- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

16/08/2023

Japan’s Economic Outlook for the Fiscal Years 2023 and 2024 (August 2023)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

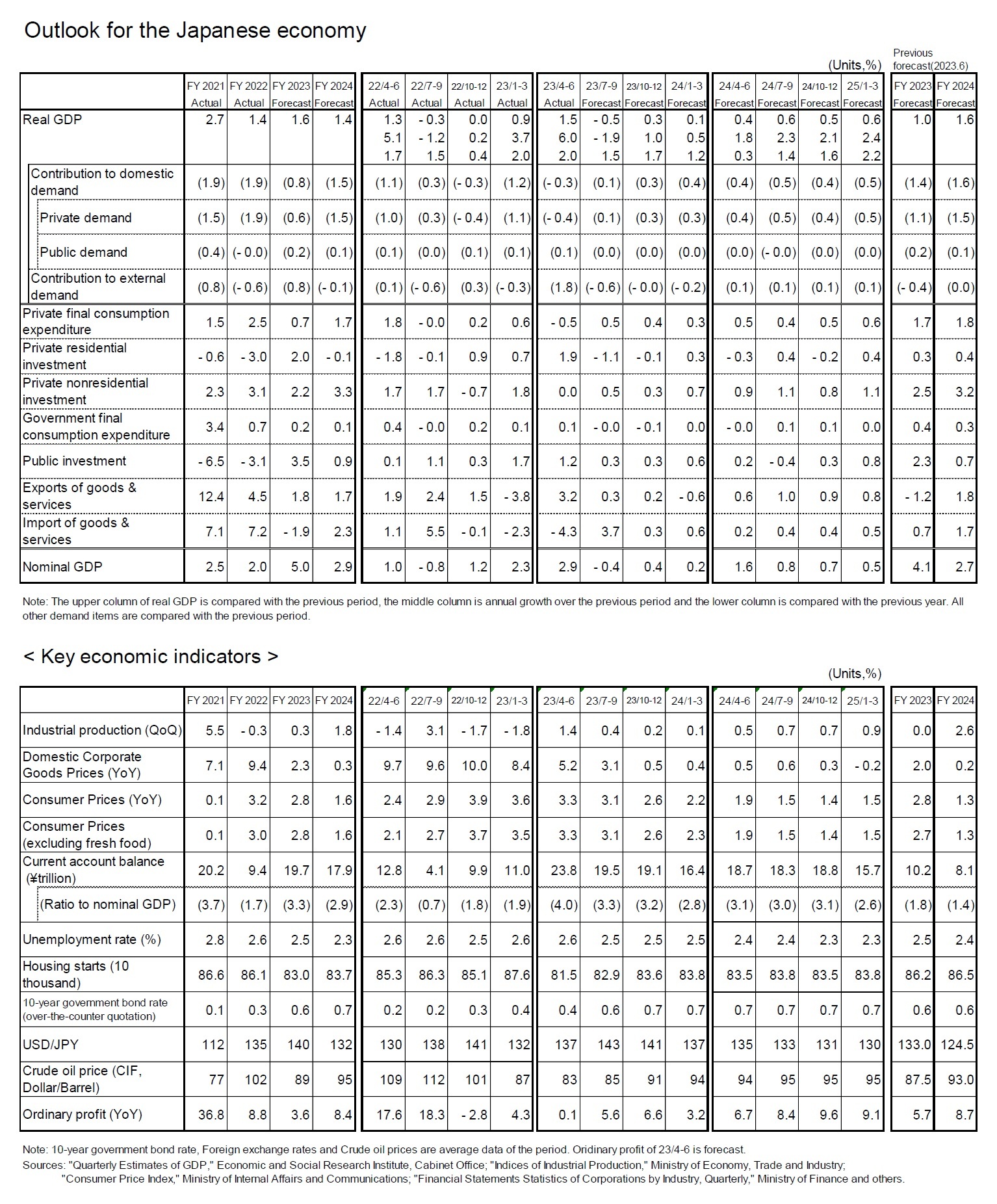

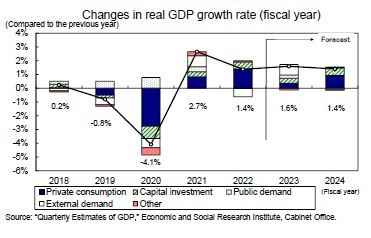

2.Real GDP growth rate is projected to be 1.6% in FY 2023 and 1.4% in FY 2024

(Growth will continue to be supported by domestic demand)

