- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

18/02/2025

Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

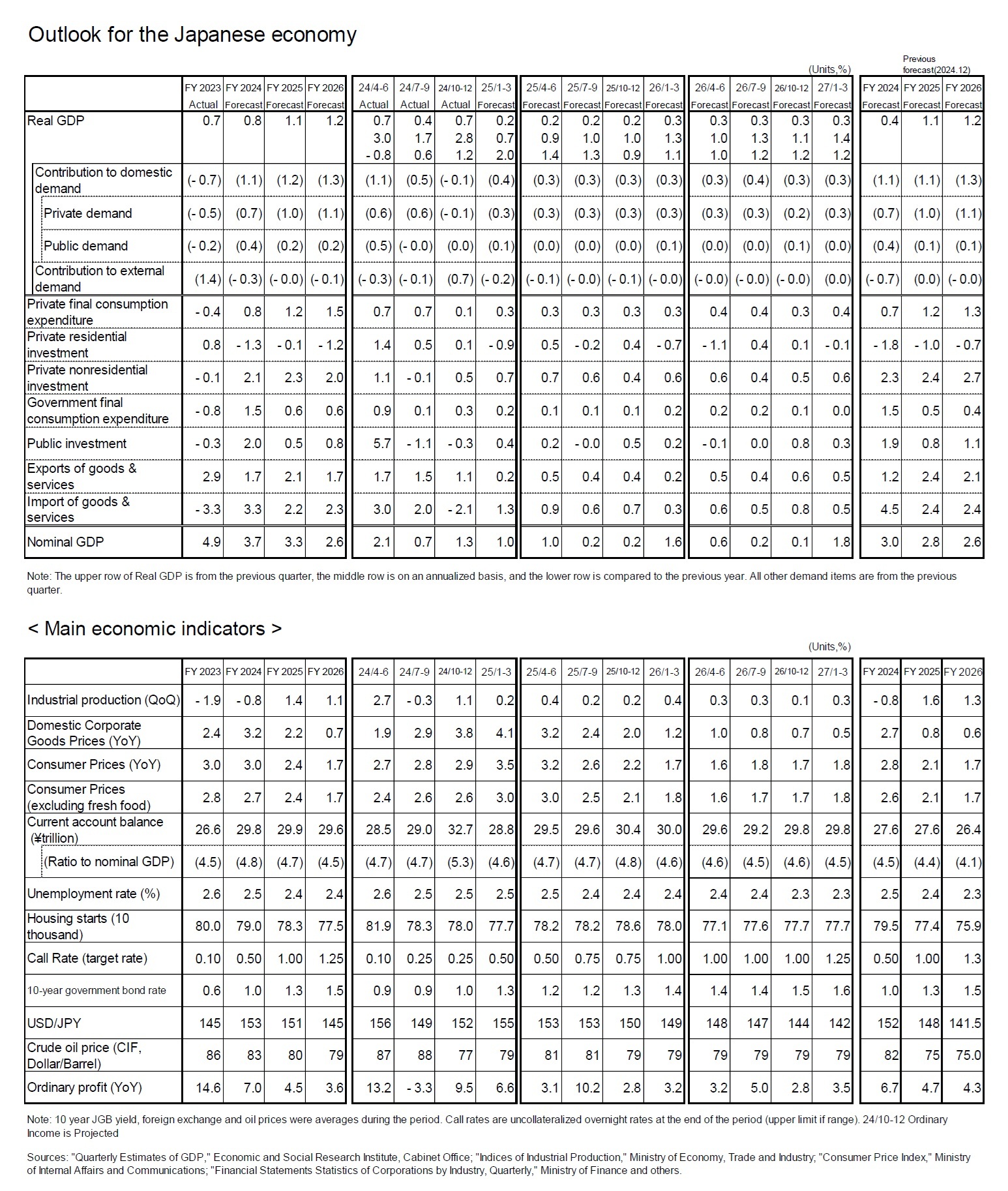

2.Real GDP Growth Rate Forecast at 0.8% for FY 2024, 1.1% for FY 2025, and 1.2% for FY 2026

(Steady Growth Around 1% Expected to Continue)

In the October–December quarter of 2024, real GDP grew by 2.8% on an annualized basis from the previous quarter. However, this growth was primarily driven by external demand, as imports declined, while domestic demand decreased for the first time in three quarters. This suggests that the actual strength of the economy may not be as robust as the headline growth rate implies.

For the January–March quarter of 2025, domestic demand is expected to turn positive, led by private consumption and capital investment. However, external demand is likely to turn negative due to a reactionary decline from the previous quarter, leading to a sharp slowdown in real GDP growth to 0.7% on an annualized basis.

Private consumption recorded strong growth of 0.7% from the previous quarter in both the April–June and July–September quarters of 2024, but growth slowed significantly to just 0.1% in the October–December quarter. A positive trend, however, is that real employee compensation increased year-over-year for the third consecutive quarter since April–June 2024, despite persistently high inflation.

Currently, rising prices of rice and fresh food are weighing on consumer sentiment. However, as inflation moderates, private consumption is expected to recover, supported by improvements in employment and income conditions.

While capital investment has been constrained by supply constraints due to labor shortages, it continues to recover fundamentally, supported by strong corporate earnings. Moving forward, growth is expected to continue at an annualized rate of around 1%, slightly above the potential growth rate, mainly driven by domestic private demand.

Potential downside risks include a sharp global economic slowdown triggered by U.S. tariff hikes and weak consumer spending due to stagnating real incomes amid rising prices.

In the October–December quarter of 2024, real GDP grew by 2.8% on an annualized basis from the previous quarter. However, this growth was primarily driven by external demand, as imports declined, while domestic demand decreased for the first time in three quarters. This suggests that the actual strength of the economy may not be as robust as the headline growth rate implies.

For the January–March quarter of 2025, domestic demand is expected to turn positive, led by private consumption and capital investment. However, external demand is likely to turn negative due to a reactionary decline from the previous quarter, leading to a sharp slowdown in real GDP growth to 0.7% on an annualized basis.

Private consumption recorded strong growth of 0.7% from the previous quarter in both the April–June and July–September quarters of 2024, but growth slowed significantly to just 0.1% in the October–December quarter. A positive trend, however, is that real employee compensation increased year-over-year for the third consecutive quarter since April–June 2024, despite persistently high inflation.

Currently, rising prices of rice and fresh food are weighing on consumer sentiment. However, as inflation moderates, private consumption is expected to recover, supported by improvements in employment and income conditions.

While capital investment has been constrained by supply constraints due to labor shortages, it continues to recover fundamentally, supported by strong corporate earnings. Moving forward, growth is expected to continue at an annualized rate of around 1%, slightly above the potential growth rate, mainly driven by domestic private demand.

Potential downside risks include a sharp global economic slowdown triggered by U.S. tariff hikes and weak consumer spending due to stagnating real incomes amid rising prices.

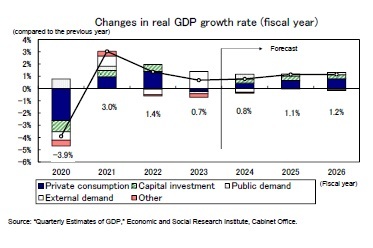

The real GDP growth rate is forecast to be 0.8% in FY 2024, 1.1% in FY 2025, and 1.2% in FY 2026. In FY 2023, real GDP grew by 0.7%, with domestic demand contributing negatively (-0.7 percentage points) for the first time in three years. However, weak domestic demand led to a 3.3% decline in imports, which in turn boosted external demand, contributing 1.4 percentage points to overall growth.

The real GDP growth rate is forecast to be 0.8% in FY 2024, 1.1% in FY 2025, and 1.2% in FY 2026. In FY 2023, real GDP grew by 0.7%, with domestic demand contributing negatively (-0.7 percentage points) for the first time in three years. However, weak domestic demand led to a 3.3% decline in imports, which in turn boosted external demand, contributing 1.4 percentage points to overall growth.For FY 2024, domestic demand is expected to remain strong, primarily driven by private consumption and capital investment. However, as imports are expected to increase, the contribution from external demand is likely to turn negative. Looking ahead to FY 2025 and beyond, exports are not expected to be a driving force for economic growth. Instead, the economy is expected to continue to be driven mainly by domestic demand.

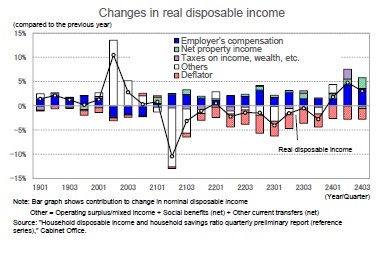

(Real Disposable Income on the Path to Recovery)

Real disposable income had been in a prolonged slump due to high inflation, but recent data indicates a positive turnaround. Household real disposable income saw a significant increase in FY 2020 due to various support measures, including the special fixed benefits provided during the COVID-19 pandemic. However, it had been declining since FY 2021.

Real disposable income had been in a prolonged slump due to high inflation, but recent data indicates a positive turnaround. Household real disposable income saw a significant increase in FY 2020 due to various support measures, including the special fixed benefits provided during the COVID-19 pandemic. However, it had been declining since FY 2021.

Since the January–March quarter of 2024, real disposable income has increased for three consecutive quarters. While government benefits for low-income households and tax cuts (income and residential) contributed to this rise in 2024, even after excluding these factors, disposable income continued to increase.

Since the January–March quarter of 2024, real disposable income has increased for three consecutive quarters. While government benefits for low-income households and tax cuts (income and residential) contributed to this rise in 2024, even after excluding these factors, disposable income continued to increase.The main reason for the recovery in real disposable income is the substantial increase in employee compensation, driven by accelerating per capita wage growth amid continued employment expansion. Real employee compensation had been declining year-over-year since the October–December quarter of 2021. However, it turned positive in the April–June quarter of 2024 for the first time in 11 quarters and has grown for three consecutive quarters, reaching a strong 3.3% growth rate in the October–December quarter of 2024.

Additionally, household property income, which had been sluggish due to ultra-low interest rates, has recently surged. This increase is mainly driven by rising dividend payments, supported by strong corporate earnings, further boosting disposable income.

Although the positive effect of income and residential tax cuts on real disposable income will fade, it is expected to remain resilient, supported by high nominal wage growth and increasing real employee compensation as inflation slows.

In FY 2025, while the effects of the tax cuts introduced in FY 2024 will dissipate, other factors such as rising dividend income from robust corporate performance and higher interest income due to elevated interest rates are expected to support disposable income.

Private consumption decreased by 0.4% in FY 2023 compared to the previous year, marking the first decline in three years. However, it is projected to grow moderately, with an increase of 0.8% in FY 2024, 1.2% in FY 2025, and 1.5% in FY 2026.

(Capital Investment Continues to Recover Gradually)

Capital investment in FY 2023 fell by 0.1% from the previous year, representing the first decrease in three years, though the drop was minimal. Looking ahead, capital investment is expected to continue its gradual recovery, rising by 2.1% in FY 2024, 2.3% in FY 2025, and 2.0% in FY 2026.

According to the December 2024 “Short-Term Economic Survey of Enterprises” (Tankan) by the Bank of Japan, capital investment plans for FY 2024 (covering all industries and company sizes, including software and R&D investments but excluding land investments) were revised downward by 0.1% compared to the September survey. Nevertheless, these plans still indicate a robust increase of 10.0% compared to the previous year.

The recovery in capital investment is being driven by strong corporate earnings, with a focus on labor-saving investments to address labor shortages, IT-related investments for digitalization, and construction investments related with the expansion of e-commerce. However, as the pace of recovery in ordinary profits gradually slows and supply constraints, such as labor shortages, continue to be limiting factors, the growth rate of capital investment is expected to remain moderate.

Capital investment in FY 2023 fell by 0.1% from the previous year, representing the first decrease in three years, though the drop was minimal. Looking ahead, capital investment is expected to continue its gradual recovery, rising by 2.1% in FY 2024, 2.3% in FY 2025, and 2.0% in FY 2026.

According to the December 2024 “Short-Term Economic Survey of Enterprises” (Tankan) by the Bank of Japan, capital investment plans for FY 2024 (covering all industries and company sizes, including software and R&D investments but excluding land investments) were revised downward by 0.1% compared to the September survey. Nevertheless, these plans still indicate a robust increase of 10.0% compared to the previous year.

The recovery in capital investment is being driven by strong corporate earnings, with a focus on labor-saving investments to address labor shortages, IT-related investments for digitalization, and construction investments related with the expansion of e-commerce. However, as the pace of recovery in ordinary profits gradually slows and supply constraints, such as labor shortages, continue to be limiting factors, the growth rate of capital investment is expected to remain moderate.

(Outlook for Prices)

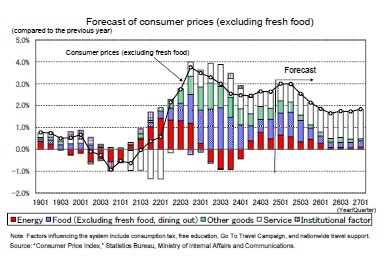

Consumer prices (excluding fresh food, hereafter referred to as core CPI) had been increasing at a rate of around 2% year-on-year since September 2023. However, following a sharp rise in electricity and city gas prices after the end of the “Emergency Support for Overcoming Extreme Heat”, core CPI growth accelerated to 3.0% in December 2024.

Until January 2024, government measures to curb energy prices had suppressed core CPI growth. However, from February 2024 onward, the reduction in electricity and city gas discounts, along with the temporary suspension of certain policies, has contributed to an increase in core CPI.

The “Emergency Support for Overcoming Extreme Heat” for electricity and city gas ended in October 2024. However, under the economic measures formulated in November 2024, the “Electricity and Gas Price Burden Reduction Support Program” was implemented for usage from January to March 2025, with the subsidy amount decreasing in March. The scale of the discount is smaller than the one provided during the summer of 2024.

Consumer prices (excluding fresh food, hereafter referred to as core CPI) had been increasing at a rate of around 2% year-on-year since September 2023. However, following a sharp rise in electricity and city gas prices after the end of the “Emergency Support for Overcoming Extreme Heat”, core CPI growth accelerated to 3.0% in December 2024.

Until January 2024, government measures to curb energy prices had suppressed core CPI growth. However, from February 2024 onward, the reduction in electricity and city gas discounts, along with the temporary suspension of certain policies, has contributed to an increase in core CPI.

The “Emergency Support for Overcoming Extreme Heat” for electricity and city gas ended in October 2024. However, under the economic measures formulated in November 2024, the “Electricity and Gas Price Burden Reduction Support Program” was implemented for usage from January to March 2025, with the subsidy amount decreasing in March. The scale of the discount is smaller than the one provided during the summer of 2024.

Additionally, the “Mitigation Measures of Drastic Changes in Fuel Oil Prices” for gasoline, kerosene, and other fuels, originally set to expire at the end of 2024, have been extended into 2025. However, subsidies have been reduced, leading to an increase in regular gasoline prices from around 175 yen per liter in mid-December 2024 to approximately 185 yen per liter in mid-January 2025. As a result, energy prices are expected to remain elevated for the time being.

Food prices (excluding fresh food) peaked at a 9.2% increase in August 2023 before slowing to 2.6% in July 2024. However, the rate of increase picked up again, reaching 4.4% in December 2024, due to the renewed rise in import prices and soaring rice prices. While food price hikes are likely to continue for some time, upstream price trends (such as import prices and domestic corporate goods prices) for food items are lower than during the summer of 2023. At present, food price inflation in consumer prices is expected to rise to around 5% before stabilizing.

Food prices (excluding fresh food) peaked at a 9.2% increase in August 2023 before slowing to 2.6% in July 2024. However, the rate of increase picked up again, reaching 4.4% in December 2024, due to the renewed rise in import prices and soaring rice prices. While food price hikes are likely to continue for some time, upstream price trends (such as import prices and domestic corporate goods prices) for food items are lower than during the summer of 2023. At present, food price inflation in consumer prices is expected to rise to around 5% before stabilizing.

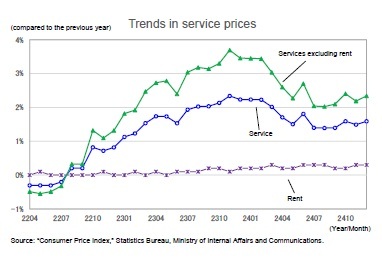

Service prices, which had been increasing at around 2% in the latter half of 2023, slowed to the mid-1% range in FY 2024. Breaking down service prices, those excluding rent peaked in the high 3% range in late 2023 before decelerating, though they continue to grow at rates exceeding 2%.

Service prices, which had been increasing at around 2% in the latter half of 2023, slowed to the mid-1% range in FY 2024. Breaking down service prices, those excluding rent peaked in the high 3% range in late 2023 before decelerating, though they continue to grow at rates exceeding 2%.On the other hand, rent, which accounts for nearly 40% of service prices, has continued to rise at a modest rate of around 0%. In Tokyo’s 23 wards, however, rent has increased from near 0% during the COVID-19 pandemic to nearly 1%, driven by soaring housing prices. While rent is expected to remain sluggish in rural areas where population decline is more pronounced, nationwide rent increases are expected to gradually accelerate, particularly in major metropolitan areas.

Labor costs, which have a significant impact on service prices, are expected to continue rising, supported by strong wage growth. As businesses pass on higher labor and logistics costs to consumers, the pace of service price increases is likely to pick up again.

The core CPI growth rate is expected to remain around 3% in the first half of 2025, mainly due to increases in energy and food prices. However, as the growth rate of goods prices slows, core CPI is expected to gradually decelerate while remaining in the 2% range throughout 2025. The rise in service prices driven by wage hikes is likely to be offset by the decline in goods price inflation due to yen appreciation, leading to core CPI falling below the Bank of Japan's 2% inflation target after entering2026.

The core CPI growth rate is expected to remain around 3% in the first half of 2025, mainly due to increases in energy and food prices. However, as the growth rate of goods prices slows, core CPI is expected to gradually decelerate while remaining in the 2% range throughout 2025. The rise in service prices driven by wage hikes is likely to be offset by the decline in goods price inflation due to yen appreciation, leading to core CPI falling below the Bank of Japan's 2% inflation target after entering2026.Core CPI is forecast to increase by 2.8% in FY 2023, followed by 2.7% in FY 2024, 2.4% in FY 2025, and 1.7% in FY 2026. Core-core CPI (excluding fresh food and energy) is expected to rise by 3.9% in FY 2023, 2.3% in FY 2024, 2.1% in FY 2025, and 1.8% in FY 2026.

The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング