- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan's Economic Outlook for Fiscal Years 2024 and 2025 (May 2024)

2024年05月23日

文字サイズ

- 小

- 中

- 大

(Outlook for prices)

Consumer prices (excluding fresh food, hereinafter “core CPI”) grew by 4.2% compared to the previous year in January 2023, the highest growth in 41 years and 4 months since September 1981. However, the rate of increase has slowed due to the government’s measures to ease the burden of electricity and city gas bills, remaining in the 2% range since September 2023.

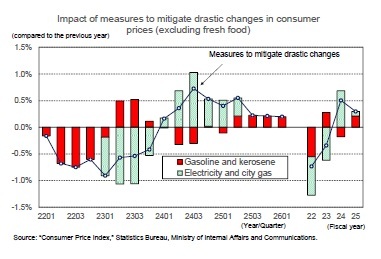

The measures to mitigate drastic changes in gasoline and kerosene prices, which have been in effect since January 2022, will be extended beyond May 2024. On the other hand, the measures to drastically reduce the price of electricity and city gas, which have been in effect since February 2023, will not be extended after June 2024, with a reduction in the measure for May 2024. The current forecast assumes that the mitigation measures for gasoline and kerosene prices will remain in effect until the end of FY2024 and continue in FY2025 with a reduced subsidy rate.

Consumer prices (excluding fresh food, hereinafter “core CPI”) grew by 4.2% compared to the previous year in January 2023, the highest growth in 41 years and 4 months since September 1981. However, the rate of increase has slowed due to the government’s measures to ease the burden of electricity and city gas bills, remaining in the 2% range since September 2023.

The measures to mitigate drastic changes in gasoline and kerosene prices, which have been in effect since January 2022, will be extended beyond May 2024. On the other hand, the measures to drastically reduce the price of electricity and city gas, which have been in effect since February 2023, will not be extended after June 2024, with a reduction in the measure for May 2024. The current forecast assumes that the mitigation measures for gasoline and kerosene prices will remain in effect until the end of FY2024 and continue in FY2025 with a reduced subsidy rate.

The impact of these easing measures on the CPI rate of increase was a depressing factor until the October–December quarter of 2023. However, it became a boosting factor in the January–March quarter of 2024. The termination of the easing measures on electricity and city gas bills is expected to raise the rate of increase by approximately 0.7% in the July–September quarter of 2024. On a fiscal year basis, the impact of these easing measures on the core CPI growth rate is expected to be around -0.7% in FY 2022, -0.3% in FY 2023, 0.5% in FY 2024, and 0.3% in FY 2025.

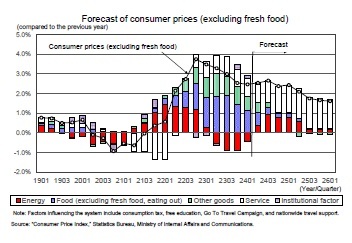

The impact of these easing measures on the CPI rate of increase was a depressing factor until the October–December quarter of 2023. However, it became a boosting factor in the January–March quarter of 2024. The termination of the easing measures on electricity and city gas bills is expected to raise the rate of increase by approximately 0.7% in the July–September quarter of 2024. On a fiscal year basis, the impact of these easing measures on the core CPI growth rate is expected to be around -0.7% in FY 2022, -0.3% in FY 2023, 0.5% in FY 2024, and 0.3% in FY 2025.Energy prices have been negative compared to the previous year since February 2023. However, the unit price of the levy to promote renewable energy generation on electricity bills will be raised from 1.40 yen to 3.49 yen per kWh from May 2024, and discounts on electricity and city gas bills will be halved in May 2024 (reflected in the CPI in June) and eliminated after June. This will turn the rate of increase in electricity and city gas prices positive again, contributing to an increase in the core CPI. The rate of increase in energy prices is expected to reach high double-digit growth compared to the previous year around summer 2024, expanding its contribution to the core CPI increase to approximately 1%.

Service prices have been growing in the low 2% range. The pace of increase is likely to accelerate further because the rate of spring wage increases in 2024 will be much higher than the previous year.

Compared to goods, service prices are largely determined by labor costs. The linkage between service prices and wages is significant, and the rate of increase in service prices in 2023 was 1.8% compared to the previous year, roughly in line with the base increase of approximately 2% in 2023. Given that RENGO’s tabulation results show that the “wage increase portion,” which corresponds to the base salary increase, is 3.57% (5th tabulation results) for the 2024 spring wage increase rate, the rate of increase in service prices is expected to rise to the 3% level.

The core CPI is expected to remain in the upper 2% range compared to the previous year in the first half of FY2024 as the slowdown in the growth rate of food (excluding fresh food) is offset by the accelerated pace of energy price hikes. After the start of FY2025, prices are expected to fall below the BOJ’s 2% price target.

By goods and services, most of the price increase in FY2022 was due to the rise in goods, mainly energy and food (excluding fresh food and eating out). However, in FY2023, the rate of increase in service prices is rising, and the focus of price increases is shifting from goods to services. From the second half of FY2024 to FY2025, services will exceed goods in their contribution to the CPI growth rate.

By goods and services, most of the price increase in FY2022 was due to the rise in goods, mainly energy and food (excluding fresh food and eating out). However, in FY2023, the rate of increase in service prices is rising, and the focus of price increases is shifting from goods to services. From the second half of FY2024 to FY2025, services will exceed goods in their contribution to the CPI growth rate.The core CPI is projected to be 2.5% in FY2024 and 1.8% in FY2025 after being 2.8% in FY2023. The core CPI (excluding fresh food and energy) is projected to be 1.9% in FY2024 and 1.6% in FY2025 after being 3.9% in FY 2023.

Please note: The data in this publication has been obtained and processed from various sources, and we do not guarantee its accuracy or safety. The opinions and forecasts contained in this publication are for informational purposes only and are not intended as an inducement to enter into or cancel any contract.

(2024年05月23日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/22 | 貿易統計25年9月-米国向け自動車輸出が数量ベースで一段と落ち込む。7-9月期の外需寄与度は前期比▲0.4%程度のマイナスに | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/03 | 雇用関連統計25年8月-失業率、有効求人倍率ともに悪化 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/30 | 鉱工業生産25年8月-7-9月期は自動車中心に減産の可能性 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/09/19 | 消費者物価(全国25年8月)-コアCPIは9ヵ月ぶりの3%割れ、年末には2%程度まで鈍化する見通し | 斎藤 太郎 | 経済・金融フラッシュ |

新着記事

-

2025年10月23日

御社のブランドは澄んでますか?-ブランド透明性が生みだす信頼とサステナビリティ開示のあり方(1) -

2025年10月23日

EIOPAがソルベンシーIIのレビューに関する技術基準とガイドラインのセットの新たな協議を開始等 -

2025年10月23日

中国:25年7~9月期GDPの評価-秋風索莫の気配が漂う中国経済。内需の悪化により成長率は減速 -

2025年10月23日

パワーカップルと小学校受験-データで読み解く暮らしの風景 -

2025年10月22日

高市新政権が発足、円相場の行方を考える~マーケット・カルテ11月号

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan's Economic Outlook for Fiscal Years 2024 and 2025 (May 2024)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (May 2024)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!