- NLI Research Institute >

- Asset management・Asset building >

- Foreign Investors Trading Trends in Japanese Stock Market (by region): An Analysis for January 2024

Column

22/02/2024

Foreign Investors Trading Trends in Japanese Stock Market (by region): An Analysis for January 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

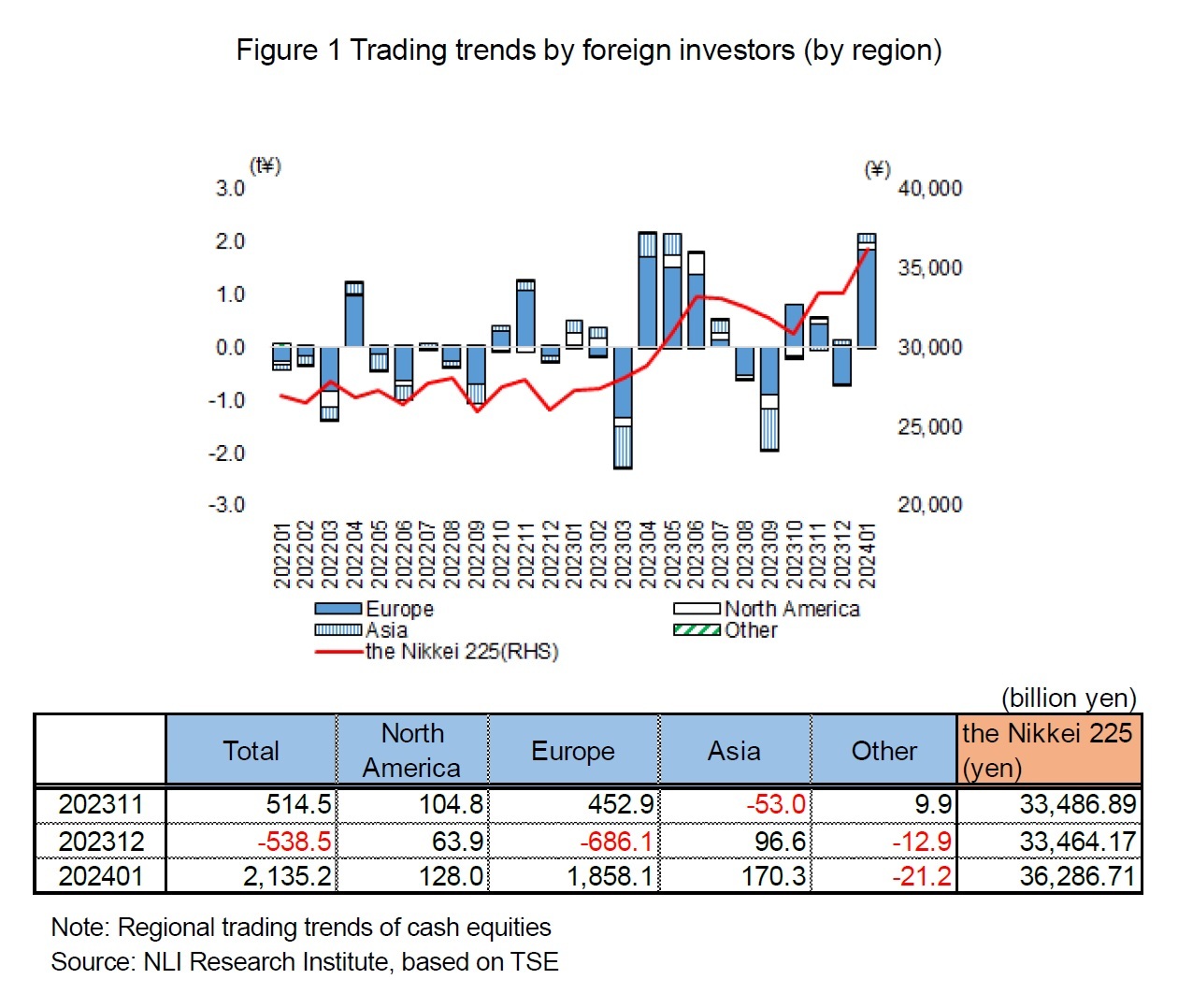

The Tokyo Stock Exchange publishes the trading trends of nonresidential investors in cash equities by region—'North America,' 'Europe,' 'Asia,' and 'Other'—around the 20th of every month. According to the data for January, Investors from 'North America,' 'Europe,' and 'Asia' regions were net buyers, while net selling was observed in 'Other' regions. Notably, the net buying from 'Europe' reached 1,858.1 billion yen, the largest net buyers by region.

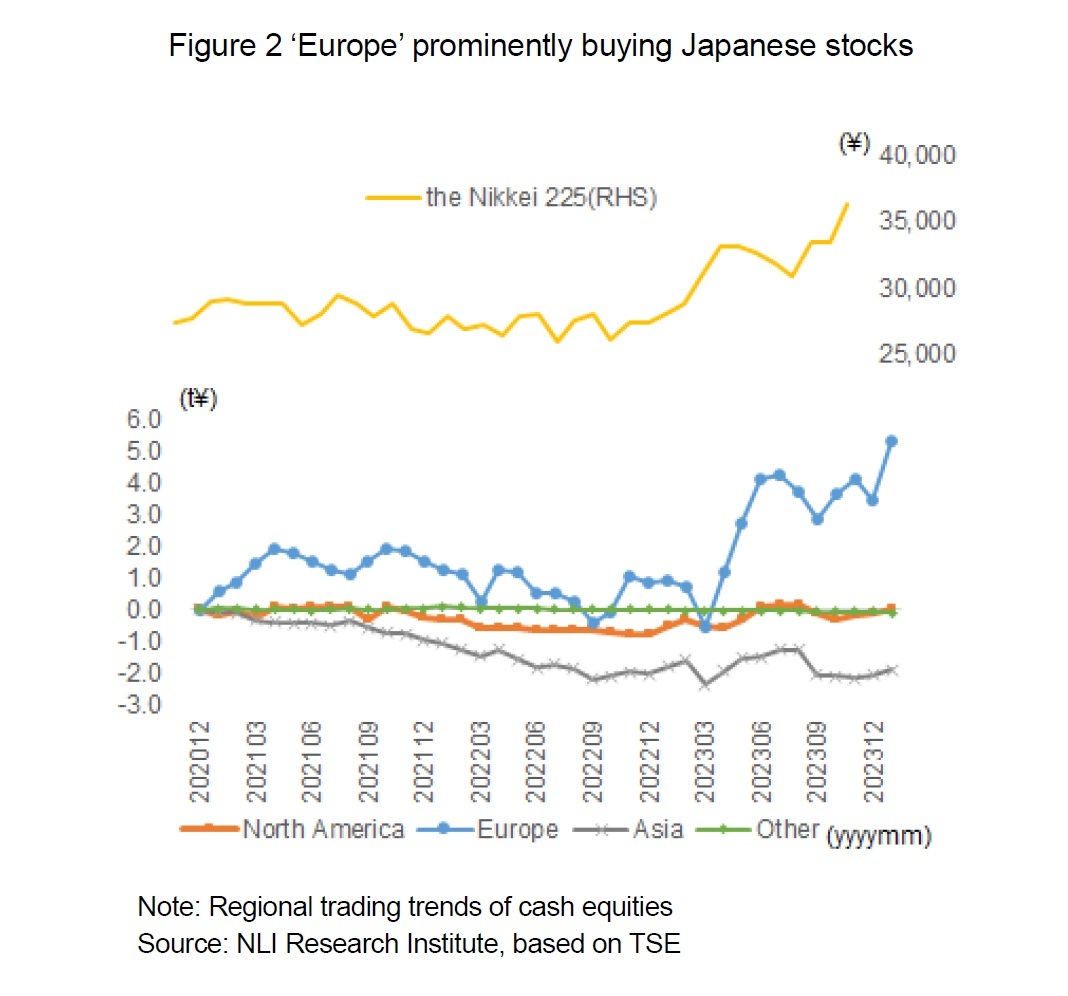

Figure 2 shows the cumulative regional trading trends by foreign investors over the past three years, and the influence of ‘Europe’ stands out in particular. In the three months from April to June 2023, 'Europe' purchased a net total of 4,678.9 billion in cash equities, during which the Nikkei Stock Average rose by approximately 5,000 yen. While there were periods of net selling in the latter half of 2023, the trend of net purchases continued into January 2024.

