- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 日本経済 >

- Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

山下 大輔

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

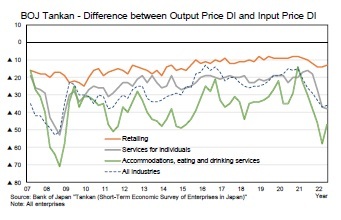

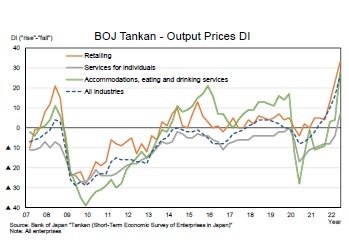

According to the BOJ's Tankan, the retail sector tended to raise selling prices as purchase prices rose. However, in “Accommodations, eating and drinking services” and “Services for individuals” covering travel and entertainment, sales price increases were limited compared to purchase price increases, indicating that the gap between the input price diffusion index (DI) (rise minus fall) and the output price DI (rise minus fall) is widening. This suggests that the pass-through of production cost increases to consumer prices is not being fully implemented.

According to the BOJ's Tankan, the retail sector tended to raise selling prices as purchase prices rose. However, in “Accommodations, eating and drinking services” and “Services for individuals” covering travel and entertainment, sales price increases were limited compared to purchase price increases, indicating that the gap between the input price diffusion index (DI) (rise minus fall) and the output price DI (rise minus fall) is widening. This suggests that the pass-through of production cost increases to consumer prices is not being fully implemented.Firm cost increase pass-through behavior depends on the characteristics of an item, such as whether it is a necessary good or not. For necessities such as food and utilities, the volume of consumption would be difficult to reduce even if prices increase. Therefore, it is easier for firms to raise prices of necessary goods because the negative impact of a price increase would not be relatively large.

Moreover, in terms of food products, it has been pointed out that there is "synchronization in the timing of price changes" (Bank of Japan, 2022). It is possible that price increases of food products accelerate in such a way that when some food products companies raise their prices, other food products companies also raise their prices.

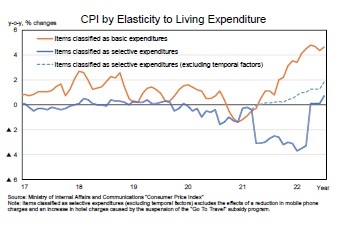

In fact, CPI classified by the elasticity to living expenditure shows that consumer prices of items classified as basic expenditure, which corresponds to necessary goods, covering energy and many food products, have risen more than 4 percent on a year-over-year basis. On the other hand, the increase in consumer prices of items classified as selective expenditures has been limited, even excluding the impact of the large reduction in mobile phone charges.

In fact, CPI classified by the elasticity to living expenditure shows that consumer prices of items classified as basic expenditure, which corresponds to necessary goods, covering energy and many food products, have risen more than 4 percent on a year-over-year basis. On the other hand, the increase in consumer prices of items classified as selective expenditures has been limited, even excluding the impact of the large reduction in mobile phone charges.

Firm price-setting behavior is greatly affected by consumer reaction to price increases. While it is natural for consumers not to welcome price increases, Japanese consumers' reluctance to accept price hikes is said to be particularly strong (Watanabe, 2022). In Japan, it is characteristic for consumers to be accustomed to prices that remain the same for a long time.

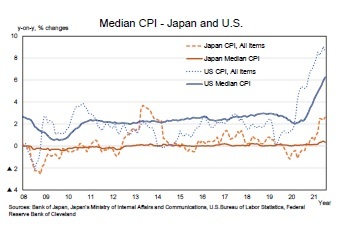

Focusing on the interior of the distribution of the consumer price changes, the year-over-year rate of change in the weighted median CPI has remained around 0 percent in Japan. This contrasts with the U.S., where the rate has been approximately 2 percent until recently.

Focusing on the interior of the distribution of the consumer price changes, the year-over-year rate of change in the weighted median CPI has remained around 0 percent in Japan. This contrasts with the U.S., where the rate has been approximately 2 percent until recently.An economic model developed by Rotemberg (2005) to explain price rigidity shows that only when consumers perceive prices as unfair do they react negatively to price hikes. Applying this model to Japan, consumers may take it for granted that the prices of goods and services do not change significantly, and may view price hikes as unfair.

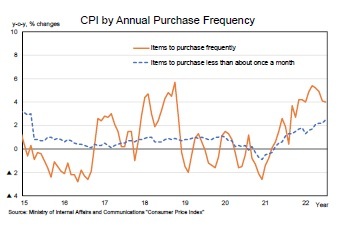

It has been pointed out that consumer perception of price increases is strongly influenced by price increases for goods that they purchase more frequently; the higher the perception of price increases, the more negatively consumers tend to perceive price increases (Takahashi and Tamanyu, 2022). In light of this, it is highly likely that higher energy prices and food prices will increase households' perception of inflation, leading households to perceive price hikes negatively. The increased reluctance of consumers to accept price hikes could result in a limited range of consumer price increase.

It has been pointed out that consumer perception of price increases is strongly influenced by price increases for goods that they purchase more frequently; the higher the perception of price increases, the more negatively consumers tend to perceive price increases (Takahashi and Tamanyu, 2022). In light of this, it is highly likely that higher energy prices and food prices will increase households' perception of inflation, leading households to perceive price hikes negatively. The increased reluctance of consumers to accept price hikes could result in a limited range of consumer price increase.While it is true that the expected inflation rate is rising, it is highly likely that the degree of pass-through of raw material cost increases to consumer prices will vary between necessities and luxuries. Moreover, higher energy and food prices are likely to make consumers more reluctant to accept price increases, contributing to a more modest price pass-through for other items. As a result, higher inflation expectations may be revised downward over time. However, as consumers continue to experience higher prices and become accustomed to a rising price environment, their attitudes toward price increases and firm price-setting behavior may change, and the underlying trend of the inflation expectation might rise.

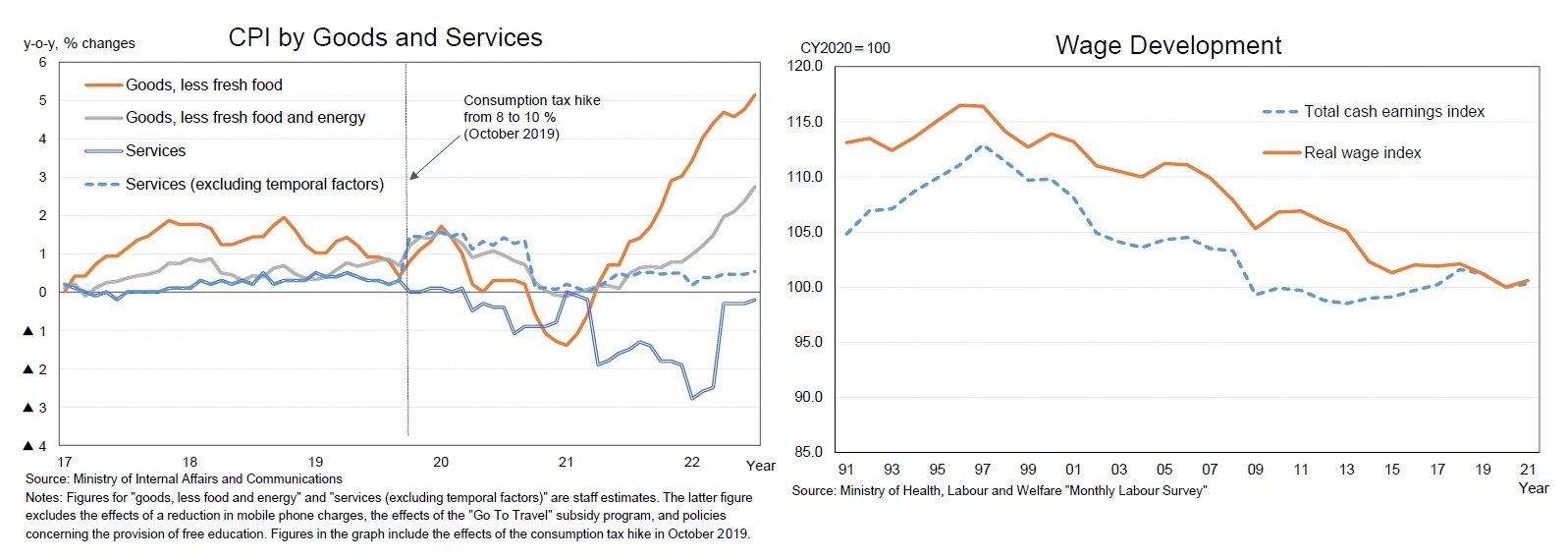

When consumer prices are divided into goods and services, the fluctuation in service prices has been relatively small. Although they fell sharply in the most recent period due to the impact of reductions in mobile phone charges, service prices have remained largely unchanged if adjusted for the impact of these and other factors.

Increases in service prices are considered to be highly linked to wage increases, and unless the situation changes to the one where wages rise continuously, it would be difficult to expect the underlying trend of service prices to rise.

IV. Conclusion

References

Bank of Japan (2022) Outlook for Economic Activity and Prices, April 2022.

Cabinet Office (2019) The Japanese Economy 2018–2019, January 2019.

Kuroda, Haruhiko (2021) "Japan’s Economy and Monetary Policy", speech at a Meeting with Business Leaders in Nagoya," November 15, 2021, Bank of Japan.

Rotemberg, Julio J. (2005) "Customer anger at price increases, changes in the frequency of price adjustment and monetary policy," Journal of Monetary Economics, vol. 52(4), pp. 829–852.

Takahashi, Yusuke and Yuichiro Tamanyu (2022) "Households' Perceived Inflation and CPI inflation: the case of Japan," Bank of Japan Working Paper Series No. 22-E-1.

Watanabe, Tsutomu (ed.) (2016) Mansei defure: shin’in no kaimei (Chronic Deflation: Clarifying the True Causes), Nikkei Publishing (in Japanese).

Watanabe, Tsutomu (2022) Bukka towa Nanika (On Prices), Kodansha (in Japanese).

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2022年08月26日「基礎研レポート」)

このレポートの関連カテゴリ

山下 大輔

山下 大輔のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2023/08/22 | Japan's Productivity through the Lens of “Cheap Japan” | 山下 大輔 | 基礎研レポート |

| 2023/07/26 | 日本の物価は持続的に上昇するか-消費者物価の今後の動向を考える | 山下 大輔 | ニッセイ基礎研所報 |

| 2023/07/10 | 景気ウォッチャー調査(23年6月)~景況感の回復ペースが鈍化 | 山下 大輔 | 経済・金融フラッシュ |

| 2023/06/08 | 景気ウォッチャー調査(23年5月)~現状判断DIは4か月連続で上昇 | 山下 大輔 | 経済・金融フラッシュ |

新着記事

-

2025年08月19日

「縮みながらも豊かに暮らす」社会への転換(3)-「稼ぐ力」「GX」強化と若年・女性参加を促す「ウェルビーイング」 -

2025年08月19日

今週のレポート・コラムまとめ【8/12-8/18発行分】 -

2025年08月18日

タイ経済:25年4-6月期の成長率は前年同期比2.8%増~駆け込み輸出が観光業の落ち込みを相殺 -

2025年08月18日

2025・2026年度経済見通し(25年8月) -

2025年08月15日

マレーシア経済:25年4-6月期の成長率は前年同期比+4.4%~堅調な内需に支えられて横ばいの成長に

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Pricesのレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!