- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for June 2024

Column

08/07/2024

Investors Trading Trends in Japanese Stock Market: An Analysis for June 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

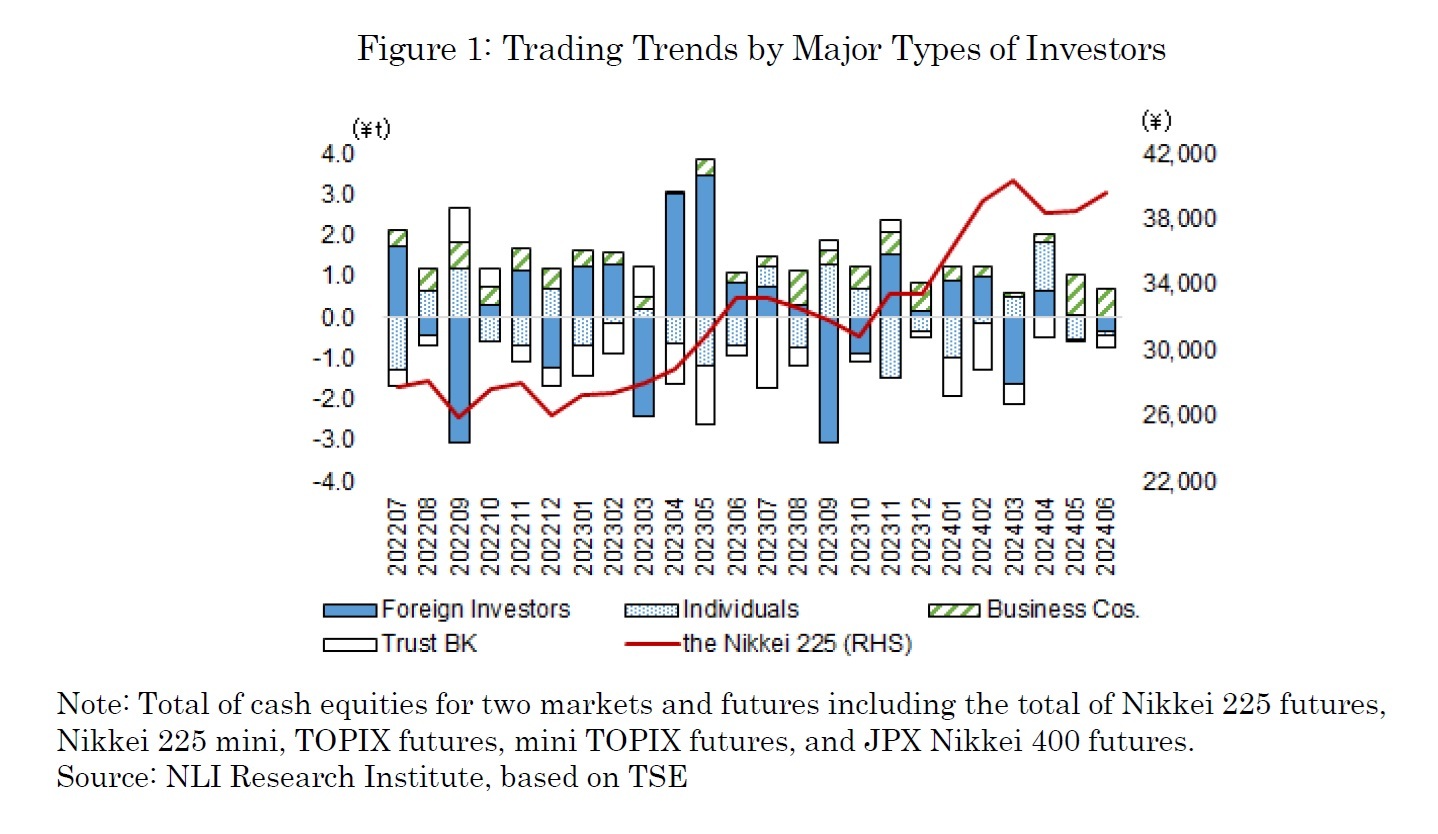

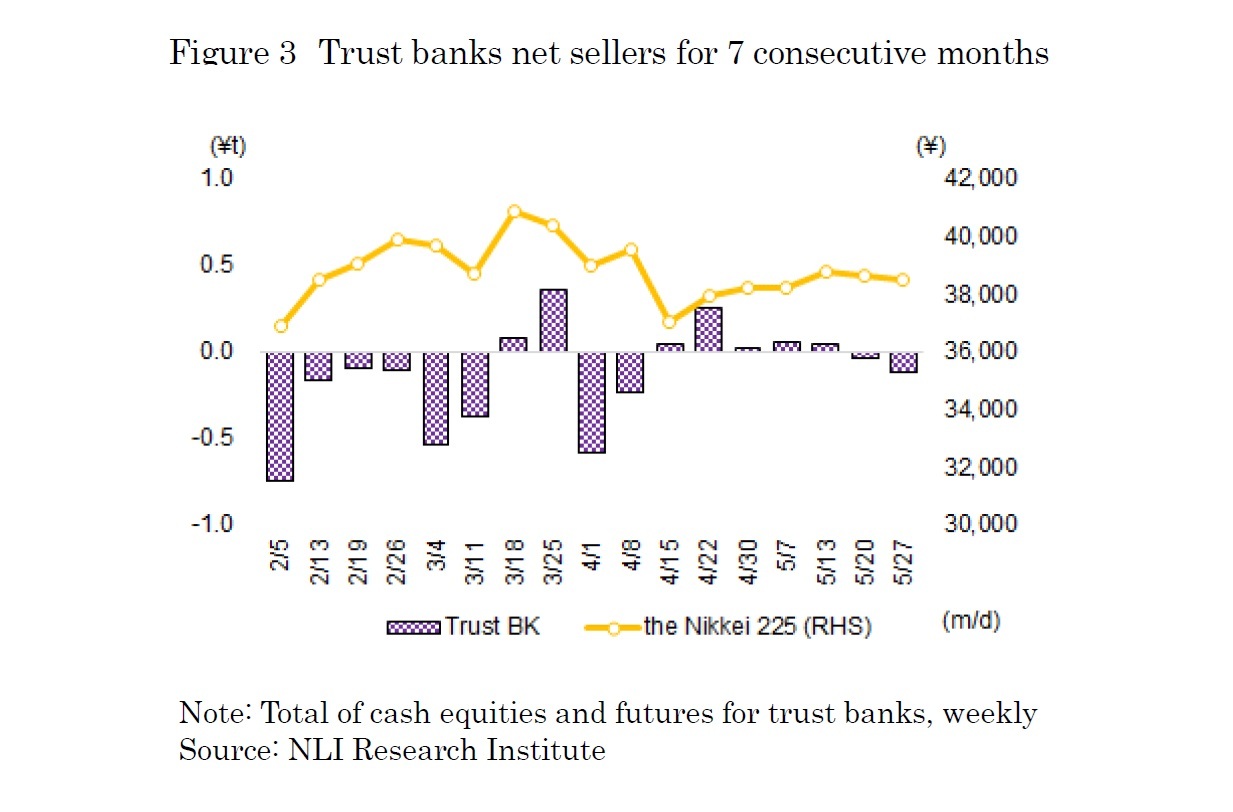

The Nikkei stock average continued to rise in June. In early June, the market was affected by a lack of new factors following the end of the fiscal year-end earnings announcements for companies with March fiscal year ends, as well as a wait-and-see attitude due to the anticipation of monetary policy meetings in Japan, the U.S., and Europe. Consequently, the index remained around the late May level of the upper 38,500 range. The Nikkei rose to 39,134 on Jun 11, driven by the positive reaction to the yen's depreciation to the \157/$ level on Jun 10. However, due to political uncertainties in Europe, the Nikkei fell below 39,000 on Jun 12 and further declined to 38,102 by Jun 17. In late June, the Nikkei rose again, reaching 39,667 on June 26, supported by the rise in U.S. tech stocks and the yen's further depreciation to the \160/$ level. The Nikkei ended the month at 39,583. Business corporations were net buyers, foreign investors, trust banks, and individuals were net sellers.

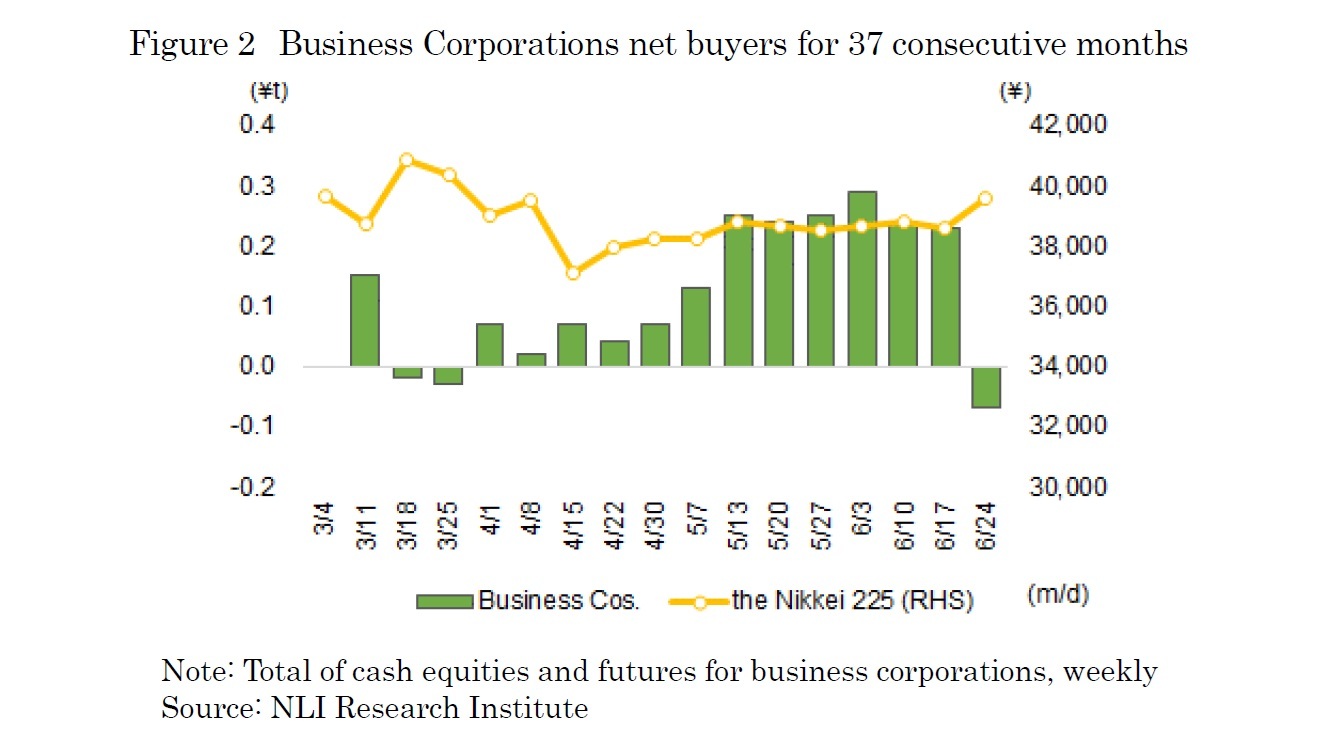

The trading by type of investors on June 2024, spanning from June 3 to 28, show that business corporations were the largest net buyers, with a total of 693.2 billion yen in cash equities and futures. The amount set for share buybacks (for TOPIX constituent stocks) from January to June 2024 has already reached 9.3 trillion yen, with the amount set in May alone hitting a record high of 5.8 trillion yen. As share buybacks were central, business corporations became the largest net buyers for the second consecutive month.

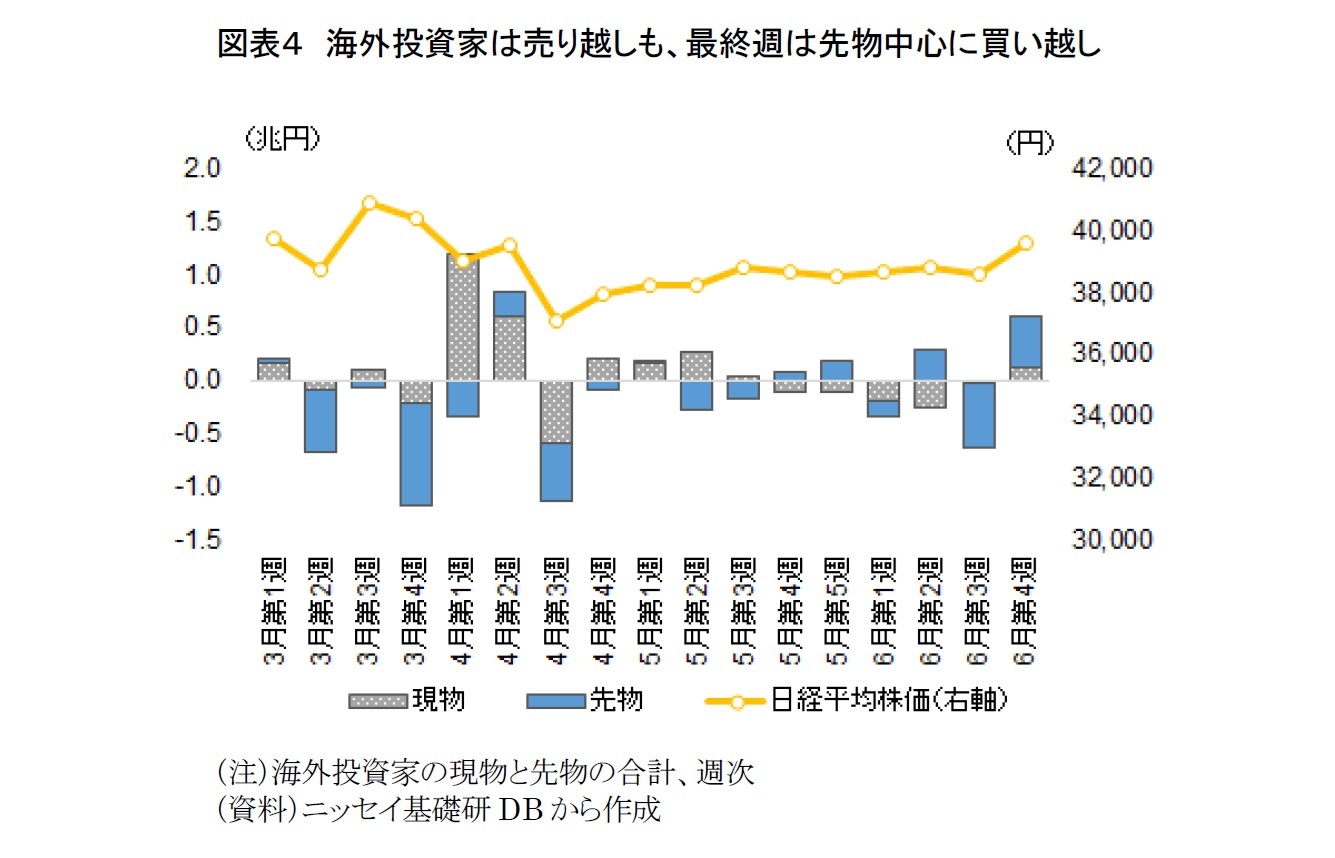

In June, foreign investors were also net sellers with a total of 321.3 billion yen in both cash equities and futures. However, on a weekly basis, they were net buyers in the fourth week of June with a total of 596 billion yen in both cash equities and futures. During this period, the Nikkei rose by approximately 980 yen, drawing attention to the main buyers. It appears that foreign investors were main buyers. The Nikkei continued to rise into July, reaching 40,912 as of July 5, with an increase of about 2,100 yen in the past two weeks. It is assumed that foreign investors continued to buy in the first week of July.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855