This trading data is calculated based on information from 51 securities companies with a capital of more than 3 billion yen, which engage in stock trading on the Tokyo and Nagoya stock exchanges. Since investment funds come through various channels, it is difficult to pinpoint the exact source of the funds. However, the net buying observed since April 2023 can be attributed to several factors: expectations for corporate reforms in response to requests from the Tokyo Stock Exchange, a bullish stance on Japanese stocks by prominent U.S. investors, and a sense of security from the accommodative financial environment. It is conceivable that these inflows into Japan consist of long-term investments from European investors, Middle Eastern oil money via Europe, and capital diverted from the uncertainties in China.

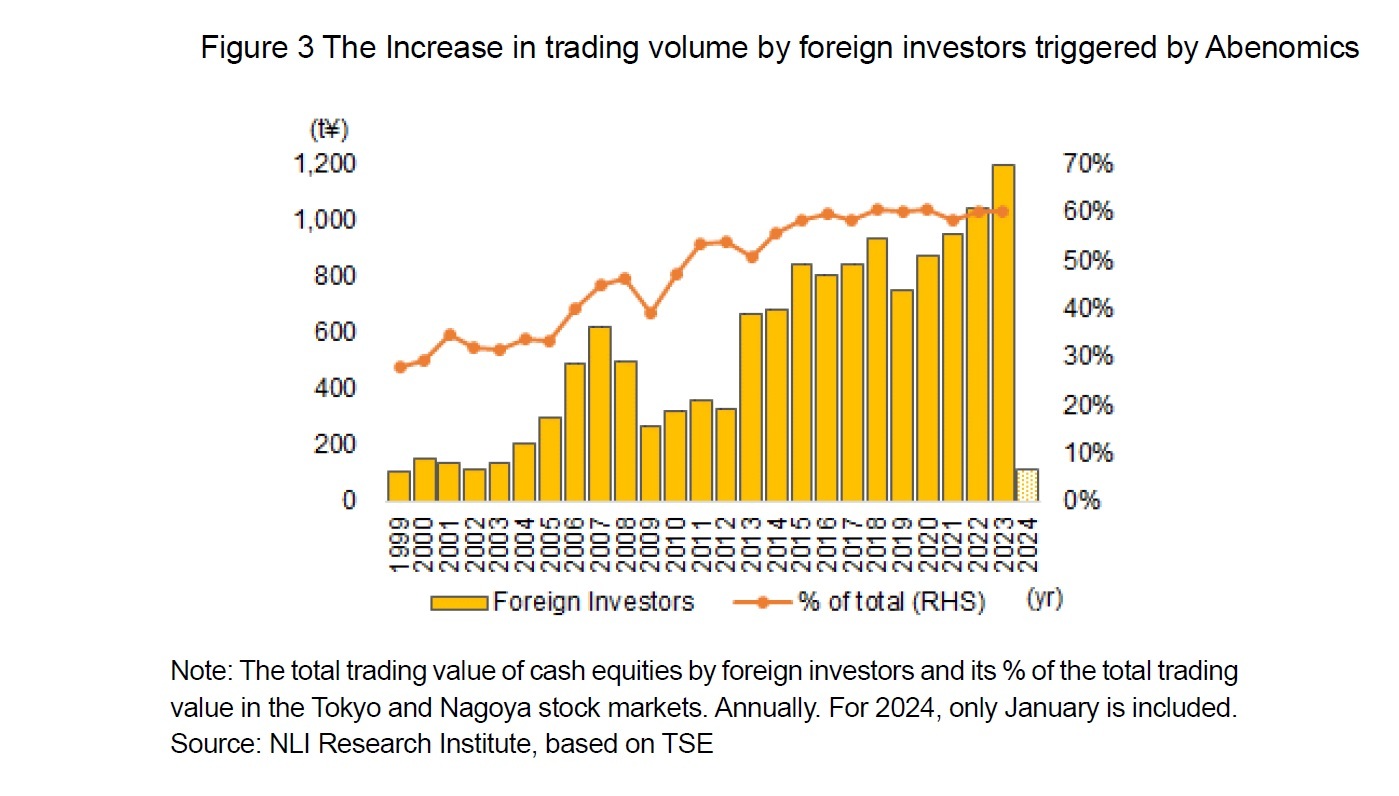

So, since when has the presence of foreign investors become notably prominent in the Japanese stock market? Firstly, an examination of the trend in the share of trading volume by foreign investors in the Japanese stock market is conducted. An annual review of the total trading value of cash equities by foreign investors, starting from 1999 (as depicted in Figure 3), reveals a significant increase in trading volume, particularly after 2013. This uptick is associated with the economic strategies under “Abenomics”, launched during the second Abe administration which began in December 2012. The anticipated transformation of Japanese companies due to Abenomics, coupled with the Bank of Japan's extensive monetary easing, likely spurred stock acquisitions by foreign investors. Consequently, the market share held by foreign investors jumped from around 30% in the 2000s to around 60% in the latter half of the 2010s, marking a substantial rise in their influence within the Japanese stock market.

