- シンクタンクならニッセイ基礎研究所 >

- 資産運用・資産形成 >

- 株式 >

- Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025

Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025

金融研究部 研究員 森下 千鶴

文字サイズ

- 小

- 中

- 大

Summary

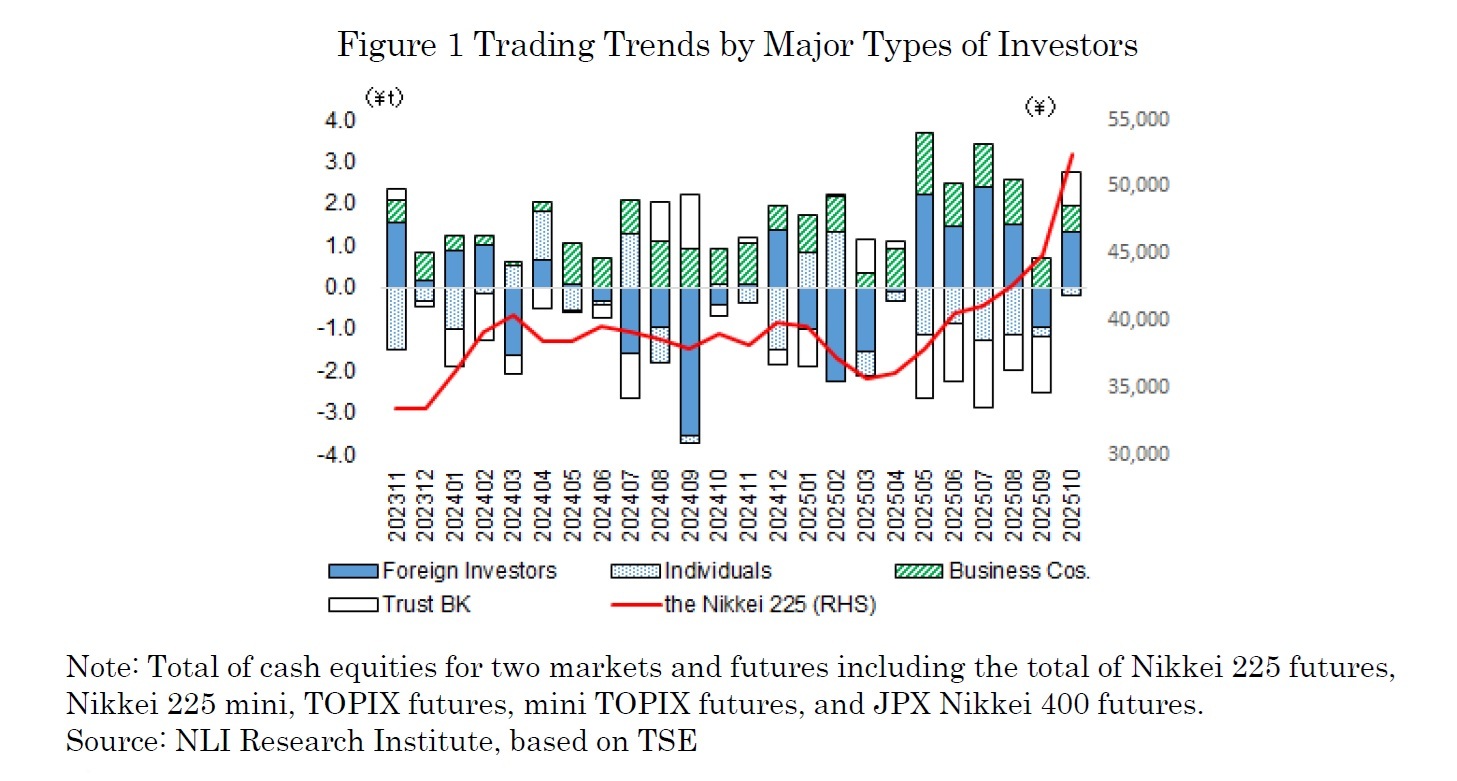

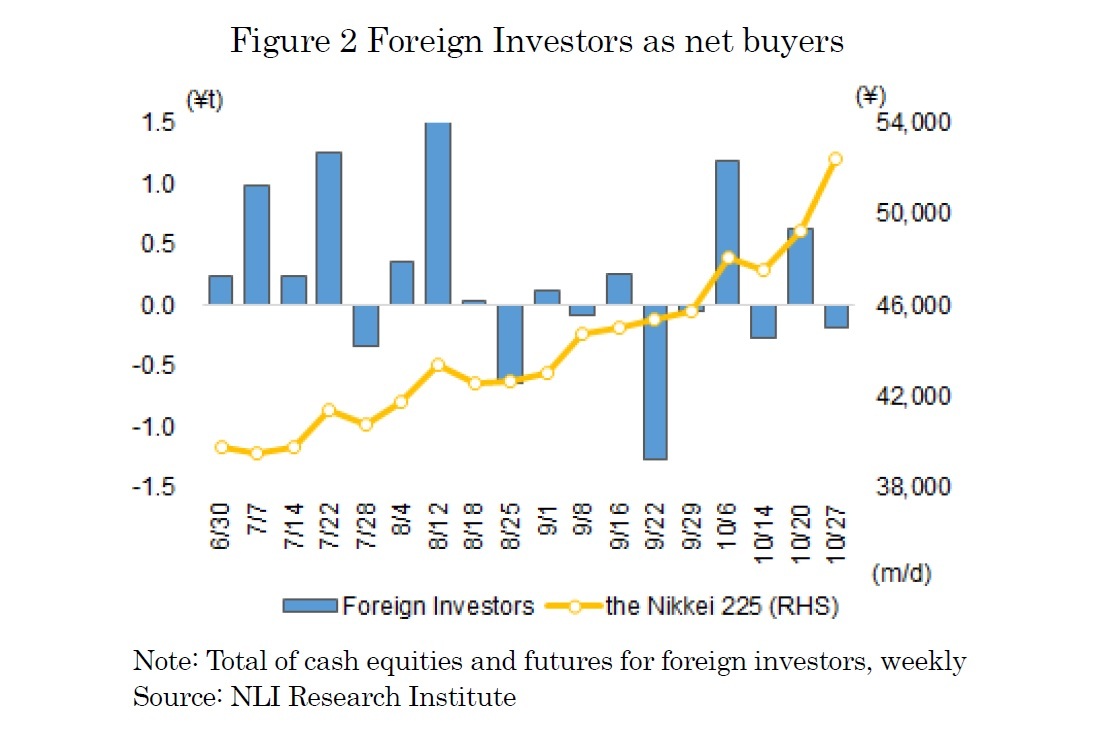

・Foreign investors were the largest net buyers in October, with a total net purchase of 1.32 trillion yen.

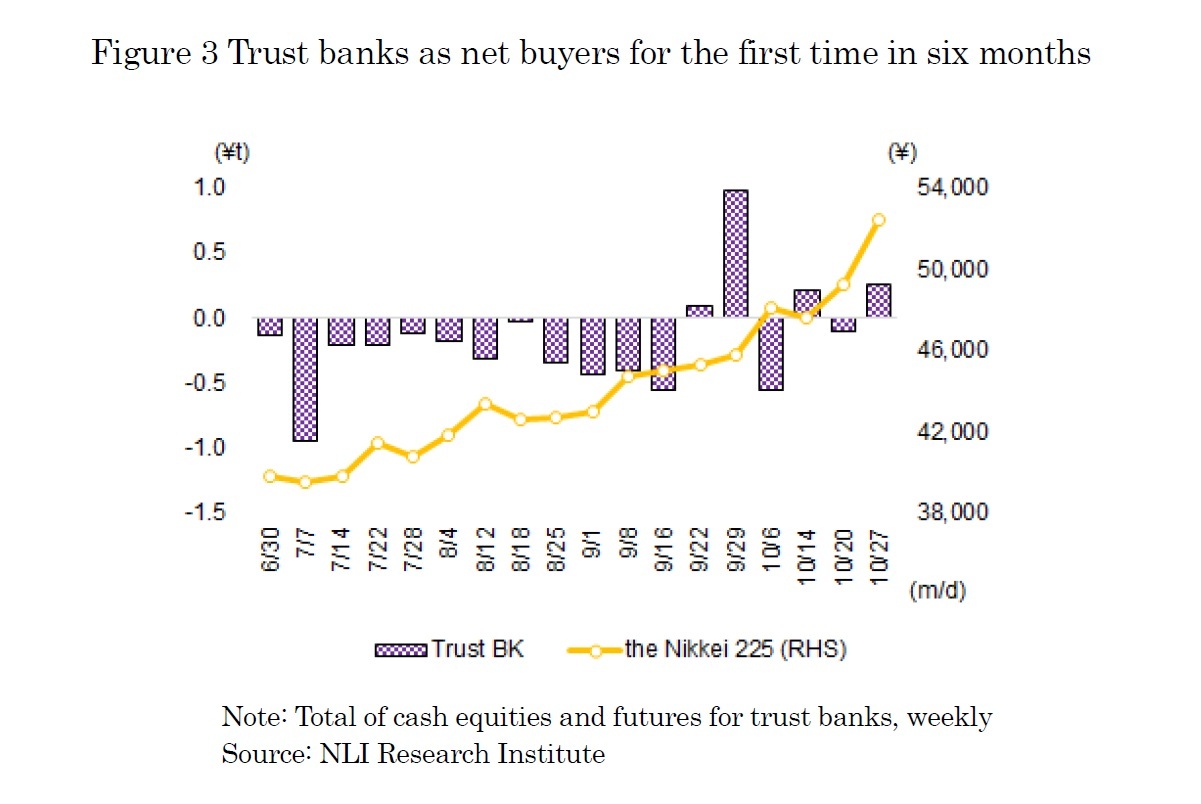

・Trust banks recorded a net purchase of 801.4 billion yen, turning net buyers for the first time in six months.

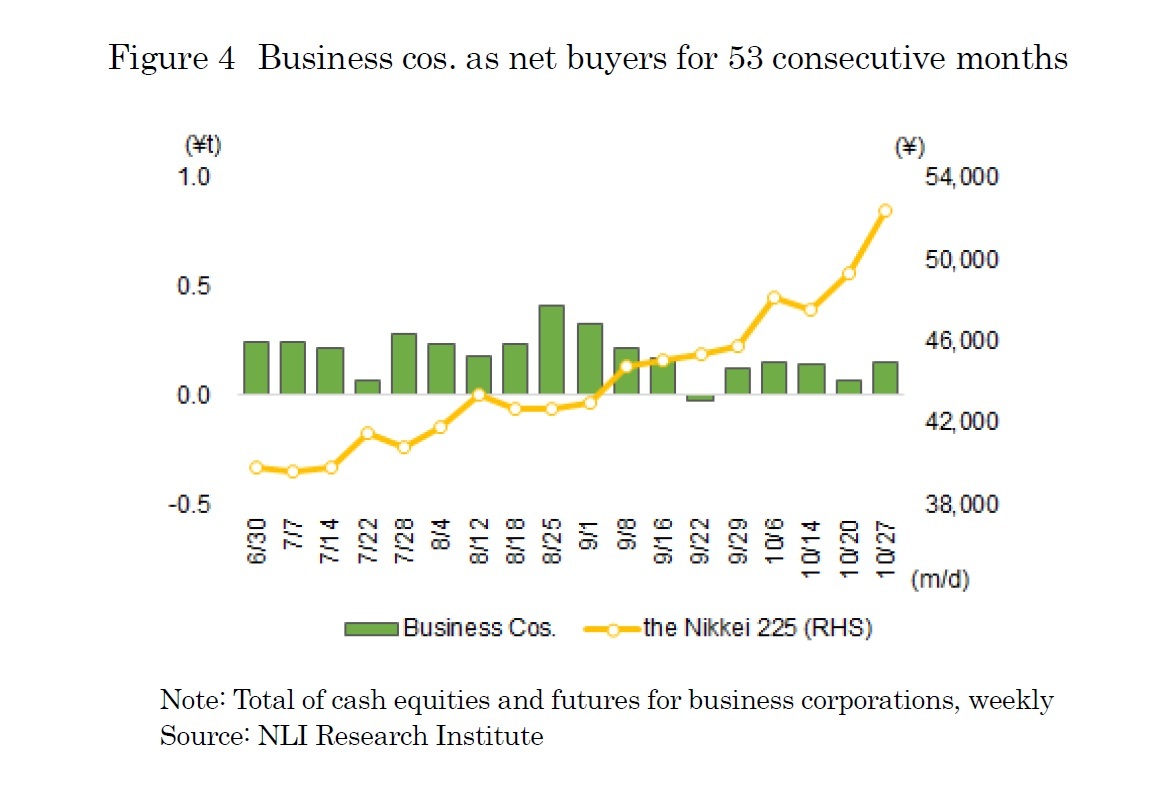

・Business corporations posted a net purchase of 637.4 billion yen, marking their 53rd consecutive month of net buying.

