- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 日本経済 >

- Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

山下 大輔

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

I. Introduction

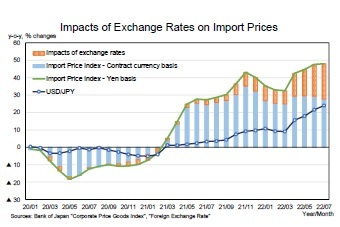

II. Recent Price Developments

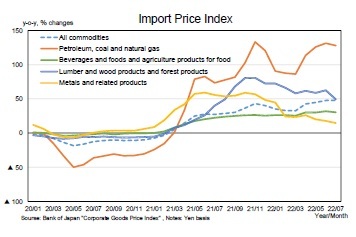

In 2021, prices of commodities such as crude oil and natural gas began to soar due to the increase in demand associated with the global economic recovery. This sharp rise in commodity prices has led to an increase in import prices for Japan, a country that relies on imports for most of these commodities. Import prices have continued to rise year-on-year since March 2021, and since September 2021, the year-on-year rate of increase has exceeded 30 percent. Looking at the breakdown of the import prices, “Petroleum, coal, and natural gas” have risen approximately 100 percent; lumber, metals, and food products have also risen significantly.

In 2021, prices of commodities such as crude oil and natural gas began to soar due to the increase in demand associated with the global economic recovery. This sharp rise in commodity prices has led to an increase in import prices for Japan, a country that relies on imports for most of these commodities. Import prices have continued to rise year-on-year since March 2021, and since September 2021, the year-on-year rate of increase has exceeded 30 percent. Looking at the breakdown of the import prices, “Petroleum, coal, and natural gas” have risen approximately 100 percent; lumber, metals, and food products have also risen significantly.

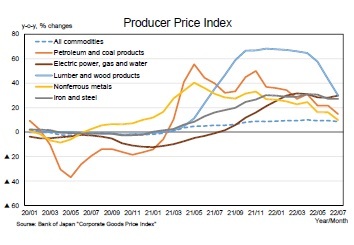

This has led to an increase in production costs for goods produced using imported commodities. In response to the rise in import prices, domestic corporate goods prices have similarly risen on a year-on-year basis since March 2021, rising 10.0 percent on a year-on-year basis in April 2022, the highest rate since December 1980 (10.4 percent).

This has led to an increase in production costs for goods produced using imported commodities. In response to the rise in import prices, domestic corporate goods prices have similarly risen on a year-on-year basis since March 2021, rising 10.0 percent on a year-on-year basis in April 2022, the highest rate since December 1980 (10.4 percent).

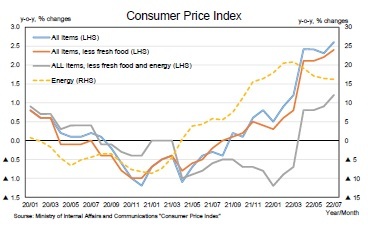

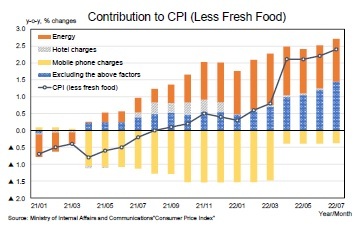

Consumer prices also began to rise in 2021, accompanied by an increase in energy prices. CPI (all items less fresh food) has risen every month since September 2021, and has continued to rise above 2 percent year-on-year since April 2022. Note that the rate of increase rose sharply in April 2022; however, from April 2021 until March 2022, the year-on-year rate of increase included the temporal impact of a substantial reduction in mobile phone charges which were urged by the Japanese government.

Consumer prices also began to rise in 2021, accompanied by an increase in energy prices. CPI (all items less fresh food) has risen every month since September 2021, and has continued to rise above 2 percent year-on-year since April 2022. Note that the rate of increase rose sharply in April 2022; however, from April 2021 until March 2022, the year-on-year rate of increase included the temporal impact of a substantial reduction in mobile phone charges which were urged by the Japanese government.

Russia's invasion of Ukraine has further pushed up commodity prices. In addition, the yen is depreciating due to factors such as the U.S.’ tightening of its monetary policy and a widening interest rate differential; this will cause yen-denominated import prices to rise further.

Russia's invasion of Ukraine has further pushed up commodity prices. In addition, the yen is depreciating due to factors such as the U.S.’ tightening of its monetary policy and a widening interest rate differential; this will cause yen-denominated import prices to rise further.While it is projected that import prices and domestic producer prices will continue to rise, will the rise in consumer prices expand to a wider range of items besides energy, resulting in sustained price increases?

III. Will higher energy prices lead to higher general prices?

When an economy is booming, the tightening of supply–demand conditions caused by increased demand will likely exert upward pressure on prices. In addition, if future price increases are anticipated, current prices will be affected through wage- and price-setting which take into account such anticipated increases. Rising import prices due to surging commodity prices and a weakening yen will directly increase domestic prices if the imported goods are final goods. If the imported goods are raw materials or intermediate goods, the effect on domestic prices depends on whether companies pass through the increased production costs to domestic prices. When imported goods have a direct relationship with domestic prices—e.g., the relationship between crude oil prices and energy prices such as petroleum products, electricity charges, and manufactured and piped gas charges—a price increase in imported goods leads to higher domestic prices.

A. Business Cycle

A. Business CycleIn the process of recovering from the substantial economic fallout due to the COVID-19 pandemic, it is expected that the improved supply–demand conditions caused by increased demand will put upward pressure on consumer prices.

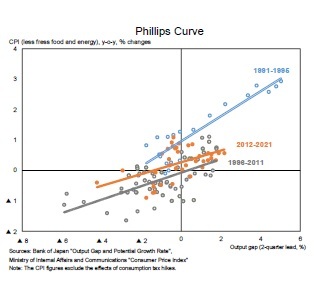

However, the degree of influence of business cycle factors on prices is said to have weakened since the late 1990s.

In addition, supply-side constraints, such as shortages of semiconductors and components, will also cause supply–demand conditions to tighten. However, it has been pointed out that Japanese firms have a strong tendency not to raise prices but to ask customers to endure delivery delays when facing supply-side constraints (Kuroda, 2021); as long as this trend continues, the upward pressure on prices due to tighter supply–demand conditions will not become significant.

B. Commodity Prices, Weaker Yen

B. Commodity Prices, Weaker YenThe current rise in consumer prices stems from higher import prices due to soaring commodity prices. In addition, the recent depreciation of the yen has greatly increased the impact of commodity prices on domestic energy prices. However, unless the commodity price hikes and the yen's depreciation continue significantly over a long period of time, their impact on consumer prices will only be temporary.

Will the increased production costs due to higher energy prices be passed on to prices of final consumer goods and services, resulting in higher consumer prices for a wide range of items? The key factors in determining this are the expected inflation rate, firm price-setting behaviors, and consumer attitudes toward higher prices.

1. Expected Inflation Rate

1. Expected Inflation RateIn general, firms faced with increased costs of production would like to raise prices if possible. Moreover, if general prices are expected to rise in the future, or at least if a firm’s competitors are expected to raise their prices, the firm will be more likely to raise its prices. Furthermore, if consumers also expect prices to rise, the upward pressure on wages will make it easier for them to accept price increases. Thus, the expected inflation rate is important.

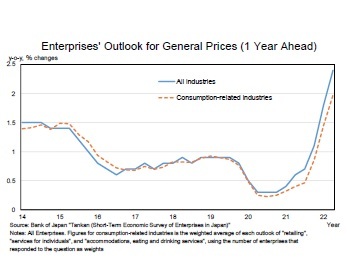

Currently, many of the relevant economic indicators show inflation expectations are clearly rising. Looking at survey-based indicators, the "Enterprises’ outlook for general prices" in the Bank of Japan's (BOJ’s) Tankan (Short-Term Economic Survey of Enterprises in Japan) has turned upward significantly since around 2021; in the June 2022 Tankan, the average outlook for one-year ahead general prices for all enterprises in all industries was 2.4 percent. Note that when narrowed down to private consumption-related industries, it is lower than that of all industries.

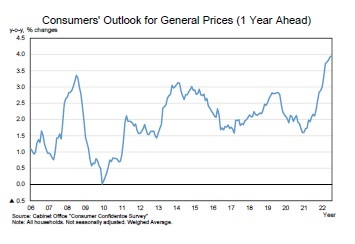

Currently, many of the relevant economic indicators show inflation expectations are clearly rising. Looking at survey-based indicators, the "Enterprises’ outlook for general prices" in the Bank of Japan's (BOJ’s) Tankan (Short-Term Economic Survey of Enterprises in Japan) has turned upward significantly since around 2021; in the June 2022 Tankan, the average outlook for one-year ahead general prices for all enterprises in all industries was 2.4 percent. Note that when narrowed down to private consumption-related industries, it is lower than that of all industries.The expected inflation rate for consumers has also reached nearly 4 percent, estimated from household expectations of prices a year ahead in the Cabinet Office's Consumer Confidence Survey.

(2022年08月26日「基礎研レポート」)

このレポートの関連カテゴリ

山下 大輔

山下 大輔のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2023/08/22 | Japan's Productivity through the Lens of “Cheap Japan” | 山下 大輔 | 基礎研レポート |

| 2023/07/26 | 日本の物価は持続的に上昇するか-消費者物価の今後の動向を考える | 山下 大輔 | ニッセイ基礎研所報 |

| 2023/07/10 | 景気ウォッチャー調査(23年6月)~景況感の回復ペースが鈍化 | 山下 大輔 | 経済・金融フラッシュ |

| 2023/06/08 | 景気ウォッチャー調査(23年5月)~現状判断DIは4か月連続で上昇 | 山下 大輔 | 経済・金融フラッシュ |

新着記事

-

2025年10月23日

御社のブランドは澄んでますか?-ブランド透明性が生みだす信頼とサステナビリティ開示のあり方(1) -

2025年10月23日

EIOPAがソルベンシーIIのレビューに関する技術基準とガイドラインのセットの新たな協議を開始等 -

2025年10月23日

中国:25年7~9月期GDPの評価-秋風索莫の気配が漂う中国経済。内需の悪化により成長率は減速 -

2025年10月23日

パワーカップルと小学校受験-データで読み解く暮らしの風景 -

2025年10月22日

高市新政権が発足、円相場の行方を考える~マーケット・カルテ11月号

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Pricesのレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!