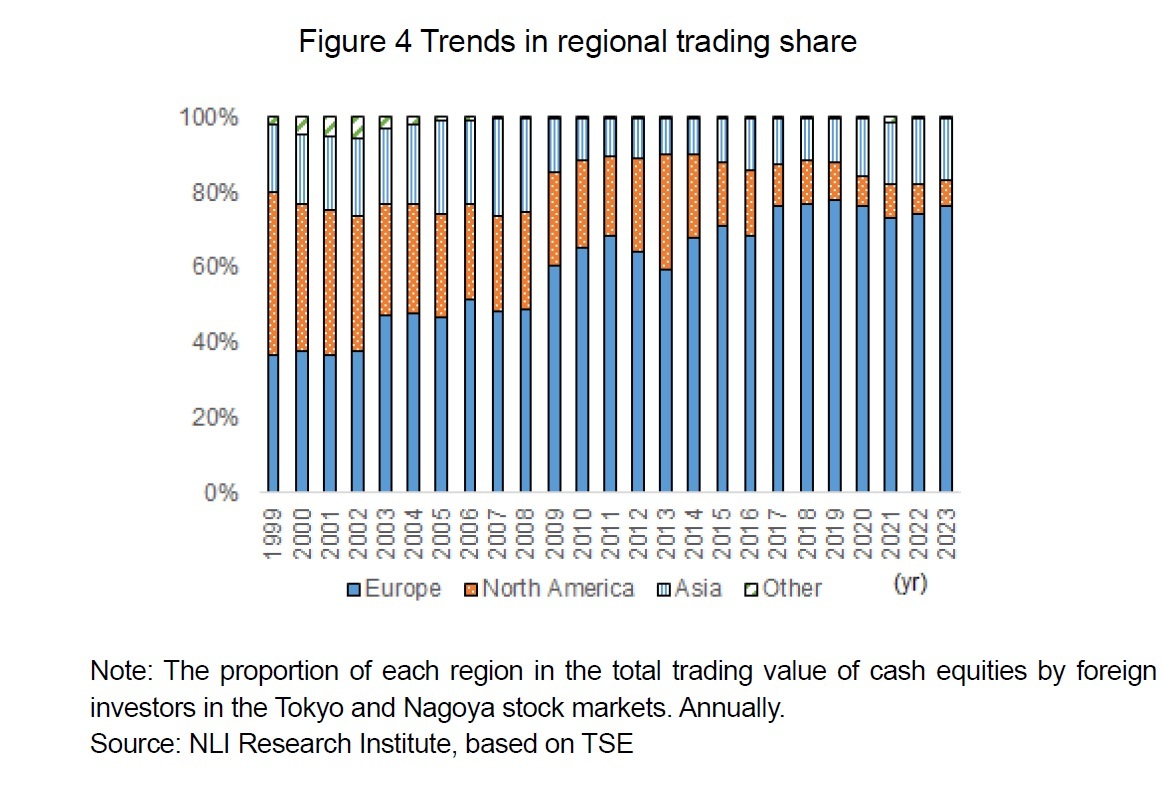

Figure 4 summarizes the regional share of trading value among foreign investors since 1999. As of the year 2000, ‘North America’ accounted for 39%, ‘Europe’ for 38%, and ‘Asia’ for 19%, with the shares of ‘North America’ and ‘Europe’ being closely contested. However, entering the latter half of the 2000s, the share of ‘North America’ declined to the 20% range, while Europe's share rose to between 40% and 60%. Even after the introduction of Abenomics in 2013, North America's share continued to decline. On the other hand, Europe's share has been steadily increasing, and by 2023, ‘North America’ was at 7% and ‘Europe’ at 76%, with Europe's trading value representing nearly 80% of the total among foreign investors. Asia's share has been stable in the 10% range, reaching 16% in 2023, making it the second largest trading share after Europe.

03-3512-1855