- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market:An Analysis for October 2024

Column

12/11/2024

Investors Trading Trends in Japanese Stock Market:An Analysis for October 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

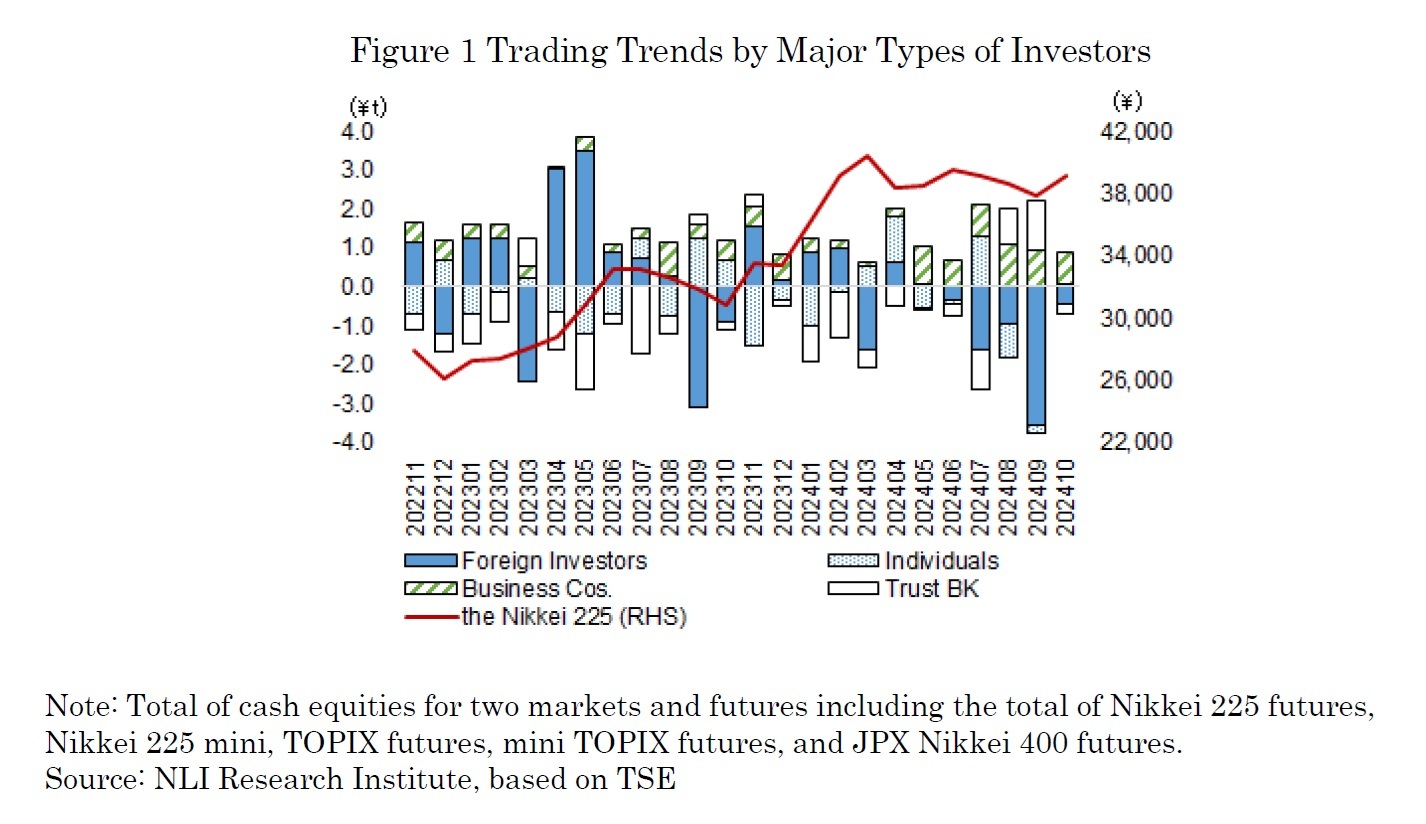

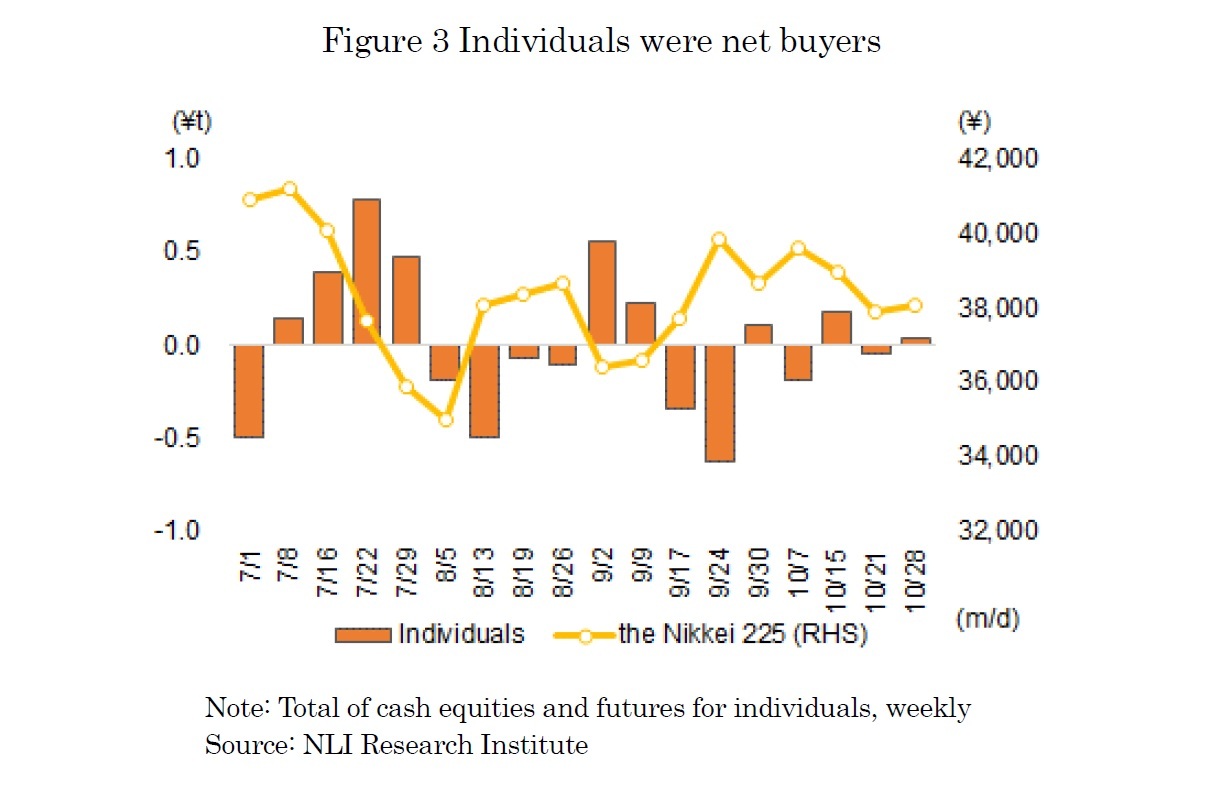

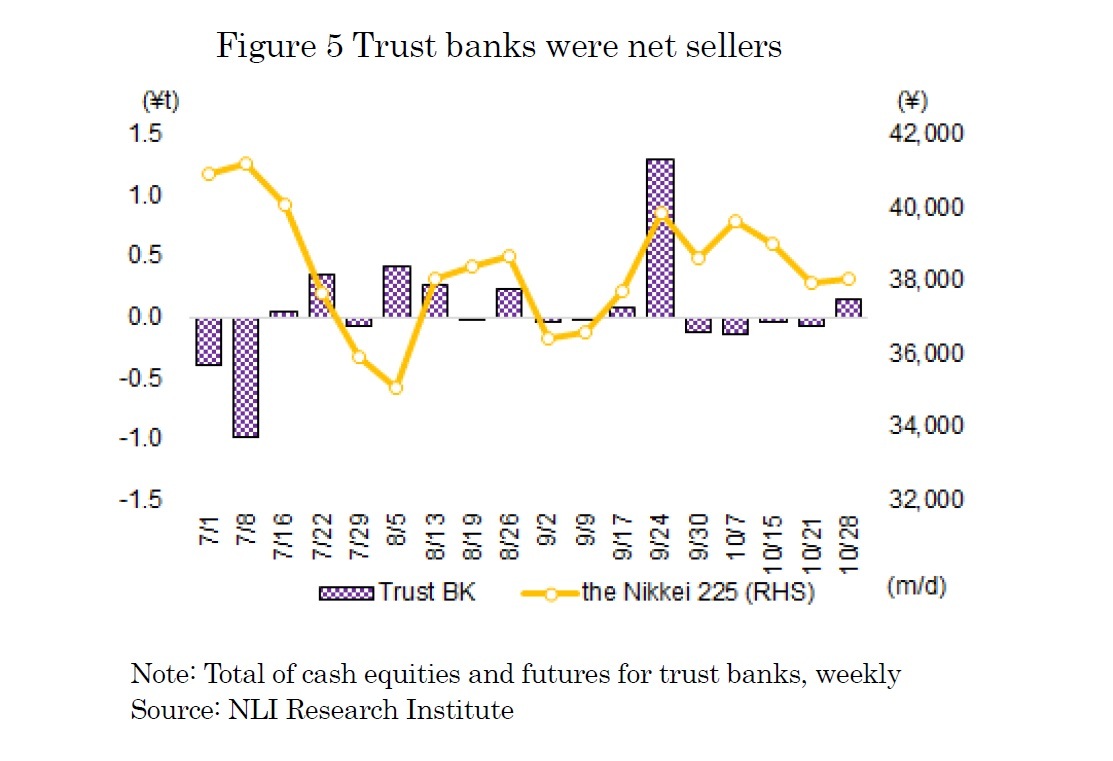

In October, the Nikkei Stock Average rose in the first half of the month as the yen weakened against the dollar, supported by strong U.S. economic indicators and receding expectations of a rate hike in Japan. The Nikkei surpassed 39,000 on the 9th and climbed to 39,910 by the 15th. In the latter half, however, concerns over semiconductor stocks increased due to disappointing earnings from ASML, a Dutch semiconductor equipment manufacturer, and uncertainty regarding the House of Representatives election results led to a decline in the index. On the 25th, the Nikkei briefly fell to 37,913, dipping into negative territory compared to the previous month’s end. However, following the election on the 27th, where the ruling party’s potential loss of a majority was considered priced in, the index resumed its rise, ending the month at 39,081. Amid these fluctuations, business corporations and individuals were net buyers, while foreign investors and trust banks were net sellers (as shown in Figure 1).

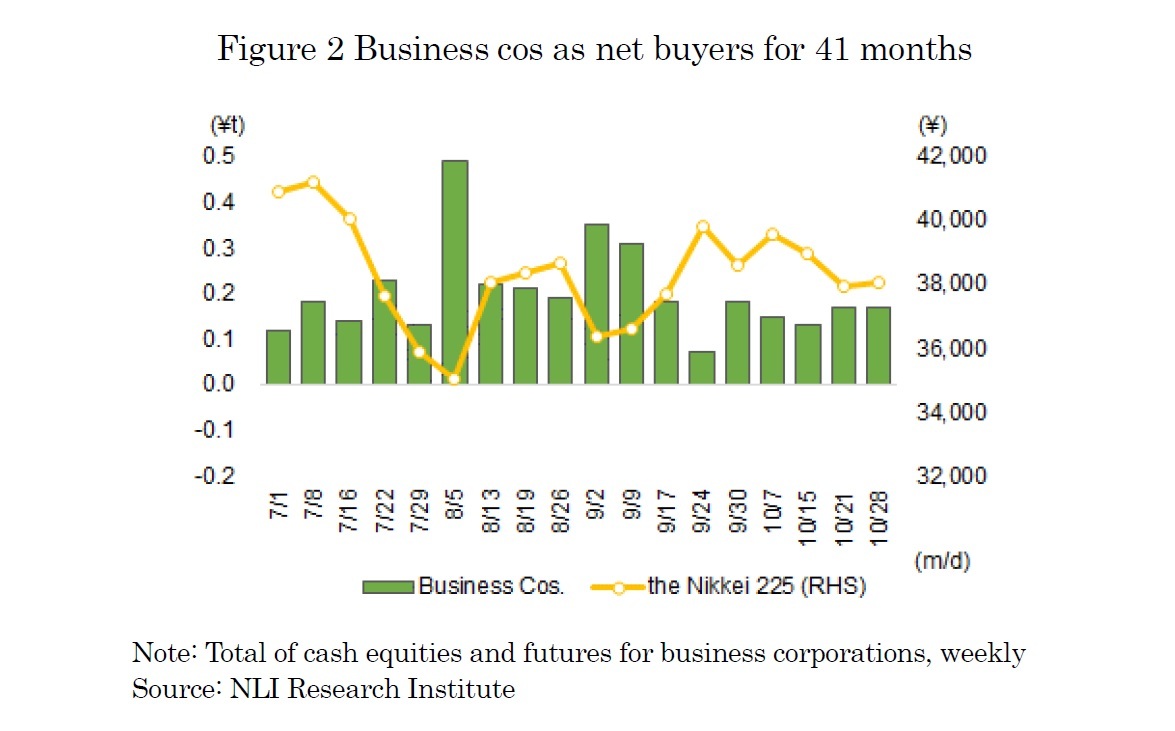

The trading by type of investors on October 2024, spanning from September 30 to November 1, show that business corporations were the largest net buyers, with a total of 829.3 billion yen in cash equities and futures(as shown in Figure 2). The amount of buybacks by TOPIX-listed companies set from January to October exceeded 13 trillion yen. While other investment sectors saw smaller amounts of trading activity in October, it appears that business corporations continued to buy back their own shares, supporting the index throughout the month.

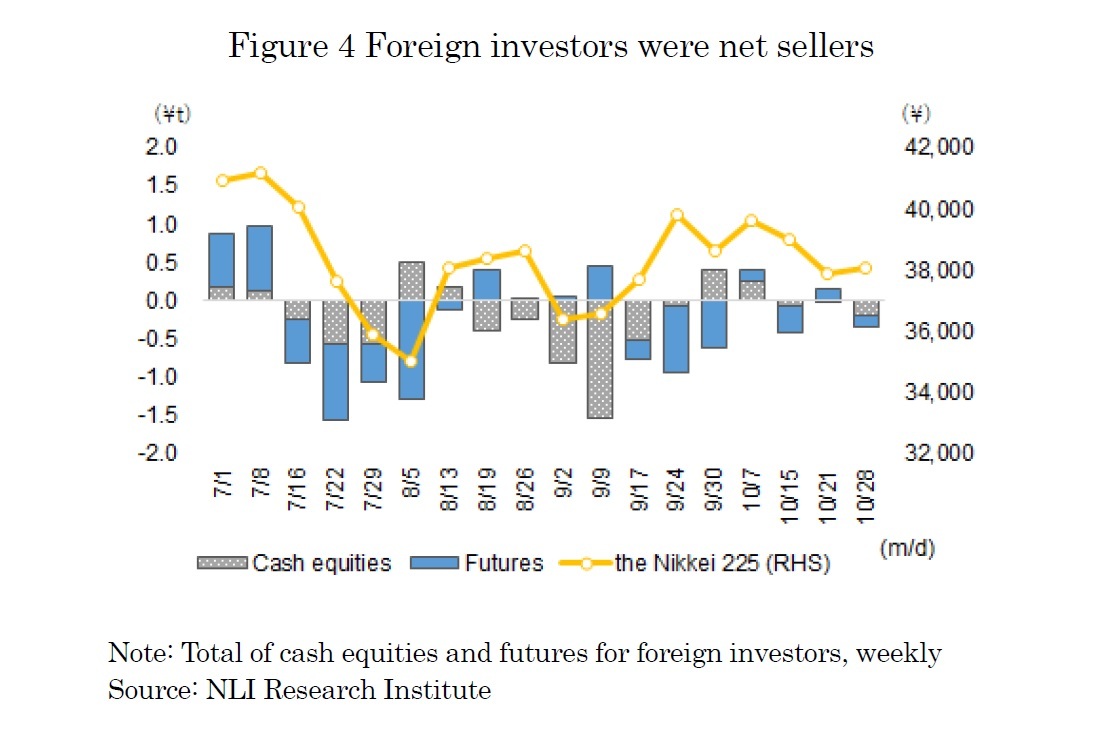

On the other hand, foreign investors were the largest net sellers in October, with a total net sale of 421.8 billion yen in cash equities and futures (as shown in Figure 4). While cash equities were overbought by 375.8 billion yen, futures were oversold by 797.6 billion yen, with notable selling by short-term investors, especially in futures. However, for cash equities, foreign investors were net buyers in the first and second weeks of October (September 30 to October 11), but shifted to net selling for three consecutive weeks in the third to fifth weeks of October (October 15 to November 1), though with small volumes. Concerns over the results of the House of Representatives election held on October 27 gradually increased within Japan, likely making it difficult for foreign investors to actively take risks from mid-October onward.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855