- シンクタンクならニッセイ基礎研究所 >

- 資産運用・資産形成 >

- 株式 >

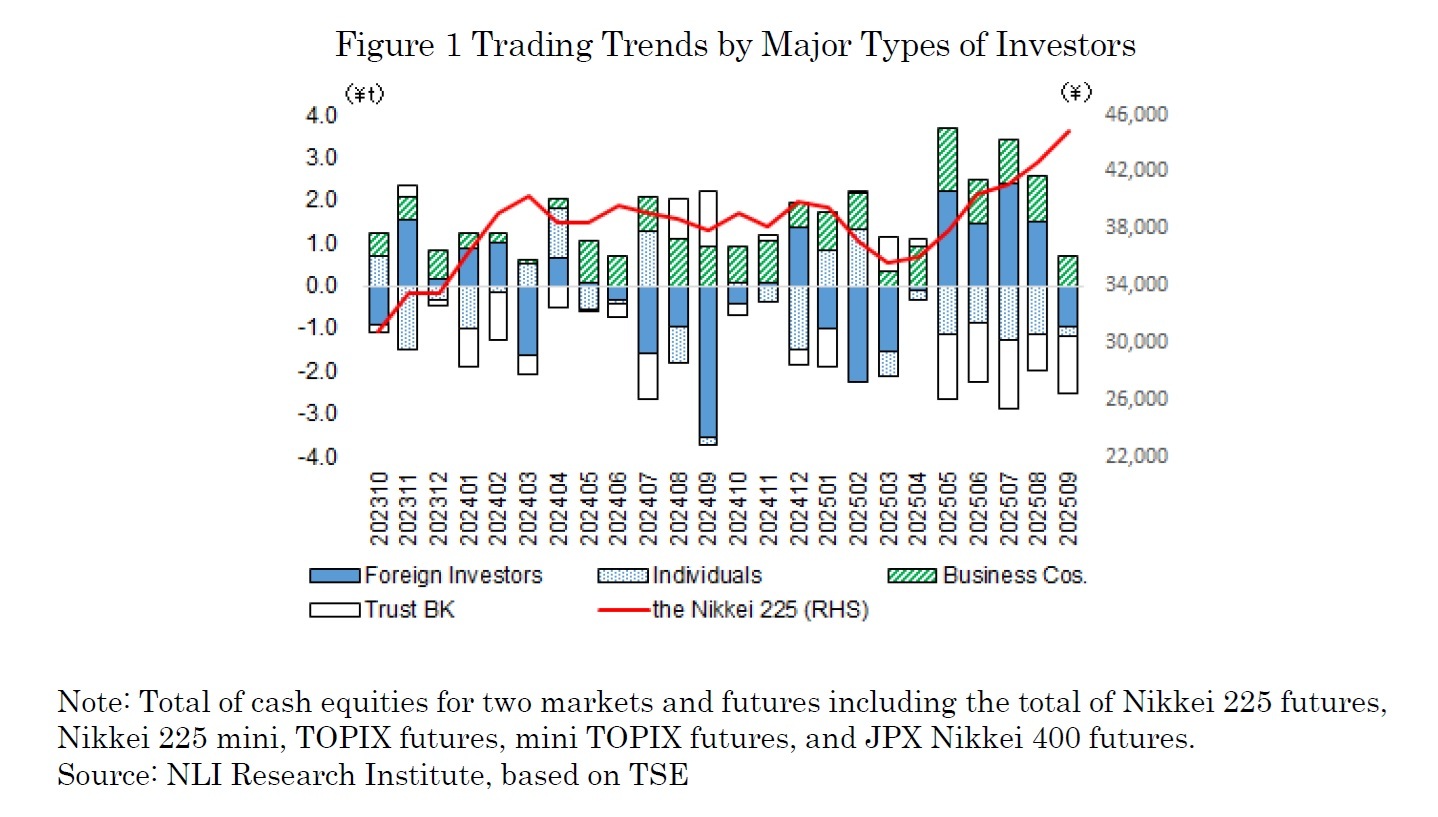

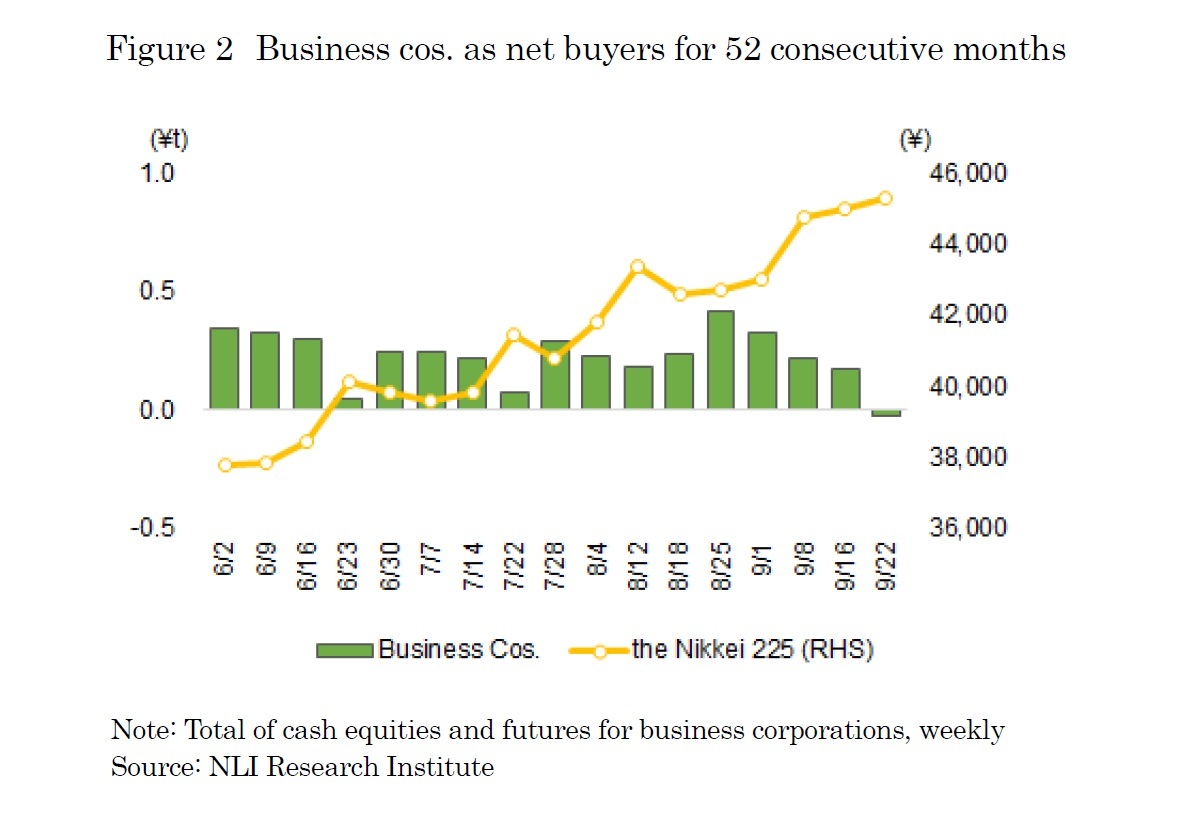

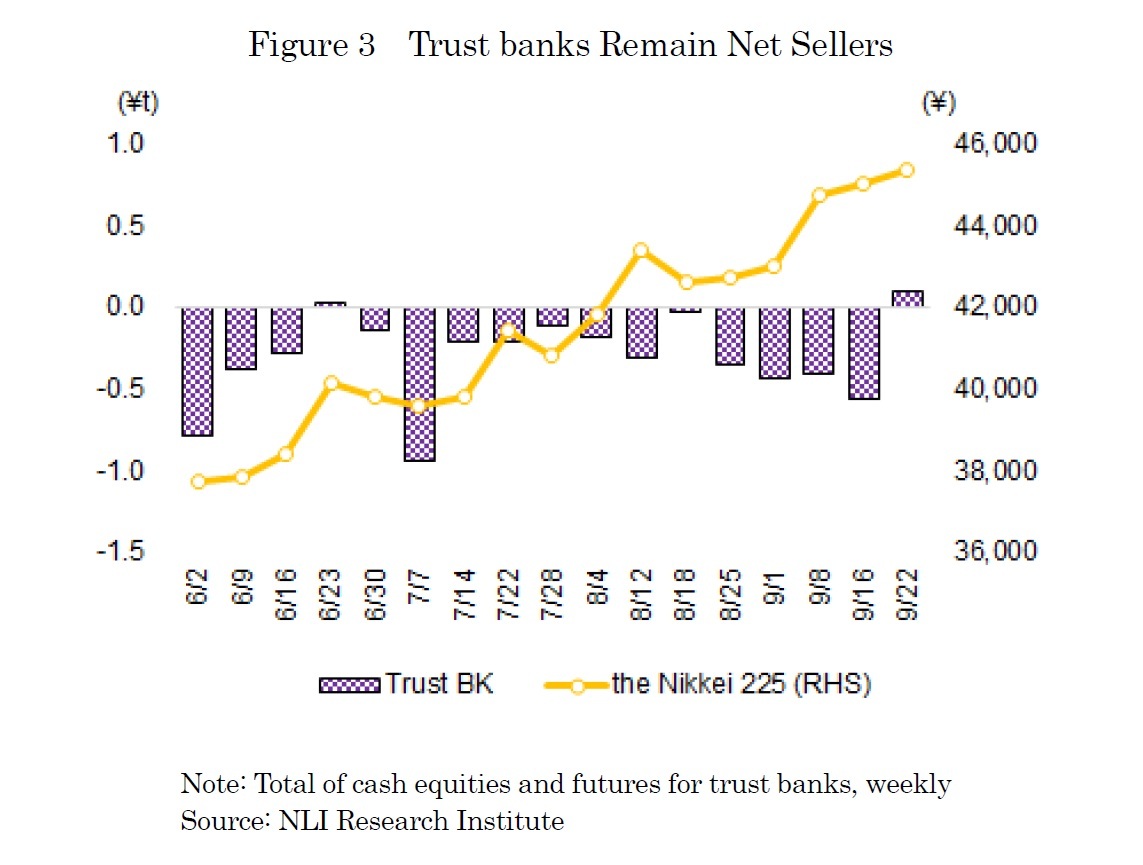

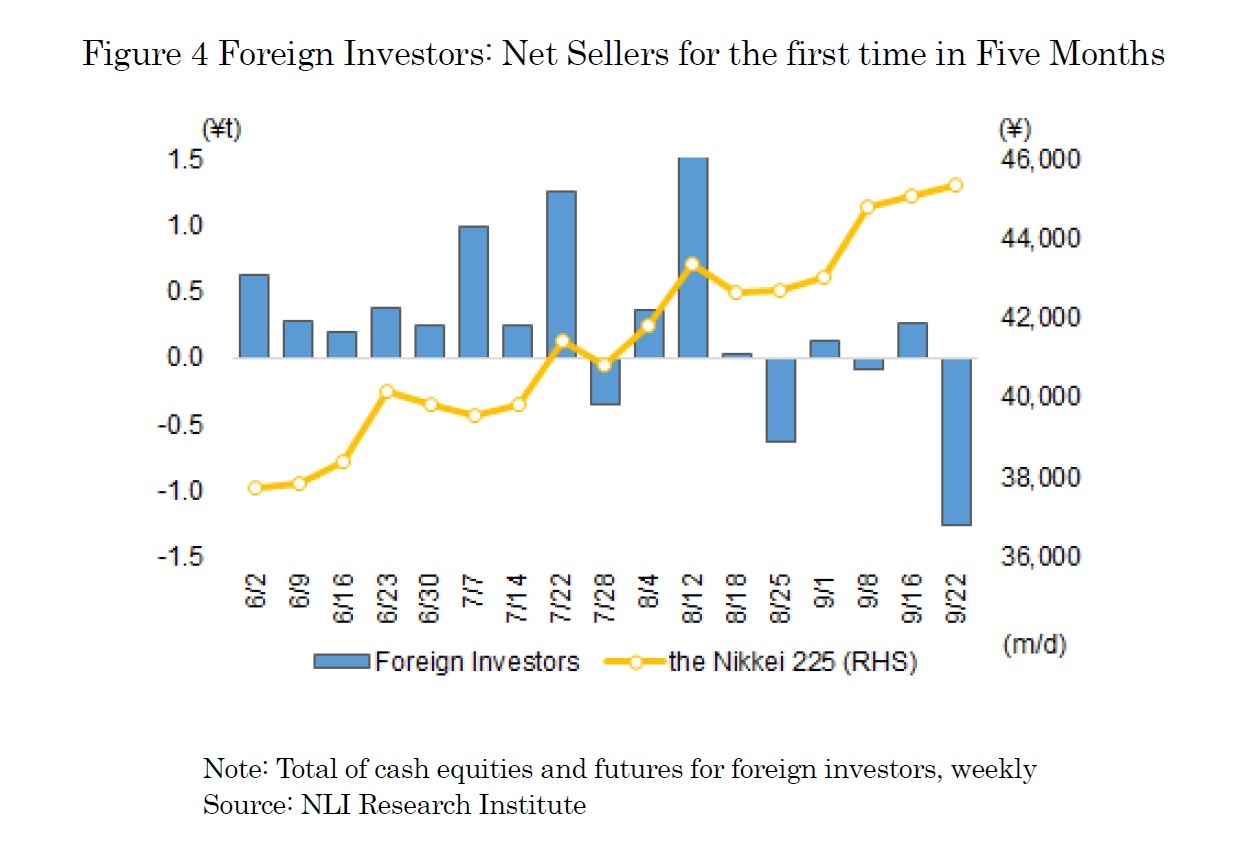

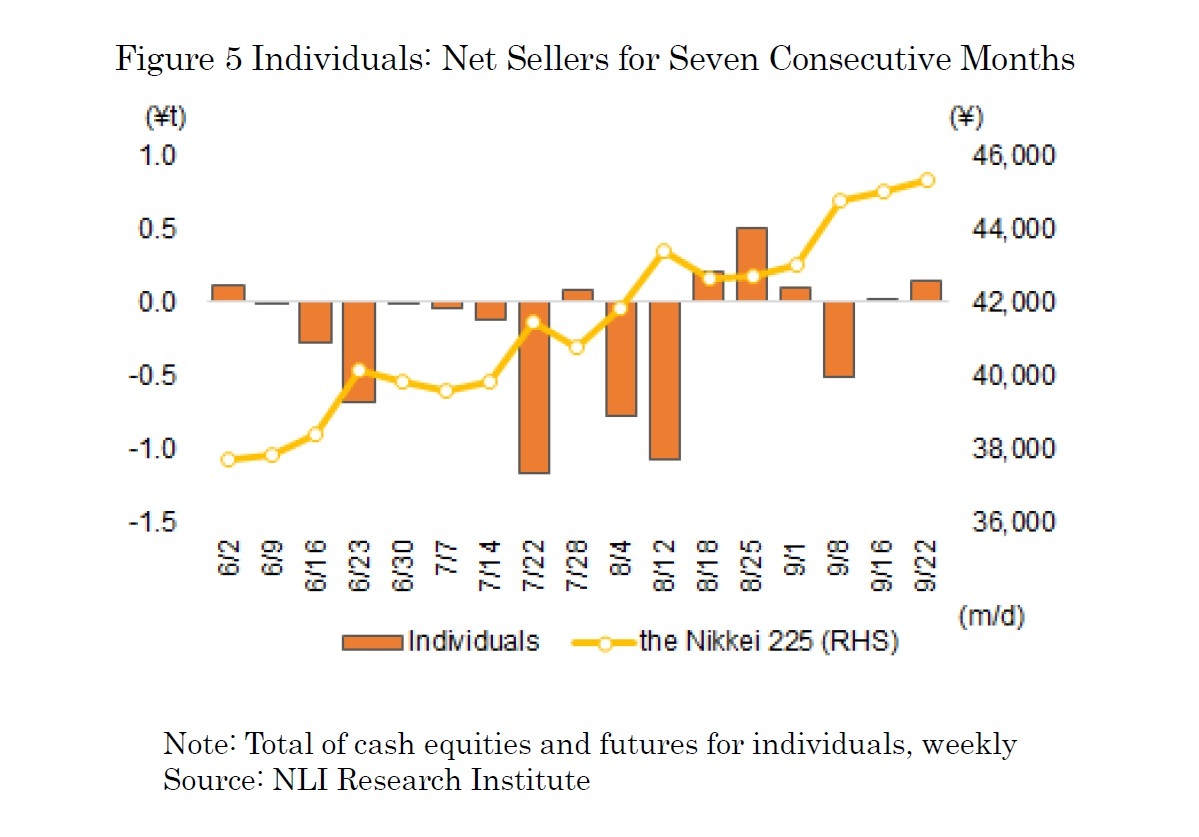

- Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025

Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025

金融研究部 研究員 森下 千鶴

文字サイズ

- 小

- 中

- 大

(2025年10月08日「研究員の眼」)

03-3512-1855

- 【職歴】

2006年 資産運用会社にトレーダーとして入社

2015年 ニッセイ基礎研究所入社

2020年4月より現職

【加入団体等】

・日本証券アナリスト協会検定会員

・早稲田大学大学院経営管理研究科修了(MBA、ファイナンス専修)

森下 千鶴のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/08 | Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/10/07 | 投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ | 森下 千鶴 | 研究員の眼 |

| 2025/10/03 | 進む東証改革、なお残る上場維持基準の課題 | 森下 千鶴 | ニッセイ年金ストラテジー |

| 2025/09/09 | Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025 | 森下 千鶴 | 研究員の眼 |

新着記事

-

2025年10月08日

Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 -

2025年10月07日

保険会社の再建・破綻処理における実務基準の市中協議(欧州)-欧州保険協会からの意見 -

2025年10月07日

株主資本コストからみた米国株式~足元の過熱感の実態は?~ -

2025年10月07日

投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ -

2025年10月07日

基礎研REPORT(冊子版)10月号[vol.343]

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!