- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for January 2024

Column

13/02/2024

Investors Trading Trends in Japanese Stock Market: An Analysis for January 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

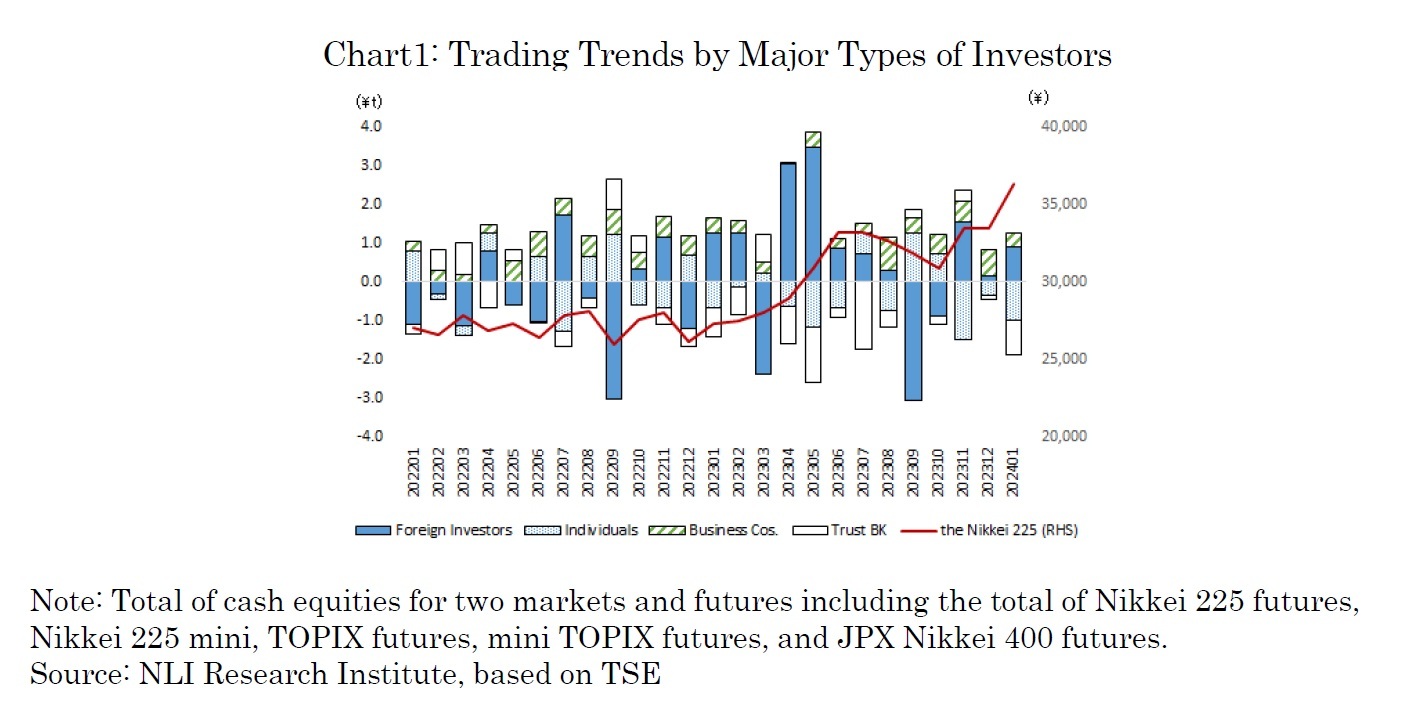

In the first half of January, the Nikkei Stock Average experiencing a decline on January 4th, the first trading day of the year, largely due to the immediate market reaction to the Noto Peninsula earthquake on New Year's Day. However, this initial downturn was quickly overturned by broader economic factors. As speculation grew around the Bank of Japan potentially postponing its monetary easing, coupled with expectations of a delay in U.S. interest rate cuts due to strong economic indicators of the United States, the yen depreciated to the \145/$ level. This depreciation, viewed positively by the market, spurred a bullish sentiment among investors, particularly foreign investors. Consequently, the Nikkei 225 enjoyed a six-day rally from January 5th to the 15th, peaking at 35,901. Despite a period of profit-taking selling that reflected caution over the high market prices, the index found new strength by the late in the month. Fueled by the rise in U.S. stocks, the Nikkei 225 reached its highest level in nearly 34 years on January 22nd, at 36,546. Although the month closed with the index slightly off this peak at 36,286, due to a cautious focus on domestic and international earnings announcements, the overall trend remained positive. Foreign investors and business corporations were net buyers, while individual investors and trust banks were net sellers.

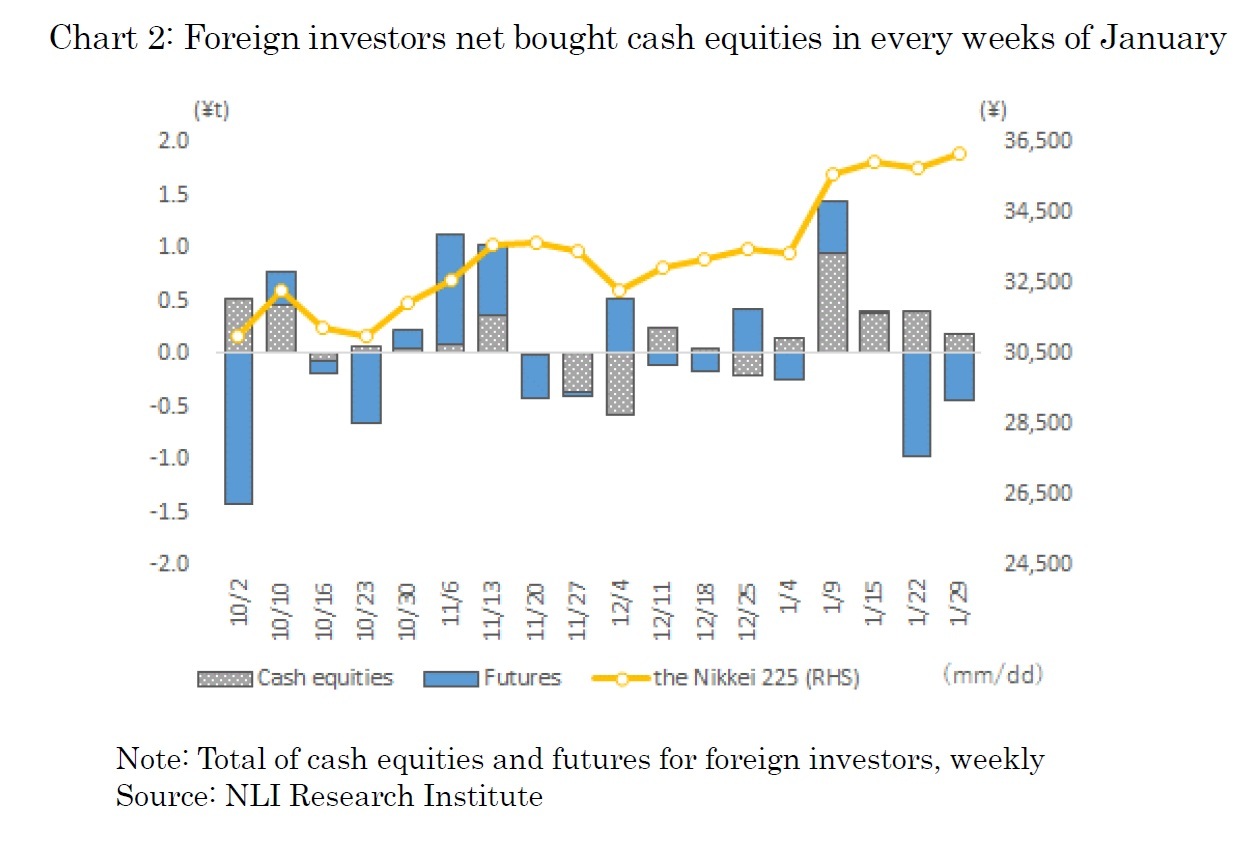

The trading by type of investors on January 2024, spanning from January 4 to February 2, show that foreign investors were the largest net buyers, with a total of 894.2 billion yen in cash equities and futures, the third consecutive month of net buyers since November 2023. Chart 2 shows the trading trends of foreign investors, offering a detailed comparison between cash equities and futures. The cash equities, often reflective of a medium- to long-term investment approach, consistently attracted overbuying throughout the month. In contrast, futures, which is typically aligned with shorter-term strategies, demonstrated fluctuating activity. Initially mirroring the overbuying observed in cash equities from January 9 to 19, futures eventually transitioned to a net selling stance in the later weeks of the month. Additionally, business corporations also have net bought a total of 358.1 billion yen in cash equities and futures in January.

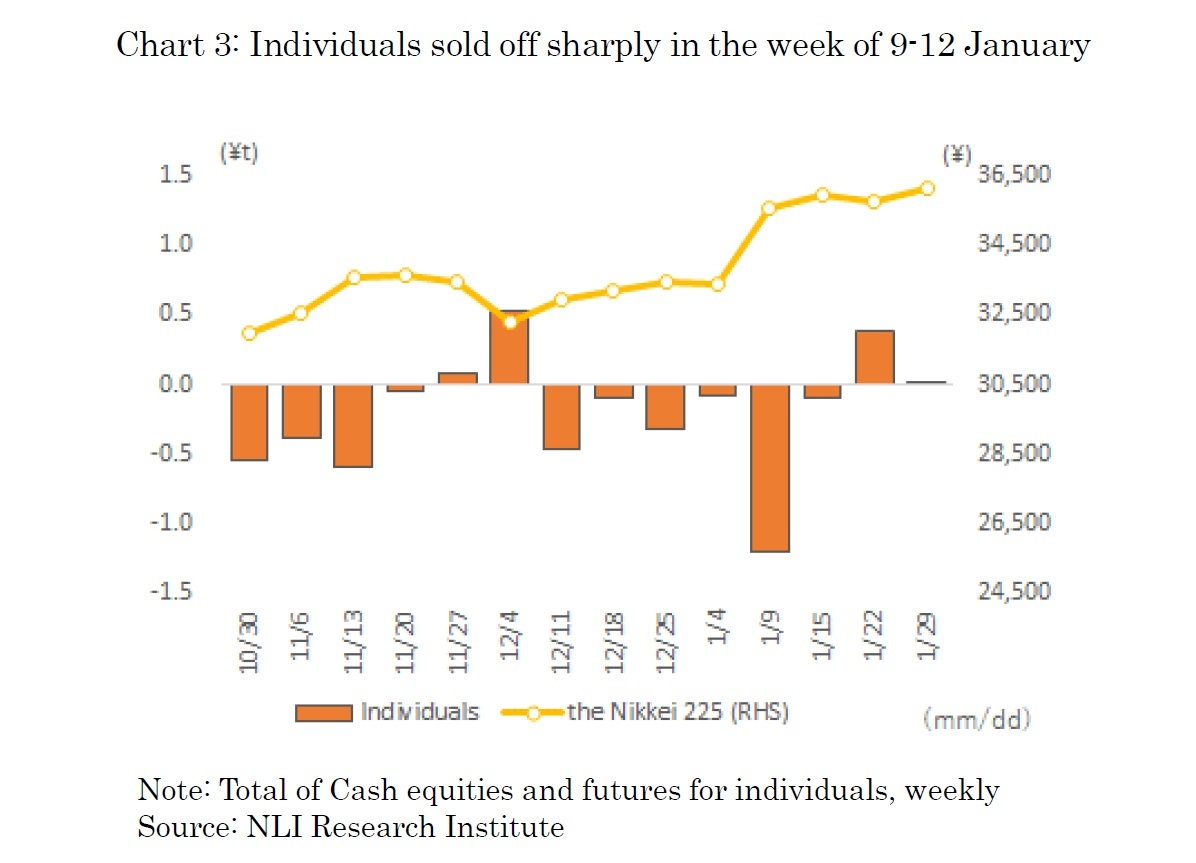

On the other hand, individual investors were the largest net sellers, with a total of 985.7 billion yen in cash equities and futures. On a weekly basis, individuals have net sold a total of 1,212.7 billion yen in combined assets during the week of 9-12 January, when the Nikkei Stock Average rose approximately 2,100 yen. Trust banks also net sold a total of 929.1 billion yen in cash and futures contracts in January.

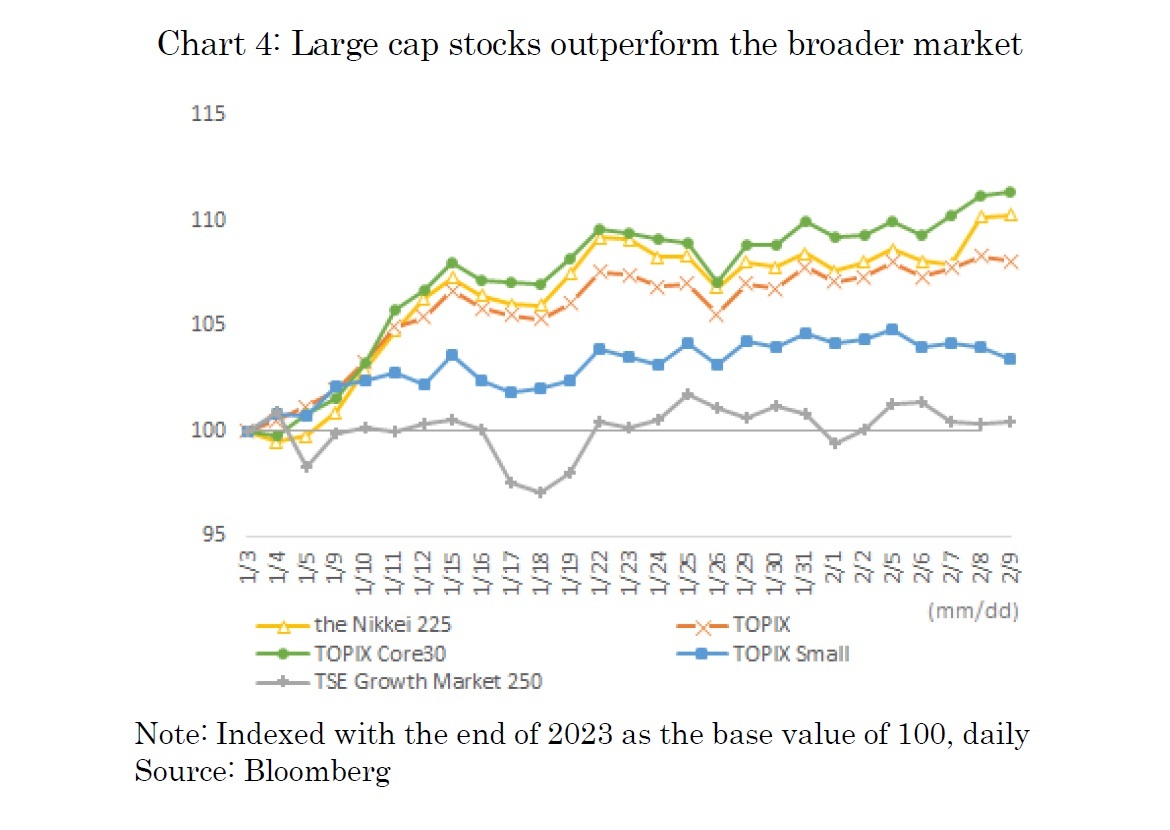

Chart 4 presents the performance trends of key indices since the start of 2024, using a base value of 100 at the close of 2023. Throughout January, foreign investors significantly favored large-cap stocks, a preference that, however, did not extend broadly across the market. The movement of these representative indices has continued in the same trajectory as observed in January. It appears that large-cap stocks, known for their substantial market capitalization and high liquidity—attributes typically sought after by foreign investors—are expected to consistently outperform the broader market.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング