exports, inflation triggered by tariff hikes is expected to suppress domestic demand, leading US real GDP growth to significantly slow from 2.8% in 2024 to 1.4% in 2025 and 1.1% in 2026. In China, where the scale of tariff hikes is larger than in other countries/regions, economic stimulus measures will only partially offset the negative effects. Thus, real GDP growth is expected to sharply slow from 5.0% in 2024 to 4.6% in 2025 and 3.7% in 2026. Meanwhile, the euro area’s growth rate is projected to edge down from 0.9% in 2024 to 0.8% in 2025 but subsequently recover to 1.0% in 2026, supported by fiscal expansion related to defense and infrastructure. Overall, global economic growth is projected to remain subdued through the forecast horizon of 2026.While Japan’s exports have remained broadly flat, they are expected to significantly decline in the April–June quarter of 2025, particularly to the US, as the effects of tariff hikes become evident. This outlook assumes that no additional reciprocal tariffs will be imposed and export declines will begin to stabilize in the latter half of FY 2025. However, strong downward pressure on exports is likely to persist for the time being due to the ongoing slowdown in the US and Chinese economies and reduced global trade.

Exports of goods and services in GDP statistics are projected to decline from a 1.7% increase in FY 2024 to a 2.1% decrease in FY 2025, followed by a modest 1.0% increase in FY 2026.

(Spring Wage Negotiations in 2026 Expected to Show a Slower Pace of Wage Increases)

According to the fifth tally of the 2025 Spring Labour Offensive released by Rengo on May 8, the average wage increase rate in 2025 was 5.32%, up by 0.22 percentage points from the previous year, with the base wage hike component at 3.75%. The wage increase rate for 2025 is almost certain to remain in the 5% range, following the 5.10% achieved in 2024, marking the highest in 33 years.

According to the fifth tally of the 2025 Spring Labour Offensive released by Rengo on May 8, the average wage increase rate in 2025 was 5.32%, up by 0.22 percentage points from the previous year, with the base wage hike component at 3.75%. The wage increase rate for 2025 is almost certain to remain in the 5% range, following the 5.10% achieved in 2024, marking the highest in 33 years.

The average increase was 4.93% among small and medium-sized enterprises (fewer than 300 union members), reflecting a 0.48 percentage point rise from the previous year. While this is below the 5.36% increase seen among large enterprises (300 or more union members, up 0.17 percentage points from the previous year), the gap has narrowed compared to 2024.

The average increase was 4.93% among small and medium-sized enterprises (fewer than 300 union members), reflecting a 0.48 percentage point rise from the previous year. While this is below the 5.36% increase seen among large enterprises (300 or more union members, up 0.17 percentage points from the previous year), the gap has narrowed compared to 2024.Rengo’s basic policy for the 2025 negotiations called for wage hikes of over 5%, including regular pay raises, and urged smaller unions to actively demand corrections to wage disparities. The current settlement outcomes align with this policy.

Total cash earnings per employee posted a strong 3.7% increase in the October–December quarter of 2024, mainly due to a significant rise in winter bonuses. However, the growth rate slowed to 2.2% with limited bonus payments in the January–March quarter of 2025.

Real wages—adjusted for consumer prices—showed positive growth compared to the previous year in June, July, November, and December 2024, largely due to increases in special cash earnings. However, they remained negative in other months.

Regular cash earnings (scheduled + non-scheduled earnings)—which are more stable than total cash earnings—have been in negative territory for over three years since February 2022.

Two consecutive years of 5% wage hikes can be attributed to substantial improvements in labor demand-supply conditions, corporate earnings, and prices. However, going forward, wage hike momentum is expected to weaken due to the economic slowdown caused by Trump’s tariffs.

Although structural-demographic factors such as a declining population and aging society will continue to create a labor shortage, deteriorating corporate profits due to declining exports and slowing inflation are likely to suppress wage increases.

The spring wage hike rate for 2026 is projected to be 4.2%. According to the Ministry of Health, Labour and Welfare’s Spring Wage Negotiation Status of Major Private Companies, the wage hike rate was 5.33% in 2024, the highest in 33 years, and is expected to remain in the 5% range in 2025 (NLI Research Institute forecast: 5.20%). Although a significant decline in 2026 seems inevitable, a wage hike rate in the low 4% range would still translate to a base wage increase (excluding regular raises) in the high 2% range, remaining above the Bank of Japan’s 2% inflation target.

Real wages rose by 0.4% in the October–December quarter of 2024—the first increase in eleven quarters—mainly due to strong nominal wage growth driven by special cash earnings. However, real wages fell by 2.1% in the January–March quarter of 2025 as the nominal wage growth slowed while consumer prices sharply accelerated.

Real wages rose by 0.4% in the October–December quarter of 2024—the first increase in eleven quarters—mainly due to strong nominal wage growth driven by special cash earnings. However, real wages fell by 2.1% in the January–March quarter of 2025 as the nominal wage growth slowed while consumer prices sharply accelerated.Given that consumer prices are expected to remain elevated into FY 2025, real wage growth is likely to remain negative for some time. Sustained and stable increases in real wages are expected from the October–December quarter of 2025 onwards, when nominal wage growth of around 3% coincides with a deceleration in the consumer price index (excluding imputed rent for owner-occupied housing) to the 2% range.

(2025年05月22日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/11/18 | 2025~2027年度経済見通し(25年11月) | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/11/17 | QE速報:2025年7-9月期の実質GDPは前期比▲0.4%(年率▲1.8%)-トランプ関税の影響が顕在化し、6四半期ぶりのマイナス成長 | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年11月20日

持続可能なESGを求めて-目標と手段とを取り違えないこと -

2025年11月20日

「ラブブ」とは何だったのか-SNS発の流行から考える“リキッド消費” -

2025年11月19日

1ドル155円を突破、ぶり返す円安の行方~マーケット・カルテ12月号 -

2025年11月19日

年金額改定の本来の意義は実質的な価値の維持-年金額改定の意義と2026年度以降の見通し(1) -

2025年11月19日

日本プロ野球の監督とMLBのマネージャー~訳語が仕事を変えたかもしれない~

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for Fiscal Years 2025-2026 (May 2025)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for Fiscal Years 2025-2026 (May 2025)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!