- NLI Research Institute >

- Economics >

- Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

16/08/2024

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

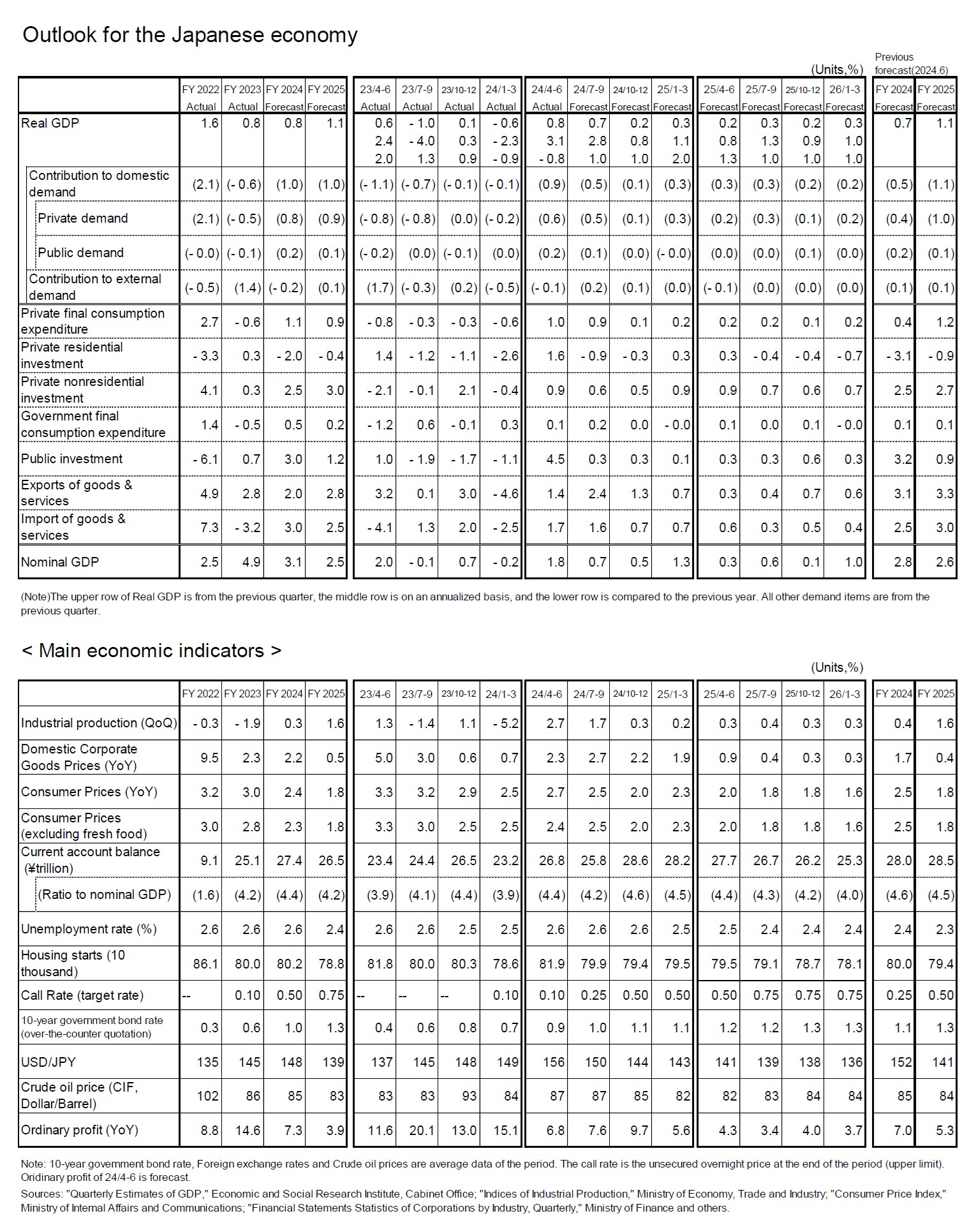

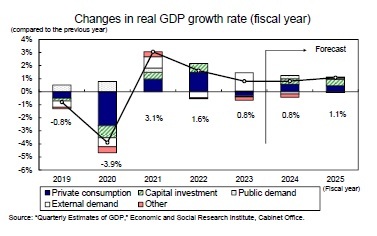

2.Real growth rate forecasted to be 0.8% in FY2024 and 1.1% in FY2025

(Higher Growth Expected in the July-September Quarter of 2024 Due to Tax Cuts)

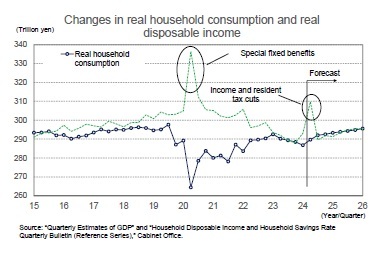

In the April-June quarter of 2024, the automobile production sector recovered and contributed to an increase in private consumption and capital investment, leading to a 3.1% positive growth on an annualized basis. Continued strong growth is expected for the July-September quarter, as private consumption is projected to increase 0.9% from the previous quarter, supported by the income and resident tax cuts implemented in June, resulting in an annualized growth rate of 2.8%.

In the April-June quarter of 2024, the automobile production sector recovered and contributed to an increase in private consumption and capital investment, leading to a 3.1% positive growth on an annualized basis. Continued strong growth is expected for the July-September quarter, as private consumption is projected to increase 0.9% from the previous quarter, supported by the income and resident tax cuts implemented in June, resulting in an annualized growth rate of 2.8%.

Although the effect of the tax cuts is temporary, real disposable income is expected to increase on a sustained basis from the October-December quarter onward, driven by stable positive real wage growth, which is expected to support consumption. Capital investment struggled in FY2023 but is showing signs of recovery as a result of strong corporate earnings. From the second half of FY2024 onward, growth is expected to continue at approximately 1% per year, which is slightly above the potential growth rate of the upper zero percent range, driven primarily by domestic private demand.

The real GDP growth rate in FY2023 was 0.8%, with domestic demand contributing -0.6%, marking the first negative contribution in three years. However, the decline in imports by 3.2% year-over-year due to weak domestic demand resulted in a 1.4% positive contribution from external demand, which significantly boosted the growth rate. In FY2024 and FY2025, while private consumption and capital investment are expected to drive domestic demand, the positive impact of external demand is expected to decrease as imports increase, and real GDP is forecasted to be 0.8% and 1.1% for those years, respectively. Growth is expected to remain centered on domestic demand in the future.

The real GDP growth rate in FY2023 was 0.8%, with domestic demand contributing -0.6%, marking the first negative contribution in three years. However, the decline in imports by 3.2% year-over-year due to weak domestic demand resulted in a 1.4% positive contribution from external demand, which significantly boosted the growth rate. In FY2024 and FY2025, while private consumption and capital investment are expected to drive domestic demand, the positive impact of external demand is expected to decrease as imports increase, and real GDP is forecasted to be 0.8% and 1.1% for those years, respectively. Growth is expected to remain centered on domestic demand in the future.

(Personal Consumption Driven by Disposable Income)

The household savings rate surged to 21.1% in the April-June quarter of 2020 due to the sharp drop in consumption following the state of emergency declaration in April 2020 and the significant increase in disposable income due to the provision of special cash payments. Subsequently, the easing of behavioral restrictions and rising prices caused the savings rate to decline to approximately 0% in 2023 as consumption rebounded. However, the rate increased to 2.1% in the January-March quarter of 2024 (from -0.3% in the October-December quarter of 2023) due to continued sluggish consumption and the increased benefits for low-income earners included in the economic stimulus package in November 2023.

The household savings rate surged to 21.1% in the April-June quarter of 2020 due to the sharp drop in consumption following the state of emergency declaration in April 2020 and the significant increase in disposable income due to the provision of special cash payments. Subsequently, the easing of behavioral restrictions and rising prices caused the savings rate to decline to approximately 0% in 2023 as consumption rebounded. However, the rate increased to 2.1% in the January-March quarter of 2024 (from -0.3% in the October-December quarter of 2023) due to continued sluggish consumption and the increased benefits for low-income earners included in the economic stimulus package in November 2023.

In the April-June quarter of 2024, disposable income was significantly boosted by reductions in income and resident taxes, which are predicted to lead to a further increase in the household savings rate. In the July-September quarter, the savings rate is expected to decline sharply as a portion of these tax cuts is spent, and the rate will likely remain slightly below the pre-COVID-19 level (average 1.2% in 2019) thereafter.

The boost to consumption from the income and resident tax cuts will be temporary, while future consumption will be driven by the underlying trend in real disposable income, excluding temporary factors. While real disposable income is currently below pre-COVID-19 levels, due to the impact of inflation, it is expected to remain firm going forward, mainly due to an acceleration in the pace of nominal wage growth and an increase in real employee compensation as the rate or price inflation slows.

The boost to consumption from the income and resident tax cuts will be temporary, while future consumption will be driven by the underlying trend in real disposable income, excluding temporary factors. While real disposable income is currently below pre-COVID-19 levels, due to the impact of inflation, it is expected to remain firm going forward, mainly due to an acceleration in the pace of nominal wage growth and an increase in real employee compensation as the rate or price inflation slows.

Private consumption declined by 0.6% year-over-year in FY2023, which was the first decline in three years. Moderate growth of 1.1% in FY2024 and 0.9% in FY2025 is expected for this factor. Although the growth in real employee compensation is predicted to be modest in FY2024, disposable income will be elevated by the income and resident tax cuts. The effects of the tax cuts will dissipate in FY2025; however, stronger growth in real employee compensation is expected to contribute to an increase in real disposable income.

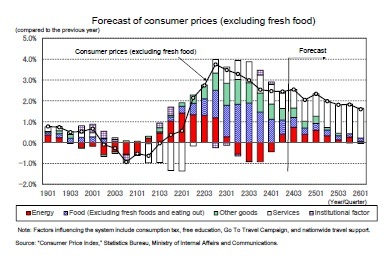

(Outlook for Prices)

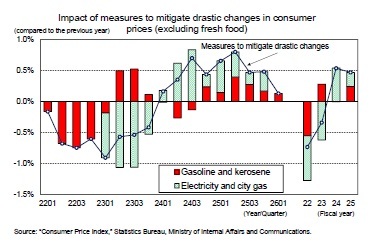

Consumer prices (excluding fresh food, hereinafter referred to as "core CPI") escalated by 4.2% year-over-year in January 2023, and this was the largest increase since September 1981 (41 years and 4 months). Subsequently, government measures to alleviate the burden of electricity and city gas bills have reduced prices to the 2% range, where they have been maintained since September 2023.

Energy prices turned positive in April 2024 for the first time in a year and three months. Following this, they rose sharply in May and June due to an increase in the unit price of the renewable energy generation levy and a reduction in discounts under the drastic price reduction measures for electricity and gas. These drastic easing measures are expected to temporarily end in July, at which time energy prices are predicted to show double-digit year-over-year growth. From September to November (for usage from August to October), the "Support Measures to Overcome Severe Summer Heat" are expected to significantly lower electricity and city gas bills, leading to a slowdown in energy price growth. However, once these support measures end in December, the growth rate is expected to recover.

The drastic easing measures implemented by the government for gasoline, kerosene, and other fuels are scheduled to expire at the end of 2024; however, since the current gasoline retail price is approximately 190 yen per liter without subsidies and this is well above the government's target of 175 yen per liter, it is likely that these measures will continue into 2025.

Consumer prices (excluding fresh food, hereinafter referred to as "core CPI") escalated by 4.2% year-over-year in January 2023, and this was the largest increase since September 1981 (41 years and 4 months). Subsequently, government measures to alleviate the burden of electricity and city gas bills have reduced prices to the 2% range, where they have been maintained since September 2023.

Energy prices turned positive in April 2024 for the first time in a year and three months. Following this, they rose sharply in May and June due to an increase in the unit price of the renewable energy generation levy and a reduction in discounts under the drastic price reduction measures for electricity and gas. These drastic easing measures are expected to temporarily end in July, at which time energy prices are predicted to show double-digit year-over-year growth. From September to November (for usage from August to October), the "Support Measures to Overcome Severe Summer Heat" are expected to significantly lower electricity and city gas bills, leading to a slowdown in energy price growth. However, once these support measures end in December, the growth rate is expected to recover.

The drastic easing measures implemented by the government for gasoline, kerosene, and other fuels are scheduled to expire at the end of 2024; however, since the current gasoline retail price is approximately 190 yen per liter without subsidies and this is well above the government's target of 175 yen per liter, it is likely that these measures will continue into 2025.

Currently, it is assumed that the support measures for electricity and city gas will continue until November 2024, the drastic easing measures for gasoline, kerosene, and other fuels will remain in place until the end of FY2024, and the subsidy rates will be reduced in FY2025.

The drastic easing measures had a downward impact on the core CPI growth rate until the October-December quarter of 2023. However, this reversed in the January-March quarter of 2024, and the impact of the end of these measures for electricity and city gas bills is expected to increase the growth rate by approximately 0.7% in the July-September quarter of 2024. In September-November 2024, the "Support Measures to Overcome Severe Summer Heat" will lower electricity and city gas prices, but the impact year-over-year will remain positive as the support measures implemented in the previous year had lowered the price level during that term.

The drastic easing measures had a downward impact on the core CPI growth rate until the October-December quarter of 2023. However, this reversed in the January-March quarter of 2024, and the impact of the end of these measures for electricity and city gas bills is expected to increase the growth rate by approximately 0.7% in the July-September quarter of 2024. In September-November 2024, the "Support Measures to Overcome Severe Summer Heat" will lower electricity and city gas prices, but the impact year-over-year will remain positive as the support measures implemented in the previous year had lowered the price level during that term.

On a fiscal year basis, the impact of the drastic easing measures on the core CPI growth rate was -0.7% in FY2022 and -0.3% in FY2023 and is predicted to be 0.5% in FY2024 and 0.5% in FY2025.

The core CPI growth rate is predicted to temporarily fall below 2% in October 2024 due to the slowdown in electricity and city gas growth under the "Support Measures to Overcome Severe Summer Heat"; however, once the support measures end, the rate is expected to return to the 2% range. Thereafter, the growth rate of core CPI is expected to continue decreasing, as the slower rate of increase in goods prices due to yen appreciation offsets the rise in service prices driven by wage increases. As a result, the core CPI growth rate for FY2025 is predicted to fall below the 2% inflation rate targeted by the Bank of Japan.

The price increase in FY2022 was mainly due to the rise in goods prices, particularly those of energy and food (excluding fresh food and eating out). In FY2023, the rate of increase in service prices rose, and the focus of price increases began to shift from goods to services. From the second half of FY2024 to FY2025, the contribution of services to the consumer price index is expected to exceed that of goods.

The price increase in FY2022 was mainly due to the rise in goods prices, particularly those of energy and food (excluding fresh food and eating out). In FY2023, the rate of increase in service prices rose, and the focus of price increases began to shift from goods to services. From the second half of FY2024 to FY2025, the contribution of services to the consumer price index is expected to exceed that of goods.The core CPI is forecasted to be 2.3% in FY2024 and 1.8% in FY2025, following a 2.8% year-over-year increase in FY2023. The core-core CPI (excluding fresh food and energy) is predicted to be 2.0% in FY2024 and 1.7% in FY2025, following a 3.9% year-over-year increase in FY2023.

The data in this publication has been obtained and processed from various sources, and we do not guarantee its accuracy or safety. The opinions and forecasts contained in this publication are for informational purposes only and are not intended as an inducement to enter into or cancel any contract.

03-3512-1836