- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-

Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-

増宮 守

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

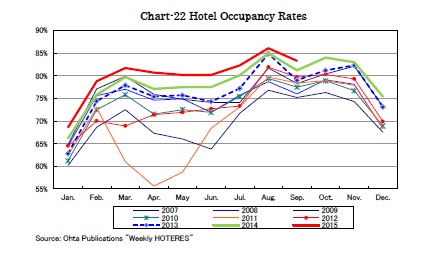

According to Ota Publications, as hotel occupancy rates in Urayasu and Kyoto surpassed 95% in August and September, most hotel rooms were often fully reserved in many cities. Not only have occupancy rates increased but room-rates have also been raised, and according to STR Global, the RevPAR of Japanese hotels in August grew by +14.7% y-o-y to 16,455 JPY.

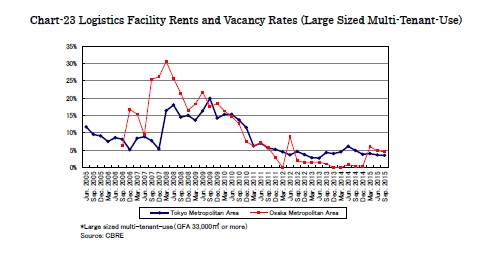

The logistics leasing market has been sustained by increasing demand. Vacancy rates of large logistics facilities for multi-tenants in the Tokyo and Osaka metropolitan area improved from 3.6% to 3.5% and from 4.8% to 4.5%, respectively (Chart-23).

Only one facility, Shinkiba Butsuryu Center, was completed in the Tokyo metropolitan area, and the modest supply pushed the vacancy rates down. On the other hand, a giant facility, GLP Naruohama with a GFA of 110,373m2, was completed in the Osaka metropolitan area. However, strong demand absorbed the vacant spaces of new facilities completed in the first half of this year and the vacancy rates continued improving.

In the Tokyo metropolitan area, a gigantic volume of new supply is scheduled in the fourth quarter followed by a series of sizable new supply throughout 2016. Although strong demand is expected to absorb parts of the new supply, it seems that vacancy rates will continue to rise for the time being.

In the Osaka metropolitan area, no new supply is scheduled in the fourth quarter. However a sizable supply will come in the latter half of 2016 and vacancy rates will turn upward.

4.Property Investment and J-REIT Markets

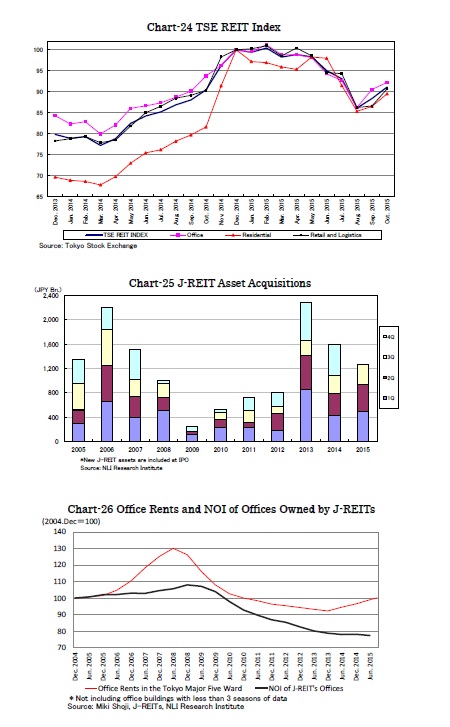

J-REITs acquired properties amounting to 340 billion JPY in the third quarter, totaling 1.2 trillion JPY in 2015. Despite high property prices making transaction activity difficult, the total acquisition amount has been larger than last year (Chart-25). Japan Senior Living Investment Corporation, as the third Japanese healthcare REIT, was listed with 14 assets of 28 billion JPY, bringing the number of J-REITs to 51.

Net Operating Income of office buildings owned by J-REITs still declined by 0.9% h-o-h in the first half of 2015 even with rising office rents (Chart-26). Compared with the conditions when J-REIT’s office NOI improved somewhat the last time from 2005 to 2008, the current pace of rent increase is slower, the areas where rents are rising are limited and J-REIT buildings have lost competitiveness to new buildings. Now that office demand has shown weakness, it has become more important for managers of J-REITs to work out how to improve the NOI of their office buildings regardless of the office rent trend.

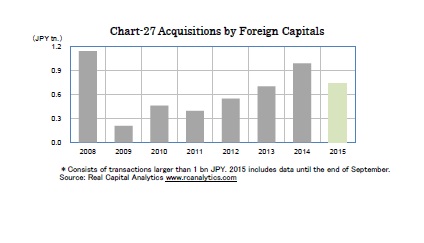

Transactions in the property investment market have been active this year as J-REITs have increased acquisitions (Chart-27). However, the total transaction amount this year has fallen short of that in 2014 when an exceptionally large amount of more than 5 trillion JPY in properties was transacted.

Foreign investors acquired Japanese properties aggressively at the beginning of this year including the case of Meguro Gajoen, however, the pace of acquisitions has since become more moderate. Considering the large amount acquired in the fourth quarter of 2014, the yearly amount acquired by foreign investors in 2015 will post a negative growth without very large acquisitions in the fourth quarter.

(2015年11月16日「不動産投資レポート」)

このレポートの関連カテゴリ

増宮 守

増宮 守のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2017/08/29 | 【アジア・新興国】アジアの保険会社による不動産投資の拡大も踊り場に~当面は中国政府の海外投資規制強化に注目~ | 増宮 守 | 保険・年金フォーカス |

| 2017/08/01 | 大丸有(大手町、丸の内、有楽町)の国際化にみる今後のエリア包括的開発への期待 | 増宮 守 | 研究員の眼 |

| 2017/05/01 | 豊洲市場がヒルズ化?ダイナミックに変貌する都心東側のソフト戦略に注目 | 増宮 守 | 研究員の眼 |

| 2017/03/14 | 海外資金による国内不動産取得動向(2016年)~アベノミクス開始以前の状況に後退~ | 増宮 守 | 基礎研レポート |

新着記事

-

2025年10月22日

高市新政権が発足、円相場の行方を考える~マーケット・カルテ11月号 -

2025年10月22日

貿易統計25年9月-米国向け自動車輸出が数量ベースで一段と落ち込む。7-9月期の外需寄与度は前期比▲0.4%程度のマイナスに -

2025年10月22日

米連邦地裁、Googleへの是正措置を公表~一般検索サービス市場における独占排除 -

2025年10月21日

選択と責任──消費社会の二重構造(2)-欲望について考える(3) -

2025年10月21日

連立協議から選挙のあり方を思う-選挙と同時に大規模な公的世論調査の実施を

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!