- シンクタンクならニッセイ基礎研究所 >

- 資産運用・資産形成 >

- 株式 >

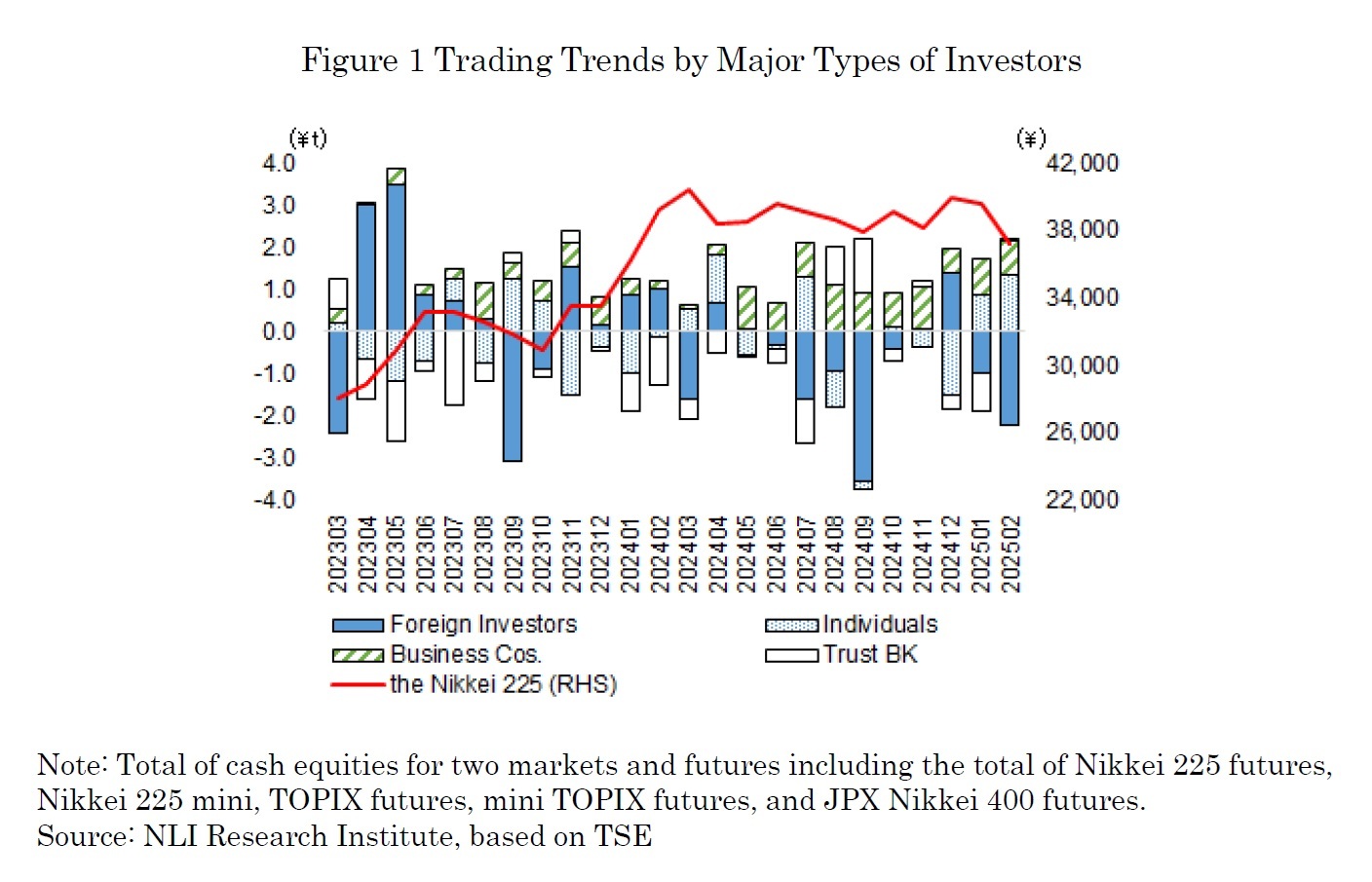

- Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025

Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025

金融研究部 研究員 森下 千鶴

文字サイズ

- 小

- 中

- 大

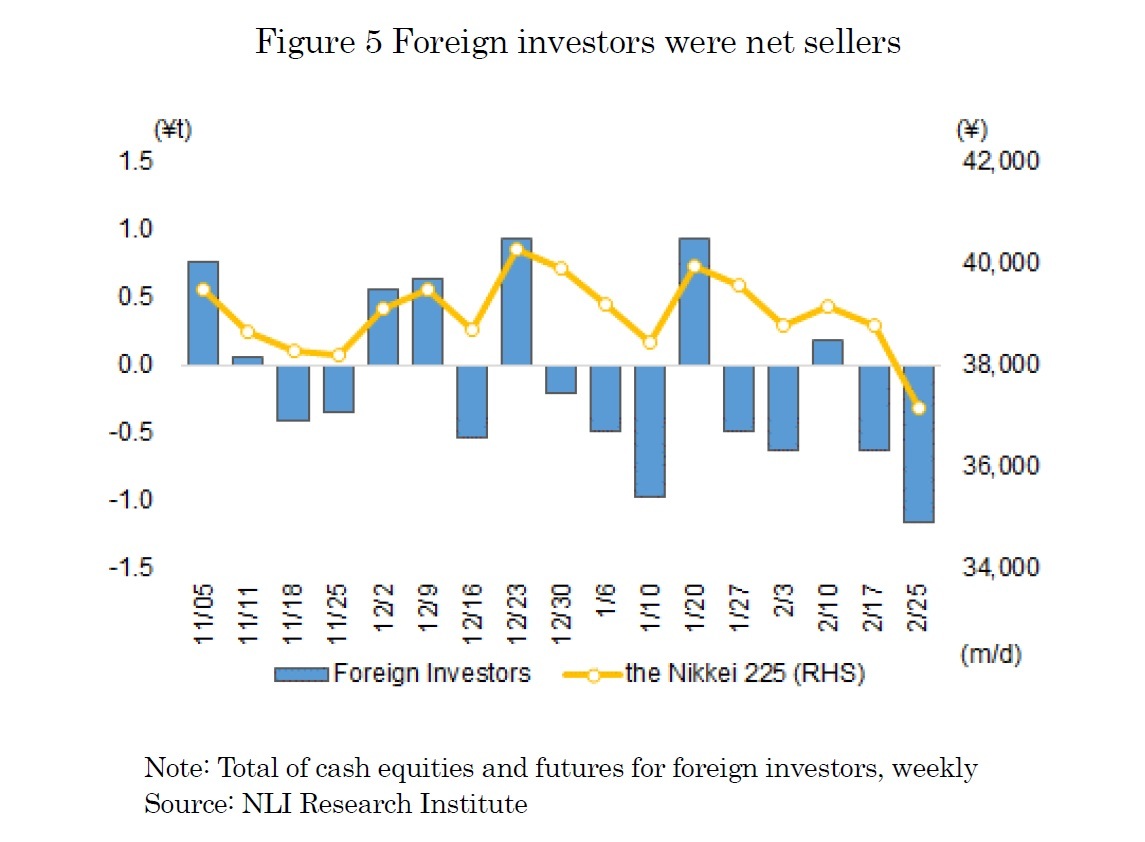

During this week, risk-off sentiment among foreign investors intensified, driven by factors such as President Trump’s announcement of additional tariffs, worsening U.S. economic indicators, and selling in U.S. tech stocks, including NVIDIA, which reported earnings on the 26th. As a result, Japanese stocks came under selling pressure, and the Nikkei ended February below 38,000, a level that had served as the lower bound of the range in recent months.

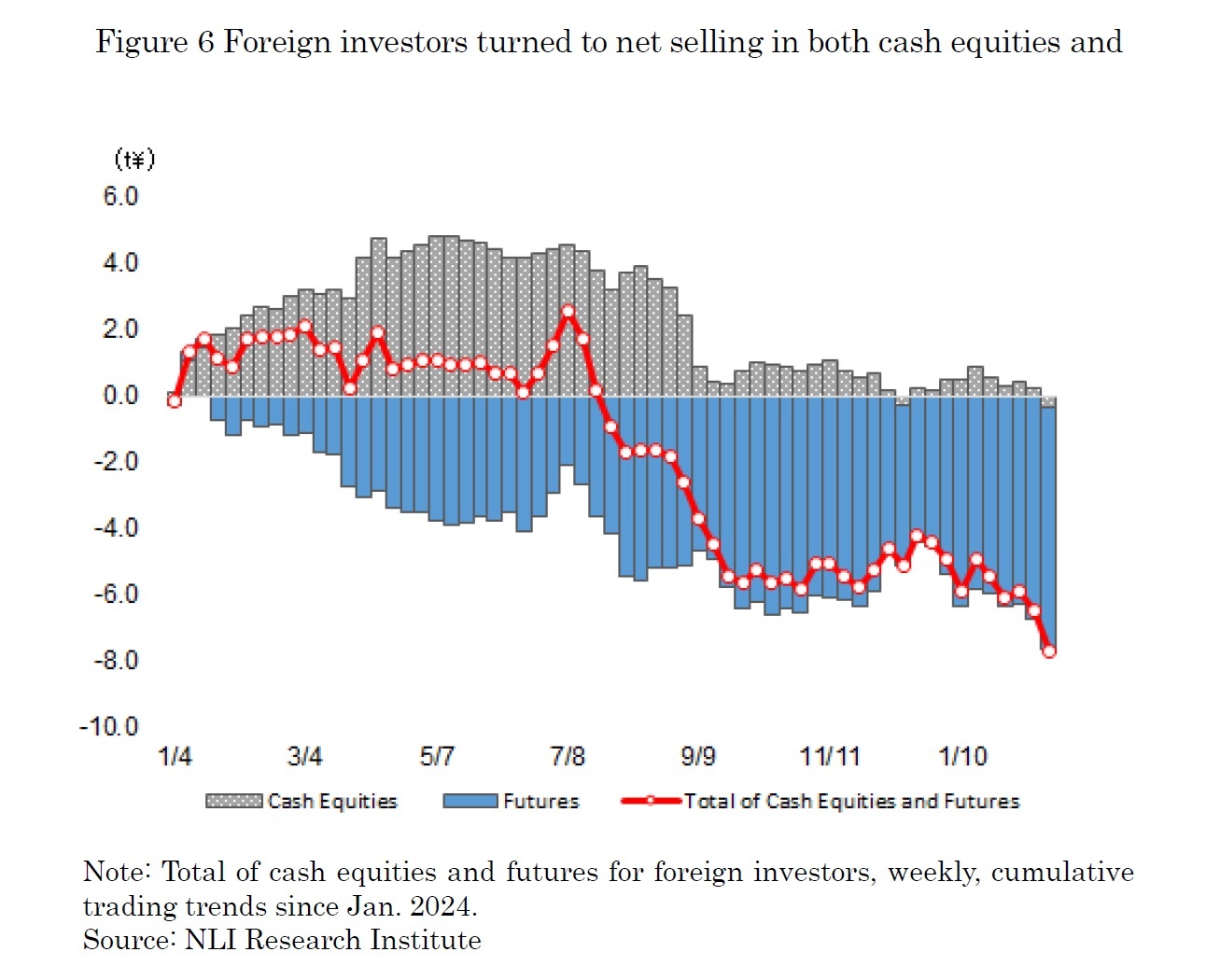

Looking at the trading trends of foreign investors since January 2024, they recorded a total net sale of 7.6 trillion yen in cash equities and futures from January 2024 to February 2025 (as shown in Figure 6). Breaking this down, cash equities saw a net sale of 350 billion yen, turning into cumulative net selling for the first time since the third week of December 2024. Meanwhile, futures posted a significant net sale of 7.27 trillion yen, highlighting particularly heavy selling in this segment. Going forward, attention will be on when foreign investors will begin buying back futures.

(2025年03月10日「研究員の眼」)

03-3512-1855

- 【職歴】

2006年 資産運用会社にトレーダーとして入社

2015年 ニッセイ基礎研究所入社

2020年4月より現職

【加入団体等】

・日本証券アナリスト協会検定会員

・早稲田大学大学院経営管理研究科修了(MBA、ファイナンス専修)

森下 千鶴のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/08 | Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/10/07 | 投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ | 森下 千鶴 | 研究員の眼 |

| 2025/10/03 | 進む東証改革、なお残る上場維持基準の課題 | 森下 千鶴 | ニッセイ年金ストラテジー |

| 2025/09/09 | Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025 | 森下 千鶴 | 研究員の眼 |

新着記事

-

2025年10月30日

潜在成長率は変えられる-日本経済の本当の可能性 -

2025年10月30日

米FOMC(25年10月)-市場予想通り、政策金利を▲0.25%引き下げ。バランスシート縮小を12月1日で終了することも決定 -

2025年10月30日

試練の5年に踏み出す中国(後編)-「第15次五カ年計画」建議にみる、中国のこれからの針路 -

2025年10月30日

米国で進む中間期の選挙区割り変更-26年の中間選挙を見据え、与野党の攻防が激化 -

2025年10月29日

生活習慣病リスクを高める飲酒の現状と改善に向けた対策~男女の飲酒習慣の違いに着目して

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!