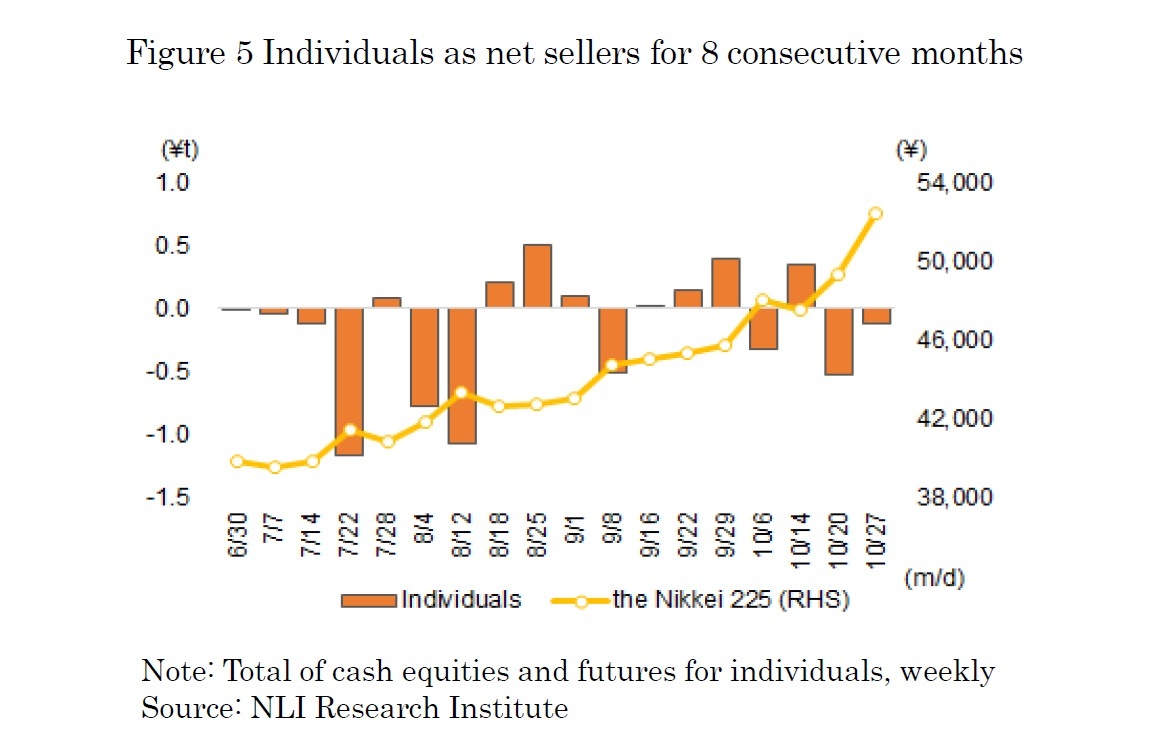

・Individuals were net sellers by 216.3 billion yen, recording their eighth consecutive month of net selling.

In October 2025, the Nikkei 225 rose for the seventh consecutive month, reaching the 50,000 level for the first time in history. Early in the month, the market started on a soft note due to concerns over a potential U.S. government shutdown, with the index closing in the 44,000 range on the 2nd. Supported by expectations of U.S. rate cuts and a weaker yen, the upward trend strengthened. After Ms. Takaichi’s victory in the LDP presidential election on the 4th, optimism pushed the market higher, and the Nikkei surged to 47,944 on the 6th. In mid-October, the index briefly declined due to the Komeito Party’s exit from the coalition and renewed concerns over U.S. regional banks. However, expectations of a coalition between the LDP and Nippon Ishin, along with gains in generative AI-related stocks, helped the market resume its rise. Following the launch of the new Takaichi Cabinet on the 21st, expectations for expansionary fiscal policy and gains in U.S. high-tech stocks accelerated the rally. On the 27th, the Nikkei closed at 50,512, marking its first-ever finish above 50,000, and ended the month at 52,411. By investor type, foreign investors, trust banks and business corporations were net buyers, while individuals were net sellers (as shown in Figure 1).

This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

(2025年11月11日「研究員の眼」)

03-3512-1855

- 【職歴】

2006年 資産運用会社にトレーダーとして入社

2015年 ニッセイ基礎研究所入社

2020年4月より現職

【加入団体等】

・日本証券アナリスト協会検定会員

・早稲田大学大学院経営管理研究科修了(MBA、ファイナンス専修)

森下 千鶴のレポート

| 日付 | タイトル | 執筆者 | 媒体 |

|---|---|---|---|

| 2025/11/11 | Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/11/11 | 投資部門別売買動向(25年10月)~信託銀行が6カ月ぶりに買い越し~ | 森下 千鶴 | 研究員の眼 |

| 2025/10/08 | Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025 | 森下 千鶴 | 研究員の眼 |

| 2025/10/07 | 投資部門別売買動向(25年9月)~事業法人は52カ月連続買い越し~ | 森下 千鶴 | 研究員の眼 |

新着記事

-

2025年11月11日

年金の「年収の壁」が実質引上げ!? 4月からは残業代を含まない判定も~年金改革ウォッチ 2025年11月号 -

2025年11月11日

Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025 -

2025年11月11日

投資部門別売買動向(25年10月)~信託銀行が6カ月ぶりに買い越し~ -

2025年11月11日

東京オフィス賃料は上昇基調が強まる。REIT市場は6カ月連続で上昇-不動産クォータリー・レビュー2025年第3四半期 -

2025年11月11日

基礎研REPORT(冊子版)11月号[vol.344]

お知らせ

-

2025年07月01日

News Release

-

2025年06月06日

News Release

-

2025年04月02日

News Release

【Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025】【シンクタンク】ニッセイ基礎研究所は、保険・年金・社会保障、経済・金融・不動産、暮らし・高齢社会、経営・ビジネスなどの各専門領域の研究員を抱え、様々な情報提供を行っています。

Investors Trading Trends in Japanese Stock Market:An Analysis for October 2025のレポート Topへ

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!

各種レポート配信をメールでお知らせ。読み逃しを防ぎます!