- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for Fiscal Years 2025-2026 (August 2025)

2025年08月25日

文字サイズ

- 小

- 中

- 大

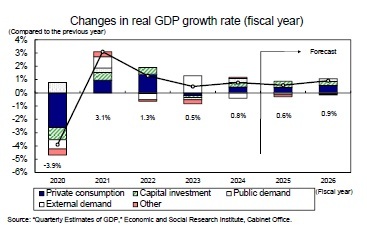

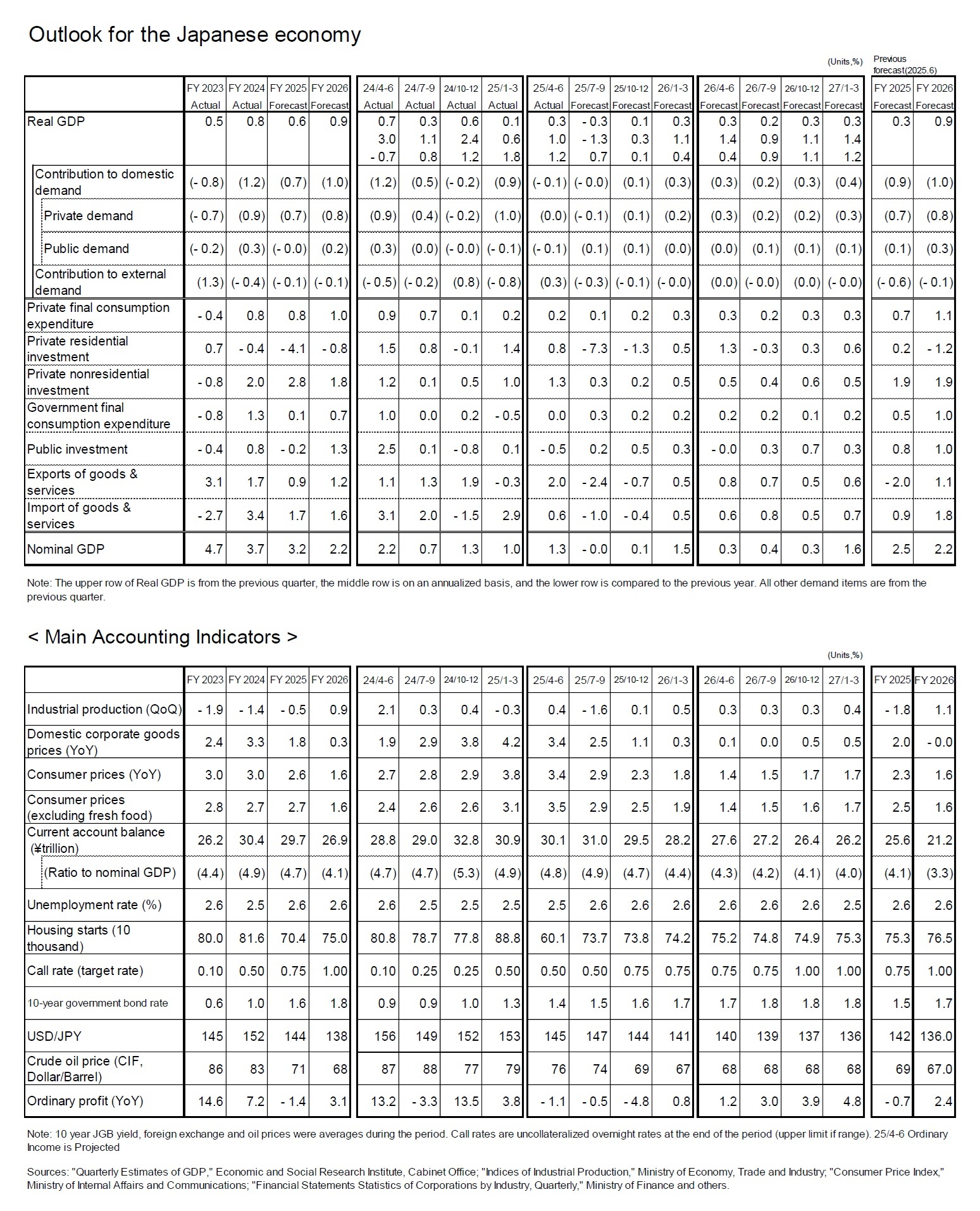

2.Real Growth Rate Forecast: 0.6% for FY 2025, 0.9% for FY 2026

(Negative Growth in the July–September Quarter of 2025)

While exports remained resilient under the Trump tariffs—resulting in positive growth of 1.0% on an annualized basis in the April–June quarter of 2025—the economy is expected to contract in the July–September quarter. Exports will decline as the impact of tariff hikes becomes more pronounced, and private residential investment will sharply fall due to a reactionary decline following last-minute demand ahead of the amendments to the Energy Conservation Act for Buildings and the Building Standards Act. Therefore, real GDP is expected to contract by -1.3% on an annualized basis from the previous quarter, marking the first negative growth in six quarters. The economy is expected to narrowly return to positive growth at 0.3% on an annualized basis in the October–December quarter, with the pace of export decline moderating and private consumption gradually recovering amid slowing inflation. However, if tariffs are further raised, the risk of prolonged negative growth and a recession will increase.