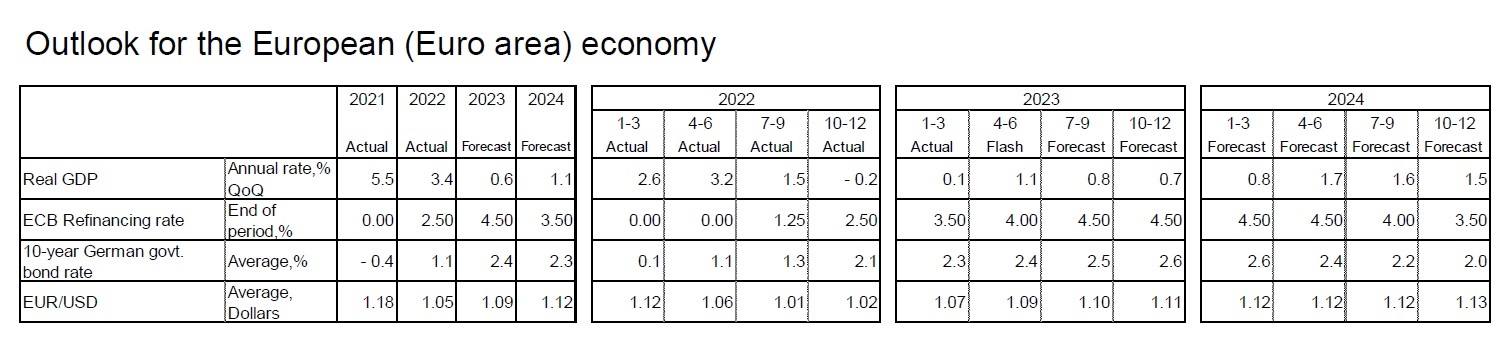

Although foreign demand played a pivotal role in propelling growth during the April-June quarter of 2023, the substantial increase in exports was primarily a response to the contraction witnessed in the January-March quarter. Looking ahead, exports of goods are likely to remain sluggish due to the slowdown in overseas economies, although exports of services will continue to increase from the July-September quarter, mainly as a result of inbound tourist demand. Exports are not expected to be the driving force of the economy in the near term. On the other hand, capital investment will continue to increase on the back of high levels of corporate earnings, while private consumption will recover, especially in face-to-face services, as socioeconomic activities normalize. Thus, the Japanese economy is expected to continue to grow, primarily as a consequence of domestic demand.

In the July-September quarter of 2023, real GDP is expected to decline for the first time in four quarters to -1.9% (annualized q-o-q). Imports will increase sharply in response to the decline in the April-June quarter (-4.3% from the previous quarter), whereas exports will remain low, and external demand will significantly depress the growth rate. Although domestic demand such as private consumption will remain resilient, negative growth will be unavoidable due to the large drop in external demand.

Although foreign demand played a pivotal role in propelling growth during the April-June quarter of 2023, the substantial increase in exports was primarily a response to the contraction witnessed in the January-March quarter. Looking ahead, exports of goods are likely to remain sluggish due to the slowdown in overseas economies, although exports of services will continue to increase from the July-September quarter, mainly as a result of inbound tourist demand. Exports are not expected to be the driving force of the economy in the near term. On the other hand, capital investment will continue to increase on the back of high levels of corporate earnings, while private consumption will recover, especially in face-to-face services, as socioeconomic activities normalize. Thus, the Japanese economy is expected to continue to grow, primarily as a consequence of domestic demand.

In the July-September quarter of 2023, real GDP is expected to decline for the first time in four quarters to -1.9% (annualized q-o-q). Imports will increase sharply in response to the decline in the April-June quarter (-4.3% from the previous quarter), whereas exports will remain low, and external demand will significantly depress the growth rate. Although domestic demand such as private consumption will remain resilient, negative growth will be unavoidable due to the large drop in external demand.

