- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)

16/02/2024

Japan’s Economic Outlook for Fiscal Years 2023 to 2025 (February 2024)

Font size

- S

- M

- L

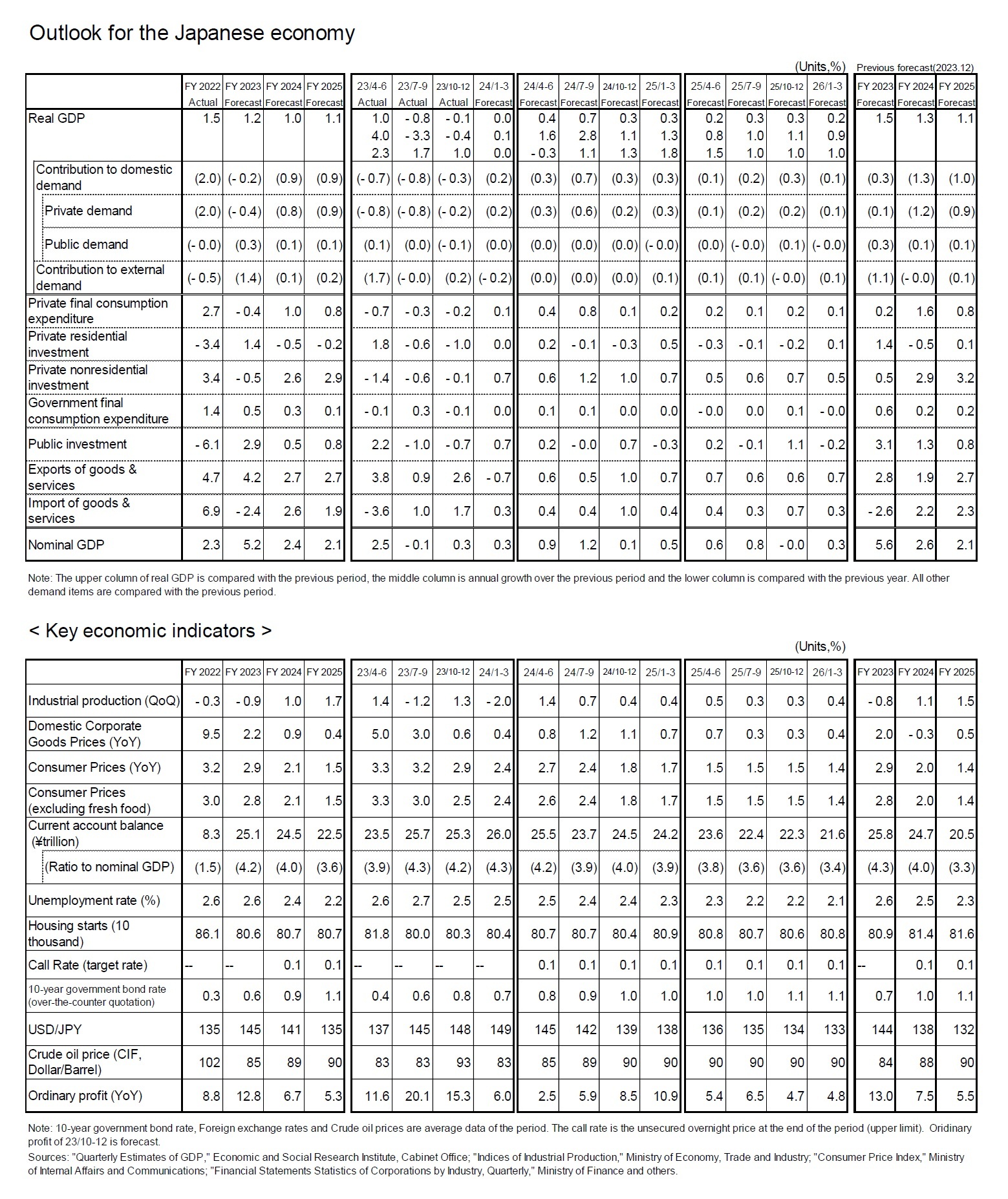

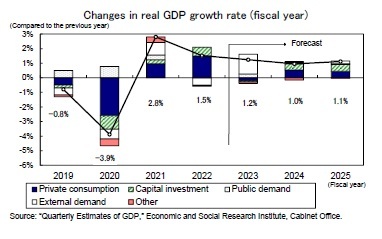

2.The real growth rate is projected to be 1.2% in FY2023, 1.0% in FY2024, and 1.1% in FY2025.

(There is a high risk of a downturn in both domestic and foreign demand in the first half of 2024)

The October–December quarter of 2023 marked the second consecutive quarter of negative growth, mainly due to a drop in domestic demand. It is particularly concerning that private consumption and capital investment—the pillars of domestic demand—have declined for three consecutive quarters since the April–June quarter of 2023, despite the normalization of socioeconomic activities following the reclassification of COVID-19 to a Class 5 disease.

The October–December quarter of 2023 marked the second consecutive quarter of negative growth, mainly due to a drop in domestic demand. It is particularly concerning that private consumption and capital investment—the pillars of domestic demand—have declined for three consecutive quarters since the April–June quarter of 2023, despite the normalization of socioeconomic activities following the reclassification of COVID-19 to a Class 5 disease.

Industrial production, which is linked to the business cycle, increased by 1.3% from the previous quarter in the October–December quarter of 2023), the first increase in two quarters. However, a production cutback is inevitable in January 2024 because of the impact of production stoppages following the revelation of fraud at some automakers. The manufacturing production forecast index, which represents the production plans of companies, indicates ˗6.2% from the previous month for January and 2.2% from the previous month for February. Industrial production is expected to turn negative in the January–March quarter of 2024, mainly due to a sharp decline in automobile production.

The impact of production stoppages has already been felt in car sales which fell sharply by 11.5% in January 2024 from the previous month (seasonally adjusted by the Institute). In the January–March quarter of 2024, exports of goods and services are expected to remain sluggish because of the rebound from the increase in service exports in the October–December quarter of 2023. Moreover, domestic private demand, including private consumption and capital investment, is also expected to remain stagnant. Domestic private demand, including private consumption and capital investment, is forecasted to experience an annualized growth rate of 0.1% from the previous quarter (i.e., almost zero growth).

The real GDP will probably increase in the April–June quarter of 2024 to an annualized rate of 1.6% from the previous quarter. However, because the real disposable income of households will not substantially increase until the summer of 2024—when the results of the 2024 spring wage offensive will be reflected and income tax and resident tax cuts will be implemented—a full recovery in consumption is not expected until then. In the first half of 2024, both domestic and foreign demand will continue to face high downside risks.

The tax cuts included in the economic stimulus package are scheduled to be implemented in June 2024 and will boost private consumption in the July–September quarter, which, as a result, is expected to show an annualized growth rate of 2.8% from the previous quarter. Nevertheless, the effects of the tax cuts will only be temporary, and from the October–December quarter onward, an annualized growth rate of around 1% is expected.

Therefore, the real GDP growth is projected to be 1.2% in FY2023, 1.0% in FY2024, and 1.1% in FY2025.In FY2023, exports will grow slowly but imports will decline against a backdrop of weak domestic demand, thus, external demand will help boost the growth rate. Domestic demand is expected to decline for the first time in three years, mainly due to lower private consumption against a backdrop of lower real incomes accompanying rising prices.

Therefore, the real GDP growth is projected to be 1.2% in FY2023, 1.0% in FY2024, and 1.1% in FY2025.In FY2023, exports will grow slowly but imports will decline against a backdrop of weak domestic demand, thus, external demand will help boost the growth rate. Domestic demand is expected to decline for the first time in three years, mainly due to lower private consumption against a backdrop of lower real incomes accompanying rising prices.

In FY2024, domestic demand is expected to turn to growth, as private consumption is predicted to recover because of the increase in real employee compensation and the effects of tax cuts. In addition, capital investment is predicted to remain strong against the backdrop of high corporate earnings.

Although private consumption growth will slow down in FY2025 as a reaction to the tax cuts, capital investment will remain strong, ensuring growth of about 1%, which is slightly above the potential growth rate.

Although private consumption growth will slow down in FY2025 as a reaction to the tax cuts, capital investment will remain strong, ensuring growth of about 1%, which is slightly above the potential growth rate.

(Inflation outlook)

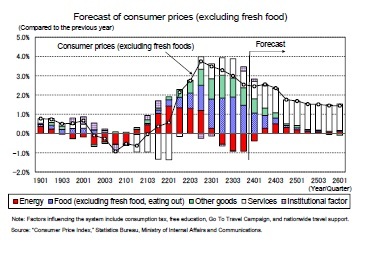

Consumer prices (excluding fresh food, hereafter, core CPI) rose to 4.2% y/y in January 2023, the highest increase in 41 years and 4 months (since September 1981), but then slowed down as a result of the measures taken by the government to ease the burden of electricity and city gas bills, and have remained hovering around the 2% range since September 2023.

Consumer prices (excluding fresh food, hereafter, core CPI) rose to 4.2% y/y in January 2023, the highest increase in 41 years and 4 months (since September 1981), but then slowed down as a result of the measures taken by the government to ease the burden of electricity and city gas bills, and have remained hovering around the 2% range since September 2023.

The current price hikes were initially due to large increases in the prices of energy and food, triggered by a sharp rise in import prices because of high crude oil prices and a weak yen. However, energy prices peaked at around 20% y/y in early 2022 and continued to slow down. After entering 2023, energy prices have been negative, partly because of the government’s drastic easing measures. In addition, food prices (excluding fresh food) rose to 9.2% y/y in August 2023 because of the spread of the price pass-on of higher raw material costs associated with soaring import prices, but decreased to 6.2% y/y in December, reflecting the stabilization of food prices in the upstream stage (i.e., import prices and domestic corporate prices).

The current price hikes were initially due to large increases in the prices of energy and food, triggered by a sharp rise in import prices because of high crude oil prices and a weak yen. However, energy prices peaked at around 20% y/y in early 2022 and continued to slow down. After entering 2023, energy prices have been negative, partly because of the government’s drastic easing measures. In addition, food prices (excluding fresh food) rose to 9.2% y/y in August 2023 because of the spread of the price pass-on of higher raw material costs associated with soaring import prices, but decreased to 6.2% y/y in December, reflecting the stabilization of food prices in the upstream stage (i.e., import prices and domestic corporate prices).

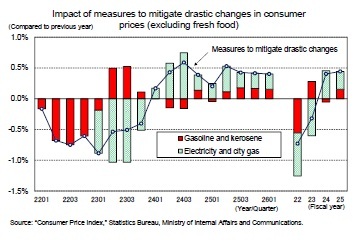

The price stabilization measures for gasoline and kerosene, in effect since January 2022, will continue until the end of April 2024. In addition, the measures for electricity and city gas, in effect since February 2023, will continue until April 2024, with an expected reduction of subsidies in May.

The current over-the-counter price of gasoline is about 190 yen per liter, without subsidies, and unless the yen appreciates and crude oil prices fall significantly, the price will remain well above the government’s target of 175 yen per liter for May 2024. Hence, it is highly probable that the drastic easing measures for gasoline and kerosene will continue after May 2024.

The current forecast assumes that the gasoline subsidy will remain as it is until the end of FY2024 and will continue in FY2025 with a reduced amount and that the subsidies for electricity and city gas will continue throughout FY2024 with a reduced amount and will end in FY2025.

The drastic easing measures depressed the core CPI inflation rate until the October–December quarter of 2023 but will boost it starting in the January–March quarter of 2024. On a fiscal year basis, the impact of the drastic easing measures on the core CPI inflation rate is expected to be about ˗0.7% in FY2022, ˗0.3% in FY2023, 0.4% in FY2024, and 0.4% in FY2025.

The rise in import prices, which are the main cause of high prices, has stopped and the increase rate in the prices of goods has already peaked. By contrast, the prices of services, which are linked to labor costs, have grown at about 2% y/y since August 2023, whereas, in December, the prices of goods (excluding fresh food) and services grew at the same rate (2.3%).

Furthermore, the prices of services which continue to grow in the low 2% range, slightly above the base salary increase in 2023, and will remain high as companies continue to pass on increased labor costs to their consumers.

Although the increase rate of the core CPI continues to be influenced by various support measures taken by the government, the underlying trend continues to slow down. Notwithstanding, the core CPI growth rate is not expected to fall below the BOJ’s target of 2% until the second half of FY2024, when the positive effect of the weaker yen is expected to wane, and the increase rate of the prices of food and other goods is expected to slow down.

Furthermore, the prices of services which continue to grow in the low 2% range, slightly above the base salary increase in 2023, and will remain high as companies continue to pass on increased labor costs to their consumers.

Although the increase rate of the core CPI continues to be influenced by various support measures taken by the government, the underlying trend continues to slow down. Notwithstanding, the core CPI growth rate is not expected to fall below the BOJ’s target of 2% until the second half of FY2024, when the positive effect of the weaker yen is expected to wane, and the increase rate of the prices of food and other goods is expected to slow down.

The increases in the prices of goods and services in FY2022 were mostly due to rises in the prices of energy and food (excluding fresh food and eating out). Nonetheless, the focus of price increases is shifting from goods to services, and from FY2024 onward, services will exceed goods in their contribution to CPI growth.

The increases in the prices of goods and services in FY2022 were mostly due to rises in the prices of energy and food (excluding fresh food and eating out). Nonetheless, the focus of price increases is shifting from goods to services, and from FY2024 onward, services will exceed goods in their contribution to CPI growth.The core CPI is projected to be 2.8% in FY2023, 2.1% in FY2024, and 1.5% in FY2025, following the 3.0% seen in FY2022. In addition, the core CPI is projected to be 3.8% y/y in FY2023, 1.9% in FY2024, and 1.5% in FY2025 following the 2.2% seen in FY2022.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング