- シンクタンクならニッセイ基礎研究所 >

- 資産運用・資産形成 >

- 株式 >

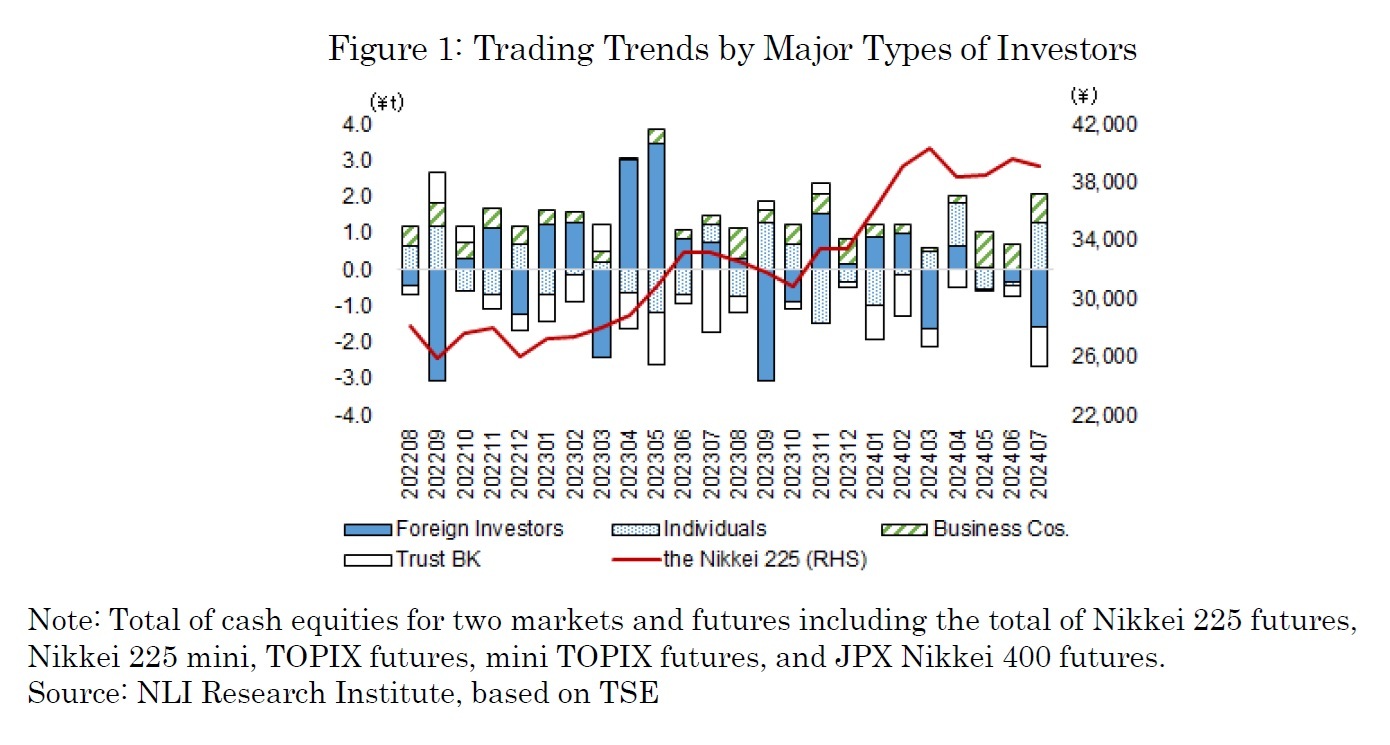

- Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024

Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024

金融研究部 研究員 森下 千鶴

文字サイズ

- 小

- 中

- 大

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2024年08月15日「研究員の眼」)

03-3512-1855

- 【職歴】

2006年 資産運用会社にトレーダーとして入社

2015年 ニッセイ基礎研究所入社

2020年4月より現職

【加入団体等】

・日本証券アナリスト協会検定会員

・早稲田大学大学院経営管理研究科修了(MBA、ファイナンス専修)

森下 千鶴のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/08 | Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/10/07 | 投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ | 森下 千鶴 | 研究員の眼 |

| 2025/10/03 | 進む東証改革、なお残る上場維持基準の課題 | 森下 千鶴 | ニッセイ年金ストラテジー |

| 2025/09/09 | Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025 | 森下 千鶴 | 研究員の眼 |

新着記事

-

2025年11月07日

フィリピンGDP(25年7-9月期)~民間消費の鈍化で4.0%成長に減速、電子部品輸出は堅調 -

2025年11月07日

次回の利上げは一体いつか?~日銀金融政策を巡る材料点検 -

2025年11月07日

個人年金の改定についての技術的なアドバイス(欧州)-EIOPAから欧州委員会への回答 -

2025年11月07日

中国の貿易統計(25年10月)~輸出、輸入とも悪化。対米輸出は減少が続く -

2025年11月07日

英国金融政策(11月MPC公表)-2会合連続の据え置きで利下げペースは鈍化

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!