- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for May 2025

Column

10/06/2025

Investors Trading Trends in Japanese Stock Market: An Analysis for May 2025

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

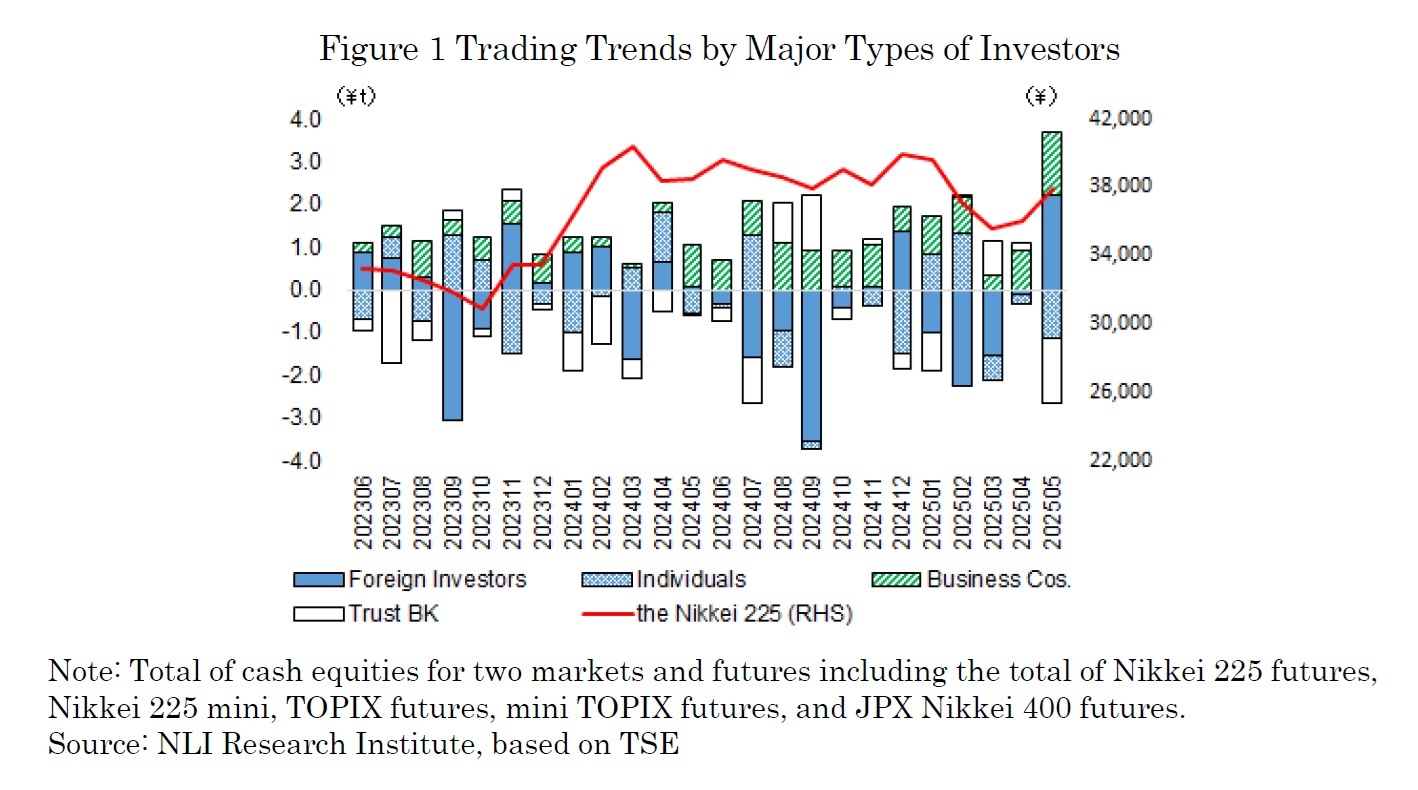

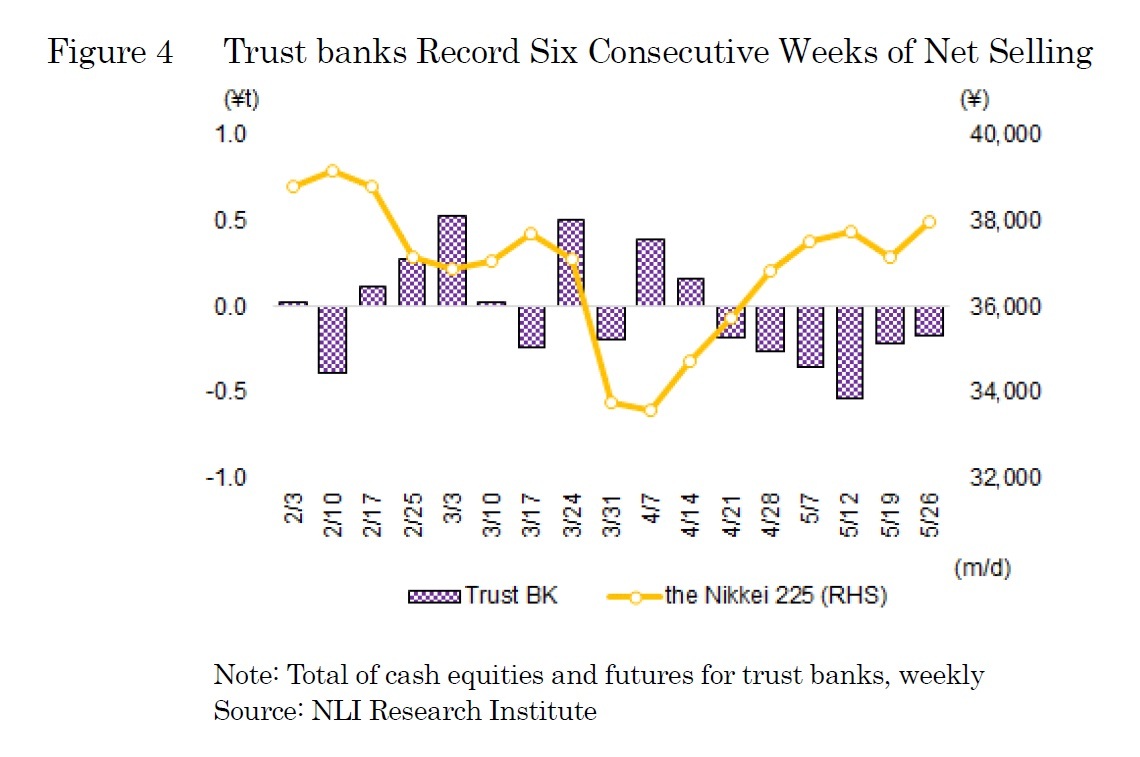

In May 2025, the Nikkei 225 rose for the second consecutive month, supported by a U.S.-China agreement to reduce additional tariffs and continued yen depreciation. In early May, optimism over a U.S.-U.K. trade deal and the unchanged monetary policy in both Japan and the U.S. lifted the Nikkei above 38,000, reaching 38,183 on the 13th. In late May, while progress in U.S.-China trade talks served as a positive factor, the downgrade of U.S. government bonds and a stronger yen weighed on the market, with the Nikkei falling below 37,000 to 36,985 on the 22nd. Subsequently, the index recovered on the back of a postponement of EU-targeted tariffs and strong earnings from NVIDIA, but toward month-end, the market lost direction due to uncertainty surrounding a judicial ruling on Trump-era tariffs. The Nikkei ended the month at 37,965.By investor type, foreign investors and business corporations were net buyers, while trust banks and individuals were net sellers (as shown in Figure 1).

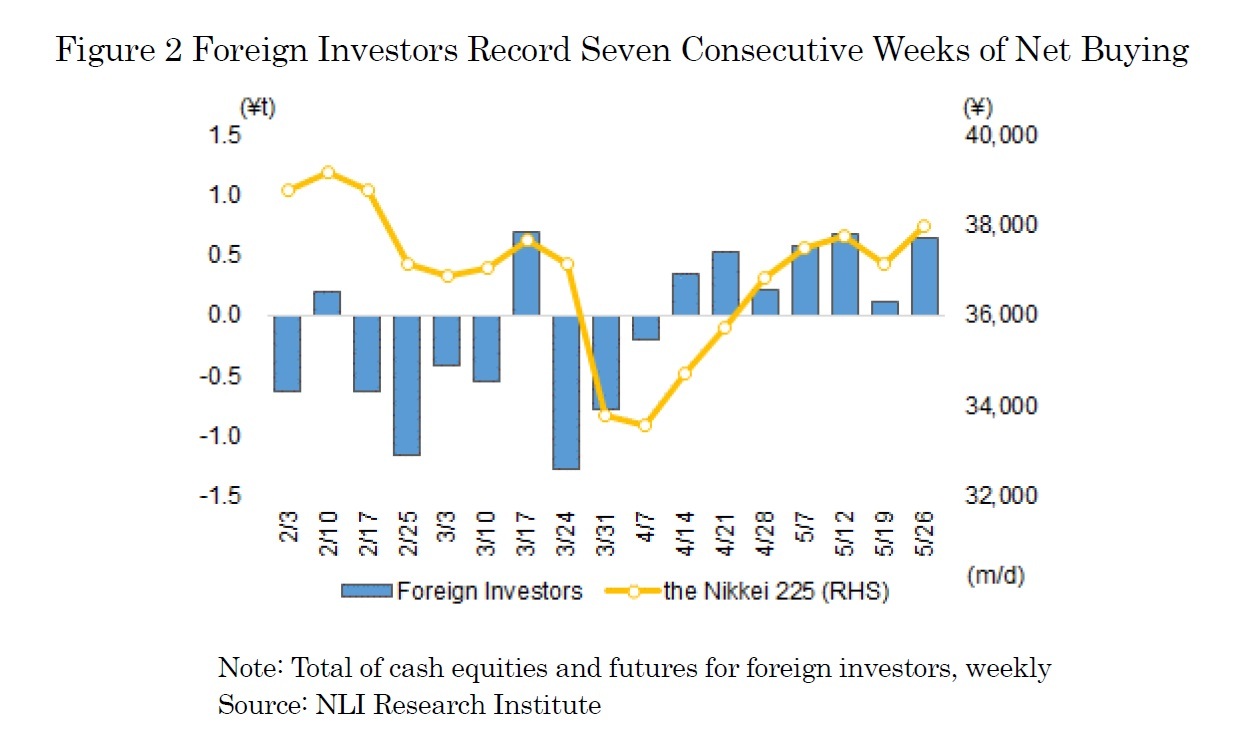

The trading by type of investors in May 2025 (April 28 to May 30) shows that foreign investors were the largest net buyers, with a total net purchase of 2.22 trillion yen in cash equities and futures (as shown in Figure 2). On a weekly basis, foreign investors recorded net buying for seven consecutive weeks, starting from the third week of April.

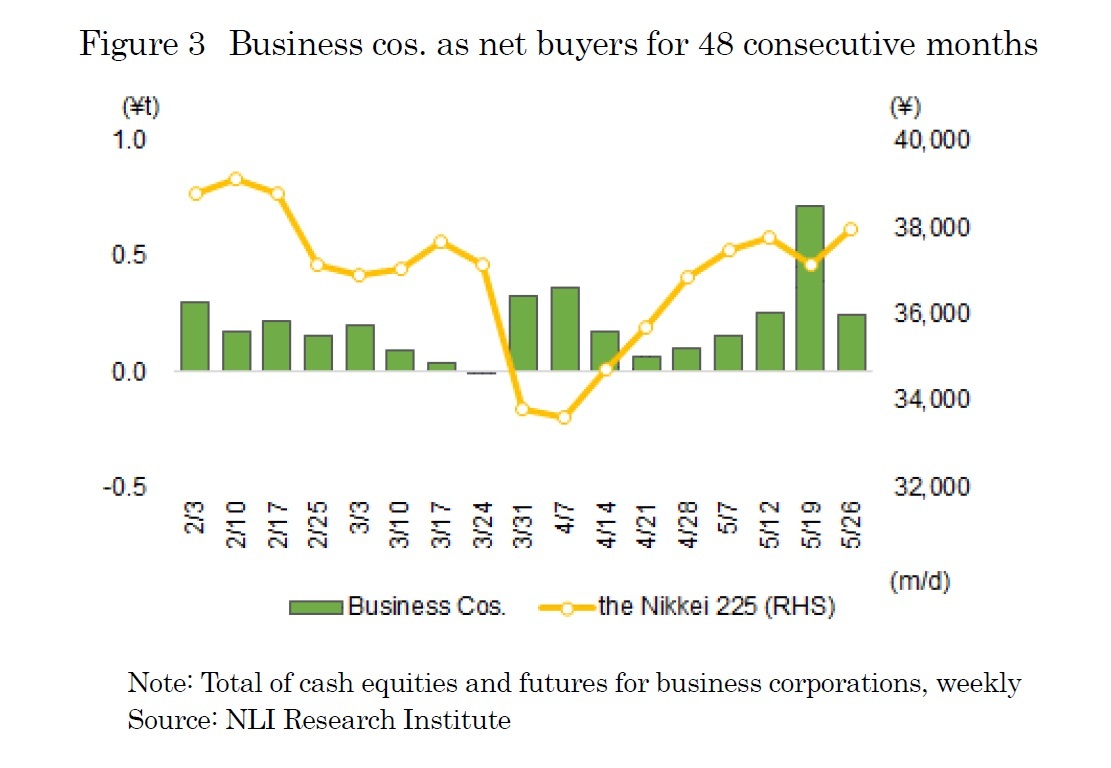

In May 2025, business corporations were also net buyers, with a total net purchase of 1.47 trillion yen in cash equities and futures, marking their 48th consecutive month of net buying (as shown in Figure 3). From April to May 2025, share buyback announcements by TOPIX constituent companies totaled 8.8 trillion yen, representing an increase of approximately 1.2 times compared to the same period the previous year. Share buybacks are generally announced in conjunction with earnings releases. Notably, in the fourth week of May (May 19 to 23)—shortly after the peak of earnings season—business corporations recorded a significant net purchase of around 700 billion yen.

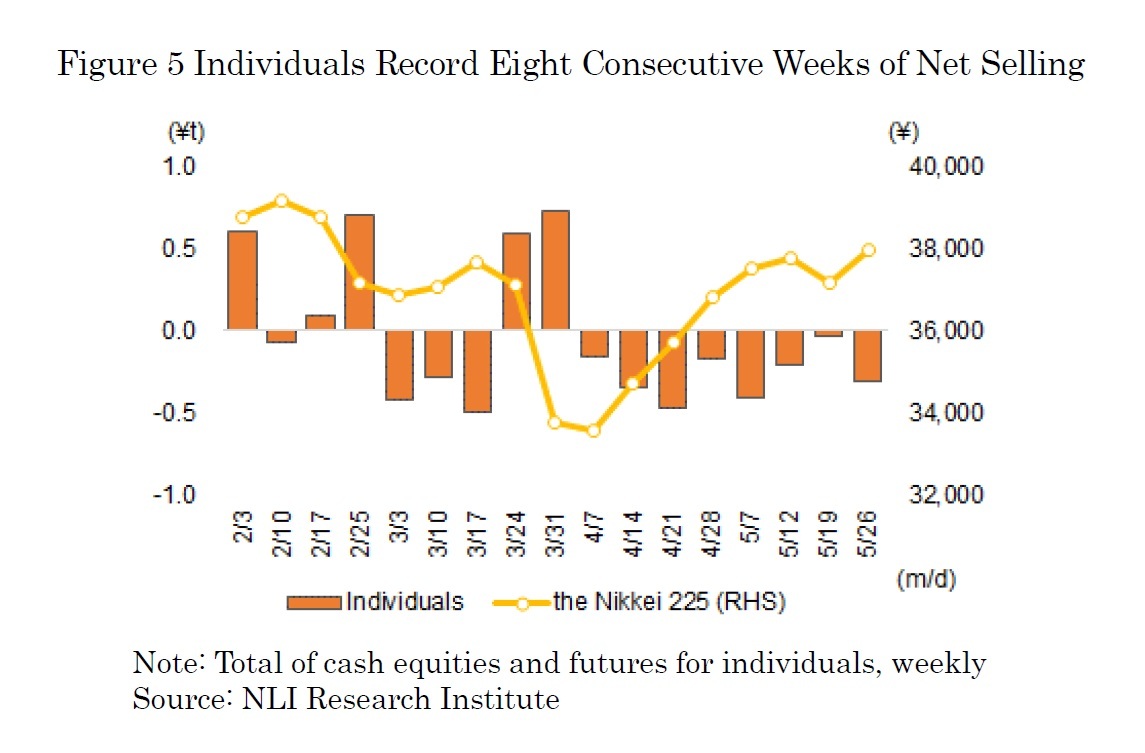

In May, individuals also recorded a net sale of 1.1203 trillion yen in cash equities and futures (as shown in Figure 5). On a weekly basis, they were net sellers for eight consecutive weeks, starting from the second week of April, likely reflecting continued profit-taking during the market’s upward trend.

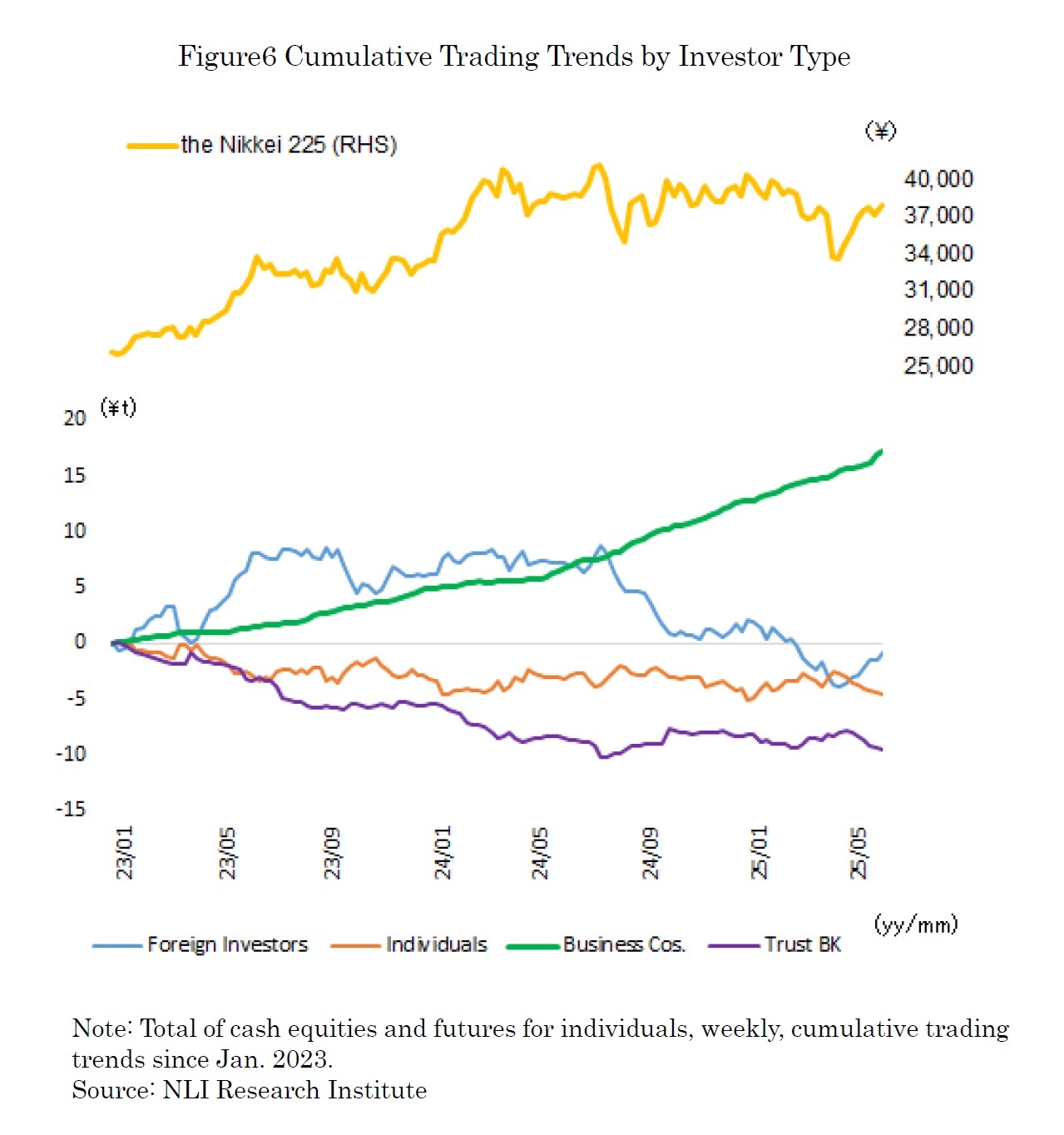

Figure 6 illustrates the weekly cumulative trading trends in cash equities and futures by investor type, along with the movement of the Nikkei Stock Average, from January 2023 to May 2025. Over this period, business corporations were the largest net buyers, with cumulative net purchases totaling approximately 17 trillion yen. In contrast, foreign investors, individuals, and trust banks were cumulative net sellers. Foreign investors significantly increased their holdings in Japanese equities in the first half of 2023 following the Tokyo Stock Exchange’s request in January 2023 for companies to implement management that is conscious of capital costs and stock prices. However, starting in 2024, monetary policy shifts, yen appreciation, and concerns over a U.S. economic slowdown weighed on sentiment, and selling intensified, particularly from July onward. By early April 2025, amid rising concerns over tariff policies under the Trump administration, foreign investors’ cumulative net selling peaked at 3.8 trillion yen. Since then, they have resumed buying, and by the end of May, the net selling amount had narrowed to 0.8 trillion yen. Looking ahead, while business corporations’ sustained buying is expected to continue, attention will be focused on whether foreign investors will maintain their net buying stance beyond June.

This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング