- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2025-2026 (May 2025)

19/05/2025

Japan’s Economic Outlook for Fiscal Years 2025-2026 (May 2025)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

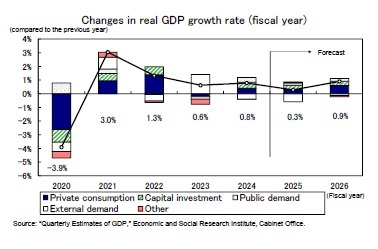

2.Real GDP Growth Forecast: 0.3% in FY 2025 and 0.9% in FY 2026

(Two Consecutive Quarters of Negative Growth Expected in the April–June Quarter of 2025)

While real GDP in the January–March quarter of 2025 declined by 0.7% on an annualized basis—marking the first contraction in four quarters—this was mainly due to a sharp decline in external demand following the previous quarter’s surge. On a trend basis, the economy continues to moderately recover.

While real GDP in the January–March quarter of 2025 declined by 0.7% on an annualized basis—marking the first contraction in four quarters—this was mainly due to a sharp decline in external demand following the previous quarter’s surge. On a trend basis, the economy continues to moderately recover.

Looking ahead, exports are expected to decline significantly due to US tariff hikes. Persistently high consumer price inflation will likely dampen private consumption, and increased uncertainty surrounding Trump’s tariff policies might restrain capital investment. As a result, real GDP for the April–June quarter of 2025 is projected to shrink by 0.9% on an annualized basis, marking two consecutive quarters of contraction due to sluggish domestic demand and falling exports.

In the July–September quarter, a slower pace of export decline and a mild recovery in private consumption—supported by decelerating inflation—are expected to lead to a modest 0.4% expansion on an annualized basis. However, if the currently suspended additional reciprocal tariffs are enacted, the economy could continue to contract, increasing the risk of a recession.

From the second half of FY 2025 onwards, the negative impact of tariff hikes is expected to gradually subside. With exports stabilizing, domestic demand—mainly driven by private consumption and capital investment—is projected to rise, supporting annualized growth of around 1%, slightly above Japan’s potential growth rate.

In the July–September quarter, a slower pace of export decline and a mild recovery in private consumption—supported by decelerating inflation—are expected to lead to a modest 0.4% expansion on an annualized basis. However, if the currently suspended additional reciprocal tariffs are enacted, the economy could continue to contract, increasing the risk of a recession.

From the second half of FY 2025 onwards, the negative impact of tariff hikes is expected to gradually subside. With exports stabilizing, domestic demand—mainly driven by private consumption and capital investment—is projected to rise, supporting annualized growth of around 1%, slightly above Japan’s potential growth rate.

Real GDP is projected to grow by 0.3% in FY 2025 and 0.9% in FY 2026. By demand component, domestic demand turned positive in FY 2024 for the first time in two years and is expected to continue growing in FY 2025 and FY 2026. However, the Trump tariffs are also likely to affect domestic demand, moderating the pace of expansion. External demand is projected to make a negative contribution for the second consecutive year, with a −0.6% contribution in FY 2025 following a −0.4% contribution in FY 2024. While the 2024 decline was driven by a 3.4% increase in imports, in FY 2025, exports are expected to fall by 2.1% due to US tariff hikes. Although exports are projected to rise in FY 2026, the continuing global economic slowdown and appreciation of the yen are expected to limit growth. As a result, external demand is forecast to make a −0.1% contribution in FY 2026 and is not expected to drive overall growth.

Real GDP is projected to grow by 0.3% in FY 2025 and 0.9% in FY 2026. By demand component, domestic demand turned positive in FY 2024 for the first time in two years and is expected to continue growing in FY 2025 and FY 2026. However, the Trump tariffs are also likely to affect domestic demand, moderating the pace of expansion. External demand is projected to make a negative contribution for the second consecutive year, with a −0.6% contribution in FY 2025 following a −0.4% contribution in FY 2024. While the 2024 decline was driven by a 3.4% increase in imports, in FY 2025, exports are expected to fall by 2.1% due to US tariff hikes. Although exports are projected to rise in FY 2026, the continuing global economic slowdown and appreciation of the yen are expected to limit growth. As a result, external demand is forecast to make a −0.1% contribution in FY 2026 and is not expected to drive overall growth.

(Corporate Investment Behavior Likely to Become More Cautious)

Capital investment rose by 1.4% in the January–March quarter of 2025 compared to the previous quarter, marking the fourth consecutive quarterly increase and exceeding the 0.8% gain seen in the October–December quarter of 2024.

Investment has continued to recover, supported by robust corporate earnings, with a focus on labor-saving measures in response to workforce shortages, digital transformation, and construction investment related to the expansion of e-commerce.

However, moving forward, growing uncertainty over US tariff policy and a worsening earnings environment are expected to make businesses more cautious in their investment decisions.

Capital investment rose by 1.4% in the January–March quarter of 2025 compared to the previous quarter, marking the fourth consecutive quarterly increase and exceeding the 0.8% gain seen in the October–December quarter of 2024.

Investment has continued to recover, supported by robust corporate earnings, with a focus on labor-saving measures in response to workforce shortages, digital transformation, and construction investment related to the expansion of e-commerce.

However, moving forward, growing uncertainty over US tariff policy and a worsening earnings environment are expected to make businesses more cautious in their investment decisions.

According to the Bank of Japan’s March 2025 Tankan Survey, capital investment plans for FY 2024 (including software and R&D investment, excluding land acquisition) were revised downward by 1.5% from the December 2024 survey to 8.4% growth from the previous year (all industries and enterprise sizes).

The initial capital investment plan for FY 2025 indicated 2.2% growth from the previous year, lower than the 4.5% increase projected at the beginning of FY 2024.

The current profit plan for FY 2024 shows a 1.6% increase from the previous year, turning positive after previous forecasts of a decline. However, the rate of profit growth has significantly slowed compared with FY 2021–FY 2023.

The initial plan for FY 2025 indicates a 1.4% decline from the previous year. While initial profit forecasts tend to be conservative, it should be noted that the March 2025 Tankan did not reflect the impact of the US tariff policy announced between late March and early April. Therefore, unlike in previous years, both investment and earnings plans could be revised downward moving forward.

Capital investment is expected to continue growing—up 2.6% in FY 2024, 1.9% in FY 2025, and 1.8% in FY 2026—although the pace of increase will likely slow.

The initial capital investment plan for FY 2025 indicated 2.2% growth from the previous year, lower than the 4.5% increase projected at the beginning of FY 2024.

The current profit plan for FY 2024 shows a 1.6% increase from the previous year, turning positive after previous forecasts of a decline. However, the rate of profit growth has significantly slowed compared with FY 2021–FY 2023.

The initial plan for FY 2025 indicates a 1.4% decline from the previous year. While initial profit forecasts tend to be conservative, it should be noted that the March 2025 Tankan did not reflect the impact of the US tariff policy announced between late March and early April. Therefore, unlike in previous years, both investment and earnings plans could be revised downward moving forward.

Capital investment is expected to continue growing—up 2.6% in FY 2024, 1.9% in FY 2025, and 1.8% in FY 2026—although the pace of increase will likely slow.

(Price Outlook)

The core consumer price index (excluding fresh food, hereafter referred to as core CPI) had remained in the 2% range since September 2023 but surged to 3.0% in December 2024 due to a sharp increase in electricity and city gas prices following the end of emergency energy subsidies. The 3% range of inflation continued through March 2025.

The core consumer price index (excluding fresh food, hereafter referred to as core CPI) had remained in the 2% range since September 2023 but surged to 3.0% in December 2024 due to a sharp increase in electricity and city gas prices following the end of emergency energy subsidies. The 3% range of inflation continued through March 2025.

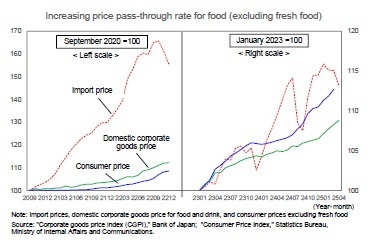

Prices for food excluding fresh food peaked at 9.2% in August 2023, slowed to 2.6% by July 2024 and subsequently began accelerating again due to renewed increases in import prices and surging domestic rice prices, reaching 6.2% in March 2025.

While upstream food price growth (import prices) remains lower than in summer 2023, downstream price pass-through (consumer prices) is increasing. Food import prices rose about 60% between fall 2020 and the end of 2023, although the consumer price increase was just under 10%.

While upstream food price growth (import prices) remains lower than in summer 2023, downstream price pass-through (consumer prices) is increasing. Food import prices rose about 60% between fall 2020 and the end of 2023, although the consumer price increase was just under 10%.

By contrast, food import prices have only risen by about 15% since early 2023—about a quarter of the previous surge—but consumer food prices have already increased more than 10%. This reflects a reduced resistance among firms to passing costs onto consumers, alongside higher labor and logistics costs and persistent inflation. Food prices are expected to remain elevated for the time being.

By contrast, food import prices have only risen by about 15% since early 2023—about a quarter of the previous surge—but consumer food prices have already increased more than 10%. This reflects a reduced resistance among firms to passing costs onto consumers, alongside higher labor and logistics costs and persistent inflation. Food prices are expected to remain elevated for the time being.

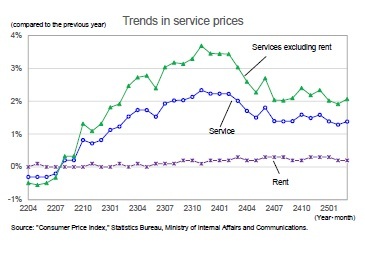

Service prices—which had been growing at a pace in the low 2% range since the second half of 2023—decelerated to the mid-1% range entering FY 2024.

Within services, those excluding rent peaked at the high 3% range in late 2023 but have slowed while still maintaining 2% growth. Meanwhile, rent—which accounts for about 40% of services—remains in the low 0% range and continues to dampen overall service inflation.

Within services, those excluding rent peaked at the high 3% range in late 2023 but have slowed while still maintaining 2% growth. Meanwhile, rent—which accounts for about 40% of services—remains in the low 0% range and continues to dampen overall service inflation.

However, in Tokyo’s 23 wards, rising housing prices pushed rent inflation to 1.3% in April 2025, reflecting a sharp 0.5 percentage point increase from the previous month. While rent growth is likely to remain weak in rural areas experiencing population decline, rents in major metropolitan areas are expected to gradually increase nationwide.

However, in Tokyo’s 23 wards, rising housing prices pushed rent inflation to 1.3% in April 2025, reflecting a sharp 0.5 percentage point increase from the previous month. While rent growth is likely to remain weak in rural areas experiencing population decline, rents in major metropolitan areas are expected to gradually increase nationwide.Labor costs—a key driver of service prices—are likely to continue rising, supported by high wage increases. As firms continue passing on higher labor and logistics costs, service price inflation is expected to accelerate again.

Core CPI inflation is projected to remain in the 3% range for a while into FY 2025. However, as energy prices are pushed down by government measures over the summer, the inflation rate is expected to fall into the 2% range. With the yen’s appreciation slowing goods price inflation and wage-driven service price increases offsetting one another, core CPI inflation is projected to dip below the Bank of Japan’s 2% target in 2026.

Core CPI is projected to rise by 2.7% in FY 2024, 2.4% in FY 2025, and 1.6% in FY 2026, while core-core CPI (excluding fresh food and energy) is forecast to increase by 2.3% in FY 2024, 2.5% in FY 2025, and 1.7% in FY 2026.

Core CPI is projected to rise by 2.7% in FY 2024, 2.4% in FY 2025, and 1.6% in FY 2026, while core-core CPI (excluding fresh food and energy) is forecast to increase by 2.3% in FY 2024, 2.5% in FY 2025, and 1.7% in FY 2026.

The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング