- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

18/02/2025

Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

■Summary

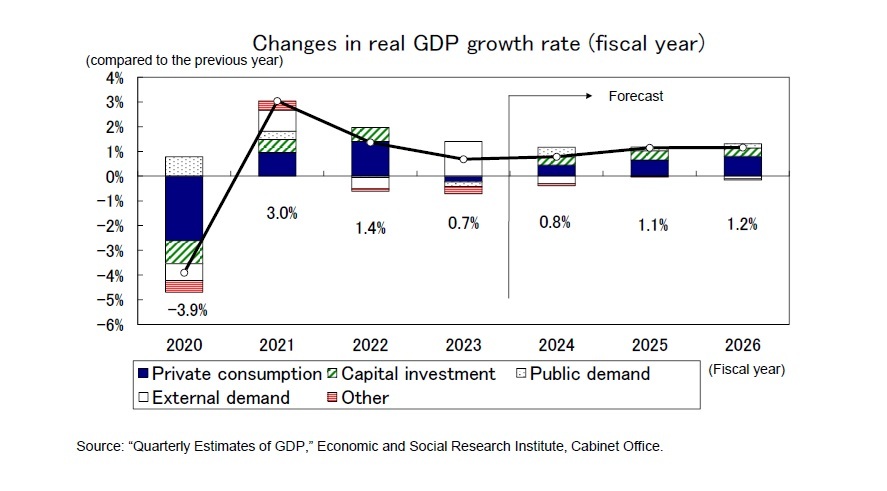

<Real GDP Growth Rate Forecast: 0.8% for FY 2024, 1.1% for FY 2025, and 1.2% for FY 2026>

- In the October–December quarter of 2024, real GDP grew by 0.7% from the previous quarter (equivalent to an annualized rate of 2.8%), marking the third consecutive quarter of expansion. However, this growth was primarily driven by a significant increase in external demand due to a decline in imports, while domestic demand contracted for the first time in three quarters. As a result, the underlying economic conditions are weaker than the headline growth rate suggests.

- Looking ahead, an increase in real disposable income, largely supported by rising employee compensation, is expected to bolster consumption. Meanwhile, capital investment is anticipated to continue its recovery, underpinned by strong corporate earnings.

- The real GDP growth rate is projected to be 0.8% in FY 2024, 1.1% in FY 2025, and 1.2% in FY 2026. While exports are unlikely to be a driving force in the near term, domestic demand is expected to remain resilient, sustaining the recovery. However, downside risks include a sharp slowdown in the global economy triggered by U.S. tariff hikes and a potential decline in consumption due to stagnating real incomes amid rising prices.

- The consumer price index (excluding fresh food) is expected to rise by 2.7% in FY 2024, 2.4% in FY 2025, and 1.7% in FY 2026. Inflation is projected to remain around 3% in the first half of 2025, driven primarily by higher energy and food prices, before gradually easing. However, it is likely to stay within the 2% range throughout 2025. A stronger yen is expected to reduce goods price inflation, offsetting the rise in service prices and ultimately bringing inflation below the Bank of Japan's 2% target in early 2026.

■Index

1.Positive Growth of 2.8% on an Annualized Basis in the October–December Quarter of 2024

・Exports Are Unlikely Drive Economic Growth

・Bonuses Significantly Boost Wages

・Spring Wage Increase Rate in 2025 Expected to Stay in the 5% Range for the

Second Consecutive Year

2.Real GDP Growth Rate Forecast at 0.8% for FY 2024, 1.1% for FY 2025, and 1.2% for FY 2026

・Steady Growth Around 1% Expected to Continue

・Real Disposable Income on the Path to Recovery

・Capital Investment Continues to Recover Gradually

・Outlook for Prices

1.Positive Growth of 2.8% on an Annualized Basis in the October–December Quarter of 2024

・Exports Are Unlikely Drive Economic Growth

・Bonuses Significantly Boost Wages

・Spring Wage Increase Rate in 2025 Expected to Stay in the 5% Range for the

Second Consecutive Year

2.Real GDP Growth Rate Forecast at 0.8% for FY 2024, 1.1% for FY 2025, and 1.2% for FY 2026

・Steady Growth Around 1% Expected to Continue

・Real Disposable Income on the Path to Recovery

・Capital Investment Continues to Recover Gradually

・Outlook for Prices

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング