- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

18/02/2025

Japan’s Economic Outlook for Fiscal Years 2024-2026 (February 2025)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1.Positive Growth of 2.8% on an Annualized Basis in the October–December Quarter of 2024

In the October–December quarter of 2024, real GDP grew by 0.7% from the previous quarter (equivalent to an annualized rate of 2.8%), marking the third consecutive quarter of positive growth. Despite the ongoing negative impact of high prices, the effects of income tax and residential tax reductions have diminished, resulting in private consumption remaining nearly flat, increasing just 0.1% from the previous quarter. Capital investment, supported by strong corporate earnings, increased by 0.5%, while a decline in private inventories contributed negatively by 0.2 percentage points, leading to a 0.1% drop in domestic demand—the first decline in three quarters.

On the other hand, exports rose by 1.1%, marking their third consecutive quarter of growth, while imports declined by 2.1%. Consequently, net exports of goods and services contributed 0.7 percentage points to GDP growth, significantly boosting the overall growthrate.

Real GDP in the October–December quarter of 2024 has now exceeded the pre-COVID-19 average (2019 levels) by 1.8%, marking three straight quarters of positive growth. However, private consumption and residential investment remain below pre-COVID-19 levels, down 0.4% and 10.6%, respectively, indicating continued weakness in the household sector.

On the other hand, exports rose by 1.1%, marking their third consecutive quarter of growth, while imports declined by 2.1%. Consequently, net exports of goods and services contributed 0.7 percentage points to GDP growth, significantly boosting the overall growthrate.

Real GDP in the October–December quarter of 2024 has now exceeded the pre-COVID-19 average (2019 levels) by 1.8%, marking three straight quarters of positive growth. However, private consumption and residential investment remain below pre-COVID-19 levels, down 0.4% and 10.6%, respectively, indicating continued weakness in the household sector.

For the calendar year 2024, real GDP increased by 0.1% compared to the previous year (down from 1.5% in 2023), securing four consecutive years of positive growth. While the household sector remained weak (private consumption down 0.1%, private residential investment down 2.3%), capital investment (+1.2%) and public demand (+0.5%) contributed positively to economic growth.

Nominal GDP for 2024 grew by 2.9% (down from 5.6% in 2023), marking four straight years of growth. The GDP deflator increased by 2.9% (compared to 4.1% in 2023), continuing its positive trend for a third consecutive year.

Nominal GDP for 2024 grew by 2.9% (down from 5.6% in 2023), marking four straight years of growth. The GDP deflator increased by 2.9% (compared to 4.1% in 2023), continuing its positive trend for a third consecutive year.

(Exports Are Unlikely Drive Economic Growth)

Although global trade volume turned positive in early 2024 and has gradually been increasing, Japan’s exports remain stagnant.

Looking ahead, overseas economies—which influence Japan’s export outlook—face growing uncertainty. In the United States, real GDP growth exceeded its potential growth rate in 2023 (2.9%) and 2024 (2.8%). However, economic policies under President Trump, particularly tariff hikes and the forced deportation of undocumented immigrants, are expected to accelerate inflation and slow down economic growth. As a result, U.S. GDP growth is expected to decelerate to 2.1% in 2025 and 1.8% in 2026.

Meanwhile, in China, a prolonged real estate downturn, coupled with the negative effects of additional U.S. tariffs, is expected to significantly slow real GDP growth from 5.0% in 2024 to 4.2% in 2025 and 3.5% in 2026.

In contrast, the euro area is forecast to experience a gradual recovery, with real GDP growth rising from 0.7% in 2024 to 1.0% in 2025 and 1.4% in 2026. However, given the sharp decline during the COVID-19 pandemic, the overall pace of recovery is expected to remain moderate.

While the global economy is projected to recover through 2026, growth rates are expected to remain low.

Given the prolonged low growth in overseas economies, Japan’s export growth is unlikely to accelerate or serve as a driving force for economic recovery. Net exports of goods and services are forecast to grow 1.7% in FY 2024, 2.1% in FY 2025, and 1.7% in FY 2026, maintaining on a moderate growth trajectory.

Although global trade volume turned positive in early 2024 and has gradually been increasing, Japan’s exports remain stagnant.

Looking ahead, overseas economies—which influence Japan’s export outlook—face growing uncertainty. In the United States, real GDP growth exceeded its potential growth rate in 2023 (2.9%) and 2024 (2.8%). However, economic policies under President Trump, particularly tariff hikes and the forced deportation of undocumented immigrants, are expected to accelerate inflation and slow down economic growth. As a result, U.S. GDP growth is expected to decelerate to 2.1% in 2025 and 1.8% in 2026.

Meanwhile, in China, a prolonged real estate downturn, coupled with the negative effects of additional U.S. tariffs, is expected to significantly slow real GDP growth from 5.0% in 2024 to 4.2% in 2025 and 3.5% in 2026.

In contrast, the euro area is forecast to experience a gradual recovery, with real GDP growth rising from 0.7% in 2024 to 1.0% in 2025 and 1.4% in 2026. However, given the sharp decline during the COVID-19 pandemic, the overall pace of recovery is expected to remain moderate.

While the global economy is projected to recover through 2026, growth rates are expected to remain low.

Given the prolonged low growth in overseas economies, Japan’s export growth is unlikely to accelerate or serve as a driving force for economic recovery. Net exports of goods and services are forecast to grow 1.7% in FY 2024, 2.1% in FY 2025, and 1.7% in FY 2026, maintaining on a moderate growth trajectory.

(Bonuses Significantly Boost Wages)

Total cash earnings per worker accelerated in FY 2024, reaching a high growth rate of 3.9% in the October–December quarter compared to the previous year. The 2024 spring wage negotiations resulted in the highest wage hike in 33 years, leading to a rise in scheduled cash earnings. Additionally, substantial increases in year-end bonuses, following strong summer bonuses, further boosted total cash earnings.

Total cash earnings per worker accelerated in FY 2024, reaching a high growth rate of 3.9% in the October–December quarter compared to the previous year. The 2024 spring wage negotiations resulted in the highest wage hike in 33 years, leading to a rise in scheduled cash earnings. Additionally, substantial increases in year-end bonuses, following strong summer bonuses, further boosted total cash earnings.

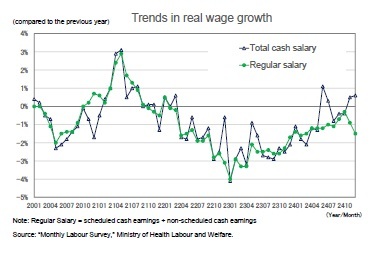

The real wage growth rate, which had remained negative for over two years since April 2022, briefly turned positive in June and July 2024. However, it fell back into negative territory from August to October before rebounding in November and December. The primary factor behind this temporary improvement was the sharp increase in special cash earnings (bonuses), while regularly paid earnings (scheduled and non-scheduled cash earnings), which tend to follow stable trends, remained negative.

The real wage growth rate, which had remained negative for over two years since April 2022, briefly turned positive in June and July 2024. However, it fell back into negative territory from August to October before rebounding in November and December. The primary factor behind this temporary improvement was the sharp increase in special cash earnings (bonuses), while regularly paid earnings (scheduled and non-scheduled cash earnings), which tend to follow stable trends, remained negative.From January 2025 onward, when special cash earnings are rarely paid, the growth of nominal wages is expected to slow significantly, leading to a return to negative real wage growth. A sustained and stable increase in real wages is unlikely until after the start of FY 2025.

(Spring Wage Increase Rate in 2025 Expected to Stay in the 5% Range for the Second Consecutive Year)

In the 2024 spring labor negotiations, the wage increase rate reached 5.33% (according to the Ministry of Health, Labour and Welfare's “Survey on Wage Increase Requests and Settlements by Major Private Enterprises”), marking the highest level in 33 years. Examining the environment surrounding the 2025 negotiations, the job openings-to-applicants ratio is declining but remains well above 1.0, while the unemployment rate continues to hover in the mid-2% range, indicating a persistently tight labor market. Additionally, ordinary corporate profits (seasonally adjusted) from the “Financial Statements Statistics of Corporations by Industry” remain near record-high levels, while consumer prices (excluding fresh food) remain elevated.

In the 2024 spring labor negotiations, the wage increase rate reached 5.33% (according to the Ministry of Health, Labour and Welfare's “Survey on Wage Increase Requests and Settlements by Major Private Enterprises”), marking the highest level in 33 years. Examining the environment surrounding the 2025 negotiations, the job openings-to-applicants ratio is declining but remains well above 1.0, while the unemployment rate continues to hover in the mid-2% range, indicating a persistently tight labor market. Additionally, ordinary corporate profits (seasonally adjusted) from the “Financial Statements Statistics of Corporations by Industry” remain near record-high levels, while consumer prices (excluding fresh food) remain elevated.

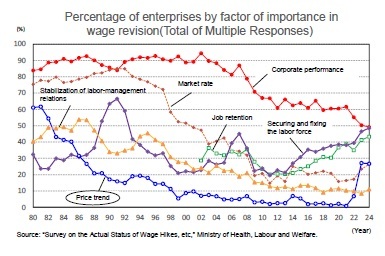

The recent acceleration in price increases, particularly for food, is also likely to further drive wage hikes. According to the Ministry of Health, Labour and Welfare's “Survey on Wage Revisions and Other Matters”, the percentage of companies citing “price trends” as a key factor in wage decisions (multiple responses allowed) had remained below 10% for over 20 years after falling below this threshold in 1999, hitting a record low of 0.8% in 2021. However, as prices surged from 2022 onward, this figure rose sharply to the high 20% range in 2023 and 2024, reaching levels last seen in the late 1980s.

The recent acceleration in price increases, particularly for food, is also likely to further drive wage hikes. According to the Ministry of Health, Labour and Welfare's “Survey on Wage Revisions and Other Matters”, the percentage of companies citing “price trends” as a key factor in wage decisions (multiple responses allowed) had remained below 10% for over 20 years after falling below this threshold in 1999, hitting a record low of 0.8% in 2021. However, as prices surged from 2022 onward, this figure rose sharply to the high 20% range in 2023 and 2024, reaching levels last seen in the late 1980s.According to the “Survey on Wage Increases and Other Issues”, released by the Institute of Labor Administration on February 5, the expected wage increase rate for 2025—based on responses from approximately 485 labor and management representatives and labor market experts—averaged 4.60%. This figure significantly exceeds the previous year's forecast (3.66%) but falls short of the actual 5.33% increase recorded in 2024. Historically, the actual wage increase rate for major companies, compiled by the Ministry of Health, Labour and Welfare, has closely aligned with this survey's projections. However, in 2023 and 2024, actual increases exceeded forecasts by a considerable margin. Taking these trends into account, we project that the wage increase rate for the 2025 spring labor negotiations will remain elevated at 5.20%, marking the second consecutive year in the 5% range.

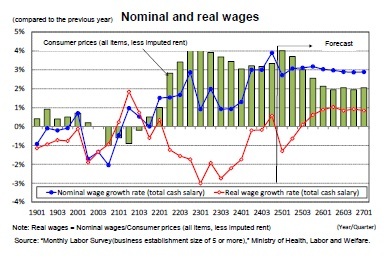

While nominal wages are expected to continue growing at a relatively high rate, their pace of increase is likely to slow after January 2025, when bonuses are not paid. As a result, real wage growth is highly likely to turn negative again. Sustainable and stable positive real wage growth is expected to be delayed until the July–September quarter of 2025, when consumer prices (excluding imputed rent for owner-occupied housing)—currently around 4%—are forecast to slow to approximately 3%.

While nominal wages are expected to continue growing at a relatively high rate, their pace of increase is likely to slow after January 2025, when bonuses are not paid. As a result, real wage growth is highly likely to turn negative again. Sustainable and stable positive real wage growth is expected to be delayed until the July–September quarter of 2025, when consumer prices (excluding imputed rent for owner-occupied housing)—currently around 4%—are forecast to slow to approximately 3%.In FY 2023, nominal employee compensation increased by 1.9% compared to the previous year, marking the third consecutive year of growth. However, with persistently high consumer prices, real employee compensation declined by 1.4%, recording its second consecutive year of decrease.

For FY 2024, employment growth and a significant rise in per capita employee compensation are expected to drive a strong 4.5% increase in nominal employee compensation compared to the previous year. Meanwhile, real employee compensation is projected to turn positive, rising by 1.7%.

Looking ahead, as the pace of corporate earnings recovery slows, growth in special cash earnings is expected to decelerate, leading to a moderation in nominal employee compensation to 3.7% in FY 2025 and 3.3% in FY 2026. However, with inflation expected to ease, real employee compensation is projected to remain resilient, increasing by 1.6% in FY 2025 and 1.8% in FY 2026.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング