- シンクタンクならニッセイ基礎研究所 >

- 経済 >

- 経済予測・経済見通し >

- Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022)

2022年02月24日

文字サイズ

- 小

- 中

- 大

(Price Outlook)

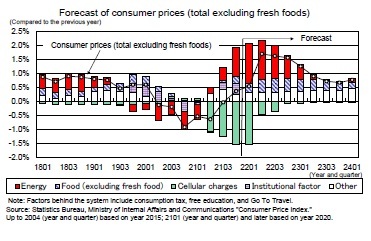

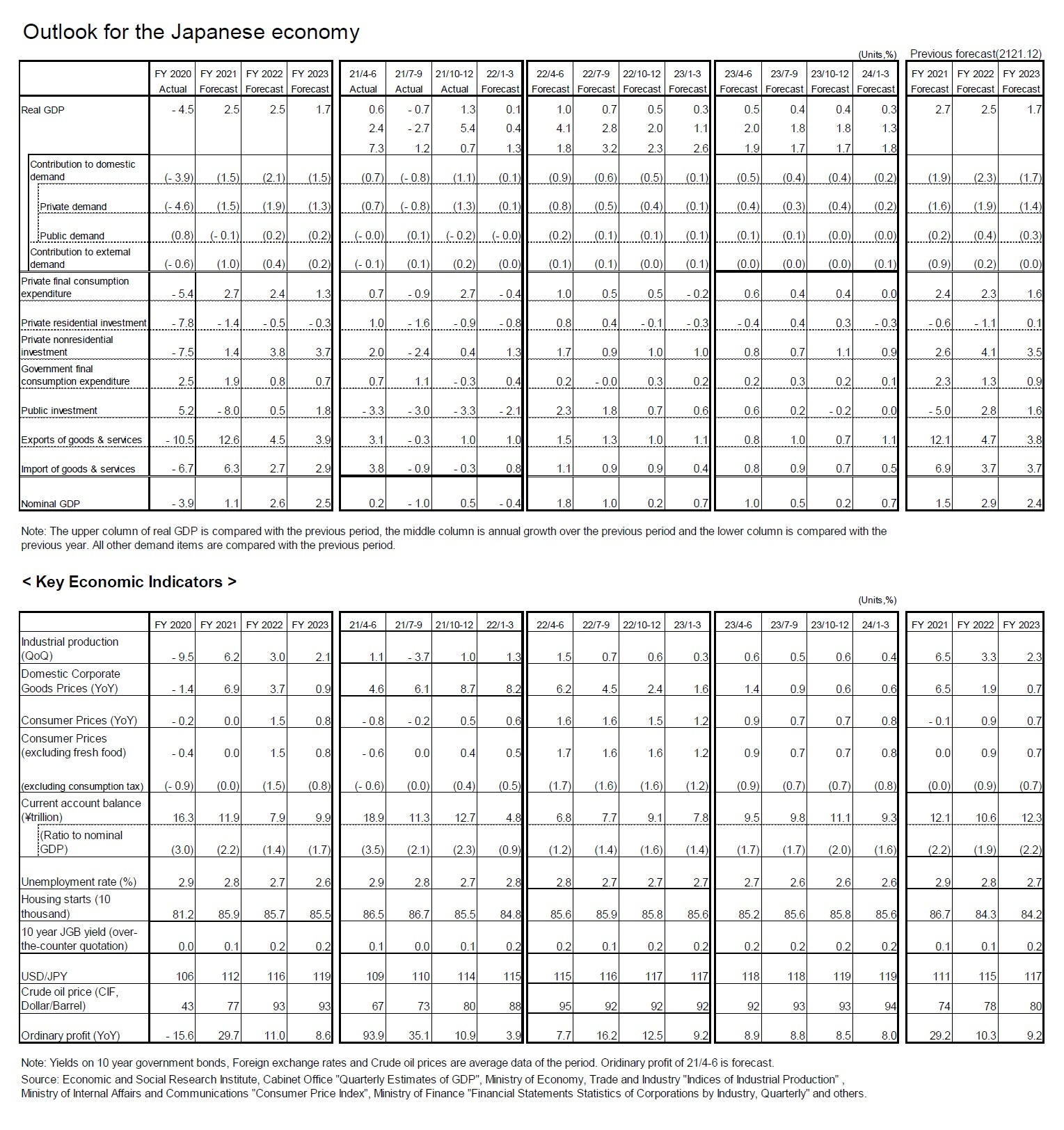

Consumer prices (total CPI excluding fresh food) increased by 0.1% year-on-year for the first time in 18 months in September 2021 and increased by 0.5% year-on-year in December 2021. The sharp decline in mobile phone service charges has pushed down the core CPI inflation rate by about 1.5%, while rising energy costs due to high oil prices and rising accommodation fees due to the suspension of Go To Travel have pushed up the core CPI.

Crude oil prices, which once fell to the 70 dollar per barrel level, have risen to the 90 dollar per barrel level due to concerns over a supply and demand crunch caused by the expansion of demand in the wake of the recovery of the global economy, the decline in production capacity due to the contraction of investment, as well as heightened tensions in Ukraine. Although the government has instituted a gasoline subsidy program [*]1, the effect of controlling gasoline prices is limited, and the pace of increase in electricity and gas prices, which will be reflected later in the impact of high oil prices, is expected to accelerate. The contribution of energy prices to core CPI inflation will rise to the mid 1% level by the end of FY 2021.

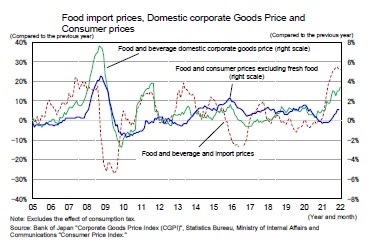

The pace of increase is likely to accelerate in the future for food products (excluding fresh foods). Food prices increased by 0.1% year-on-year in July 2021 and 1.1% year-on-year in December 2021, but the growth rate is still limited compared to the price increase rate in the upstream stage.

Consumer prices (total CPI excluding fresh food) increased by 0.1% year-on-year for the first time in 18 months in September 2021 and increased by 0.5% year-on-year in December 2021. The sharp decline in mobile phone service charges has pushed down the core CPI inflation rate by about 1.5%, while rising energy costs due to high oil prices and rising accommodation fees due to the suspension of Go To Travel have pushed up the core CPI.

Crude oil prices, which once fell to the 70 dollar per barrel level, have risen to the 90 dollar per barrel level due to concerns over a supply and demand crunch caused by the expansion of demand in the wake of the recovery of the global economy, the decline in production capacity due to the contraction of investment, as well as heightened tensions in Ukraine. Although the government has instituted a gasoline subsidy program [*]1, the effect of controlling gasoline prices is limited, and the pace of increase in electricity and gas prices, which will be reflected later in the impact of high oil prices, is expected to accelerate. The contribution of energy prices to core CPI inflation will rise to the mid 1% level by the end of FY 2021.

The pace of increase is likely to accelerate in the future for food products (excluding fresh foods). Food prices increased by 0.1% year-on-year in July 2021 and 1.1% year-on-year in December 2021, but the growth rate is still limited compared to the price increase rate in the upstream stage.

Import prices of foodstuffs have recently increased in the upper 20% range compared to the previous year, and food prices in domestic corporate goods price have increased in the 3% range compared to the previous year. Since 2000, the inflation rate of foodstuffs (excluding fresh food) has exceeded 2% two times, from April 2008 to April 2009 and from October to December 2015. Comparing the upstream inflation rate, the import price inflation rate is higher now than it was in 2008 and 2015, and the inflation rate in domestic corporate goods price is higher than it was in 2015. By the middle of 2022, the inflation rate of foodstuffs (excluding fresh foods) will reach the 2% level, and the contribution to the core CPI inflation rate will increase to about 0.5%.

Import prices of foodstuffs have recently increased in the upper 20% range compared to the previous year, and food prices in domestic corporate goods price have increased in the 3% range compared to the previous year. Since 2000, the inflation rate of foodstuffs (excluding fresh food) has exceeded 2% two times, from April 2008 to April 2009 and from October to December 2015. Comparing the upstream inflation rate, the import price inflation rate is higher now than it was in 2008 and 2015, and the inflation rate in domestic corporate goods price is higher than it was in 2015. By the middle of 2022, the inflation rate of foodstuffs (excluding fresh foods) will reach the 2% level, and the contribution to the core CPI inflation rate will increase to about 0.5%.Core CPI growth is expected to decline in January 2022, when the impact of the "Go To Travel" shutdown is expected to evaporate. However, it is expected to accelerate to the upper 1% level in April 2022, when the impact of the sharp decline in mobile phone service charges is expected to diminish, and is expected to remain at the 1% level during FY 2022.

However, most of the increase in prices was caused by passing on a substantial increase in raw material prices to sales prices, which accounted for about 50% of the total increase in the consumer price index. Service prices, which are highly linked to wages, have remained sluggish. Although the wage increase rate for spring labor negotiations is expected to continue improving in 2022 and 2023, it is expected to remain at a low level of 0% in terms of wage increases. A rise in service prices is not expected to lead to a significant increase in prices. The core CPI inflation rate is likely to slow to the upper 0% level after the start of 2023, when the upward pressure caused by rising raw material prices is expected to end.

However, most of the increase in prices was caused by passing on a substantial increase in raw material prices to sales prices, which accounted for about 50% of the total increase in the consumer price index. Service prices, which are highly linked to wages, have remained sluggish. Although the wage increase rate for spring labor negotiations is expected to continue improving in 2022 and 2023, it is expected to remain at a low level of 0% in terms of wage increases. A rise in service prices is not expected to lead to a significant increase in prices. The core CPI inflation rate is likely to slow to the upper 0% level after the start of 2023, when the upward pressure caused by rising raw material prices is expected to end.Core CPI inflation is projected to increase by 0.0% in FY 2021, 1.5% in FY 2022, and 0.8% in FY 2023.

1 Maximum of 5 yen for the portion exceeding 170 yen per liter

Please note:The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

(2022年02月24日「Weekly エコノミスト・レター」)

このレポートの関連カテゴリ

03-3512-1836

経歴

- ・ 1992年:日本生命保険相互会社

・ 1996年:ニッセイ基礎研究所へ

・ 2019年8月より現職

・ 2010年 拓殖大学非常勤講師(日本経済論)

・ 2012年~ 神奈川大学非常勤講師(日本経済論)

・ 2018年~ 統計委員会専門委員

斎藤 太郎のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/10/31 | 2025年7-9月期の実質GDP~前期比▲0.7%(年率▲2.7%)を予測~ | 斎藤 太郎 | Weekly エコノミスト・レター |

| 2025/10/31 | 鉱工業生産25年9月-7-9月期の生産は2四半期ぶりの減少も、均してみれば横ばいで推移 | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/31 | 雇用関連統計25年9月-女性の正規雇用比率が50%に近づく | 斎藤 太郎 | 経済・金融フラッシュ |

| 2025/10/30 | 潜在成長率は変えられる-日本経済の本当の可能性 | 斎藤 太郎 | 基礎研レポート |

新着記事

-

2025年11月04日

数字の「26」に関わる各種の話題-26という数字で思い浮かべる例は少ないと思われるが- -

2025年11月04日

ユーロ圏消費者物価(25年10月)-2%目標に沿った推移が継続 -

2025年11月04日

米国個人年金販売額は2025年上半期も過去最高記録を更新-但し保有残高純増は別の課題- -

2025年11月04日

パワーカップル世帯の動向(2)家庭と働き方~DINKS・子育て・ポスト子育て、制度と夫婦協働が支える -

2025年11月04日

「ブルー寄付」という選択肢-個人の寄付が果たす、資金流入の突破口

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022) 】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022) のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!