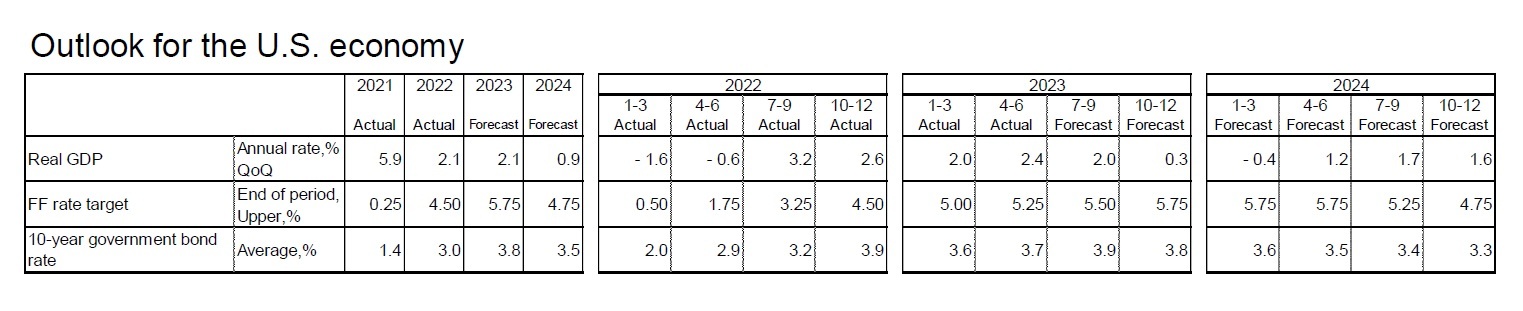

In the January-March quarter of 2024, when the U.S. economy is expected to experience slight negative growth, Japan’s annual growth rate will be in the low zero-percent range, mainly due to a decline in exports. However, after the start of fiscal 2024, when the overseas economy is expected to rebound, the growth rate will increase mainly thanks to a recovery in exports.

In the January-March quarter of 2024, when the U.S. economy is expected to experience slight negative growth, Japan’s annual growth rate will be in the low zero-percent range, mainly due to a decline in exports. However, after the start of fiscal 2024, when the overseas economy is expected to rebound, the growth rate will increase mainly thanks to a recovery in exports.Real GDP growth rate is projected to be 1.6% in FY 2023 and 1.4% in FY 2024. In FY 2024, while exports are expected to remain low, imports will outpace exports, reflecting the strength of domestic demand. This means that external demand is expected to make a small negative contribution to the growth rate. On the other hand, domestic demand is expected to slow down in FY 2023, mainly due to sluggish private consumption growth on the back of lower real incomes. Meanwhile, in FY 2024, domestic demand growth is likely to accelerate again because consumption growth will increase on the back of higher real incomes and capital investment will remain firm.

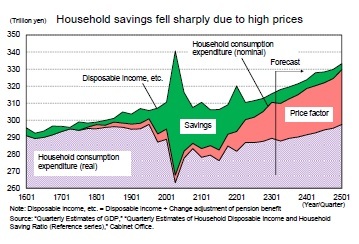

(Household savings rate approaches normal level)

Private consumption in the April-June quarter of 2023 declined for the first time in three quarters, falling by 0.5% from the previous quarter. This decline can be attributed to factors such as the decrease in real purchasing power due to inflation. Additionally, the household savings rate has converged toward a standard level, and the stimulus from the reduction in the savings rate seems to have reached its limit, resulting in sluggish consumption.

The household savings rate, which averaged 1.2% from 2015–2019 prior to the onset of the COVID-19 pandemic, jumped to 21.4% in the April-June quarter of 2020. This substantial increase was a result of two key factors: the pronounced reduction in consumption following the declaration of a state of emergency in April 2020, and a significant rise in disposable income owing to the provision of special fixed benefits.

Private consumption in the April-June quarter of 2023 declined for the first time in three quarters, falling by 0.5% from the previous quarter. This decline can be attributed to factors such as the decrease in real purchasing power due to inflation. Additionally, the household savings rate has converged toward a standard level, and the stimulus from the reduction in the savings rate seems to have reached its limit, resulting in sluggish consumption.

The household savings rate, which averaged 1.2% from 2015–2019 prior to the onset of the COVID-19 pandemic, jumped to 21.4% in the April-June quarter of 2020. This substantial increase was a result of two key factors: the pronounced reduction in consumption following the declaration of a state of emergency in April 2020, and a significant rise in disposable income owing to the provision of special fixed benefits.

The variance in household savings from the normal level (2015–2019 average) in the January-March quarter of 2023 can be broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditures), and price factors (household consumption deflator). The increase in disposable income by 16.6 trillion yen, due to various COVID-19 related support measures by the government, as well as an increase in employer compensation, is a factor boosting savings. In addition, a decline in the level of real household consumption expenditure boosted savings by 4.7 trillion yen. Having said this, the greatly accelerated pace of price inflation has reduced savings by -19.8 trillion yen. As a result, household savings, which increased to 72.9 trillion yen (seasonally adjusted, annualized) in the April-June quarter of 2020, have declined to near normal levels of 5.0 trillion yen in the January-March quarter of 2023 (up by 1.5 trillion yen from the 2015–2019 average).

The variance in household savings from the normal level (2015–2019 average) in the January-March quarter of 2023 can be broken down into income factors (disposable income, etc.), consumption factors (real household consumption expenditures), and price factors (household consumption deflator). The increase in disposable income by 16.6 trillion yen, due to various COVID-19 related support measures by the government, as well as an increase in employer compensation, is a factor boosting savings. In addition, a decline in the level of real household consumption expenditure boosted savings by 4.7 trillion yen. Having said this, the greatly accelerated pace of price inflation has reduced savings by -19.8 trillion yen. As a result, household savings, which increased to 72.9 trillion yen (seasonally adjusted, annualized) in the April-June quarter of 2020, have declined to near normal levels of 5.0 trillion yen in the January-March quarter of 2023 (up by 1.5 trillion yen from the 2015–2019 average).Looking ahead, while inflation will continue to bring down the savings rate, rising disposable income growth due to higher wages will support consumption. In our current outlook, we assume that the household savings rate will decline to roughly the same level as that seen under normal circumstances by the end of FY2024.

Private consumption is forecast to grow 0.7% y/y in FY 2023 and 1.7% y/y in FY 2024. The continued decline in real incomes due to the persistently high rate of price inflation in FY 2023 will suppress consumption growth, while the increase in real incomes due to the decline in the rate of price inflation in FY 2024 will boost consumption growth. In FY2024, consumption growth is expected to receive a boost from a rise in real income, driven by a decrease in the rate of price inflation.

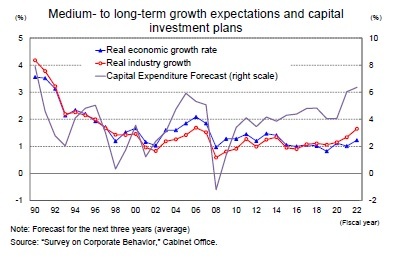

(Medium- to long-term growth expectations among corporations will gradually increase)

Capital investment is expected to remain stable, with a growth rate of 2.2% y/y in FY 2023 and 3.3% y/y in FY 2024.

A major influence on medium- to long-term capital investment trends is the expected growth rate of companies. One of the reasons why the expected growth rate has been sluggish for a long time can be attributed to the fact that many corporate managers have believed that a shrinking domestic market is inevitable under a declining population.

Capital investment is expected to remain stable, with a growth rate of 2.2% y/y in FY 2023 and 3.3% y/y in FY 2024.

A major influence on medium- to long-term capital investment trends is the expected growth rate of companies. One of the reasons why the expected growth rate has been sluggish for a long time can be attributed to the fact that many corporate managers have believed that a shrinking domestic market is inevitable under a declining population.

According to the Cabinet Office's " Survey on Business Behavior," the outlook for real economic growth for companies over the next three years remains low, at just 1.2% (surveyed in FY 2022). However, the outlook for real growth in industry demand, which had been lower than the outlook for real economic growth for 18 consecutive years since FY 1999, has exceeded the real economic growth rate since FY 2017, rising to 1.6% in FY 2022. In line with this, the outlook for capital investment also increased to 6.4% in FY 2022 (the annual average for the next three years and the highest level in approximately 30 years). The fact that industry demand growth expectations are improving is a positive factor in the outlook for capital investment.

According to the Cabinet Office's " Survey on Business Behavior," the outlook for real economic growth for companies over the next three years remains low, at just 1.2% (surveyed in FY 2022). However, the outlook for real growth in industry demand, which had been lower than the outlook for real economic growth for 18 consecutive years since FY 1999, has exceeded the real economic growth rate since FY 2017, rising to 1.6% in FY 2022. In line with this, the outlook for capital investment also increased to 6.4% in FY 2022 (the annual average for the next three years and the highest level in approximately 30 years). The fact that industry demand growth expectations are improving is a positive factor in the outlook for capital investment.

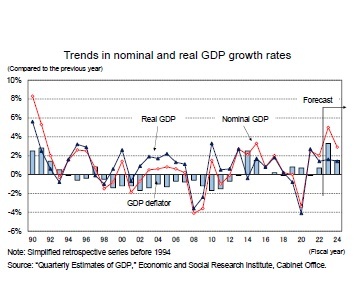

(Nominal GDP growth rate in FY 2023 set to be the highest it has been in 32 years)

The growth rate of nominal GDP continues to outpace that of real GDP. This divergence is driven by a pronounced rise in the GDP deflator, which is attributed to the escalation of the domestic demand deflator stemming from the propagation of higher import prices into domestic prices, the decline of import deflator, which is a deduction from GDP, mirroring the fall in oil prices. After increasing from 3.4% in the April-June quarter to 4.6% y/y in the July-September quarter, it is widely expected to peak out, but the GDP deflator in FY 2023 will be 3.3% y/y, a significant acceleration from the 0.7% y/y in FY 2022. As a result, nominal GDP growth rate in FY 2023 is expected to be 5.0%, the highest it has been in 32 years since FY 1991 (5.3%).2

2 Based on simplified retrospective series of GDP statistics.

The growth rate of nominal GDP continues to outpace that of real GDP. This divergence is driven by a pronounced rise in the GDP deflator, which is attributed to the escalation of the domestic demand deflator stemming from the propagation of higher import prices into domestic prices, the decline of import deflator, which is a deduction from GDP, mirroring the fall in oil prices. After increasing from 3.4% in the April-June quarter to 4.6% y/y in the July-September quarter, it is widely expected to peak out, but the GDP deflator in FY 2023 will be 3.3% y/y, a significant acceleration from the 0.7% y/y in FY 2022. As a result, nominal GDP growth rate in FY 2023 is expected to be 5.0%, the highest it has been in 32 years since FY 1991 (5.3%).2

2 Based on simplified retrospective series of GDP statistics.

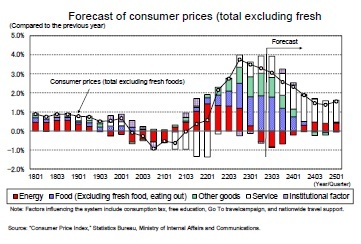

(Outlook for consumer price inflation)

Consumer Prices (excluding fresh food, hereinafter core CPI) grew to 4.2% y/y in January 2023 (the highest growth in 41 years and 4 months since September 1981) and has remained in the low 3% range since February due to government measures to ease the burden of electricity and city gas bills. However, the core core CPI (excluding fresh food and energy) has increased to the upper 4% range, further increasing the underlying upward pressure on prices.

The rise in import prices, which previously stood as the main cause of inflation, has now come to a halt. In July 2023, import prices were significantly negative (-14.1% y/y). Therefore, the rate of increase in goods prices is expected to slow down in the future as the trend to pass on raw material costs to prices gradually weakens.

On the other hand, while service prices have increased to the mid-1% range, base increases, which are highly linked to service prices, were around 2% in 2023. The pace of increase is likely to accelerate further in the future as the trend to pass on increased labor costs to prices spreads. T Moreover, given the extended time period over which prices have remained static, the pace of future service price increases is likely to be very fast.

Consumer Prices (excluding fresh food, hereinafter core CPI) grew to 4.2% y/y in January 2023 (the highest growth in 41 years and 4 months since September 1981) and has remained in the low 3% range since February due to government measures to ease the burden of electricity and city gas bills. However, the core core CPI (excluding fresh food and energy) has increased to the upper 4% range, further increasing the underlying upward pressure on prices.

The rise in import prices, which previously stood as the main cause of inflation, has now come to a halt. In July 2023, import prices were significantly negative (-14.1% y/y). Therefore, the rate of increase in goods prices is expected to slow down in the future as the trend to pass on raw material costs to prices gradually weakens.

On the other hand, while service prices have increased to the mid-1% range, base increases, which are highly linked to service prices, were around 2% in 2023. The pace of increase is likely to accelerate further in the future as the trend to pass on increased labor costs to prices spreads. T Moreover, given the extended time period over which prices have remained static, the pace of future service price increases is likely to be very fast.

The core CPI growth rate will slow from the current 3% level to the upper 2% level after the fall of 2023, but it will not fall below the BOJ's price target of 2% until after the beginning of 2024. This shift will occur when the deceleration in the rate of goods price growth becomes evident, owing to the diffusion of the impact from declining import prices, coinciding with the continual decrease in energy prices.

The core CPI growth rate will slow from the current 3% level to the upper 2% level after the fall of 2023, but it will not fall below the BOJ's price target of 2% until after the beginning of 2024. This shift will occur when the deceleration in the rate of goods price growth becomes evident, owing to the diffusion of the impact from declining import prices, coinciding with the continual decrease in energy prices.In regard to goods and services, most of the price increases in FY 2022 were caused by rises in goods, primarily energy and food (excluding fresh food and eating out). However, from FY 2023 to FY 2024, the focus of price increases will gradually shift from goods to services.

Core CPI is projected to be 2.8% y/y in FY 2023 and 1.6% y/y in FY 2024, after 3.0% y/y in FY 2022, and core core CPI is projected to be 3.7% y/y in FY 2023 and 1.3% y/y in FY 2024, after 2.2% y/y in FY 2022.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836