- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- JAPAN’s Economic Outlook for Fiscal Years 2022 and 2023 (August 2022)

JAPAN’s Economic Outlook for Fiscal Years 2022 and 2023 (August 2022)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

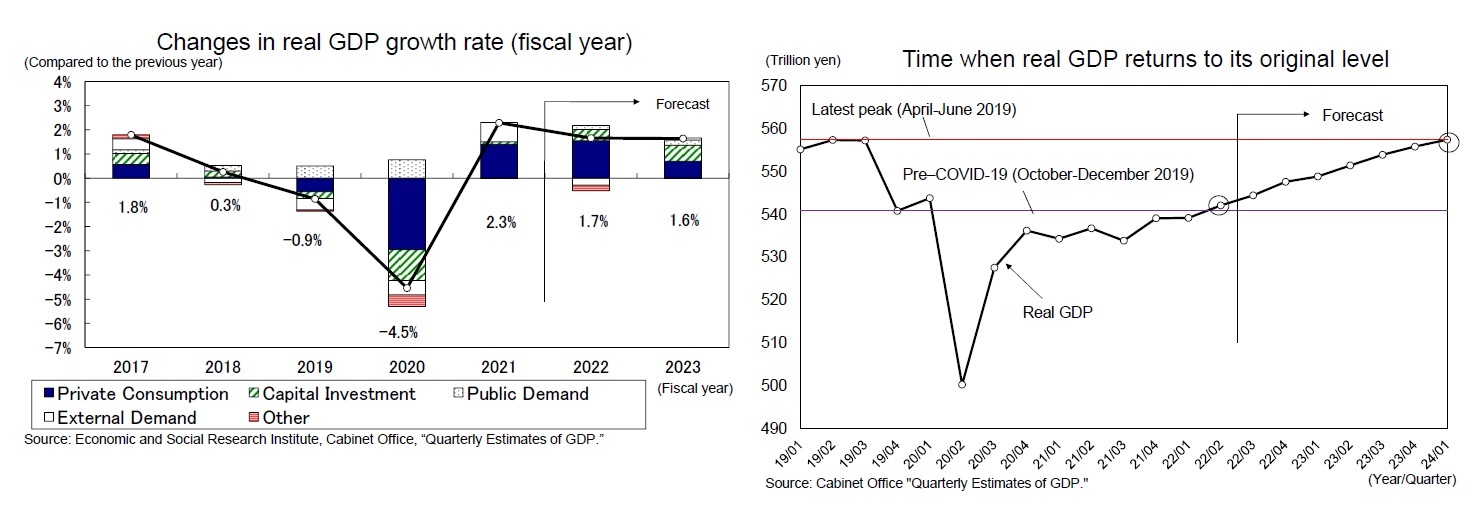

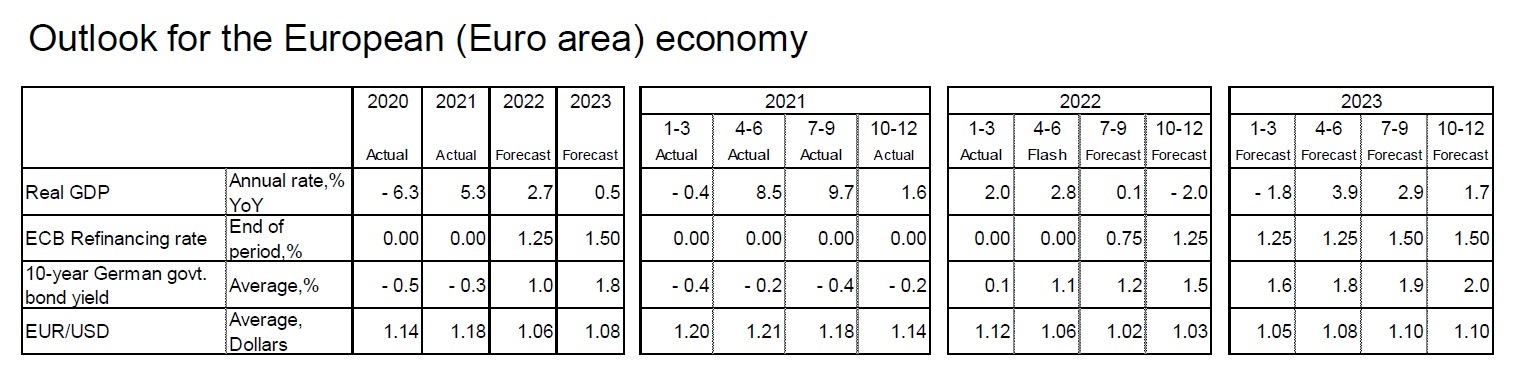

In the April–June quarter of 2022, the economy grew at an annual rate of 2.2% from the previous quarter, mainly due to a strong increase in private consumption, particularly for face-to-face services.

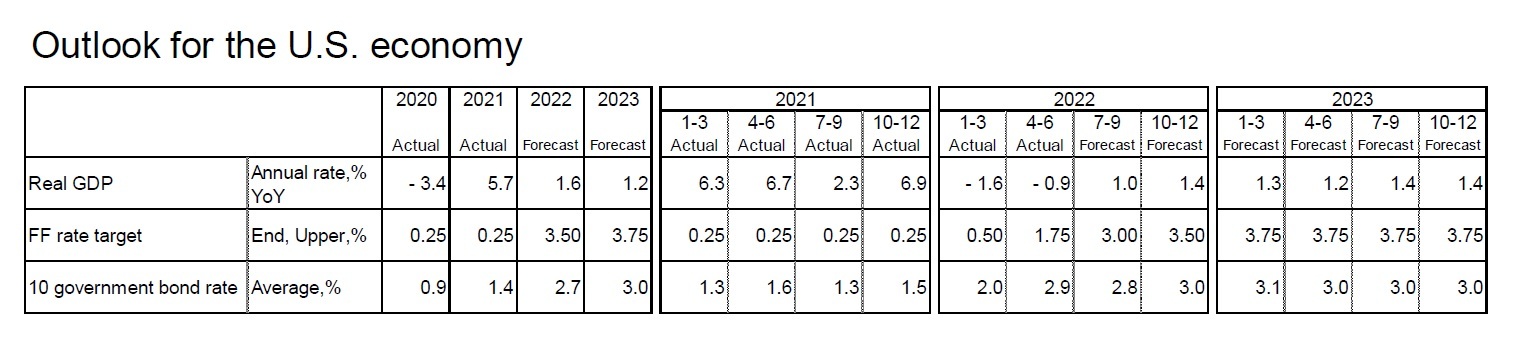

While a boost from exports is unlikely for the time being due to the high likelihood of continued weakness in overseas economies, positive growth is expected to continue beyond the July-September quarter of 2022, mainly due to increases in private consumption and capital investment backed by high household savings and corporate earnings, in the absence of action restrictions in the state of emergency and elsewhere. However, there are significant downside risks, including a sharp slowdown in the economy of the United States due to monetary tightening, a downturn in China’s economy due to continued zero-COVID-19 policy, a worsening of the Ukrainian situation, curbs on economic activities due to winter electricity shortages, and uncertainty about policy responses to the spread of the virus causing COVID-19.

It is difficult to completely end the spread of the COVID-19 virus, and the number of new positive cases is expected to fluctuate in the future. To ensure that economic and social activities are not restricted even in the event of an outbreak of the COVID-19 virus, it is necessary to review the Infectious Diseases Act and develop a system for providing medical care.

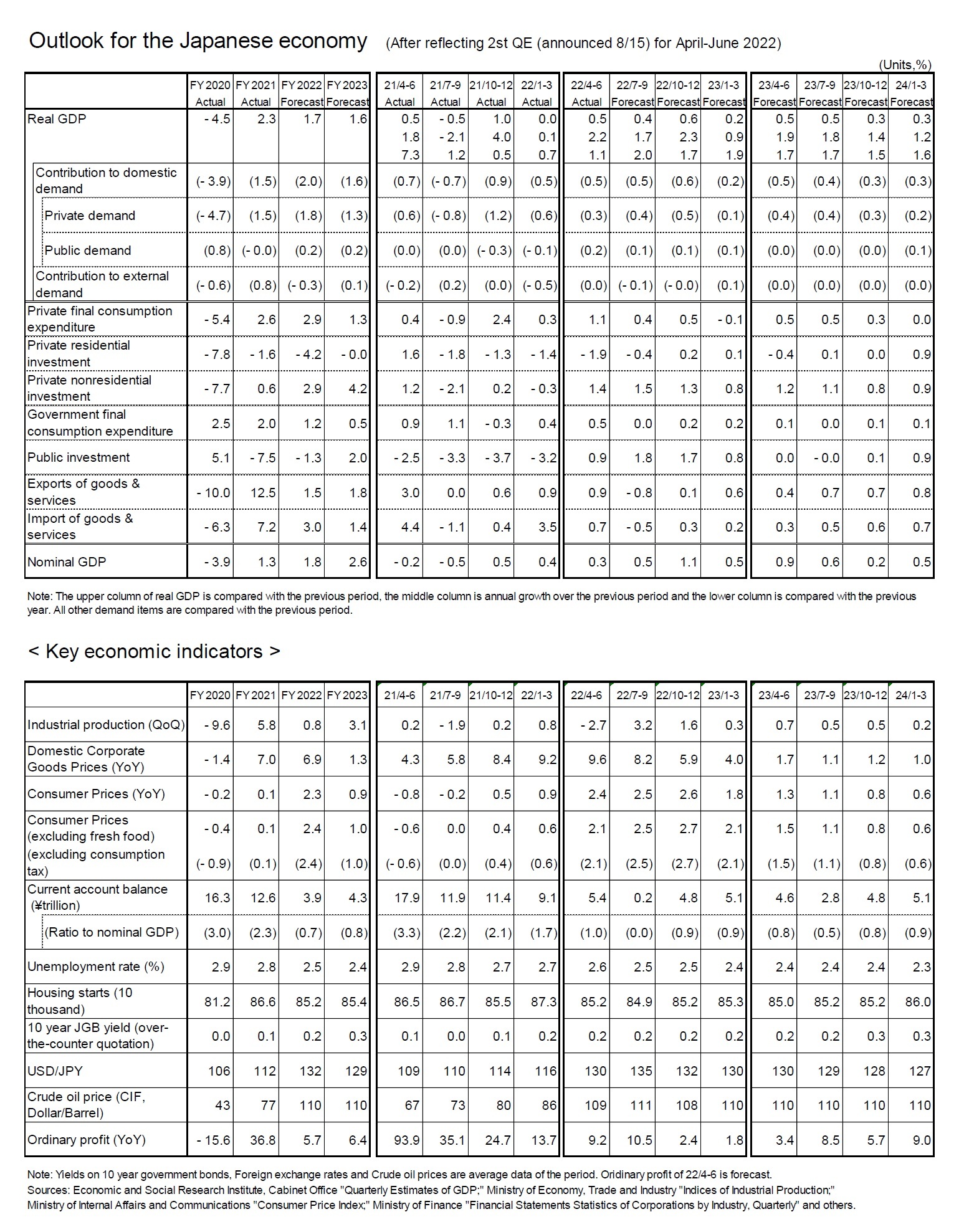

Real GDP is expected to grow by 1.7% in FY 2022 and 1.6% in FY 2023. In the April–June quarter of 2022, real GDP exceeded the level in the pre-COVID-19 period (October–December quarter of 2019) by 0.2%. As mentioned above, Japan’s level of economic activity fell sharply in the pre-COVID-19 period due to an increase in the consumption tax rate, so simply returning to pre-COVID-19 levels does not constitute economic normalization. We expect real GDP to recover its most recent peak (April–June quarter 2019) in the January–March 2024 quarter.

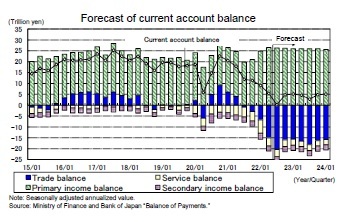

The surplus in the current account balance continued to shrink after peaking at 22.6 trillion yen (seasonally adjusted and annualized) in the October–December quarter of 2020, reaching 5.4 trillion yen in the April–June quarter of 2022. After the trade balance turned negative in the July–September quarter of 2021, the sharp increase in the deficit due to the high growth of imports in line with the high price of crude oil is the main reason for the shrinking surplus in the current account balance. On the other hand, the primary-income surplus, which continued a high level of around 20 trillion yen annually, backed by a large amount of net foreign assets, has given the current account balance a major boost.

Looking ahead, the surplus in the current account balance will shrink further and may temporarily fall into a deficit as the country’s trade deficit widens due to sluggish exports in a time of slowdown in overseas economies and higher imports stemming from higher oil prices and a weaker yen. Although a deficit in the services account gradually shrinks as inbound demand recovers, a significant improvement is not expected as there is likely to be a limited easing of immigration restrictions for the time being. On the other hand, despite the expectation of yen’s appreciation toward the end of the forecast period, the primary income balance will remain high since the yen will remain relatively weak (compared to its levels in the period up to FY 2021).

From the second half of FY 2022, the trade deficit is expected to narrow, albeit modestly, as a pause in oil-price movements slows down import growth. However, as the overseas economic slowdown continues and export growth is not expected to increase significantly, a trade surplus will not be realized until the end of FY 2023, and the primary income surplus will continue to supplement the trade deficit. The current account balance is expected to contract significantly from 12.6 trillion yen in FY 2021 (2.3% of nominal GDP) to 3.9 trillion yen in FY 2022 (0.7% of nominal GDP), and in FY 2023, it is expected to remain low at 4.3 trillion yen (0.8% of nominal GDP).

From the second half of FY 2022, the trade deficit is expected to narrow, albeit modestly, as a pause in oil-price movements slows down import growth. However, as the overseas economic slowdown continues and export growth is not expected to increase significantly, a trade surplus will not be realized until the end of FY 2023, and the primary income surplus will continue to supplement the trade deficit. The current account balance is expected to contract significantly from 12.6 trillion yen in FY 2021 (2.3% of nominal GDP) to 3.9 trillion yen in FY 2022 (0.7% of nominal GDP), and in FY 2023, it is expected to remain low at 4.3 trillion yen (0.8% of nominal GDP).

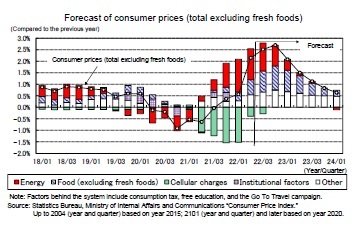

Consumer prices (total CPI excluding fresh foods, hereafter core CPI) have been in the low 2% range since April 2022 compared to the previous year. The big boost to the core CPI so far has been a sharp rise in energy prices due to higher oil prices, but the main driver of the increase has shifted to food (excluding fresh food).

Food prices started to rise at a rate of 0.1% year on year in July 2021 and increased to 3.2% year on year in June 2022. However, prices at the upstream level are high, with import prices of around 30% year on year and food prices in domestic corporate goods at the 5% level. It is likely that the price increase of food products (excluding fresh foods) will increase at a high rate of around 4% from the summer onward as a result of the further shift to consumers of upstream price increases.

On the other hand, the price of crude oil (Dubai) has fallen to the $90 level per barrel mainly due to the growing concern of a slowdown in the world economy, but the market has been structured such that a fall in the market does not directly lead to a fall in energy prices because gasoline and kerosene prices have been suppressed by the mitigation measures of drastic changes in fuel oil prices (subsidies to oil wholesalers). Energy prices peaked at 20.8% year on year in March 2022 and have slowed but will continue to grow at a high rate of 10% year on year during 2022.

The core CPI is expected to rise to the upper 2% level in the fall of 2022, when the impact of lower mobile phone rates will have run its course and premiums on fire and earthquake insurance will likely rise. This is the result of a further acceleration in the pace of food inflation and the spread of price pass-through for a wide range of items such as daily necessities and clothing in response to rising import prices due to the weaker yen.

However, most of the rise in prices has been caused by shifting large increases in the prices of raw materials to the selling prices faced by consumers. Service prices, which account for about 50% of CPI prices, and are closely linked to wages, have remained sluggish. The spring wage increase rate will continue to improve in 2022 and 2023, but in terms of base increases, the rate is expected to be in the low 0% range. We do not expect the trend of prices to increase significantly through higher service prices. In the second half of FY 2023, when upward pressure from rising raw material prices is expected to run its course, core CPI inflation is likely to slow to the upper zero percent range.

However, most of the rise in prices has been caused by shifting large increases in the prices of raw materials to the selling prices faced by consumers. Service prices, which account for about 50% of CPI prices, and are closely linked to wages, have remained sluggish. The spring wage increase rate will continue to improve in 2022 and 2023, but in terms of base increases, the rate is expected to be in the low 0% range. We do not expect the trend of prices to increase significantly through higher service prices. In the second half of FY 2023, when upward pressure from rising raw material prices is expected to run its course, core CPI inflation is likely to slow to the upper zero percent range.Core CPI inflation is forecast to be 2.4% in FY 2022 and 1.0% in FY 2023.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2022年08月19日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/24 | 消費者物価(全国25年9月)-コアCPI上昇率は拡大したが、先行きは鈍化へ | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/22 | 貿易統計25年9月-米国向け自動車輸出が数量ベースで一段と落ち込む。7-9月期の外需寄与度は前期比▲0.4%程度のマイナスに | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月24日

米連邦政府閉鎖と代替指標の動向-代替指標は労働市場減速とインフレ継続を示唆、FRBは政府統計を欠く中で難しい判断を迫られる -

2025年10月24日

企業年金の改定についての技術的なアドバイス(欧州)-EIOPAから欧州委員会への回答 -

2025年10月24日

消費者物価(全国25年9月)-コアCPI上昇率は拡大したが、先行きは鈍化へ -

2025年10月24日

保険業界が注目する“やせ薬”?-GLP-1は死亡率改善効果をもたらすのか -

2025年10月23日

御社のブランドは澄んでますか?-ブランド透明性が生みだす信頼とサステナビリティ開示のあり方(1)

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【JAPAN’s Economic Outlook for Fiscal Years 2022 and 2023 (August 2022)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

JAPAN’s Economic Outlook for Fiscal Years 2022 and 2023 (August 2022)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!