- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)

Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

1.Annualized negative growth in the October–December quarter of 2023

Nominal GDP increased for the first time in two quarters to 0.3% from the previous quarter 1.2% on an annualized basis), outpacing real growth. On the other hand, the GDP deflator increased by 0.4% from the previous quarter (against 0.8% in the July–September quarter) and 3.8% year-on-year (against 5.2% in the July–September quarter). In addition to the rise in the prices of goods, the prices of services also increased because of the higher labor costs, boosting the domestic demand deflator for the 12th consecutive quarter (0.4% from the previous July–September quarter).

As a result, the real GDP in the calendar year 2023 was 1.9% (against 1.0% in 2022) and the nominal GDP was 5.7% (against 1.3% in 2022), and both show positive growth for the third consecutive year. The nominal GDP exhibited the highest growth in 32 years (since 1991, 6.5%).

Although the global economy has maintained a certain degree of resilience, with the growth rate hovering around 3% (according to the Institute’s estimate), the global trade volume has continued to decline since the October–December quarter of 2022. Even though the non-manufacturing sector has tended to recover, partly because of pent-up demand in the post-COVID-19 period, global trade has experienced a decline because of continued stagnation in the manufacturing sector resulting from IT-related inventory adjustments and other factors.

The real GDP growth in the United States continues to exceed expectations, reaching an annualized 4.9% from the previous quarter in the July–September quarter of 2023 and an annualized 3.3% from the previous quarter in the October–December quarter of 2023. However, growth is expected to slow down by mid-2024 to an annualized 1% as a result of cumulative monetary tightening. The real GDP growth in the euro area is likely to remain low in 2024 (0.7%, following 0.5% in 2023). Furthermore, China’s real GDP growth rate in 2023, which rose to 5.2%from 3.0% in 2022 after the end of the zero-COVID-19 policy, is expected to decline to about 4% in 2024 and 2025 because of the prolonged slump in the real estate market and other factors.

Therefore, the growth of the overseas economy slowed down significantly from about 6% in 2021 to 3% in 2022 and 2023 and is expected to remain around 3% in 2024 and 2025, which is below the average growth rate of approximately 4% seen since 1980.

After slowing down from 4.7% y/y in FY2022 to 4.2% y/y in FY2023, Japan’s exports are expected to decrease below 3% y/y in both FY2024 and FY2025, partly because of the strong yen. Thus, exports are not expected to drive the Japanese economy in the foreseeable future.

Personal consumption, which rapidly declined due to the impact of the COVID-19 pandemic, was expected to recover quickly as COVID-19 subsided and socioeconomic activities normalized. However, a sudden expansion of consumption—the so-called “revenge consumption”—has not materialized. In May 2023, COVID-19 was reclassified as a Class 5 disease under the Infectious Disease Control Law. However, private consumption as part of the GDP has declined for three consecutive quarters since the April–June quarter of 2023 and shows increasing signs of stagnation.

The negative effect of high prices partly explains the sluggish consumption despite the normalization of socioeconomic activities. Nonetheless, price increases exceeding 2% y/y began in April 2022 and personal consumption remained relatively firm during FY2022. This was probably due to the significant decline in consumption levels that resulted from the restrictions on activities in the wake of the COVID-19 pandemic, as well as various support measures such as the provision of special fixed benefits, which led to a high household savings rate.

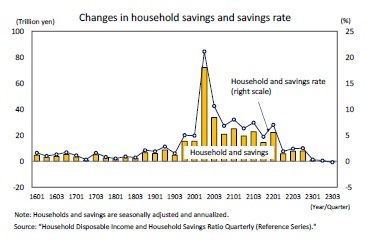

The household savings rate averaged 1.2% from 2015 to 2019 (before the pandemic) but jumped to 21.1% in the April–June quarter of 2020 as a result of the sharp drop in consumption following the declaration of a state of emergency in April 2020 as well as the substantial increase in disposable income because of the provision of special fixed benefits. Subsequently, the savings rate declined as consumption rose as a result of the easing of COVID-19 restrictions. The high prices also played a role in this. Nonetheless, the savings rate remained higher than before the pandemic until 2022. Thus, despite the headwind of high prices, private consumption remained strong by lowering the savings rate.

However, the “Preliminary Quarterly Report on Household Disposable Income and Household Savings Ratio (Reference Series)” released by the Cabinet Office in January 2024 revealed that the household savings rate declined significantly after the start of 2023, turning slightly negative (˗0.2%) in the July–September quarter of 2023. Thus, the consumption-boosting effect of the decrease in the savings rate has already disappeared.

However, the “Preliminary Quarterly Report on Household Disposable Income and Household Savings Ratio (Reference Series)” released by the Cabinet Office in January 2024 revealed that the household savings rate declined significantly after the start of 2023, turning slightly negative (˗0.2%) in the July–September quarter of 2023. Thus, the consumption-boosting effect of the decrease in the savings rate has already disappeared.

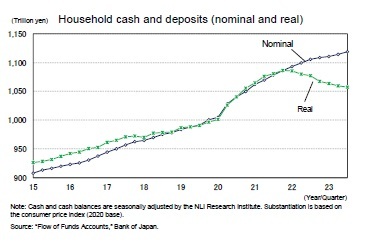

Furthermore, flow-based savings are already below pre-COVID-19 levels. Therefore, although revenge consumption through a decrease in the saving rate is not expected to continue, households should have ample accumulated savings from the time of the pandemic. Accordingly, as a result of the accumulation of flow savings, households’ cash and deposit balances as stock are increasing at an accelerated pace in response to the increase in savings during the pandemic.

Furthermore, flow-based savings are already below pre-COVID-19 levels. Therefore, although revenge consumption through a decrease in the saving rate is not expected to continue, households should have ample accumulated savings from the time of the pandemic. Accordingly, as a result of the accumulation of flow savings, households’ cash and deposit balances as stock are increasing at an accelerated pace in response to the increase in savings during the pandemic.However, when household cash and deposit balances are realized by the 2020-based consumer price index, it is evident that they increased significantly during the COVID-19 pandemic but have been in decline since 2022. Therefore, high prices led to a decrease not only in income (flow) but also in financial assets (stock) accumulated during the pandemic and resulted in a lack of revenge consumption.

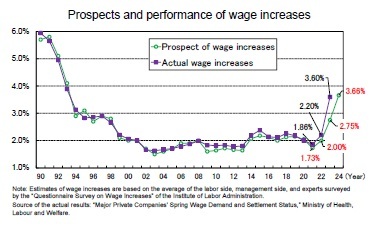

The spring wage offensive of 2023 resulted in a 3.60% wage increase—the highest in 30 years—according to the “Status of Spring Wage Hike Demands and Compromises by Major Private Corporations” of the Ministry of Health, Labour and Welfare. Meanwhile, the unemployment rate has remained in the mid-2% range, and the labor supply-demand balance remains tight. Moreover, ordinary profit (seasonally adjusted) in the corporate sector is at record high levels, and consumer price inflation has remained high. Thus, the environment for wage increases remains favorable.

In the 2023 spring wage offensive, RENGO raised its demands for a rise from around 4% (including the portion equivalent to regular salary increases)—which dates back to 2015——to approximately 5%. Also, RENGO will demand a rise of 5% or more in the 2024 spring wage offensive. Furthermore, RENGO member unions are increasingly proposing high wage hikes. In addition, management shows a positive attitude toward wage increases, as evidenced by Keidanren’s “2024 Report of the Special Committee on Management and Labor Policy,” which states that contributing to the realization of structural wage increases is a “social responsibility.”

In the 2023 spring wage offensive, RENGO raised its demands for a rise from around 4% (including the portion equivalent to regular salary increases)—which dates back to 2015——to approximately 5%. Also, RENGO will demand a rise of 5% or more in the 2024 spring wage offensive. Furthermore, RENGO member unions are increasingly proposing high wage hikes. In addition, management shows a positive attitude toward wage increases, as evidenced by Keidanren’s “2024 Report of the Special Committee on Management and Labor Policy,” which states that contributing to the realization of structural wage increases is a “social responsibility.”According to the “Questionnaire Survey on Wage Increases,” released on January 31st by the Institute for the Study of Labor Administration, forecasts for 2024 indicate an average wage increase of 3.66% according to approximately 478 labor and management parties and experts in the labor economy. This is significantly higher than the previous year’s forecast (2.75%) and slightly higher than the actual result for 2023 (3.60%). Actual wage increases by major companies compiled by the Ministry of Health, Labour and Welfare tend to be slightly higher than those forecasted by the same survey, but the actual increase for 2023 was significantly higher. Taking these factors into account, the current forecast is for a 4.00% increase in the spring wage offensive of 2024.

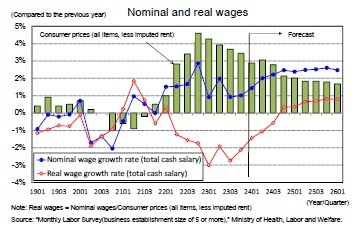

Real wages have been negative since April 2022, mainly due to consumer price inflation. Although nominal wage growth is expected in the future, the decline in real wages is likely to continue for some time because consumer price inflation will remain high. Thus, real wage growth is not expected to turn positive until the second half of FY2024, when consumer price inflation is expected to fall below 2%.

In FY2022, nominal employee compensation increased for the second consecutive year (2.4% , but real employee compensation decreased (˗1.3% ) because of the increase in consumer prices. As a result, real employee compensation is expected to decline for the second consecutive year, to ˗1.5%. On the other hand, nominal employee compensation is expected to rise to 2.7% in FY2024 and 2.9% in FY2025 because of the wage increases resulting from the spring wage offensive. In addition, price hikes are expected to slow down. Therefore, real employee compensation is expected to increase to 0.4% y/y in FY2024, for the first time in three years, and then rise to 1.4% y/y in FY2025. At the same time, price increases are expected to slow down.

In FY2022, nominal employee compensation increased for the second consecutive year (2.4% , but real employee compensation decreased (˗1.3% ) because of the increase in consumer prices. As a result, real employee compensation is expected to decline for the second consecutive year, to ˗1.5%. On the other hand, nominal employee compensation is expected to rise to 2.7% in FY2024 and 2.9% in FY2025 because of the wage increases resulting from the spring wage offensive. In addition, price hikes are expected to slow down. Therefore, real employee compensation is expected to increase to 0.4% y/y in FY2024, for the first time in three years, and then rise to 1.4% y/y in FY2025. At the same time, price increases are expected to slow down.

(2024年02月21日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/09/17 | 貿易統計25年8月-関税引き上げの影響が顕在化し、米国向け自動車輸出が数量ベースで大きく落ち込む | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/08 | 2025・2026年度経済見通し-25年4-6月期GDP2次速報後改定 | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/09/01 | 法人企業統計25年4-6月期-トランプ関税の影響で製造業は減益も、非製造業が堅調を維持 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/08/29 | 鉱工業生産25年7月-自動車中心に下振れリスクが高く、7-9月期は減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年09月17日

ふるさと納税「お得競争」の終焉-ポイント還元の廃止で問われる「地域貢献」と「持続可能な制度」のこれから -

2025年09月17日

貿易統計25年8月-関税引き上げの影響が顕在化し、米国向け自動車輸出が数量ベースで大きく落ち込む -

2025年09月17日

「最低賃金上昇×中小企業=成長の好循環」となるか?-中小企業に託す賃上げと成長の好循環の行方 -

2025年09月17日

家計消費の動向(二人以上世帯:~2025年7月)-実質賃金改善下でも「メリハリ消費」継続、娯楽支出は堅調を維持 -

2025年09月16日

インド消費者物価(25年9月)~8月のCPI上昇率は+2.1%に上昇、GST合理化でインフレ見通しは緩和

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!