- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-

Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-

増宮 守

このレポートの関連カテゴリ

文字サイズ

- 小

- 中

- 大

2.Land Prices

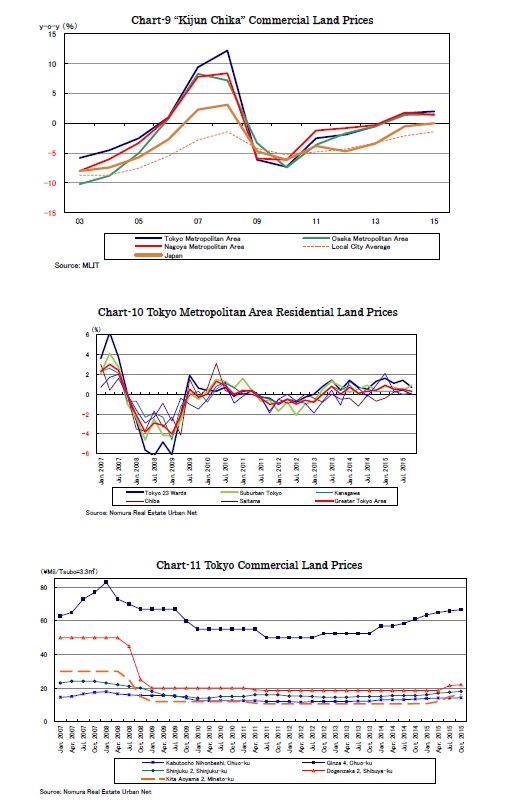

According to Nomura Real Estate Urban Net, the average residential land price in the Tokyo metropolitan area appreciated for the eighth consecutive quarter, posting 0.3% q-o-q growth (Chart-10). Residential land prices in the Tokyo 23 wards and greater Tokyo still rose by 0.7% and 0.9% q-o-q respectively, however, it looks like those in the surrounding prefectures of Kanagawa, Saitama and Chiba have already faced difficulties in rising.

Among commercial land prices in the center of Tokyo, those in Ginza appreciated noticeably recovering to the level seen in 2008 (Chart-11).

3.Sub-sectors

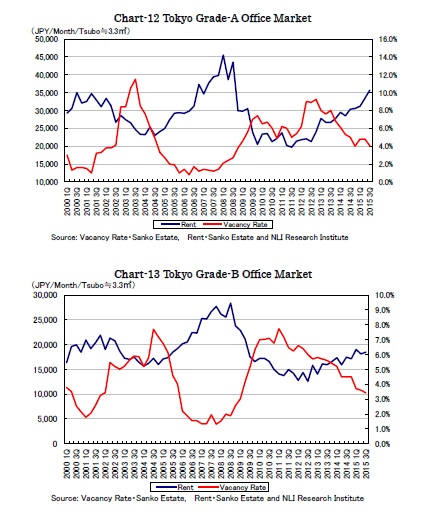

Vacancy rates of Tokyo grade-A1offices and very large sized offices in the Tokyo major three wards improved by 0.8% and 0.3% q-o-q to 4.0% and 3.7%, respectively, in the third quarter (Chart-12). Moreover, the rising of Tokyo grade-A office rents accelerated, even at a high level, as the office rent index of Tokyo grade-A offices grew by 6.8% q-o-q to 35,652 JPY.

On the other hand, Tokyo grade-B office rents rose only mildly, even though the vacancy rates have improved to a very low level (Chart-13). It seems the market polarization has become increasingly noticeable these few years and more corporate tenants tend to focus on grade-A offices.

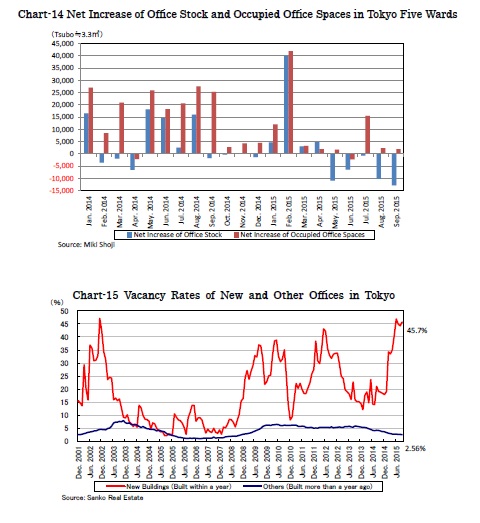

The recent improvement of office vacancy rates has been based on the decrease in office stock, which is apparently different from when it was driven by increasing occupied spaces in 2013 and 2014 (Chart-14). The weak demand has also been noticeable in the new building market. Vacancy rates of new office buildings have outnumbered the peak in 2012 when new building supply swelled significantly (Chart-15). The supply volume this year has been much less than that which was seen in 2012, however, weak demand has made it difficult for new buildings to secure tenants before completion.

Though the low vacancy rates and rising rents are still explaining the strong market, the office demand has weakened affected by the equity market fluctuation from the end of August. From now on, considering the uncertain business conditions in China, the US interest rate hike and the raising of the domestic consumption tax, it has become increasingly difficult to expect the trend in rising office rent to continue.

(2015年11月16日「不動産投資レポート」)

このレポートの関連カテゴリ

増宮 守

増宮 守のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2017/08/29 | 【アジア・新興国】アジアの保険会社による不動産投資の拡大も踊り場に~当面は中国政府の海外投資規制強化に注目~ | 増宮 守 | 保険・年金フォーカス |

| 2017/08/01 | 大丸有(大手町、丸の内、有楽町)の国際化にみる今後のエリア包括的開発への期待 | 増宮 守 | 研究員の眼 |

| 2017/05/01 | 豊洲市場がヒルズ化?ダイナミックに変貌する都心東側のソフト戦略に注目 | 増宮 守 | 研究員の眼 |

| 2017/03/14 | 海外資金による国内不動産取得動向(2016年)~アベノミクス開始以前の状況に後退~ | 増宮 守 | 基礎研レポート |

新着記事

-

2025年10月21日

今週のレポート・コラムまとめ【10/14-10/20発行分】 -

2025年10月20日

中国の不動産関連統計(25年9月)~販売は前年減が続く -

2025年10月20日

ブルーファイナンスの課題-気候変動より低い関心が普及を阻む -

2025年10月20日

家計消費の動向(単身世帯:~2025年8月)-外食抑制と娯楽維持、単身世帯でも「メリハリ消費」の傾向 -

2025年10月20日

縮小を続ける夫婦の年齢差-平均3歳差は「第二次世界大戦直後」という事実

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!