While exports remained resilient under the Trump tariffs—resulting in positive growth of 1.0% on an annualized basis in the April–June quarter of 2025—the economy is expected to contract in the July–September quarter. Exports will decline as the impact of tariff hikes becomes more pronounced, and private residential investment will sharply fall due to a reactionary decline following last-minute demand ahead of the amendments to the Energy Conservation Act for Buildings and the Building Standards Act. Therefore, real GDP is expected to contract by -1.3% on an annualized basis from the previous quarter, marking the first negative growth in six quarters. The economy is expected to narrowly return to positive growth at 0.3% on an annualized basis in the October–December quarter, with the pace of export decline moderating and private consumption gradually recovering amid slowing inflation. However, if tariffs are further raised, the risk of prolonged negative growth and a recession will increase.

After entering 2026, the impact of tariff hikes is expected to gradually diminish, exports will recover, and domestic demand will expand, led by private consumption and capital investment. Growth of around 1% on an annualized basis is projected to continue, slightly above the potential growth rate. The real GDP growth rate is forecast at 0.6% for FY 2025 and 0.9% for FY 2026. By demand component, domestic demand—which turned to positive growth in FY 2024 for the first time in two years—will continue to expand in FY 2025 and FY 2026, although the pace will remain modest as the effects of the Trump tariffs spill over into domestic demand. External demand is projected to make a negative contribution of -0.1% in FY 2025 following -0.4% in FY 2024. Although exports are expected to recover in FY 2026, a continued slowdown in overseas economies and yen appreciation will subdue growth. External demand is projected to make a negative contribution of -0.1%, meaning it cannot be expected to serve as a driver of growth.

After entering 2026, the impact of tariff hikes is expected to gradually diminish, exports will recover, and domestic demand will expand, led by private consumption and capital investment. Growth of around 1% on an annualized basis is projected to continue, slightly above the potential growth rate. The real GDP growth rate is forecast at 0.6% for FY 2025 and 0.9% for FY 2026. By demand component, domestic demand—which turned to positive growth in FY 2024 for the first time in two years—will continue to expand in FY 2025 and FY 2026, although the pace will remain modest as the effects of the Trump tariffs spill over into domestic demand. External demand is projected to make a negative contribution of -0.1% in FY 2025 following -0.4% in FY 2024. Although exports are expected to recover in FY 2026, a continued slowdown in overseas economies and yen appreciation will subdue growth. External demand is projected to make a negative contribution of -0.1%, meaning it cannot be expected to serve as a driver of growth.

(Outlook for Prices)

Core consumer prices (excluding fresh food) have remained in the 3% range compared to the previous year since December 2024. Mainly driven by faster rises in food prices, inflation accelerated to 3.7% in May 2025, but slowed to 3.3% in June as energy price increases significantly moderated.

Food prices (excluding fresh food)—which had slowed from a peak of 9.2% compared to the previous year in August 2023 to 2.6% in July 2024—began to rise again due to the rebound in import prices and soaring rice prices, reaching 8.2% in June 2025. While the rise in upstream food prices (import prices) has remained lower than in the summer of 2023, the pass-through rate to downstream consumer prices has increased. Import prices of food rose by about 60% from autumn 2020 to the end of 2023, while consumer prices of food (excluding fresh food) increased by less than 10% during the same period. By contrast, since early 2023, food import prices rose by only about 15% at their peak—about one-fourth of the previous surge—but consumer food prices have increased at almost the same rate of 15%. In addition to pass-through of labor and logistics costs, prolonged high inflation appears to have reduced resistance for firms to engage in price hikes.

Meanwhile, according to Teikoku Databank’s Survey on Price Trends of 195 Major Food Companies, the number of food items subject to price hikes in 2025 is increasing at a pace exceeding that of 2024. However, there are signs that the pace of this increase might level off over the next three months. While the inflation rate for food is likely to remain elevated for the time being, it is expected to level off toward the latter half of FY 2025.

Core consumer prices (excluding fresh food) have remained in the 3% range compared to the previous year since December 2024. Mainly driven by faster rises in food prices, inflation accelerated to 3.7% in May 2025, but slowed to 3.3% in June as energy price increases significantly moderated.

Food prices (excluding fresh food)—which had slowed from a peak of 9.2% compared to the previous year in August 2023 to 2.6% in July 2024—began to rise again due to the rebound in import prices and soaring rice prices, reaching 8.2% in June 2025. While the rise in upstream food prices (import prices) has remained lower than in the summer of 2023, the pass-through rate to downstream consumer prices has increased. Import prices of food rose by about 60% from autumn 2020 to the end of 2023, while consumer prices of food (excluding fresh food) increased by less than 10% during the same period. By contrast, since early 2023, food import prices rose by only about 15% at their peak—about one-fourth of the previous surge—but consumer food prices have increased at almost the same rate of 15%. In addition to pass-through of labor and logistics costs, prolonged high inflation appears to have reduced resistance for firms to engage in price hikes.

Meanwhile, according to Teikoku Databank’s Survey on Price Trends of 195 Major Food Companies, the number of food items subject to price hikes in 2025 is increasing at a pace exceeding that of 2024. However, there are signs that the pace of this increase might level off over the next three months. While the inflation rate for food is likely to remain elevated for the time being, it is expected to level off toward the latter half of FY 2025.

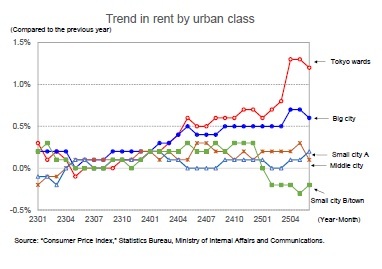

Service prices—which had been rising in the low 2% range since the second half of 2023—slowed to the mid-1% range after the start of FY 2024. Among service prices, services excluding rents peaked in the high 3% range compared to the previous year around the end of 2023, but have since slowed while maintaining growth in the 2% range. Rents—which account for slightly less than 40% of services—have continued to rise in the low 0% range, restraining overall service price growth. However, rents in the Tokyo metropolitan area rose from 0% during the COVID-19 pandemic to 1.3% compared to the previous year in April 2025, reflecting soaring housing prices and marking a sharp acceleration of 0.5 percentage points from the previous month. Looking at rents in the consumer price index by city size, rents in small cities B and towns/villages (population less than 50,000) were negative compared to the previous year, those in small cities A (population 50,000–150,000) and medium cities (population 150,000–1,000,000) rose in the low 0% range, while those in large cities (government-designated cities and Tokyo’s 23 wards) increased in the high 0% range. While rents in depopulated regions are likely to remain sluggish, nationwide rents—led by large metropolitan areas—are expected to gradually accelerate.

Service prices—which had been rising in the low 2% range since the second half of 2023—slowed to the mid-1% range after the start of FY 2024. Among service prices, services excluding rents peaked in the high 3% range compared to the previous year around the end of 2023, but have since slowed while maintaining growth in the 2% range. Rents—which account for slightly less than 40% of services—have continued to rise in the low 0% range, restraining overall service price growth. However, rents in the Tokyo metropolitan area rose from 0% during the COVID-19 pandemic to 1.3% compared to the previous year in April 2025, reflecting soaring housing prices and marking a sharp acceleration of 0.5 percentage points from the previous month. Looking at rents in the consumer price index by city size, rents in small cities B and towns/villages (population less than 50,000) were negative compared to the previous year, those in small cities A (population 50,000–150,000) and medium cities (population 150,000–1,000,000) rose in the low 0% range, while those in large cities (government-designated cities and Tokyo’s 23 wards) increased in the high 0% range. While rents in depopulated regions are likely to remain sluggish, nationwide rents—led by large metropolitan areas—are expected to gradually accelerate.Core CPI is projected at 2.7% in FY 2025 and 1.6% in FY 2026, following 2.7% in FY 2024. Core-core CPI (excluding fresh food and energy) is projected at 3.0% in FY 2025 and 2.0% in FY 2026, following 2.3% in FY 2024.

(2025年08月25日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/11/21 | 貿易統計25年10月-米国向け自動車輸出が持ち直し | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/11/21 | 消費者物価(全国25年10月)-コアCPI上昇率は25年度末にかけて2%を割り込む公算 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/11/18 | 2025~2027年度経済見通し(25年11月) | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/11/17 | QE速報:2025年7-9月期の実質GDPは前期比▲0.4%(年率▲1.8%)-トランプ関税の影響が顕在化し、6四半期ぶりのマイナス成長 | 斎藤 太郎 | Weekly エコノミスト・レター |

新着記事

-

2025年11月21日

物価高対策としてのおこめ券の政策評価と課題~米に限定する物価高対策の違和感~ -

2025年11月21日

貿易統計25年10月-米国向け自動車輸出が持ち直し -

2025年11月21日

消費者物価(全国25年10月)-コアCPI上昇率は25年度末にかけて2%を割り込む公算 -

2025年11月20日

持続可能なESGを求めて-目標と手段とを取り違えないこと -

2025年11月20日

「ラブブ」とは何だったのか-SNS発の流行から考える“リキッド消費”

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for Fiscal Years 2025-2026 (August 2025)】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for Fiscal Years 2025-2026 (August 2025)のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!