- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

経済研究部 経済調査部長 斎藤 太郎

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

Consumer prices (excluding prices of fresh food, hereafter core consumer price index [CPI]) have been significantly influenced by various policy measures since the COVID-19 pandemic, making it challenging to discern the underlying trend.

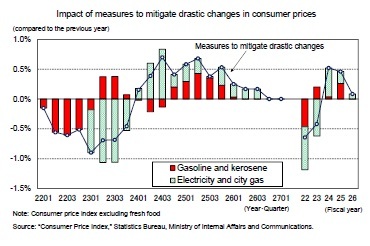

Policies affecting consumer prices during this period include the “Go To Travel Project” (July–December 2020) and “National Travel Assistance” (October 2022–July 2023) aimed at stimulating travel demand, as well as measures implemented to combat rising prices, such as the “Mitigation Measures for Drastic Changes in Fuel Oil Prices” (from January 2022) and the “Measures to Mitigate Drastic Changes in Electricity and Gas Prices” (from February 2023). These policies suppressed the year-on-year growth rate of consumer prices during their implementation but worked to raise prices once their effects subsided.

Estimates suggest that the impact of these policies on core CPI growth acted as a suppressing factor for approximately two years starting in January 2022. However, since February 2024, the reduction in electricity and city gas price discounts and the temporary suspension of policies have turned these into upward factors. For instance, the “Measures to Mitigate Drastic Changes in Electricity and Gas Prices” ended with usage through May 2024 (billed in June), and the “Emergency Assistance for Overcoming Severe Summer Heat” began for usage in August–October 2024. However, the reduced discounts compared to the same period in the previous year have contributed to the upward pressure on the year-on-year growth rate of core CPI.

Looking ahead, core CPI growth will likely continue to be influenced by policy measures. Currently, support measures for electricity and city gas prices are in effect until usage in October 2024 (billed in November), and mitigation measures for gasoline and kerosene are set to continue through the end of 2024. However, the economic stimulus package to be formulated in November is highly likely to include the resumption of support for electricity and city gas prices and an extension of mitigation measures for gasoline and kerosene.

Under the current outlook, support measures for electricity and city gas prices are expected to resume for usage starting in January 2025 (billed in February) and continue through August 2025 (billed in September), with a reduction in discounts starting in March. Mitigation measures for gasoline and kerosene are assumed to gradually phase out subsidies, with the price ceiling raised from the current 175 yen to 185 yen over two months starting in December 2024, before termination.

The upward impact of these energy-related measures on consumer prices is estimated to narrow from approximately 0.7% in the July–September quarter of 2024 to about 0.4% in the October–December quarter but will likely expand again after entering 2025 due to the reduction in subsidies or cessation of subsidy policies. On a fiscal-year basis, the impact of energy-related measures on core CPI growth was a suppressing factor in FY2022 (around -0.6%) and FY2023 (-0.4%). However, they are expected to act as upward factors from FY2024 onward, contributing approximately 0.5% in FY2024 and FY2025 and 0.1% in FY2026.

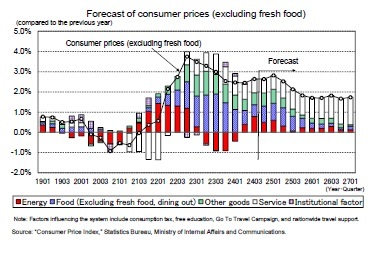

The upward impact of these energy-related measures on consumer prices is estimated to narrow from approximately 0.7% in the July–September quarter of 2024 to about 0.4% in the October–December quarter but will likely expand again after entering 2025 due to the reduction in subsidies or cessation of subsidy policies. On a fiscal-year basis, the impact of energy-related measures on core CPI growth was a suppressing factor in FY2022 (around -0.6%) and FY2023 (-0.4%). However, they are expected to act as upward factors from FY2024 onward, contributing approximately 0.5% in FY2024 and FY2025 and 0.1% in FY2026.The core CPI growth rate is forecasted to rise rapidly from the low 2% range to approximately 3% in December 2024, following the conclusion of the “Emergency Assistance for Overcoming Severe Summer Heat.” However, it is expected to slow after February 2025, when support measures for electricity and city gas prices are anticipated to resume. Nonetheless, the smaller discounts on electricity and city gas prices compared to those in the summer of 2024, coupled with reduced subsidies for gasoline and kerosene, will accelerate energy price growth from late 2024 to early 2025. As a result, core CPI growth is expected to remain in the 2% range for the time being, falling below the Bank of Japan’s price target of 2% only in the second half of FY2025, primarily due to a slowdown in goods price increases caused by yen appreciation.

Goods prices, particularly those related to energy, will likely remain volatile due to policy factors. However, they are expected to gradually decelerate as lower import prices from the yen appreciation take effect. Meanwhile, service prices, which had been growing at a rate of over 2% since the second half of FY2023, have slowed to the mid-1% range in FY2024. Nevertheless, with high wage growth expected to continue beyond 2025, the pace of service price increases is likely to accelerate again as rising labor costs are passed on to prices. Between FY2025 and FY2026, service prices are expected to contribute more to consumer price growth than goods prices.

Goods prices, particularly those related to energy, will likely remain volatile due to policy factors. However, they are expected to gradually decelerate as lower import prices from the yen appreciation take effect. Meanwhile, service prices, which had been growing at a rate of over 2% since the second half of FY2023, have slowed to the mid-1% range in FY2024. Nevertheless, with high wage growth expected to continue beyond 2025, the pace of service price increases is likely to accelerate again as rising labor costs are passed on to prices. Between FY2025 and FY2026, service prices are expected to contribute more to consumer price growth than goods prices.Core CPI is forecasted to increase by 2.8% year-on-year in FY2023, followed by 2.6% in FY2024, 2.0% in FY2025, and 1.7% in FY2026. Core-core CPI (excluding fresh food and energy) is forecasted to grow by 3.9% in FY2023, then slow to 2.3% in FY2024, 2.0% in FY2025, and 1.7% in FY2026.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2024年11月21日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月04日

今週のレポート・コラムまとめ【10/28-10/31発行分】 -

2025年10月31日

交流を広げるだけでは届かない-関係人口・二地域居住に求められる「心の安全・安心」と今後の道筋 -

2025年10月31日

ECB政策理事会-3会合連続となる全会一致の据え置き決定 -

2025年10月31日

2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ -

2025年10月31日

保険型投資商品の特徴を理解すること(欧州)-欧州保険協会の解説文書

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!