- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan's Economic Outlook for FY 2020–2022

2020年11月25日

文字サイズ

- 小

- 中

- 大

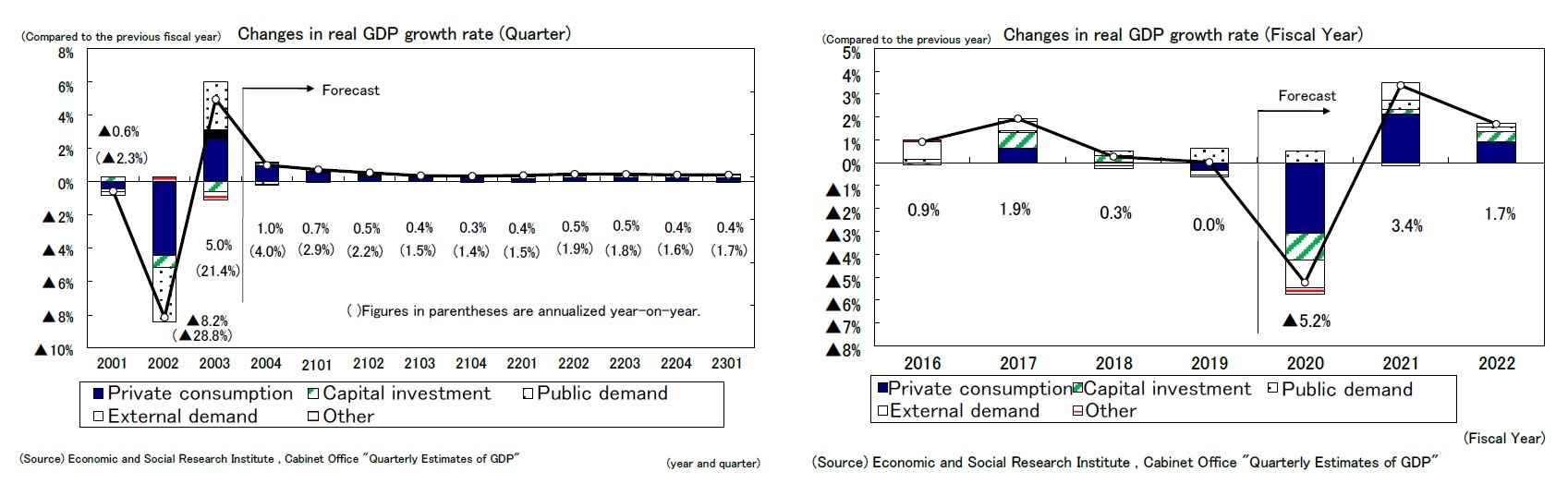

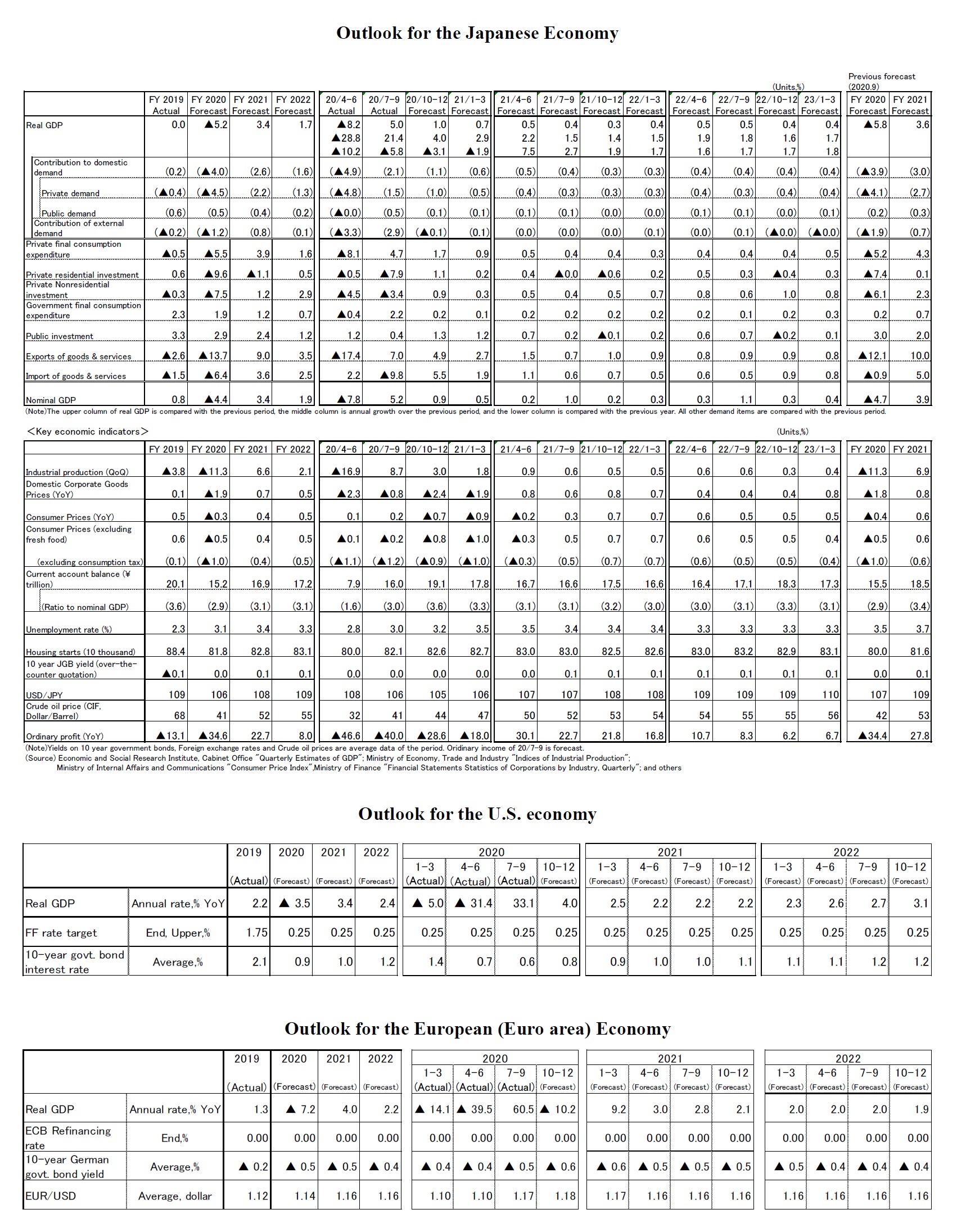

2. The real growth rate is expected to be -5.2% in FY 2020, 3.4% in FY 2021 and 1.7% in FY 2022.

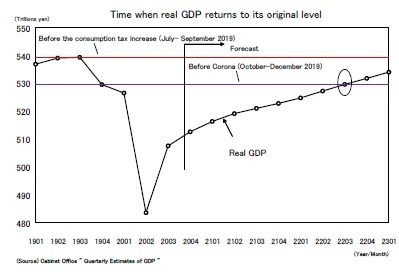

(Real GDP will exceed its most recent peak in FY 2023)

Growth in the July–September quarter of 2020 was significantly positive following the lifting of the state of emergency, but the pace is likely to slow significantly in the October–December quarter of 2020.

Real GDP growth rates in the United States and the euro area in the July–September quarter of 2020 were 33.1% and 60.5% on an annualized basis from the previous quarter, respectively. Recently, however, the number of people infected with the novel coronavirus has increased, and the trend toward lockdown has spread again in Europe. In response, real GDP growth in the euro area is expected to turn negative again in the October–December quarter of 2020. Exports of goods and services in the GDP statistics rose 7.0% in the July–September quarter, but in the October–December quarter of 2020, growth will decline, particularly to the U.S. and the euro area. On the other hand, imports, which fell by 9.8% in the July–September quarter from the previous quarter, are likely to increase in the October–December quarter after that. Contributions of external demand to the real GDP growth in the October–December quarter of 2020 is expected to be slightly negative.

Private consumption, which was the main cause of the substantial positive growth in the July–September quarter, is expected to slow down in the October–December quarter as the growth in service consumption—supported by measures to stimulate demand, such as the Go To campaign—is increasing, while the growth in consumption of goods is slowing due to the end of pent-up demand.

Although capital investment, which has been declining since the economic downturn, will increase in the October–December quarter of 2020 for the first time in 3 quarters, it is highly likely that the pace of recovery will remain moderate for the time being due to deterioration in corporate earnings and high uncertainty over the future.

Real GDP in the July–September quarter of 2020 grew at an annualized rate of 21.4%. It will decrease to 4.0% in the October–December quarter of 2020, and it will slow down in 2021. However, since the economy is in the process of normalization, it is expected that the growth rate will clearly exceed the potential growth rate for the time being. However, if a new spread of the novel coronavirus occurs and the declaration of a state of emergency is reissued, economic growth would be negative again and a slowdown in the economy would be inevitable.

Growth in the July–September quarter of 2020 was significantly positive following the lifting of the state of emergency, but the pace is likely to slow significantly in the October–December quarter of 2020.

Real GDP growth rates in the United States and the euro area in the July–September quarter of 2020 were 33.1% and 60.5% on an annualized basis from the previous quarter, respectively. Recently, however, the number of people infected with the novel coronavirus has increased, and the trend toward lockdown has spread again in Europe. In response, real GDP growth in the euro area is expected to turn negative again in the October–December quarter of 2020. Exports of goods and services in the GDP statistics rose 7.0% in the July–September quarter, but in the October–December quarter of 2020, growth will decline, particularly to the U.S. and the euro area. On the other hand, imports, which fell by 9.8% in the July–September quarter from the previous quarter, are likely to increase in the October–December quarter after that. Contributions of external demand to the real GDP growth in the October–December quarter of 2020 is expected to be slightly negative.

Private consumption, which was the main cause of the substantial positive growth in the July–September quarter, is expected to slow down in the October–December quarter as the growth in service consumption—supported by measures to stimulate demand, such as the Go To campaign—is increasing, while the growth in consumption of goods is slowing due to the end of pent-up demand.

Although capital investment, which has been declining since the economic downturn, will increase in the October–December quarter of 2020 for the first time in 3 quarters, it is highly likely that the pace of recovery will remain moderate for the time being due to deterioration in corporate earnings and high uncertainty over the future.

Real GDP in the July–September quarter of 2020 grew at an annualized rate of 21.4%. It will decrease to 4.0% in the October–December quarter of 2020, and it will slow down in 2021. However, since the economy is in the process of normalization, it is expected that the growth rate will clearly exceed the potential growth rate for the time being. However, if a new spread of the novel coronavirus occurs and the declaration of a state of emergency is reissued, economic growth would be negative again and a slowdown in the economy would be inevitable.

The pace of economic recovery is expected to remain moderate after a sharp drop, even if no strict action restrictions are imposed. This is because new lifestyles (securing social distance) will continue to restrain consumption of face-to-face services, and bankruptcies, unemployment, and declining corporate profits caused by the coronavirus disaster will exert downward pressure on future demand. In addition, in industries where demand has remained significantly depressed, the decline in supply capacity caused by the coronavirus disaster may contribute to a delay in future demand recovery. For example, in the accommodation industry, which has been strongly affected by the loss of inbound tourist demand, the number of guest rooms needed to accommodate foreign visitors has declined significantly due to a series of bankruptcies and downsizing of business, and this is likely to exert downward pressure on demand in the medium to long term.

The pace of economic recovery is expected to remain moderate after a sharp drop, even if no strict action restrictions are imposed. This is because new lifestyles (securing social distance) will continue to restrain consumption of face-to-face services, and bankruptcies, unemployment, and declining corporate profits caused by the coronavirus disaster will exert downward pressure on future demand. In addition, in industries where demand has remained significantly depressed, the decline in supply capacity caused by the coronavirus disaster may contribute to a delay in future demand recovery. For example, in the accommodation industry, which has been strongly affected by the loss of inbound tourist demand, the number of guest rooms needed to accommodate foreign visitors has declined significantly due to a series of bankruptcies and downsizing of business, and this is likely to exert downward pressure on demand in the medium to long term.The real GDP growth rate is forecast to be minus 5.2% in FY 2020, 3.4% in FY 2021, and 1.7% in FY 2022. Real GDP levels will exceed pre-coronavirus levels (October–December quarter of 2019) in the July–September quarter of 2022, but will not return to the most recent peak before the consumption tax increase (July–September quarter of 2019) until 2023.

Please: The data contained in this report has been obtained and processed from various sources, and cannot be used to guarantee the accuracy or safety of the report. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2020年11月25日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/19 | 消費者物価(全国25年8月)-コアCPIは9ヵ月ぶりの3%割れ、年末には2%程度まで鈍化する見通し | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/17 | 貿易統計25年8月-関税引き上げの影響が顕在化し、米国向け自動車輸出が数量ベースで大きく落ち込む | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月16日

EIOPAが2026年のワークプログラムと戦略的監督上の優先事項を公表-テーマ毎の活動計画等が明らかに- -

2025年10月16日

再び不安定化し始めた米中摩擦-経緯の振り返りと今後想定されるシナリオ -

2025年10月15日

インド消費者物価(25年10月)~9月のCPI上昇率は1.5%に低下、8年ぶりの低水準に -

2025年10月15日

「生活の質」と住宅価格の関係~教育サービス・治安・医療サービスが新築マンション価格に及ぼす影響~ -

2025年10月15日

IMF世界経済見通し-世界成長率見通しは3.2%まで上方修正

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan's Economic Outlook for FY 2020–2022】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan's Economic Outlook for FY 2020–2022のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!