- シンクタンクならニッセイ基礎研究所 >

- 資産運用・資産形成 >

- 株式 >

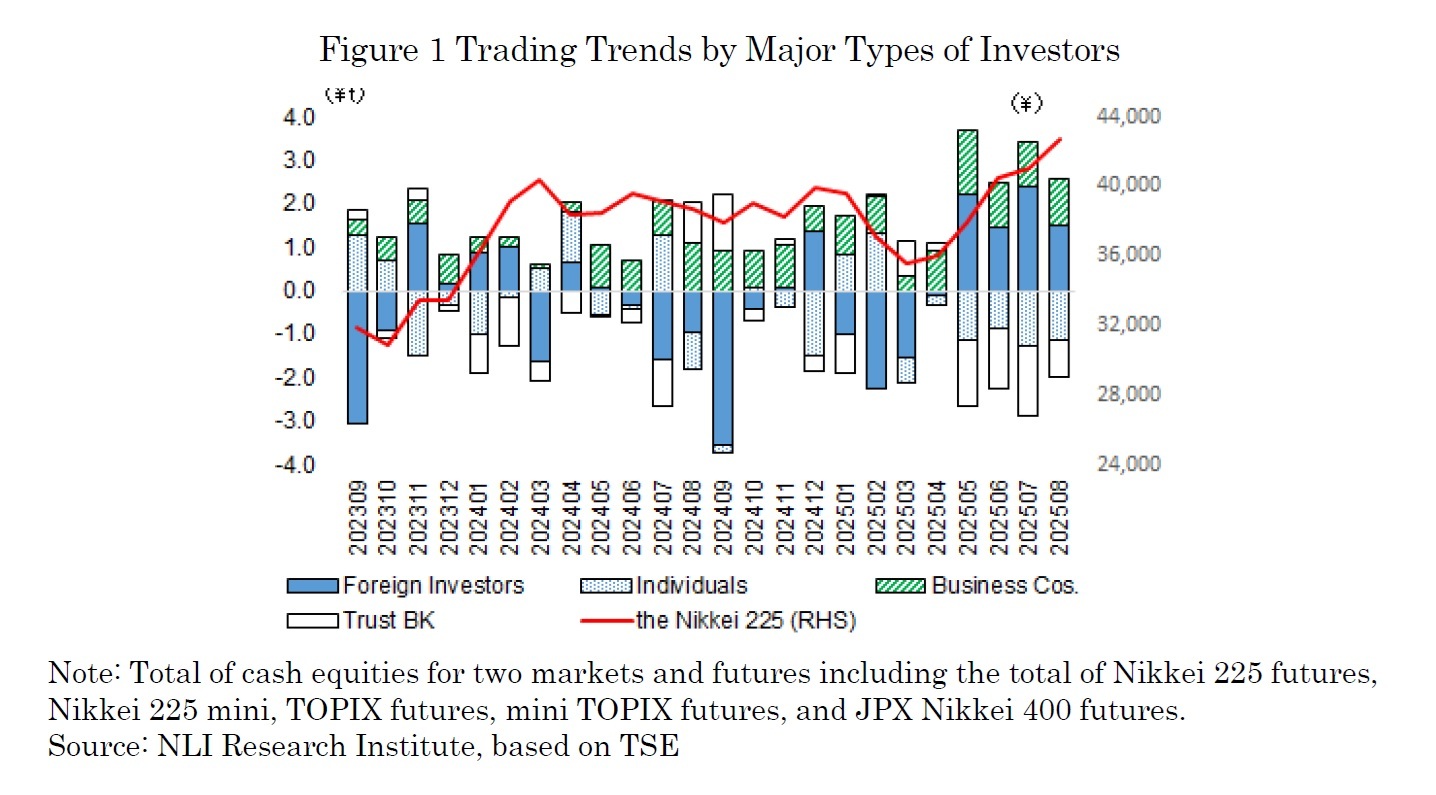

- Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025

Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025

金融研究部 研究員 森下 千鶴

文字サイズ

- 小

- 中

- 大

(2025年09月09日「研究員の眼」)

03-3512-1855

- 【職歴】

2006年 資産運用会社にトレーダーとして入社

2015年 ニッセイ基礎研究所入社

2020年4月より現職

【加入団体等】

・日本証券アナリスト協会検定会員

・早稲田大学大学院経営管理研究科修了(MBA、ファイナンス専修)

森下 千鶴のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/08 | Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/10/07 | 投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ | 森下 千鶴 | 研究員の眼 |

| 2025/10/03 | 進む東証改革、なお残る上場維持基準の課題 | 森下 千鶴 | ニッセイ年金ストラテジー |

| 2025/09/09 | Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025 | 森下 千鶴 | 研究員の眼 |

新着記事

-

2025年11月04日

今週のレポート・コラムまとめ【10/28-10/31発行分】 -

2025年10月31日

交流を広げるだけでは届かない-関係人口・二地域居住に求められる「心の安全・安心」と今後の道筋 -

2025年10月31日

ECB政策理事会-3会合連続となる全会一致の据え置き決定 -

2025年10月31日

2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ -

2025年10月31日

保険型投資商品の特徴を理解すること(欧州)-欧州保険協会の解説文書

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Investors Trading Trends in Japanese Stock Market:An Analysis for August 2025のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!