- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025

Column

10/03/2025

Investors Trading Trends in Japanese Stock Market: An Analysis for February 2025

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

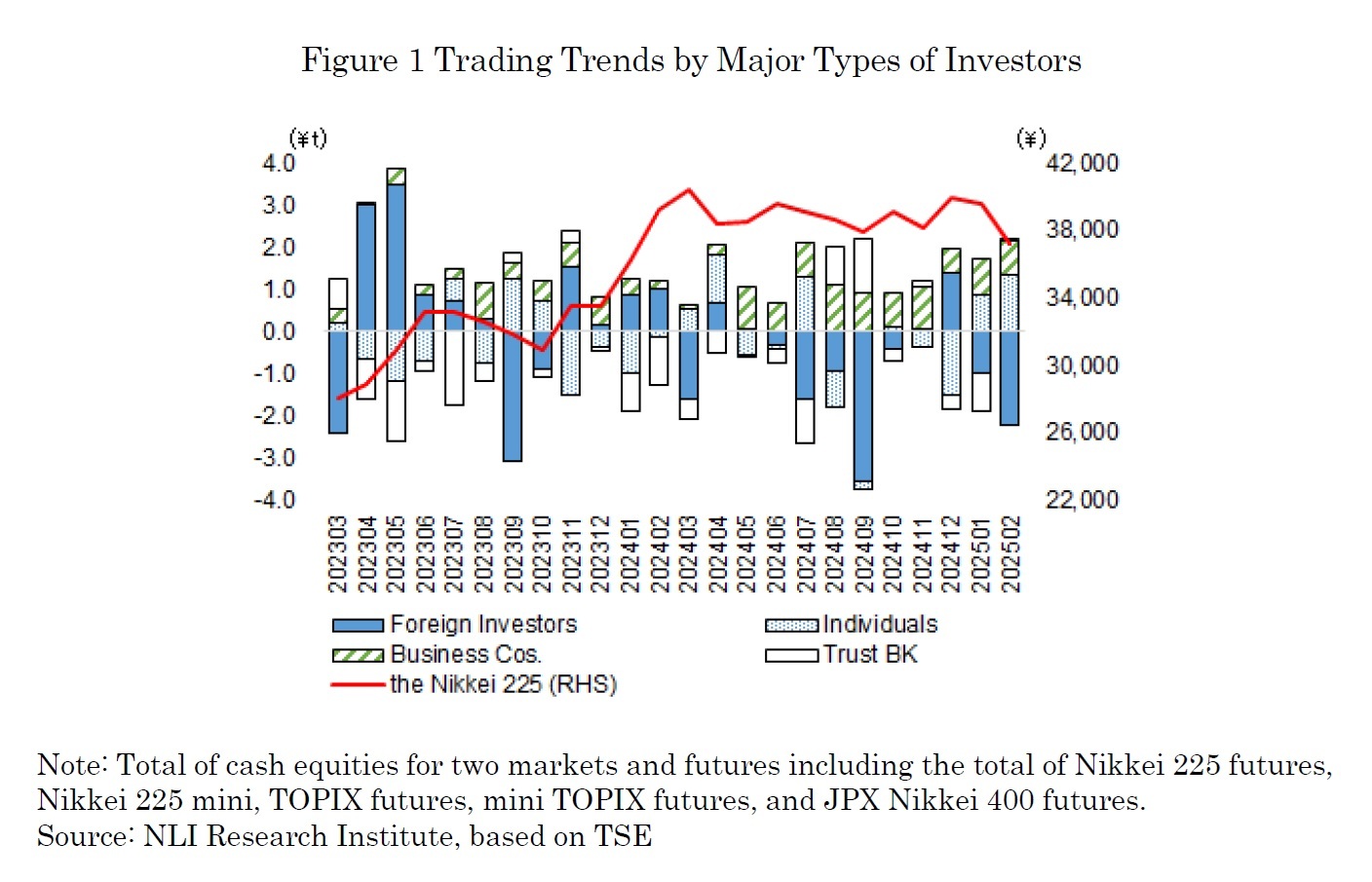

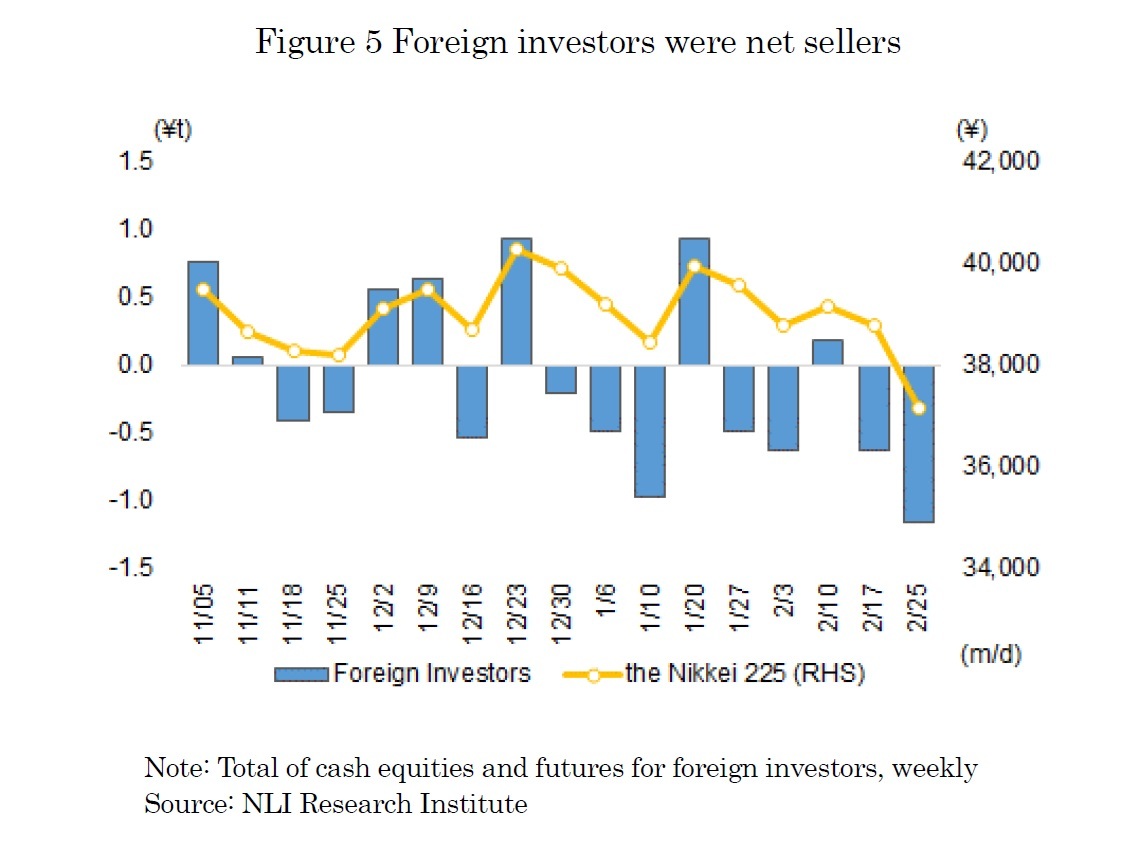

In February 2025, the Nikkei 225 started the month with a decline of over 1,000 yen from the previous month’s close of 39,572, following the announcement of additional tariffs by U.S. President Trump. The Nikkei rebounded to 39,461 on the 13th, supported by the postponement of the tariff implementation and strong corporate earnings, but gains were capped due to growing expectations of an additional BOJ rate hike and the progress of yen appreciation. In late February, the market came under renewed pressure from weakness in U.S. tech stocks, stricter U.S. semiconductor export restrictions to China, and another announcement of additional tariffs by President Trump, pushing the Nikkei into the low 38,000 yen range. By the end of the month, risk-off sentiment intensified, and on February 28, the Nikkei dropped by more than 1,300 yen from 38,256 on the 27th, finishing at 37,155. Individuals, business corporations, and trust banks were net buyers, while foreign investors recorded significant net selling (as shown in Figure 1).

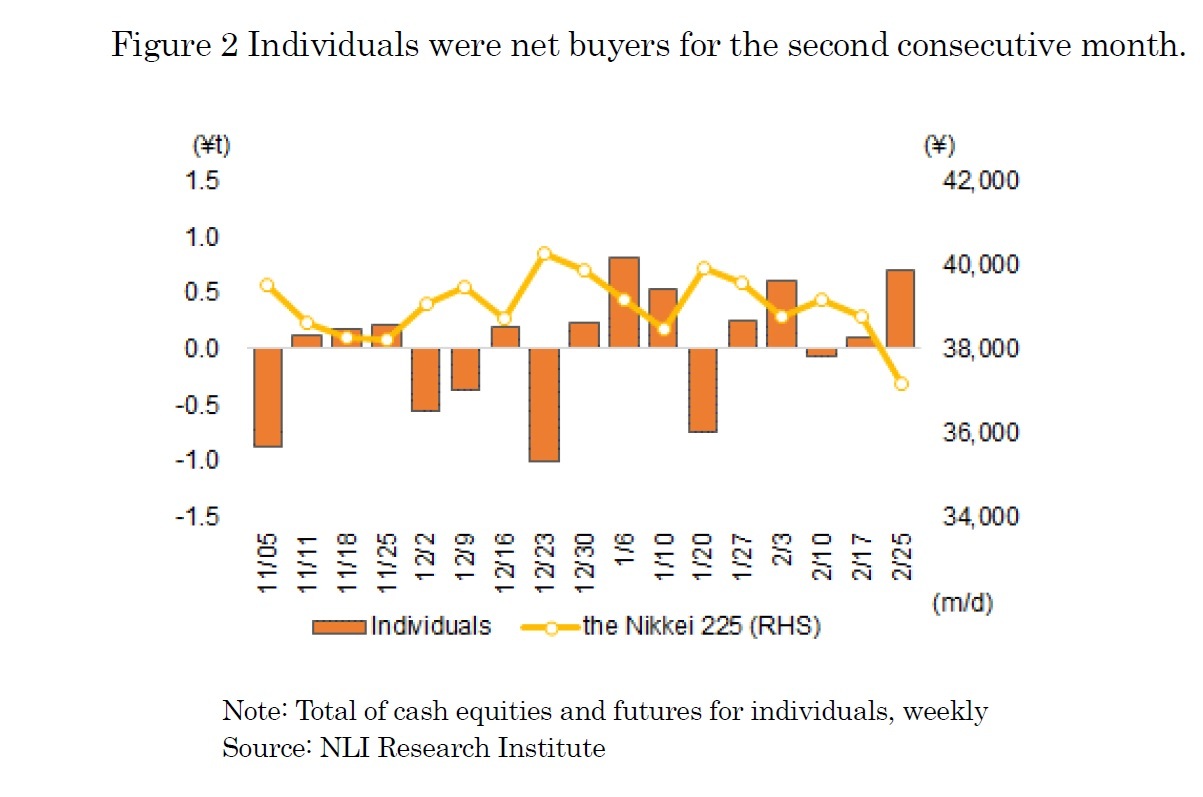

The trading by type of investors in February 2025 (February 3 to 28) shows that individuals were the largest net buyers, with a total net purchase of 1.337 trillion yen in cash equities and futures (as shown in Figure 2). On a weekly basis, individuals recorded a net purchase of 604.5 billion yen during the first week (February 3 to 7), when the Nikkei declined by 785 yen, and a net purchase of 703.2 billion yen during the fourth week (February 25 to 28), when the Nikkei dropped by 1,621 yen. These figures indicate that individuals actively bought during periods of significant market declines.

On a weekly basis, foreign investors recorded a net sale of 1.1675 trillion yen during the fourth week (February 25 to 28), when the Nikkei declined by 1,621 yen.

During this week, risk-off sentiment among foreign investors intensified, driven by factors such as President Trump’s announcement of additional tariffs, worsening U.S. economic indicators, and selling in U.S. tech stocks, including NVIDIA, which reported earnings on the 26th. As a result, Japanese stocks came under selling pressure, and the Nikkei ended February below 38,000, a level that had served as the lower bound of the range in recent months.

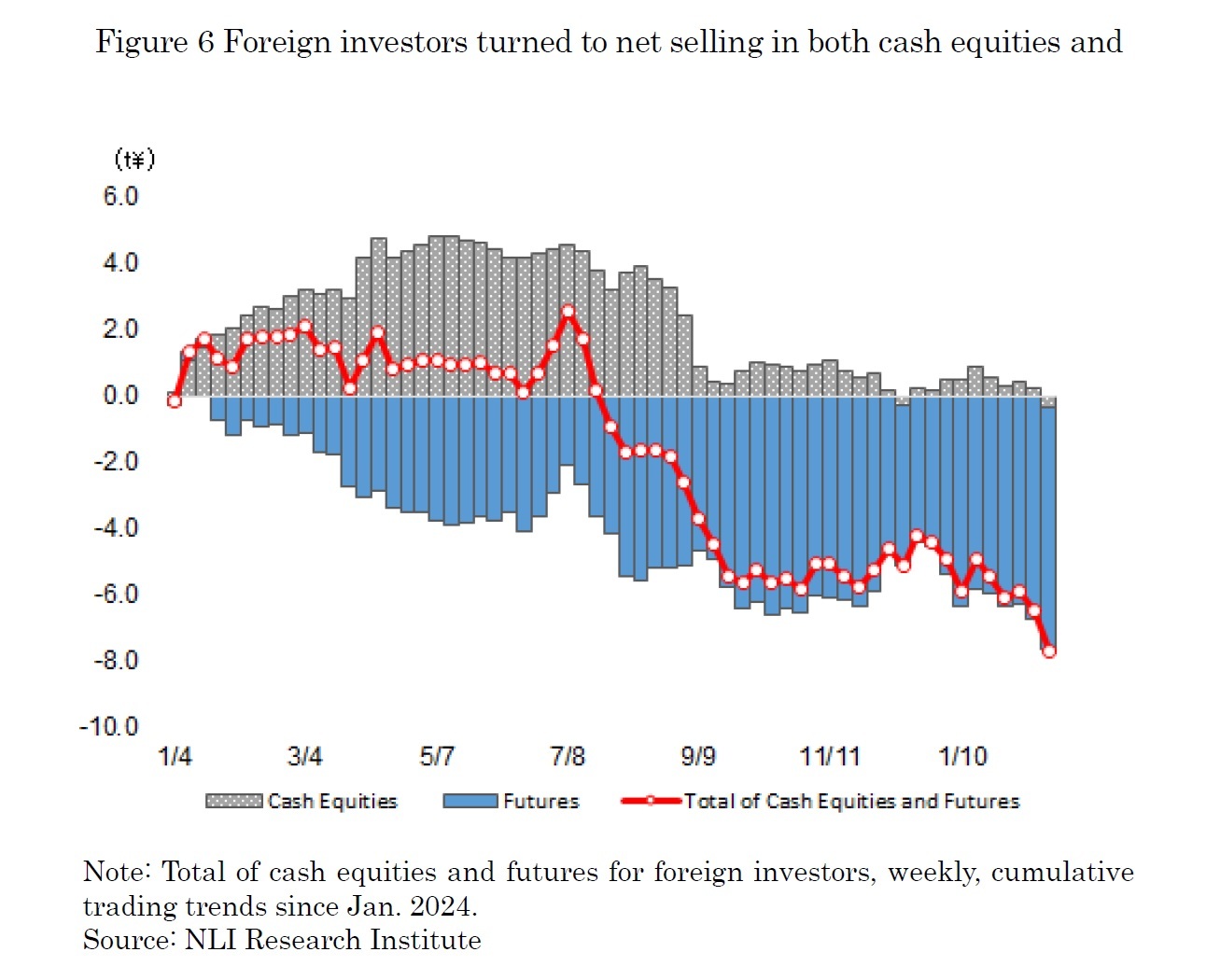

Looking at the trading trends of foreign investors since January 2024, they recorded a total net sale of 7.6 trillion yen in cash equities and futures from January 2024 to February 2025 (as shown in Figure 6). Breaking this down, cash equities saw a net sale of 350 billion yen, turning into cumulative net selling for the first time since the third week of December 2024. Meanwhile, futures posted a significant net sale of 7.27 trillion yen, highlighting particularly heavy selling in this segment. Going forward, attention will be on when foreign investors will begin buying back futures.

During this week, risk-off sentiment among foreign investors intensified, driven by factors such as President Trump’s announcement of additional tariffs, worsening U.S. economic indicators, and selling in U.S. tech stocks, including NVIDIA, which reported earnings on the 26th. As a result, Japanese stocks came under selling pressure, and the Nikkei ended February below 38,000, a level that had served as the lower bound of the range in recent months.

Looking at the trading trends of foreign investors since January 2024, they recorded a total net sale of 7.6 trillion yen in cash equities and futures from January 2024 to February 2025 (as shown in Figure 6). Breaking this down, cash equities saw a net sale of 350 billion yen, turning into cumulative net selling for the first time since the third week of December 2024. Meanwhile, futures posted a significant net sale of 7.27 trillion yen, highlighting particularly heavy selling in this segment. Going forward, attention will be on when foreign investors will begin buying back futures.

This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング