- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

18/11/2024

Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

2.The Real Growth Rate is Forecasted at 0.4% in FY2024, 1.1% in FY2025, and 1.2% in FY2026

(Growth Rate Expected to Remain Around 1% Annually.)

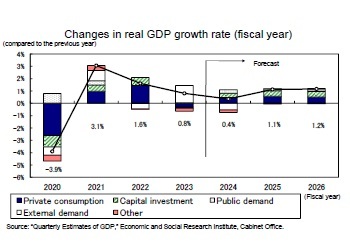

(Growth Rate Expected to Remain Around 1% Annually.)Real GDP in the July–September quarter of 2024 recorded positive growth for the second consecutive quarter, primarily driven by strong growth in private consumption supported by the effects of income and resident tax cuts. Looking ahead, while the effects of the tax cuts are expected to wane, recovery in real wages and a resulting increase in real disposable income are anticipated to underpin consumption. Although capital investment remains stagnant with ups and downs, it is expected to continue its recovery trend, supported by high corporate earnings. Starting in the second half of FY2024, growth driven by domestic private demand is forecasted to slightly exceed the potential growth rate, around the upper-zero-percent range, while maintaining an annual rate of approximately 1%

The real GDP growth rate is forecasted to be 0.4% in FY2024, 1.1% in FY2025, and 1.2% in FY2026. Downside risks include a potential sharp slowdown in the global economy caused by President-elect Trump’s economic policies and a decline in consumption stemming from reduced real incomes due to rising prices.

(Personal Consumption Dependent on Disposable Income.)

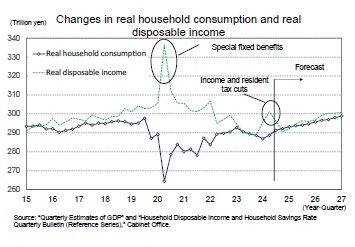

The household savings rate surged to 21.1% in the April–June quarter of 2020, reflecting a sharp drop in consumption caused by the state of emergency declaration in April 2020 and a significant increase in disposable income due to special fixed benefits. Subsequently, the savings rate declined as a result of recovery in consumption driven by the easing of behavioral restrictions and the impact of rising prices, remaining close to 0% throughout 2023. After entering 2024, disposable income increased significantly due to benefits for low-income households and income and resident tax cuts. However, consumption growth remained moderate, leading to an increase in the savings rate up to 3.7% in the April–June quarter of 2024. Although the household savings rate for the July–September quarter has not yet been published, considering the strong consumption growth, it is likely to have fallen significantly to around 1%, a level comparable to that in the pre-COVID-19 period.

The household savings rate surged to 21.1% in the April–June quarter of 2020, reflecting a sharp drop in consumption caused by the state of emergency declaration in April 2020 and a significant increase in disposable income due to special fixed benefits. Subsequently, the savings rate declined as a result of recovery in consumption driven by the easing of behavioral restrictions and the impact of rising prices, remaining close to 0% throughout 2023. After entering 2024, disposable income increased significantly due to benefits for low-income households and income and resident tax cuts. However, consumption growth remained moderate, leading to an increase in the savings rate up to 3.7% in the April–June quarter of 2024. Although the household savings rate for the July–September quarter has not yet been published, considering the strong consumption growth, it is likely to have fallen significantly to around 1%, a level comparable to that in the pre-COVID-19 period.

Thus, future consumption will largely depend on the fundamental trend of real disposable income, excluding temporary factors. After a temporary decline due to the fading effects of income and resident tax cuts, real disposable income is expected to remain solid, primarily supported by high nominal wage growth and an increase in real employee compensation caused by a slowdown in inflation. Private consumption, which declined by 0.6% year-on-year in FY2023 for the first time in three years, is forecasted to increase moderately by 0.9% in FY2024, 1.1% in FY2025, and 1.0% in FY2026. In FY2024, growth in real employee compensation will remain modest, but income and resident tax cuts will boost disposable income. From FY2025 onward, while the effects of tax cuts will dissipate, stronger growth in real employee compensation will contribute to an increase in real disposable income.

Thus, future consumption will largely depend on the fundamental trend of real disposable income, excluding temporary factors. After a temporary decline due to the fading effects of income and resident tax cuts, real disposable income is expected to remain solid, primarily supported by high nominal wage growth and an increase in real employee compensation caused by a slowdown in inflation. Private consumption, which declined by 0.6% year-on-year in FY2023 for the first time in three years, is forecasted to increase moderately by 0.9% in FY2024, 1.1% in FY2025, and 1.0% in FY2026. In FY2024, growth in real employee compensation will remain modest, but income and resident tax cuts will boost disposable income. From FY2025 onward, while the effects of tax cuts will dissipate, stronger growth in real employee compensation will contribute to an increase in real disposable income.

(Labor Shortages Restrain the Pace of Capital Investment Recovery.)

Capital investment grew by only 0.3% year-on-year in FY2023 but is forecasted to recover gradually, with an expected growth of 2.2% in FY2024, 2.7% in FY2025, and 2.6% in FY2026.

According to the September 2024 Bank of Japan Tankan Survey, capital investment plans for FY2024 (covering all sizes and industries, including software and R&D investment, but excluding land investment) were revised downward by 0.5% from the June survey. However, the year-on-year growth rate remained high at 10.1%.

Capital investment grew by only 0.3% year-on-year in FY2023 but is forecasted to recover gradually, with an expected growth of 2.2% in FY2024, 2.7% in FY2025, and 2.6% in FY2026.

According to the September 2024 Bank of Japan Tankan Survey, capital investment plans for FY2024 (covering all sizes and industries, including software and R&D investment, but excluding land investment) were revised downward by 0.5% from the June survey. However, the year-on-year growth rate remained high at 10.1%.

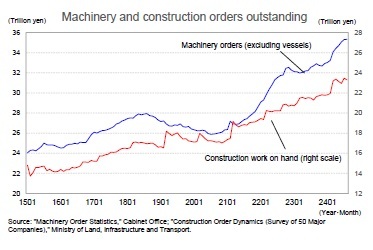

Within capital investment, machinery orders, a leading indicator of machinery investment, and construction work orders, a leading indicator of construction investment, have remained flat. However, the backlog of machinery and construction orders has continued to increase. While the high order backlog suggests future expansion of capital investment, it may also reflect supply-side constraints such as labor shortages, which have delayed machinery production and construction progress.

Within capital investment, machinery orders, a leading indicator of machinery investment, and construction work orders, a leading indicator of construction investment, have remained flat. However, the backlog of machinery and construction orders has continued to increase. While the high order backlog suggests future expansion of capital investment, it may also reflect supply-side constraints such as labor shortages, which have delayed machinery production and construction progress.Capital investment is expected to continue its recovery, supported by strong corporate earnings. Key drivers include labor-saving investments to address labor shortages, IT-related investments for digitalization, and construction investments associated with the expansion of e-commerce. However, the pace of increase is likely to remain moderate due to supply-side constraints, such as labor shortages, which are acting as a limiting factor in capital investment.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング