- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan's Economic Outlook for Fiscal Years 2021 and 2022

2021年08月24日

文字サイズ

- 小

- 中

- 大

1. The economy grew at an annualized rate of 1.3% in the April–June quarter of 2021

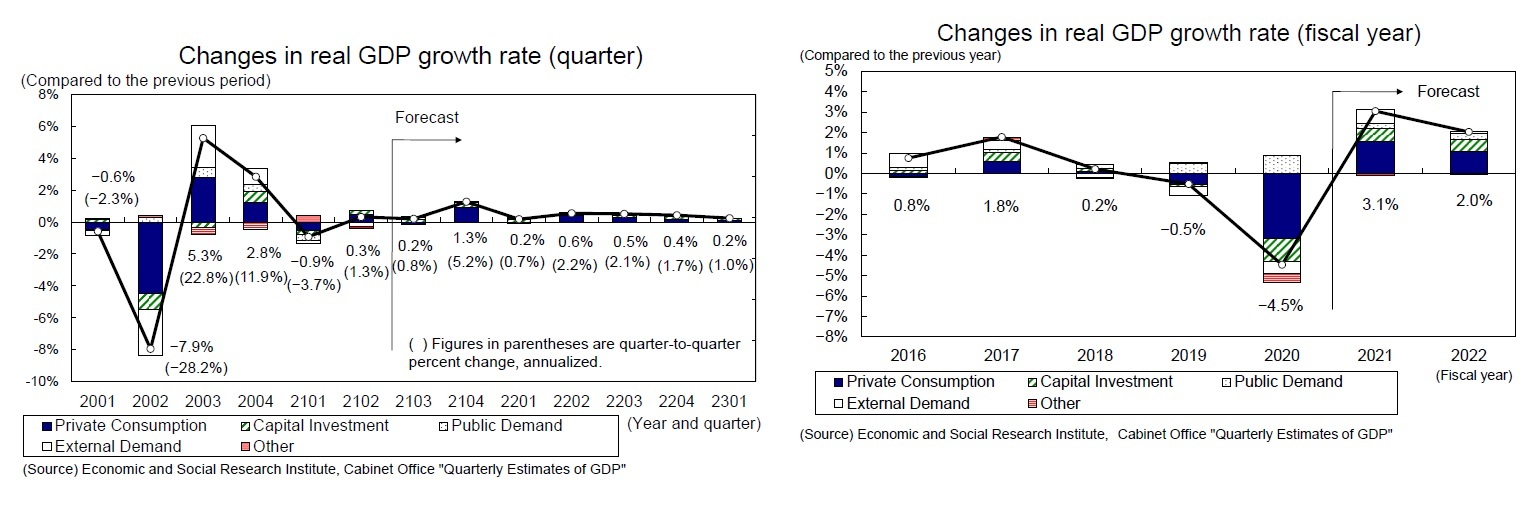

In the April–June quarter of 2021, real GDP grew 0.3% (1.3% per annum) from the previous quarter, the first positive growth in two quarters.

Although the contribution of external demand declined for the second consecutive quarter by 0.3% (an annual slump of 1.3%) from the previous quarter, even with the declaration of the state of emergency, private consumption (0.8%), housing investment (2.1%), and capital investment (1.7%) in private demand all climbed, covering the reduction in external demand. Public investment saw a decline, but public demand was also boosted as government consumption rose 0.5% from the previous quarter, reflecting the progress of vaccinations.

Real GDP in the April–June quarter of 2021 posted its first positive growth in two quarters but has not recovered the drop in the January–March quarter 2021 (down 0.9% from the previous quarter and 3.7% per annum). After posting record-high negative growth in the April–June quarter of 2020, the Japanese economy recorded double-digit annual growth for two consecutive quarters, but has remained stagnant since the beginning of 2021, when the state of emergency was reissued.

Although the contribution of external demand declined for the second consecutive quarter by 0.3% (an annual slump of 1.3%) from the previous quarter, even with the declaration of the state of emergency, private consumption (0.8%), housing investment (2.1%), and capital investment (1.7%) in private demand all climbed, covering the reduction in external demand. Public investment saw a decline, but public demand was also boosted as government consumption rose 0.5% from the previous quarter, reflecting the progress of vaccinations.

Real GDP in the April–June quarter of 2021 posted its first positive growth in two quarters but has not recovered the drop in the January–March quarter 2021 (down 0.9% from the previous quarter and 3.7% per annum). After posting record-high negative growth in the April–June quarter of 2020, the Japanese economy recorded double-digit annual growth for two consecutive quarters, but has remained stagnant since the beginning of 2021, when the state of emergency was reissued.

(Growing gap in growth rates between Japan and the United States)

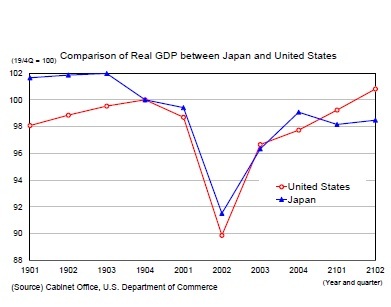

(Growing gap in growth rates between Japan and the United States)In 2021, U.S. growth in the April–June quarter was 6.5%, while Japan’s growth was only 1.3%. Compared to pre-coronavirus levels of real GDP (October–December quarter 2019), the U.S. was 0.8% above while Japan was 1.5% below. Looking back at developments in real GDP during the COVID-19 pandemic, the decline in the first half of 2020 was greater in the United States where the lockdown was implemented, and it rapidly recovered at about the same pace in the second half of 2020. As of the October–December quarter of 2020, Japan was slightly above the United States in real GDP compared to pre-coronavirus levels. In 2021, however, while the United States continued to enjoy high economic growth thanks to the relaxation of restrictions on activities in line with the progress of vaccination, Japan’s economic activities again stagnated due to the declaration of a state of emergency and the priority preventative measures to prevent the spread of the disease. As a result, the gap between the growth rates in the United States and Japan widened rapidly.

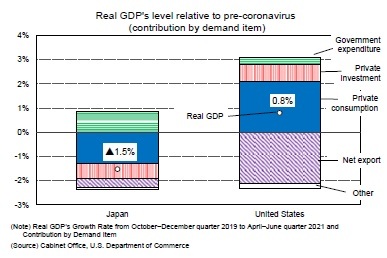

Looking at real GDP in the April–June quarter of 2021 by demand category compared to pre-coronavirus levels, the United States’ exports remain below pre-coronavirus levels and imports remain strong. Therefore net exports pushed down real GDP by 2.1%, whereas personal consumption is 3.1% higher than pre-coronavirus levels and pushed up real GDP by 2.1%. Private investment (housing and capital investment) is also higher than pre-coronavirus levels.

Looking at real GDP in the April–June quarter of 2021 by demand category compared to pre-coronavirus levels, the United States’ exports remain below pre-coronavirus levels and imports remain strong. Therefore net exports pushed down real GDP by 2.1%, whereas personal consumption is 3.1% higher than pre-coronavirus levels and pushed up real GDP by 2.1%. Private investment (housing and capital investment) is also higher than pre-coronavirus levels.In Japan, meanwhile, personal consumption has fallen 2.4% compared to pre-coronavirus levels, pushing real GDP down 1.3%, even as government spending is pushing real GDP up 0.9% in the wake of coronavirus response measures and other factors. Private investment (housing and capital investment) also saw strong growth in the April–June quarter of 2021, but remains below pre-coronavirus levels.

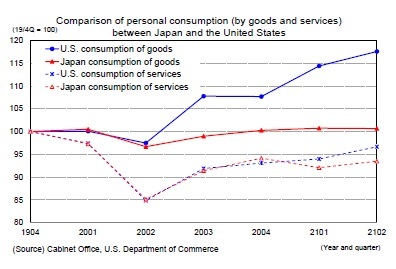

The main reason for the differences in growth rates between Japan and the United States is the significant variance in consumer spending. Examining trends in personal consumption in Japan and the United States in the wake of the coronavirus disaster by goods, there was little difference between Japan and the United States regarding consumption until the April–June quarter of 2020. However, growth since the July–September quarter of 2020 has been much higher in the United States than in Japan. This disparity is due to the higher percentage of online shopping in the United States, the larger size of household benefits, and the greater growth in disposable income than in Japan. The latest real household disposable income has increased by 6.4% compared with pre-coronavirus levels in the United States, while it has remained at 0.2% in Japan (Japan’s most recent data covered the January–March quarter in 2021, due to statistical constraints).

The main reason for the differences in growth rates between Japan and the United States is the significant variance in consumer spending. Examining trends in personal consumption in Japan and the United States in the wake of the coronavirus disaster by goods, there was little difference between Japan and the United States regarding consumption until the April–June quarter of 2020. However, growth since the July–September quarter of 2020 has been much higher in the United States than in Japan. This disparity is due to the higher percentage of online shopping in the United States, the larger size of household benefits, and the greater growth in disposable income than in Japan. The latest real household disposable income has increased by 6.4% compared with pre-coronavirus levels in the United States, while it has remained at 0.2% in Japan (Japan’s most recent data covered the January–March quarter in 2021, due to statistical constraints).Service consumption remained almost the same in Japan and the United States in 2020, but since the beginning of 2021, the United States has continued to recover with the relaxation of social distancing in line with the progress of vaccination, whereas Japan has seen sluggish recovery from the enforcement of restrictions on activities. Comparing the crowds at retail and entertainment facilities, which is closely linked to service consumption, the decline in the United States was consistently large until approximately the beginning of 2021. Since April 2021, however, the decline in Japan has greatly exceeded that of the United States.

2. Real growth rate is expected to be 3.1% in FY 2021 and 2.0% in FY 2022

(July–September quarter is also expected to remain sluggish.)

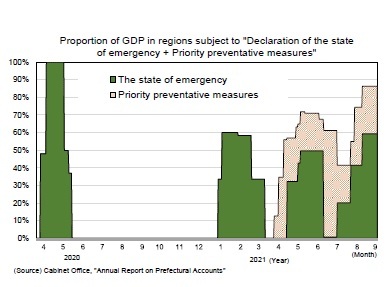

(July–September quarter is also expected to remain sluggish.)In Japan, either a declaration of a state of emergency or priority preventative measures have been implemented in most of 2021. Both measures were not performed for only a brief period of time, from January 1 to 7 and March 22 to April 4. In 2021, the January–March and April–June quarters accounted for 40% and 55% of Japan’s GDP, respectively, of the regions subject to the declaration of the state of emergency and the priority preventative measures. However, the ratio has risen to 74% at present (August 17) and to 86% from August 20. Although the government’s declaration of the state of emergency has been less effective in curbing the flow of people due to the effects of the coronavirus and fatigue from voluntary restraint, it is highly likely that this summer’s crowds will be lower than last year’s.

Summer is the season when travel demand is usually high. According to the Japan Travel Bureau’s “Travel Outlook for Summer Vacations,” the number of people traveling in Japan during summer vacation in 2021 is estimated to be 40 million, up 5.3% from the previous year (and reduced 44.8% from the year before last). This survey, estimated by the Japan Travel Bureau based on travel trends, economic indicators, industry trends, and bookings, was based on a survey conducted before a state of emergency was declared in Tokyo on July 12 (the survey period covered July 5–9). Therefore, there is a high possibility that the actual number of travelers will be smaller.

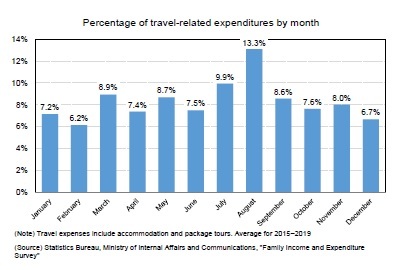

The monthly ratio of travel expenses (accommodation + package tour expenses) in the Family Income and Expenditure Survey (Statistics Bureau, Ministry of Internal Affairs)was 9.9% in July, 13.3% in August, and 8.6% in September (average from 2015 to 2019), with the July–September quarter accounting for more than 30% of the total. Cancellations are expected to continue amid calls to refrain from traveling in the wake of the coronavirus outbreak. The drop in travel spending will have a greater impact on overall consumer spending than in other quarters.

The monthly ratio of travel expenses (accommodation + package tour expenses) in the Family Income and Expenditure Survey (Statistics Bureau, Ministry of Internal Affairs)was 9.9% in July, 13.3% in August, and 8.6% in September (average from 2015 to 2019), with the July–September quarter accounting for more than 30% of the total. Cancellations are expected to continue amid calls to refrain from traveling in the wake of the coronavirus outbreak. The drop in travel spending will have a greater impact on overall consumer spending than in other quarters.

(Exports and capital investment will support the economy)

Private consumption is likely to remain sluggish for a long time due to the declaration of the state of emergency. However, unlike spring 2020, demand items other than private consumption are less susceptible to the declaration.

Exports dropped sharply in the first half of 2020 due to the effects of overseas lockdowns, then recovered sharply in the second half of 2020 due to the resumption of global economic activity and continued to be strong in 2021. By product category, automobile-related products remained sluggish due to the semiconductor shortage, but information-related products and capital goods remained strong against the background of expansion of digital-related demand and recovery in global capital investment. While exports have already recovered to pre-coronavirus levels, the pace of growth has slowed, but the outlook is expected to remain robust against the backdrop of a global economic recovery.

Private consumption is likely to remain sluggish for a long time due to the declaration of the state of emergency. However, unlike spring 2020, demand items other than private consumption are less susceptible to the declaration.

Exports dropped sharply in the first half of 2020 due to the effects of overseas lockdowns, then recovered sharply in the second half of 2020 due to the resumption of global economic activity and continued to be strong in 2021. By product category, automobile-related products remained sluggish due to the semiconductor shortage, but information-related products and capital goods remained strong against the background of expansion of digital-related demand and recovery in global capital investment. While exports have already recovered to pre-coronavirus levels, the pace of growth has slowed, but the outlook is expected to remain robust against the backdrop of a global economic recovery.

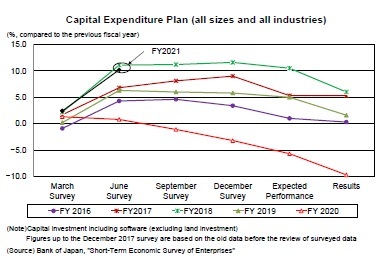

Capital investment decreased 6.8% from the previous year in FY 2020 due to a significant drop in corporate earnings caused by the novel coronavirus. In 2021, even though a state of emergency was declared in the April–June quarter, capital investment expanded 1.7% from the previous quarter.

Capital investment decreased 6.8% from the previous year in FY 2020 due to a significant drop in corporate earnings caused by the novel coronavirus. In 2021, even though a state of emergency was declared in the April–June quarter, capital investment expanded 1.7% from the previous quarter.According to the Bank of Japan’s Tankan survey conducted in June 2021, capital investment in FY 2020 (total size and industry, including software investment and excluding land investment) was drastically revised downward from March 2021, and decreased by 9.7% from the previous year—the first decrease in a decade. In contrast, capital investment plans for FY 2021 were revised upward by 2.9% from the March 2021 survey to 10.2% from the previous year. While corporate earnings have improved significantly, particularly in the manufacturing sector, capital investment has picked up, mainly in software investment for telework expansion and digitization, and machinery investments as a result of strong production activities in the manufacturing sector. Looking ahead, although construction investment in the face-to-face service industry will continue to be a downward factor, overall capital investment is expected to continue to recover due to an improvement in machinery- and digital-related investments.

(Real GDP will exceed its most recent peak in FY 2023)

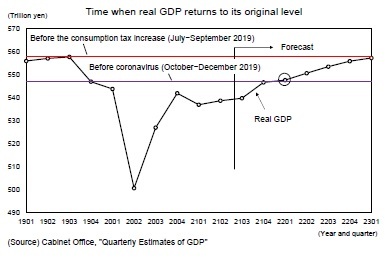

In 2020, the Japanese economy plunged in the first half as a result of requests for self-restraint and the issuance of the state of emergency in response to the spread of the novel coronavirus. A rapid recovery thereafter occurred at a pace faster than expected in the second half due to the resumption of economic activities following the lifting of the state of emergency. However, economic activity stagnated in the first half of 2021 following the reissuance of the state of emergency.

In the July–September quarter of 2021, private consumption is expected to remain sluggish at a 0.3% drop from the previous quarter due to the continuation of the declaration of the state of emergency and the expansion of the target regions. However, real GDP is expected to grow at an annual rate of 0.8% from the previous quarter, as exports will remain steady against the backdrop of a recovery in overseas economies. Housing investment and capital investment, which are less susceptible to the declaration of the state of emergency, will increase. Given the low level of economic activity, the pace of recovery will be sluggish and real GDP’s level remained below the post-coronavirus peak (October–December quarter 2020). The gap between Japan’s growth rate and that of the United States and Europe will become even clearer.

In the October–December quarter of 2021, real GDP is expected to grow at a high rate of 5.2% on an annualized basis subject to the lifting of the state of emergency. The main reason for the high growth is that the consumption of face-to-face services will pick up as a result of the easing of action restrictions. Therefore, private consumption will grow 1.7% from the previous quarter. However, we cannot deny the risk that consumption could be undermined by the intermittent issuance of priority preventative measures and the declaration of the state of emergency.

In 2020, the Japanese economy plunged in the first half as a result of requests for self-restraint and the issuance of the state of emergency in response to the spread of the novel coronavirus. A rapid recovery thereafter occurred at a pace faster than expected in the second half due to the resumption of economic activities following the lifting of the state of emergency. However, economic activity stagnated in the first half of 2021 following the reissuance of the state of emergency.

In the July–September quarter of 2021, private consumption is expected to remain sluggish at a 0.3% drop from the previous quarter due to the continuation of the declaration of the state of emergency and the expansion of the target regions. However, real GDP is expected to grow at an annual rate of 0.8% from the previous quarter, as exports will remain steady against the backdrop of a recovery in overseas economies. Housing investment and capital investment, which are less susceptible to the declaration of the state of emergency, will increase. Given the low level of economic activity, the pace of recovery will be sluggish and real GDP’s level remained below the post-coronavirus peak (October–December quarter 2020). The gap between Japan’s growth rate and that of the United States and Europe will become even clearer.

In the October–December quarter of 2021, real GDP is expected to grow at a high rate of 5.2% on an annualized basis subject to the lifting of the state of emergency. The main reason for the high growth is that the consumption of face-to-face services will pick up as a result of the easing of action restrictions. Therefore, private consumption will grow 1.7% from the previous quarter. However, we cannot deny the risk that consumption could be undermined by the intermittent issuance of priority preventative measures and the declaration of the state of emergency.

In the future, the progress of vaccinations is expected to contribute to the suppression of infection to a certain extent. However, it is unlikely that the number of infected people will drop to zero, and there is a high possibility that the number will fluctuate depending on the emergence of new variants or changes in temperature.

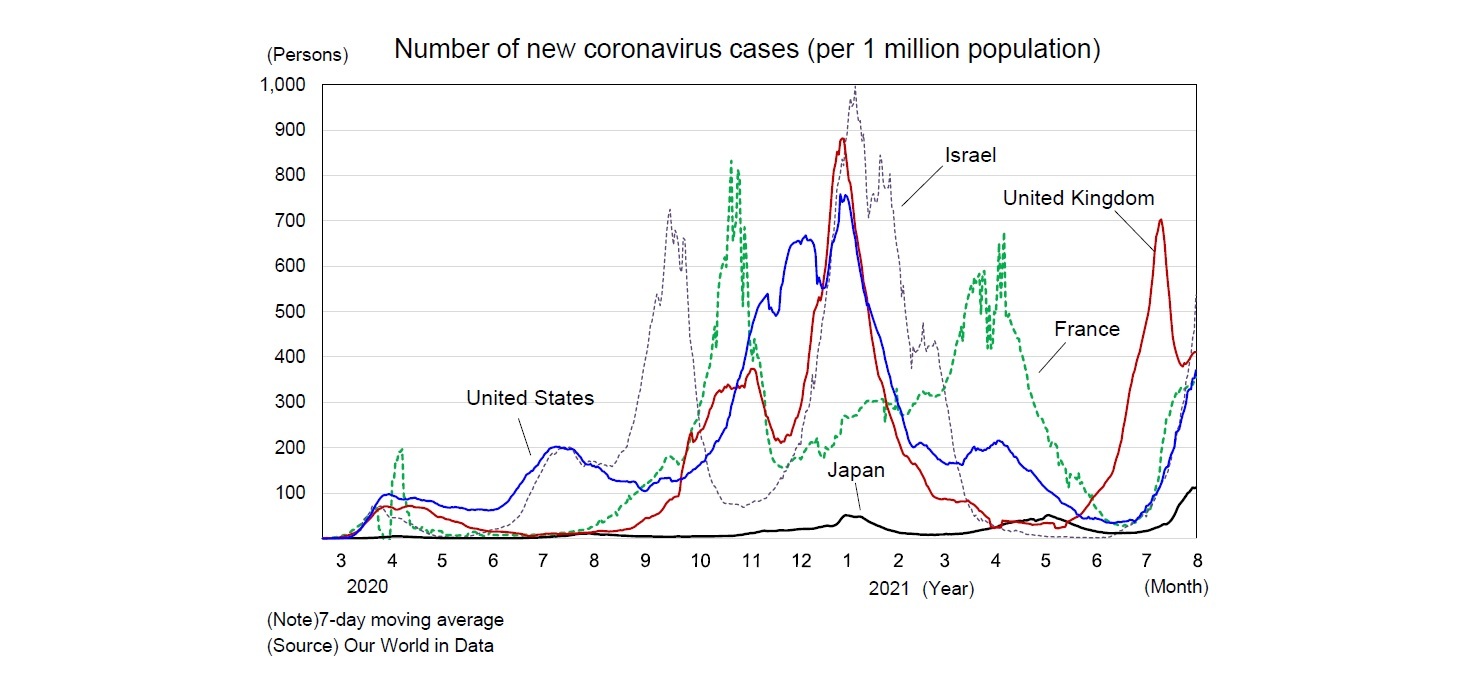

As is clear from the examples of other countries, the number of people infected with the novel coronavirus has fluctuated due to the emergence of variants regardless of the vaccination rate. Although the number of new infections in Japan has increased significantly, the number of new infections (per 1 million population) in the United States and the United Kingdom, where the vaccination rate is much higher than in Japan, is approximately three times higher than in Japan. Moreover, the number of new deaths (per 1 million population) is approximately 10 times higher than in Japan (as of August 15, 2021).

As is clear from the examples of other countries, the number of people infected with the novel coronavirus has fluctuated due to the emergence of variants regardless of the vaccination rate. Although the number of new infections in Japan has increased significantly, the number of new infections (per 1 million population) in the United States and the United Kingdom, where the vaccination rate is much higher than in Japan, is approximately three times higher than in Japan. Moreover, the number of new deaths (per 1 million population) is approximately 10 times higher than in Japan (as of August 15, 2021).

Every time the number of new coronavirus cases increases, measures to curb the spread of the disease, such as asking people to take time off or refraining from going out, could prolong the economic slump.

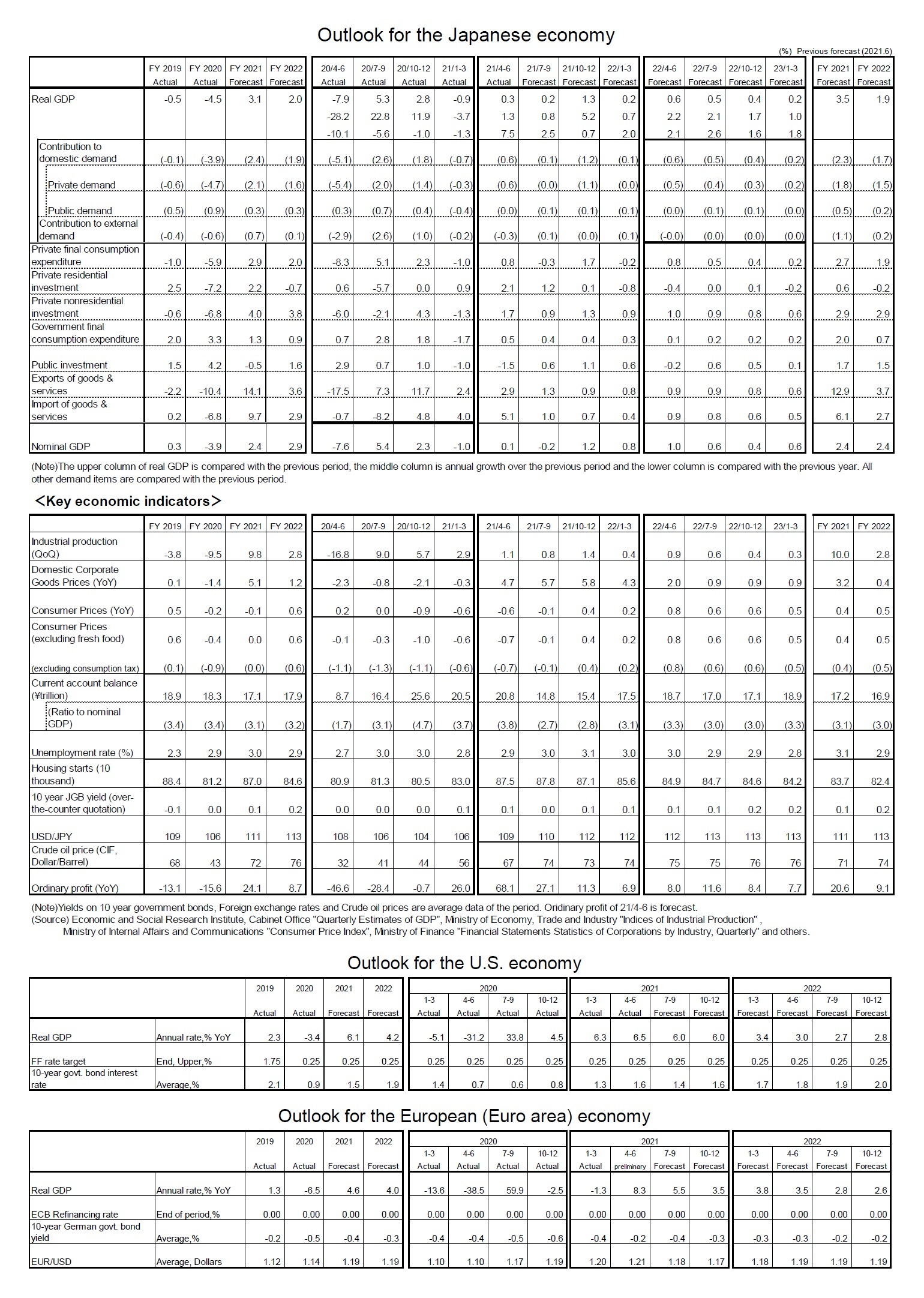

Real GDP is forecast to grow by 3.1% in FY 2021, 2.0% in FY 2022. On the one hand, even if the restrictions on economic activities are eased, consumer spending will not recover in earnest because social distancing and other measures will continue to curb consumption of face-to-face services such as dining out and travel. Private consumption is expected to grow modestly by 2.9% in FY 2021 and 2.0% in FY 2022, after the sharp decline of 5.9% in FY 2020.

On the other hand, capital investment, which has become less susceptible to the declaration of the state of emergency, increased slightly by 4.0% from the previous year in FY 2021 against the backdrop of improved corporate earnings, and will remain steady at 3.8% in FY 2022. In FY 2021, exports jumped 14.1% from the previous year on the back of the recovery of overseas economies, and a continued 3.6% robust growth in FY 2022 will likely boost the growth rate.

Real GDP is forecast to grow by 3.1% in FY 2021, 2.0% in FY 2022. On the one hand, even if the restrictions on economic activities are eased, consumer spending will not recover in earnest because social distancing and other measures will continue to curb consumption of face-to-face services such as dining out and travel. Private consumption is expected to grow modestly by 2.9% in FY 2021 and 2.0% in FY 2022, after the sharp decline of 5.9% in FY 2020.

On the other hand, capital investment, which has become less susceptible to the declaration of the state of emergency, increased slightly by 4.0% from the previous year in FY 2021 against the backdrop of improved corporate earnings, and will remain steady at 3.8% in FY 2022. In FY 2021, exports jumped 14.1% from the previous year on the back of the recovery of overseas economies, and a continued 3.6% robust growth in FY 2022 will likely boost the growth rate.

Currently, we expect the real GDP level to rise above pre-coronavirus levels (October–December quarter 2019) in the January–March quarter of 2022 and to return to its most recent peak (July–September quarter 2019) in 2023. However, it is extremely difficult to anticipate future trends in the spread of COVID-19 and the corresponding public health measures. If the government continues to implement the same policy measures as it has in the past, it will likely further delay the normalization of the economy.

Currently, we expect the real GDP level to rise above pre-coronavirus levels (October–December quarter 2019) in the January–March quarter of 2022 and to return to its most recent peak (July–September quarter 2019) in 2023. However, it is extremely difficult to anticipate future trends in the spread of COVID-19 and the corresponding public health measures. If the government continues to implement the same policy measures as it has in the past, it will likely further delay the normalization of the economy.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2021年08月24日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/19 | 消費者物価(全国25年8月)-コアCPIは9ヵ月ぶりの3%割れ、年末には2%程度まで鈍化する見通し | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/17 | 貿易統計25年8月-関税引き上げの影響が顕在化し、米国向け自動車輸出が数量ベースで大きく落ち込む | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月17日

EUの金融システムのリスクと脆弱性(2025秋)-欧州の3つの金融監督当局の合同委員会報告書 -

2025年10月17日

日本における「老衰死」増加の背景 -

2025年10月17日

選択と責任──消費社会の二重構造(1)-欲望について考える(2) -

2025年10月17日

首都圏の中古マンション価格~隣接する行政区単位での価格差は?~ -

2025年10月17日

「SDGs疲れ」のその先へ-2015年9月国連採択から10年、2030年に向け問われる「実装力」

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan's Economic Outlook for Fiscal Years 2021 and 2022】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan's Economic Outlook for Fiscal Years 2021 and 2022のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!