- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024

Column

13/08/2024

Investors Trading Trends in Japanese Stock Market:An Analysis for July 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

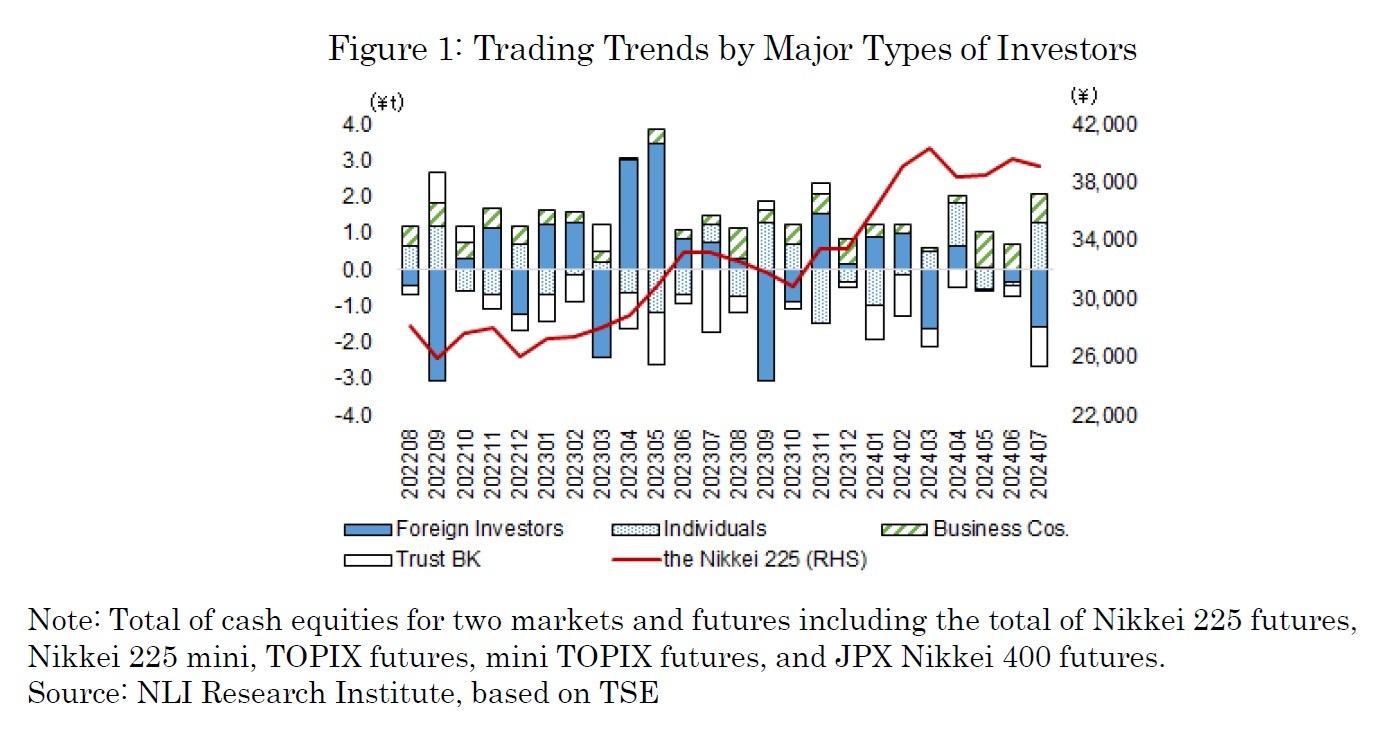

The Nikkei Stock Average in July showed a "back-and-forth" movement, rising in the first half and falling in the second half. In early July, the yen depreciated to the \161/$ level, and the rise in U.S. high-tech stocks was well-received, causing the Nikkei to surpass 40,000 on July 2, reaching 42,224 on July 11. However, in mid-July, the market turned downward due to negative reactions to former President Trump's comments on correcting the strong dollar and reports of U.S. semiconductor restrictions on China. Subsequently, uncertainty about monetary policies in Japan and the U.S. and the yen's appreciation to the \153/$ level led the Nikkei to fall below 40,000 on July 22 and drop to 37,667 on July 26. On July 31, after the Bank of Japan announced a 0.25% policy rate hike and plans to reduce government bond purchases, the yen appreciated to the \149/$ level. However, buying resumed following reports that Japan and South Korea would be excluded from U.S. semiconductor restrictions on China, with the Nikkei closing at 39,101 at the end of the month. Individuals and business corporations were net buyers, while foreign investors and trust banks were net sellers (as shown in Figure 1).

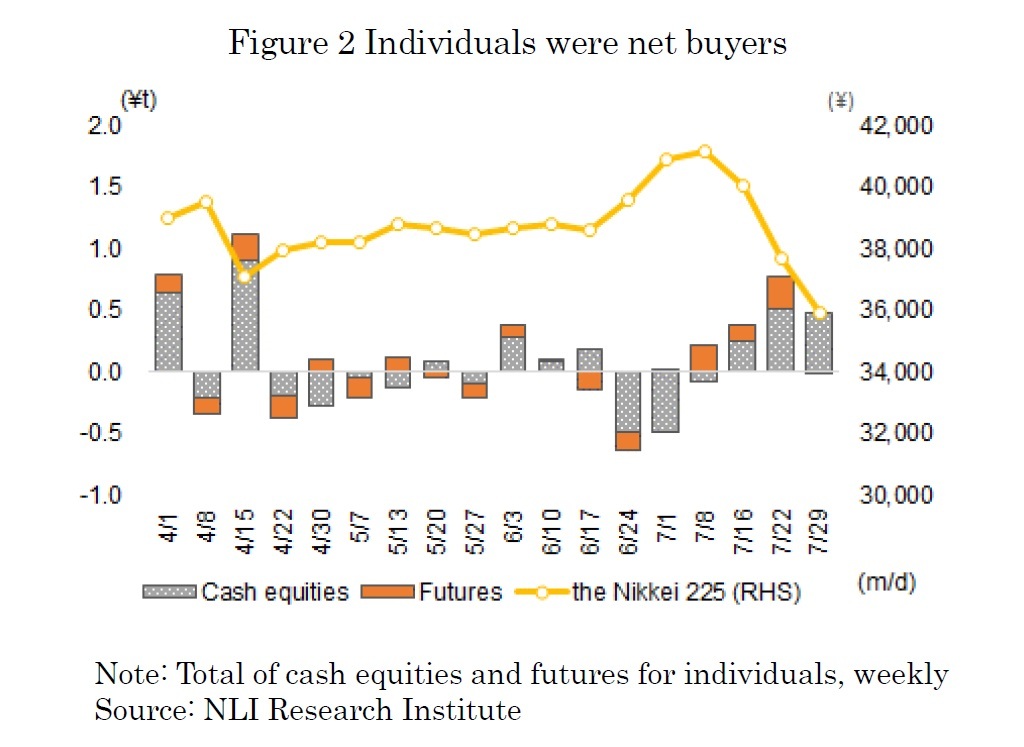

The trading by type of investors on July 2024, spanning from July 1 to August 2, show that individuals were the largest net buyers, with a total of 1.29 trillion yen in cash equities and futures. Notably, during the third to fifth weeks of July (from July 16 to August 2), when the Nikkei dropped by approximately 5,200 yen, individuals made substantial net purchases of 1.63 trillion yen in cash equities and futures, demonstrating a clear contrarian buying pattern, where they bought as stock prices fell (as shown in Figure 2).

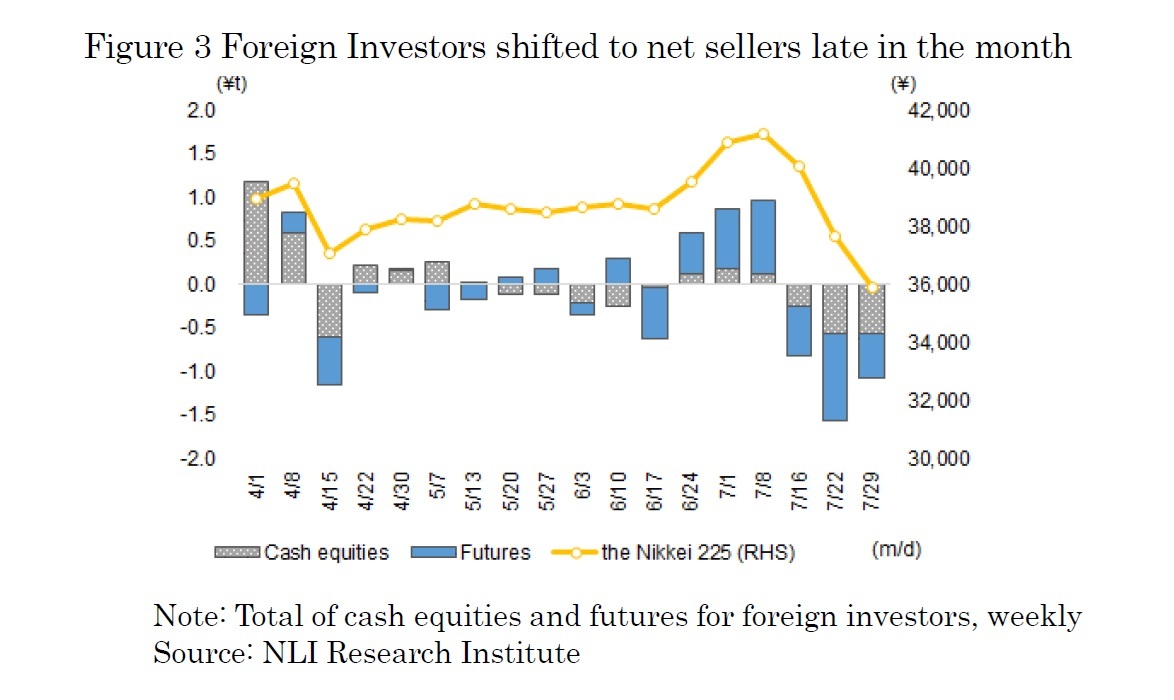

On the other hand, foreign investors were the largest net sellers, with a total net sale of 1.59 trillion yen in both cash equities and futures. During the first to second weeks of July (July 1 to July 12), they were net buyers, net purchase of 1.85 trillion yen in cash equities and futures, which coincided with a rise of approximately 1,600 yen in the Nikkei during that period. However, in the third to fifth weeks of July (July 16 to August 2), foreign investors drastically switched to net sellers, offloading a substantial 3.44 trillion yen, which corresponded with a decline of about 5,200 yen in the Nikkei during that period (as shown in Figure 3).

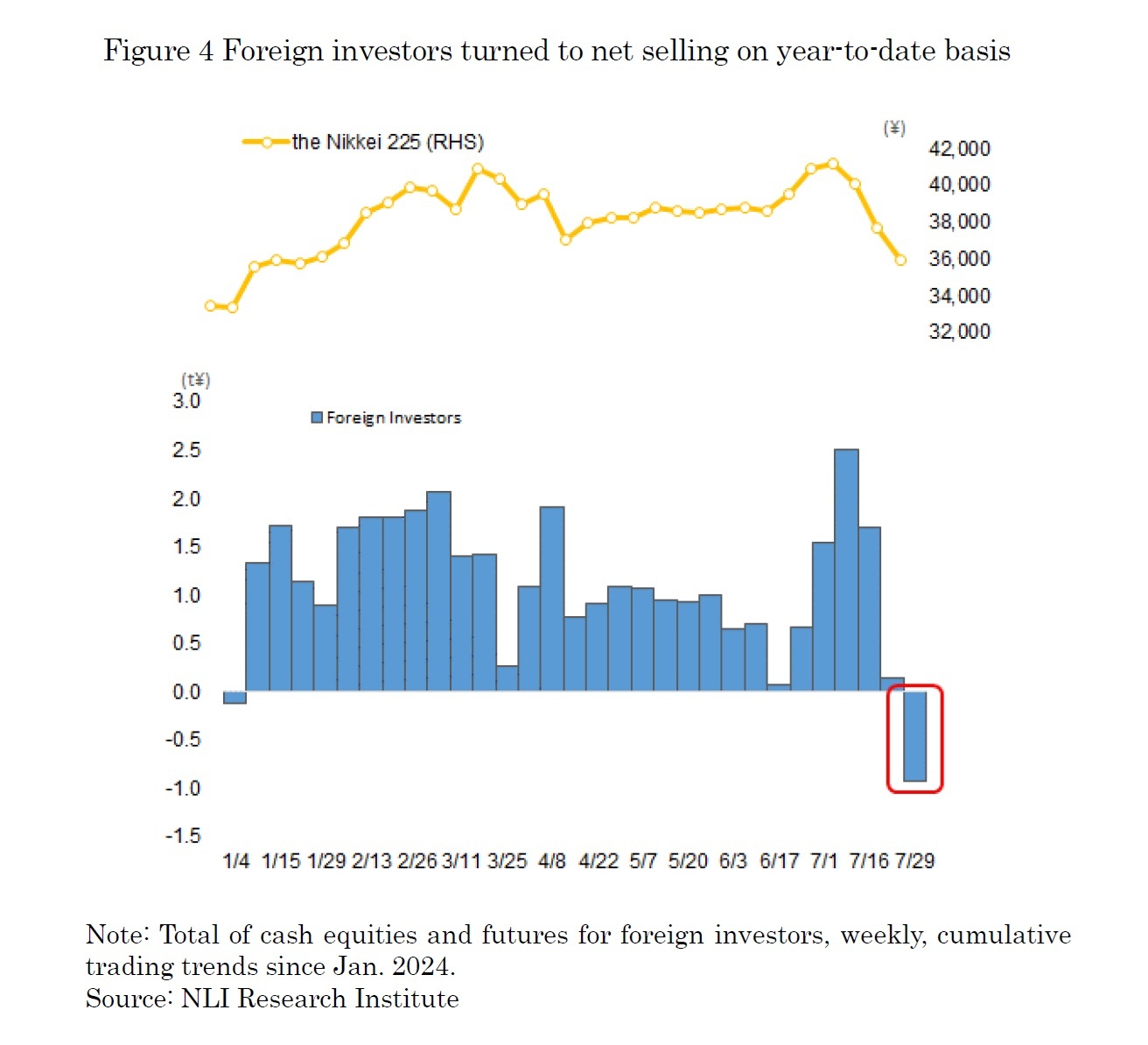

To track the trend of foreign investors since the beginning of the year, we have compiled the weekly trading data for both cash equities and futures by foreign investors from January 2024 onward (as shown in Figure 4). While foreign investors had been net buyers in total of cash equities and futures since the second week of January 2024, they sharply shifted to net selling from the third week of July. By the fifth week of July, they were net sellers even on a year-to-date basis.

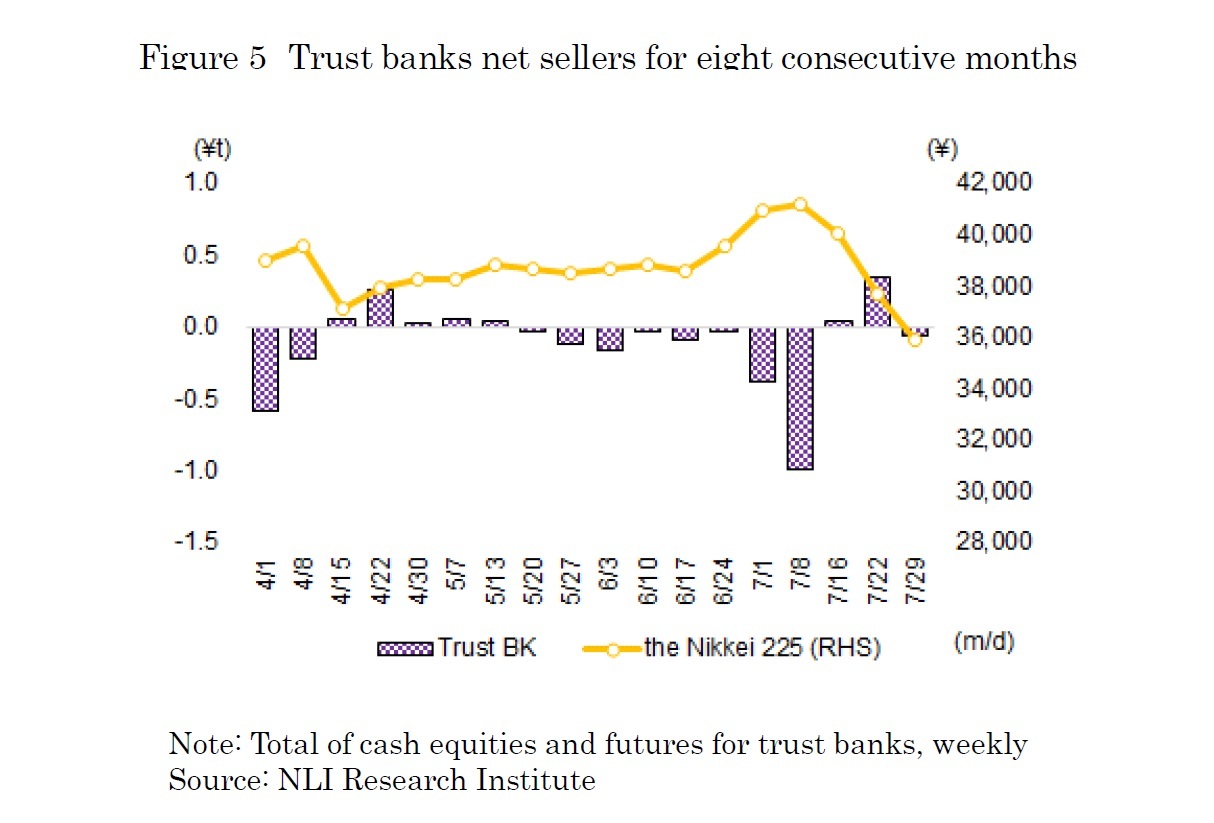

In July, trust banks were also net sellers with a total of 1.06 trillion yen in both cash equities and futures, marking eight consecutive months of net selling since December 2023. Notably, in the second week of July (July 8 to 12), they had a substantial net selling of 997 billion yen. This selling pressure appears to stem not only from rebalancing by pension funds but also from the need to generate cash for dividends from exchange-traded funds (ETFs). However, during the period from the third to the fifth week of July (July 16 to August 2), when the Nikkei fell by approximately 5,200 yen, there was a net purchases with a total of 324 billion yen in both cash equities and futures, suggesting that the selling pressure for rebalancing had eased temporarily( as shown in Figure5).

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング