- NLI Research Institute >

- Economics >

- Economic Outlook for Fiscal Years 2023 and 2024 (May 2023)

18/05/2023

Economic Outlook for Fiscal Years 2023 and 2024 (May 2023)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1.1.6% annualized positive growth in Jan–Mar quarter of 2023 compared to the previous quarter

Real GDP grew by 0.4% (1.6% annualized) in the January–March quarter of 2023.

Exports fell by 4.2% due to the slowdown in overseas economies, pushing down the growth rate of external demand (contribution to growth rate: -0.3%, annualized: -1.3%), but private consumption (0.6%), capital investment (0.9%), and housing investment (0.2%) all increased, leading to positive growth led by domestic demand.

The real GDP growth rate for the October–December quarter of 2022 was revised downward from an annualized positive growth rate of 0.1% to a negative growth rate of 0.1%. The growth rate for the January–March quarter of 2023 was higher than previously expected. Although growth exceeded expectations, this was the first positive growth in three quarters, meaning it can scarcely be said that the Japanese economy has returned to a stable growth trajectory.

In addition, real GDP in the January–March quarter of 2023 was 1.3% above the pre-COVID-19 (October–December 2019) level, but 1.5% below the peak before the consumption tax rate hike was implemented (July–September 2019). Hence, there is still some distance to go before the economy normalizes.

Real GDP growth in FY2022 was 1.2% (2.6% in FY2021) and nominal GDP growth was 1.9% (2.4% in FY2021), both positive for the second consecutive year. GDP levels exceeded FY 2019 in nominal terms but did not reach FY 2019 in real terms.

Exports fell by 4.2% due to the slowdown in overseas economies, pushing down the growth rate of external demand (contribution to growth rate: -0.3%, annualized: -1.3%), but private consumption (0.6%), capital investment (0.9%), and housing investment (0.2%) all increased, leading to positive growth led by domestic demand.

The real GDP growth rate for the October–December quarter of 2022 was revised downward from an annualized positive growth rate of 0.1% to a negative growth rate of 0.1%. The growth rate for the January–March quarter of 2023 was higher than previously expected. Although growth exceeded expectations, this was the first positive growth in three quarters, meaning it can scarcely be said that the Japanese economy has returned to a stable growth trajectory.

In addition, real GDP in the January–March quarter of 2023 was 1.3% above the pre-COVID-19 (October–December 2019) level, but 1.5% below the peak before the consumption tax rate hike was implemented (July–September 2019). Hence, there is still some distance to go before the economy normalizes.

Real GDP growth in FY2022 was 1.2% (2.6% in FY2021) and nominal GDP growth was 1.9% (2.4% in FY2021), both positive for the second consecutive year. GDP levels exceeded FY 2019 in nominal terms but did not reach FY 2019 in real terms.

(Exports are not expected to be the driving force of the economy)

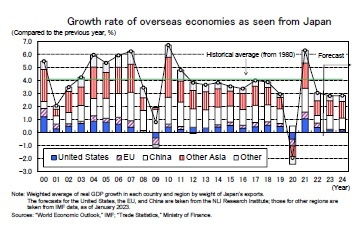

Real GDP for the January–March quarter of 2023 was 1.1% in the U.S. and 0.3% in the euro area. Looking ahead, we expect the U.S. to fall into a mild recession in the second half of 2023 due to cumulative monetary tightening. Meanwhile, in the euro area, a recession will be avoided due to lower energy prices, a resilient employment environment, and excess savings, but growth will continue to be low, staying within the range of zero percent per annum during 2023. Meanwhile, China's real GDP growth rate, which fell sharply to 3.0% in 2022 from 8.4% in 2021 due to the zero-COVID-19 policy and the associated lockdown, is likely to rise to the 5% range in 2023 following the end of the zero-COVID-19 policy.

Real GDP for the January–March quarter of 2023 was 1.1% in the U.S. and 0.3% in the euro area. Looking ahead, we expect the U.S. to fall into a mild recession in the second half of 2023 due to cumulative monetary tightening. Meanwhile, in the euro area, a recession will be avoided due to lower energy prices, a resilient employment environment, and excess savings, but growth will continue to be low, staying within the range of zero percent per annum during 2023. Meanwhile, China's real GDP growth rate, which fell sharply to 3.0% in 2022 from 8.4% in 2021 due to the zero-COVID-19 policy and the associated lockdown, is likely to rise to the 5% range in 2023 following the end of the zero-COVID-19 policy.

The growth rate of the overseas economy, weighted by Japan's export weights, will decelerate significantly from approximately 6% in 2021 to around 3% in 2022, before further declining to the upper 2% range in 2023 and 2024, remaining below the average growth rate of around 4% since 1980.

The growth rate of the overseas economy, weighted by Japan's export weights, will decelerate significantly from approximately 6% in 2021 to around 3% in 2022, before further declining to the upper 2% range in 2023 and 2024, remaining below the average growth rate of around 4% since 1980.Japan's exports, after growing a high 12.4% in FY2021, slowed to 4.4% in FY2022, and are expected to decline for the first time in three years, by 1.4%, in FY2023.

(Face-to-face service consumption and inbound tourist demand expected to recover rapidly)

On May 8th, COVID-19 infections were moved from the status of "new influenza and other infectious diseases (so-called category 2 equivalent)" to "category 5 infectious diseases" under the Infectious Diseases Control Law of Japan. As a result, infection control measures were changed from "a system of various requests and involvement by the government based on the law" to "one based on voluntary efforts by the public, respecting individual choices."

An expected consequence of the shift to category 5 is a recovery in face-to-face service consumption, such as eating out and lodging, and inbound tourist demand.

Face-to-face service consumption, which fell rapidly due to the social restrictions imposed by the COVID-19 crisis, continued to pick up in FY2022 because no state-of-emergency declarations or priority measures to prevent the spread of the disease were issued. However, the level of face-to-face service consumption at the end of FY2022 was only around 80% of the pre-COVID-19 level (2019 average), leaving significant room for future growth.

On May 8th, COVID-19 infections were moved from the status of "new influenza and other infectious diseases (so-called category 2 equivalent)" to "category 5 infectious diseases" under the Infectious Diseases Control Law of Japan. As a result, infection control measures were changed from "a system of various requests and involvement by the government based on the law" to "one based on voluntary efforts by the public, respecting individual choices."

An expected consequence of the shift to category 5 is a recovery in face-to-face service consumption, such as eating out and lodging, and inbound tourist demand.

Face-to-face service consumption, which fell rapidly due to the social restrictions imposed by the COVID-19 crisis, continued to pick up in FY2022 because no state-of-emergency declarations or priority measures to prevent the spread of the disease were issued. However, the level of face-to-face service consumption at the end of FY2022 was only around 80% of the pre-COVID-19 level (2019 average), leaving significant room for future growth.

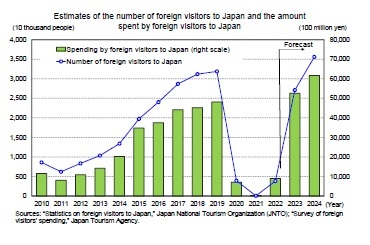

Inbound tourist demand continued to diminish after the COVID-19 crisis, but it has been recovering rapidly since October 2022, following the gradual easing of border measures. Indeed, there were 1,949,100 inbound visitors in April 2023 (down 33.4% from the same month in 2019), but this figure then recovered to a level just under 70% of the pre-COVID-19 level (2019 average). By visitors’ origin country, the U.S., Singapore, and Indonesia have already surpassed their pre-COVID-19 levels. The number of visitors to Japan from China, accounting for roughly 30% of the total number of visitors before the COVID-19 pandemic, remains at 15% (much lower than in the same month in 2019) due to Japan's mandatory testing for new strains of coronavirus for visitors from China and the fact that China has not lifted its ban on group travel to Japan. However, Japan's border measures have already been lifted, and once China lifts its ban on group travel to Japan, the number of Chinese visitors to Japan will rebound rapidly.

Even more pronounced than the recovery in the number of foreign visitors to Japan is the amount of travel spending by foreign visitors to Japan. According to the Japan Tourism Agency's "Survey of Trends in Foreign Traveler Spending in Japan," the value of travel spending by foreigners visiting Japan during the January–March quarter of 2023 was 1.146 trillion yen (down 11.9% from the same quarter in 2019). The reason why the decline is smaller than the 37.8% decline in the number of foreign visitors to Japan during the same quarter is that per capita spending was 212,000 yen, a significant increase of 43.8% over the same quarter in 2019. This is a trend that has continued since the October–December quarter of 2021, when the Survey of Spending Trends by Foreign Visitors to Japan, which had been temporarily suspended due to COVID-19, was permitted to resume.

Even more pronounced than the recovery in the number of foreign visitors to Japan is the amount of travel spending by foreign visitors to Japan. According to the Japan Tourism Agency's "Survey of Trends in Foreign Traveler Spending in Japan," the value of travel spending by foreigners visiting Japan during the January–March quarter of 2023 was 1.146 trillion yen (down 11.9% from the same quarter in 2019). The reason why the decline is smaller than the 37.8% decline in the number of foreign visitors to Japan during the same quarter is that per capita spending was 212,000 yen, a significant increase of 43.8% over the same quarter in 2019. This is a trend that has continued since the October–December quarter of 2021, when the Survey of Spending Trends by Foreign Visitors to Japan, which had been temporarily suspended due to COVID-19, was permitted to resume.Reasons for the expansion in per capita consumption include the yen's depreciation relative to its pre-COVID-19 level and the sharp decline in the number of tourists with relatively short stays, which has resulted in an increase in the percentage of business and other visitors undertaking longer stays. Of these, the average length of stay will be expected to shorten due to the rapid increase in the number of tourists, but the effect of the weaker yen will continue to boost consumption in the future.

With the lifting of the border measures, the number of inbound foreign visitors will continue to recover in the future and is likely to surpass the pre-COVID-19 level (31.88 million in 2019) in terms of monthly annualized base by the end of 2023. Although the number of inbound travelers is not expected to reach a new annual record high until 2024, the government's goal of increasing inbound travel spending to 5 trillion yen by 2023 will be achieved as the weak yen continues to push up per capita spending.

(Spring Wage Hike Rate to Highest Level in 30 Years)

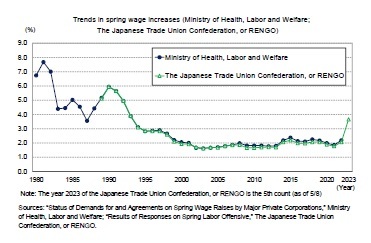

According to the "Results of the Fifth Round of Responses to the Spring 2023 Labor Offensive" released by RENGO on May 10, the average wage increase for 2023 was 3.67%, and the "portion of wage increase" corresponding to base increase was 2.14%.

According to the "Results of the Fifth Round of Responses to the Spring 2023 Labor Offensive" released by RENGO on May 10, the average wage increase for 2023 was 3.67%, and the "portion of wage increase" corresponding to base increase was 2.14%.

The spring labor offensive wage increase rate, which is usually announced by the Ministry of Health, Labor, and Welfare around August each year, is almost certain to rise significantly from 2.20% in 2022 to reach the 3% level for the first time since 1994 (3.13%). The largest year-on-year improvement since 1980 was 0.94% in 1981 (1980: 6.74% → 1981: 7.68%), but the improvement in 2023 is likely to be greater than 1%.

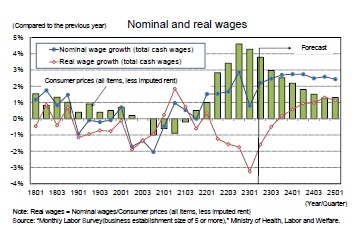

The spring labor offensive wage increase rate, which is usually announced by the Ministry of Health, Labor, and Welfare around August each year, is almost certain to rise significantly from 2.20% in 2022 to reach the 3% level for the first time since 1994 (3.13%). The largest year-on-year improvement since 1980 was 0.94% in 1981 (1980: 6.74% → 1981: 7.68%), but the improvement in 2023 is likely to be greater than 1%.Wage growth will clearly increase after the beginning of FY2023, as the rate of spring wage increases in 2023 has been the highest in 30 years. The growth of scheduled earnings is expected to increase from the current level of around 1% to the 2% level, the same as the base increase. Meanwhile, non-scheduled earnings are expected to continue to increase as the economy normalizes. However, special earnings, which grew at a high 4.6% y/y in 2022 (including 2.4% y/y in summer 2022 and 3.2% y/y at the end of 2022 for salaries paid as bonuses), will slow down in 2023, reflecting the recent stall in the improvement of corporate earnings.

Total cash earnings are expected to increase from approximately 1% y/y at present to the 2% level after entering FY2023 and to then continue to grow in the mid-to-late 2% range through FY2024.

Real wages have been negative year-on-year since April 2022, primarily as a result of the accelerating pace of consumer price inflation. Although nominal wage growth will increase in the future, the decline in real wages is likely to continue even after the start of FY2023, as the rate of consumer price inflation will remain high. Moreover, the real wage growth rate is expected to turn positive in the second half of FY2023, when the consumer price inflation rate is expected to slow down.

Real wages have been negative year-on-year since April 2022, primarily as a result of the accelerating pace of consumer price inflation. Although nominal wage growth will increase in the future, the decline in real wages is likely to continue even after the start of FY2023, as the rate of consumer price inflation will remain high. Moreover, the real wage growth rate is expected to turn positive in the second half of FY2023, when the consumer price inflation rate is expected to slow down.

The current outlook assumes that the spring wage hike rate will reach 3.6% in 2023, the highest level since 1993 (3.89%), and then remain at the 3% level in 2024, although growth will slow slightly to 3.3%. Although corporate earnings growth will decline, especially in the manufacturing sector, due to sluggish exports, the consumer price inflation rate will remain high, which will help to boost the wage growth rate.

The current outlook assumes that the spring wage hike rate will reach 3.6% in 2023, the highest level since 1993 (3.89%), and then remain at the 3% level in 2024, although growth will slow slightly to 3.3%. Although corporate earnings growth will decline, especially in the manufacturing sector, due to sluggish exports, the consumer price inflation rate will remain high, which will help to boost the wage growth rate.

03-3512-1836