- NLI Research Institute >

- Economics >

- Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

16/08/2024

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (August 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1.Positive growth of 3.1% on an annualized basis in the April-June quarter of 2024

Real GDP in the April-June quarter of 2024 increased by 0.8% from the previous quarter (3.1% on an annualized basis), marking the first positive growth in the last two quarters. Despite the persistent downward pressure from inflation, private consumption increased by 1.0% from the previous quarter, which was the first increase in five quarters. These enhanced spending levels related mainly to the recovery in automobile sales following the lifting of production and shipment suspensions caused by the fraud scandal. Capital investment also rose by 0.9% from the previous quarter due to strong corporate earnings, and this constituted the first increase in the last two quarters. In addition, government consumption (0.1% increase from the previous quarter) and public investment (4.5% increase from the previous quarter) contributed to the first rise in domestic demand in five quarters.

Exports of goods and services increased by 1.4% from the previous quarter, marking the first increase in the last two quarters; however, this was outpaced by a 1.7% rise in imports of goods and services, resulting in a -0.1% (annualized -0.4%) drag on external demand growth. The recovery in automobile production in the April-June quarter of 2024 from the previous quarter, driven by the easing of the certification fraud issue, contributed to boosting private consumption and capital investment.

The positive growth in the April-June quarter of 2024 is largely a reaction to the sharp decline in the previous quarter (-2.3% on an annualized basis), and the economy does not appear to have fully emerged from this back-and-forth pattern. In particular, the household sector has faced significant challenges since the COVID-19 pandemic. Although private consumption and residential investment increased in the April-June quarter of 2024, their levels remained lower (-1.1% and -12.0%, respectively) than the pre-COVID-19 levels (2019 average). To confirm a sustained recovery in the Japanese economy, the trends identified in the July-September quarter and onward must be closely monitored.

Exports of goods and services increased by 1.4% from the previous quarter, marking the first increase in the last two quarters; however, this was outpaced by a 1.7% rise in imports of goods and services, resulting in a -0.1% (annualized -0.4%) drag on external demand growth. The recovery in automobile production in the April-June quarter of 2024 from the previous quarter, driven by the easing of the certification fraud issue, contributed to boosting private consumption and capital investment.

The positive growth in the April-June quarter of 2024 is largely a reaction to the sharp decline in the previous quarter (-2.3% on an annualized basis), and the economy does not appear to have fully emerged from this back-and-forth pattern. In particular, the household sector has faced significant challenges since the COVID-19 pandemic. Although private consumption and residential investment increased in the April-June quarter of 2024, their levels remained lower (-1.1% and -12.0%, respectively) than the pre-COVID-19 levels (2019 average). To confirm a sustained recovery in the Japanese economy, the trends identified in the July-September quarter and onward must be closely monitored.

(Impact of Yen Appreciation on Corporate Earnings)

The Japanese yen continued to decline with reference to the US dollar due to the widening interest rate differential between the two countries, with the yen weakening to approximately 160 yen per dollar from the end of June to early July 2024. However, the yen began to appreciate against the dollar in mid-July as a reaction to factors such as the slowdown in the US consumer price index and the declaration by Donald Trump to correct the strong dollar. The Bank of Japan raised its policy rate on July 31, while the US employment report for July significantly undershot expectations and raised concerns of a possible US recession. These factors led to a sharp appreciation of the yen to 140 yen per dollar.

The Japanese yen continued to decline with reference to the US dollar due to the widening interest rate differential between the two countries, with the yen weakening to approximately 160 yen per dollar from the end of June to early July 2024. However, the yen began to appreciate against the dollar in mid-July as a reaction to factors such as the slowdown in the US consumer price index and the declaration by Donald Trump to correct the strong dollar. The Bank of Japan raised its policy rate on July 31, while the US employment report for July significantly undershot expectations and raised concerns of a possible US recession. These factors led to a sharp appreciation of the yen to 140 yen per dollar.

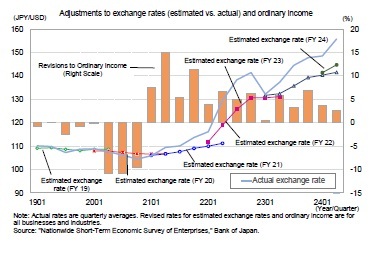

According to the June 2024 BOJ Tankan survey, the FY2024 current profit plan (all sizes, all industries) predicts a decrease of 7.5% year-over-year, with the assumed exchange rate for FY2024 set at ¥144.77 to the dollar across all sizes and industries. Since 2021, the actual exchange rate has been weaker than the assumed rate, resulting in upward revisions to earnings forecasts. For example, the assumed exchange rate for FY2023 was originally ¥131.72 to the dollar (as of March 2023), whereas the actual exchange rate was greater than 10 yen weaker than this figure (¥144.6 to the dollar FY2023 average) This resulted in a significant upward revision of current profits from the initially forecasted -2.6% to a revised 12.4% year-over-year.

According to the June 2024 BOJ Tankan survey, the FY2024 current profit plan (all sizes, all industries) predicts a decrease of 7.5% year-over-year, with the assumed exchange rate for FY2024 set at ¥144.77 to the dollar across all sizes and industries. Since 2021, the actual exchange rate has been weaker than the assumed rate, resulting in upward revisions to earnings forecasts. For example, the assumed exchange rate for FY2023 was originally ¥131.72 to the dollar (as of March 2023), whereas the actual exchange rate was greater than 10 yen weaker than this figure (¥144.6 to the dollar FY2023 average) This resulted in a significant upward revision of current profits from the initially forecasted -2.6% to a revised 12.4% year-over-year.

Although the current exchange rate is slightly weaker than the assumed rate, once the actual rate surpasses the assumed rate, the risk of downward revisions to corporate earnings increases.

This forecast assumes that the US will begin lowering interest rates in September 2024 while Japan raises its policy rate (unsecured overnight call rate) from the current 0.25% to 0.75% by the end of FY2025, leading to yen appreciation to 136 yen to the dollar by the end of FY2025.

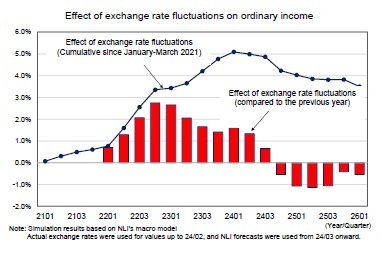

This forecast assumes that the US will begin lowering interest rates in September 2024 while Japan raises its policy rate (unsecured overnight call rate) from the current 0.25% to 0.75% by the end of FY2025, leading to yen appreciation to 136 yen to the dollar by the end of FY2025.Using our macroeconomic model, we estimate that the impact of exchange rate fluctuations on current profits from 2021 onward has consistently positive due to yen depreciation. However, this cumulative boost is expected to peak in the January-March quarter of 2024, begin to decline, and become negative on a year-over-year basis from the October-December 2024 quarter onward.

(Limited Impact of Yen Appreciation on Exports)

Since 2021, exports have remained relatively flat despite the significant depreciation of the yen. This stagnation is partially the result of a slowdown in overseas economies, supply constraints such as semiconductor shortages, and the shutdown of automobile plants due to the certification fraud issue. In addition, exports may have become less sensitive to exchange rate fluctuations. For example, companies previously tended to lower contract currency prices during periods of yen depreciation to boost export volumes and expand their overseas market share. However, during the current yen depreciation phase, which bottomed out in the April-June quarter of 2020, the export price index in contract currency terms has continued to rise, indicating that companies are maintaining prices to secure revenue in value terms as opposed to increasing export volumes.

Since 2021, exports have remained relatively flat despite the significant depreciation of the yen. This stagnation is partially the result of a slowdown in overseas economies, supply constraints such as semiconductor shortages, and the shutdown of automobile plants due to the certification fraud issue. In addition, exports may have become less sensitive to exchange rate fluctuations. For example, companies previously tended to lower contract currency prices during periods of yen depreciation to boost export volumes and expand their overseas market share. However, during the current yen depreciation phase, which bottomed out in the April-June quarter of 2020, the export price index in contract currency terms has continued to rise, indicating that companies are maintaining prices to secure revenue in value terms as opposed to increasing export volumes.

The increase in price competitiveness due to yen depreciation did not lead to a significant rise in export volumes; therefore, the downward pressure on export volumes from yen appreciation is also expected to be limited. The major determinant of future exports will more likely be the income factor, namely the growth rate of overseas economies.

In terms of overseas economic conditions, US real GDP growth is expected to slow from 2.5% in 2024 to 1.6% in 2025, partly due to the cumulative effects of monetary tightening. In contrast, real GDP growth in the Eurozone (0.4% year-over-year in 2023), is expected to gradually recover to 0.7% in 2024 and 1.4% in 2025, although a strong recovery is not anticipated. China's real GDP growth accelerated from 3.0% in 2022 to 5.2% in 2023 due to the cancellation of the zero-COVID policy; however, this growth is expected to decelerate to 4.8% in 2024 and 4.3% in 2025, reflecting the ongoing slowdown in the real estate market. Overall, overseas economies are expected to recover moderately through FY2025, although the growth rates will remain at low levels.

The global adjustment in IT-related goods appears to be reaching a turning point, which is an encouraging sign. For example, global semiconductor sales, which have been declining year-over-year since the summer of 2019 and bottomed out in the spring of 2023, are now showing double-digit growth year-over-year. In addition, the domestic balance of shipments and inventories of electronic components and devices (shipments year-over-year minus inventories year-over-year) was positive in the July-September quarter of 2023 for the first time in eight quarters and remained positive for the next four consecutive quarters. Although export growth is unlikely to accelerate significantly due to continued low growth in overseas economies, the recovery trend is expected to continue, especially in IT-related goods. The GDP statistics relating to the exports of goods and services are forecasted to rise moderately by 2.0% year-over-year in FY2024 and 2.8% in FY2025.

In terms of overseas economic conditions, US real GDP growth is expected to slow from 2.5% in 2024 to 1.6% in 2025, partly due to the cumulative effects of monetary tightening. In contrast, real GDP growth in the Eurozone (0.4% year-over-year in 2023), is expected to gradually recover to 0.7% in 2024 and 1.4% in 2025, although a strong recovery is not anticipated. China's real GDP growth accelerated from 3.0% in 2022 to 5.2% in 2023 due to the cancellation of the zero-COVID policy; however, this growth is expected to decelerate to 4.8% in 2024 and 4.3% in 2025, reflecting the ongoing slowdown in the real estate market. Overall, overseas economies are expected to recover moderately through FY2025, although the growth rates will remain at low levels.

The global adjustment in IT-related goods appears to be reaching a turning point, which is an encouraging sign. For example, global semiconductor sales, which have been declining year-over-year since the summer of 2019 and bottomed out in the spring of 2023, are now showing double-digit growth year-over-year. In addition, the domestic balance of shipments and inventories of electronic components and devices (shipments year-over-year minus inventories year-over-year) was positive in the July-September quarter of 2023 for the first time in eight quarters and remained positive for the next four consecutive quarters. Although export growth is unlikely to accelerate significantly due to continued low growth in overseas economies, the recovery trend is expected to continue, especially in IT-related goods. The GDP statistics relating to the exports of goods and services are forecasted to rise moderately by 2.0% year-over-year in FY2024 and 2.8% in FY2025.

(Wage Rate from the 2024 Spring Wage Negotiations Increases to 5% for the First Time in 33 Years)

According to the "Status of Spring Wage Hike Demands and Compensation Results of Major Private Corporations" released by the Ministry of Health, Labour and Welfare on August 2, 2024, the wage increase rate for 2024 was 5.33%. This corresponds to a 1.73 percentage point boost from the 3.60% reported in 2023, marking the first time since 1991 (5.65%) that the rate has exceeded 5%. Furthermore, RENGO's "2024 Spring Wage Struggle Final Response Tabulation Results" states that the average wage increase in 2024 was 5.10% and the "portion of wage increase" that corresponded to the base increase was 3.56% (2.12% in 2023).

The real wage growth rate (nominal wages adjusted for consumer prices) has been negative since April 2022, but turned positive in June 2024, marking the first positive figure in two years and three months. However, this June turnaround was mainly due to a significant 7.6% year-over-year increase in special cash earnings, while regular cash earnings (scheduled earnings plus overtime earnings) remained negative, with a -1.1% year-over-year change in real terms. Most summer bonuses are paid in June and July; however, according to the Monthly Labour Survey, more establishments paid their summer bonuses in June compared to the previous year, which may have contributed to the high growth in special cash earnings in June. Special payroll growth is expected to slow significantly in July and possibly result in negative real wage growth.

Real wage growth is predicted to stabilize and become positive from October to December 2024 onward, as the results of the 2024 Spring Wage Negotiations are reflected, with nominal wage growth (total cash earnings) led by scheduled earnings expected to be in the 3% range year-over-year. Meanwhile, the consumer price index (excluding imputed rent), which is currently approximately 3%, is expected to approach 2% range. The current forecast assumes that the wage hike rate in the 2025 Spring Wage Negotiations will slow to 4.50%, which is lower than the 2024 rate, but higher than that of 2023 (3.60%). Although yen appreciation will dampen corporate earnings growth, the continued strong sense of labor shortages in the corporate sector and the high consumer price index are expected to boost the wage hike rate.

According to the "Status of Spring Wage Hike Demands and Compensation Results of Major Private Corporations" released by the Ministry of Health, Labour and Welfare on August 2, 2024, the wage increase rate for 2024 was 5.33%. This corresponds to a 1.73 percentage point boost from the 3.60% reported in 2023, marking the first time since 1991 (5.65%) that the rate has exceeded 5%. Furthermore, RENGO's "2024 Spring Wage Struggle Final Response Tabulation Results" states that the average wage increase in 2024 was 5.10% and the "portion of wage increase" that corresponded to the base increase was 3.56% (2.12% in 2023).

The real wage growth rate (nominal wages adjusted for consumer prices) has been negative since April 2022, but turned positive in June 2024, marking the first positive figure in two years and three months. However, this June turnaround was mainly due to a significant 7.6% year-over-year increase in special cash earnings, while regular cash earnings (scheduled earnings plus overtime earnings) remained negative, with a -1.1% year-over-year change in real terms. Most summer bonuses are paid in June and July; however, according to the Monthly Labour Survey, more establishments paid their summer bonuses in June compared to the previous year, which may have contributed to the high growth in special cash earnings in June. Special payroll growth is expected to slow significantly in July and possibly result in negative real wage growth.

Real wage growth is predicted to stabilize and become positive from October to December 2024 onward, as the results of the 2024 Spring Wage Negotiations are reflected, with nominal wage growth (total cash earnings) led by scheduled earnings expected to be in the 3% range year-over-year. Meanwhile, the consumer price index (excluding imputed rent), which is currently approximately 3%, is expected to approach 2% range. The current forecast assumes that the wage hike rate in the 2025 Spring Wage Negotiations will slow to 4.50%, which is lower than the 2024 rate, but higher than that of 2023 (3.60%). Although yen appreciation will dampen corporate earnings growth, the continued strong sense of labor shortages in the corporate sector and the high consumer price index are expected to boost the wage hike rate.

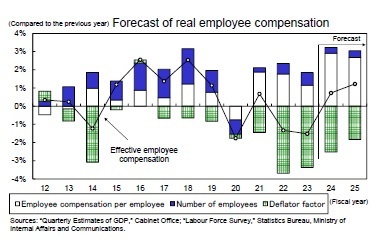

Nominal employee compensation increased by 1.9% year-over-year in FY2023, marking the third consecutive year of growth. However, real employee compensation declined by 1.5% year-over-year for the second consecutive year due to high consumer price inflation. Nominal employee compensation is expected to maintain strong growth by increasing 3.2% year-over-year in FY2024 and 3.1% year-over-year in FY2025. Similarly, real employee compensation is forecasted to increase 0.7% year-over-year in FY2024, the first increase in three years, and 1.2% year-over-year in FY2025, supported by a slower rate of price increases.

Nominal employee compensation increased by 1.9% year-over-year in FY2023, marking the third consecutive year of growth. However, real employee compensation declined by 1.5% year-over-year for the second consecutive year due to high consumer price inflation. Nominal employee compensation is expected to maintain strong growth by increasing 3.2% year-over-year in FY2024 and 3.1% year-over-year in FY2025. Similarly, real employee compensation is forecasted to increase 0.7% year-over-year in FY2024, the first increase in three years, and 1.2% year-over-year in FY2025, supported by a slower rate of price increases.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング