- NLI Research Institute >

- Economics >

- "Cheap Japan" through the lens of the Big Mac

Column

03/03/2023

"Cheap Japan" through the lens of the Big Mac

Font size

- S

- M

- L

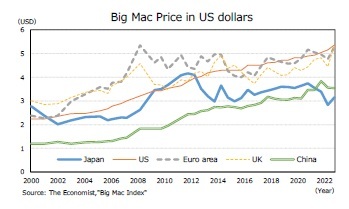

In recent years, the so-called "cheap Japan" phenomenon, where prices in Japan are cheaper than other countries, has often been discussed.1 The Economist magazine periodically surveys the price of a McDonald’s Big Mac as an example of regional price variations. In April 2000, the selling price of a Big Mac in Japan was ¥294 ($2.77), which was higher than the price in the United States, which was $2.24, and the eurozone, which was €2.56 ($2.38). However, in January 2023, the selling price in Japan was ¥4102 ($3.15), which was about 40% cheaper than the U.S. price of $5.36 and the eurozone, which was €4.86 ($5.28).

In recent years, the so-called "cheap Japan" phenomenon, where prices in Japan are cheaper than other countries, has often been discussed.1 The Economist magazine periodically surveys the price of a McDonald’s Big Mac as an example of regional price variations. In April 2000, the selling price of a Big Mac in Japan was ¥294 ($2.77), which was higher than the price in the United States, which was $2.24, and the eurozone, which was €2.56 ($2.38). However, in January 2023, the selling price in Japan was ¥4102 ($3.15), which was about 40% cheaper than the U.S. price of $5.36 and the eurozone, which was €4.86 ($5.28).

The Big Mac is the same product all over the world. Although fluctuations in exchange rates are difficult to instantly be reflected in the price, it would not seem natural that, on average, there would be a large and persistent price gap with other countries. However, as the graph shows, the price gap between Europe, the United States, and Japan has widened since 2013. By 2022, Japan sold Big Macs cheaper than China.

The direct causes of "cheap Japan" is long-term stagnation in prices and depreciation of the Japanese Yen.

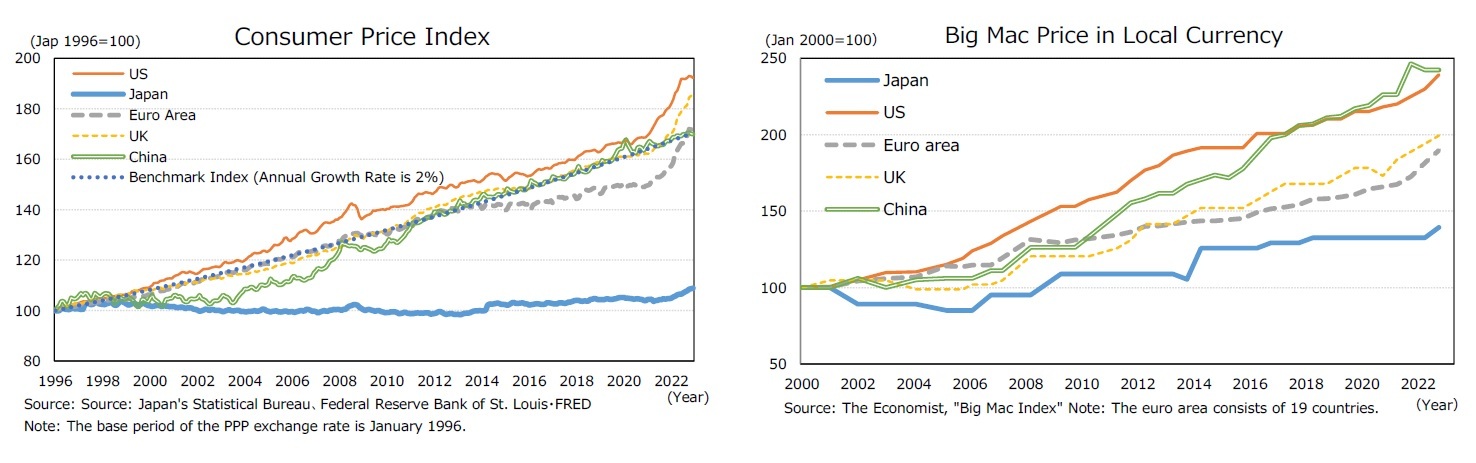

Japan has faced stubbornly low inflation since the late 1990s. As the following CPI graph shows, Japan’s CPI has remained generally flat since the late 1990s, which is a significantly different scenario than in the United States or the eurozone, where prices have risen at an annual average rate of around 2%. Since 2021, the world has been hit by rising prices, and in Japan, the consumer price inflation rate exceeded 4% from the previous year for the first time in 40 years. However, compared to other countries, the inflation rate in Japan has still not been overwhelmingly high. The persistence of low inflation is likely to have created a strong expectation that prices will remain unchanged, thereby strengthening price stickiness. For example, prices for Big Macs have not risen in Japan compared with overseas locations.

The direct causes of "cheap Japan" is long-term stagnation in prices and depreciation of the Japanese Yen.

Japan has faced stubbornly low inflation since the late 1990s. As the following CPI graph shows, Japan’s CPI has remained generally flat since the late 1990s, which is a significantly different scenario than in the United States or the eurozone, where prices have risen at an annual average rate of around 2%. Since 2021, the world has been hit by rising prices, and in Japan, the consumer price inflation rate exceeded 4% from the previous year for the first time in 40 years. However, compared to other countries, the inflation rate in Japan has still not been overwhelmingly high. The persistence of low inflation is likely to have created a strong expectation that prices will remain unchanged, thereby strengthening price stickiness. For example, prices for Big Macs have not risen in Japan compared with overseas locations.

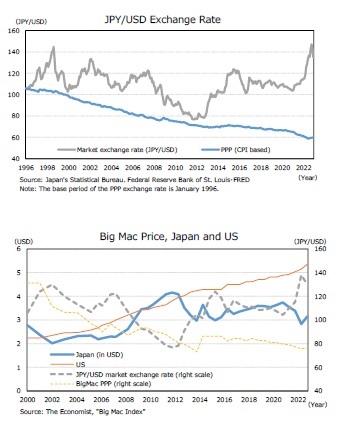

Moreover, the yen’s purchasing power has not risen enough to offset the difference in the inflation rate between Japan and other countries (i.e., the yen has not fully appreciated). For example, under the assumption of the law of one price, if goods previously sold for 100 yen in Japan and one dollar in the United States are now sold for two dollars in the United States due to a price hike, (while remaining 100 yen in Japan), it should be possible to buy two dollars’ worth of goods for 100 yen, implying an increase in the purchasing power of the yen. If a purchasing power parity (PPP) exchange rate were calculated reflecting changes in purchasing power due to inflation differentials between Japan and the United States using the actual dollar/yen exchange rate in January 1996 as the base period, the PPP exchange rate should have fallen below ¥80 per dollar in 2008 and should have reached around ¥60 per dollar by 2022.3 Note that the level of the PPP exchange rate itself is not particularly meaningful as it depends on the base period. As a direction, however, the PPP exchange rate has been definitely moving toward a stronger yen. However, the actual market-based exchange rate shows that the yen has generally depreciated more than its PPP exchange rate. The PPP of the Big Mac is around 80 yen to the dollar, which also indicates that the actual dollar/yen exchange rate is weaker than the PPP.

Moreover, the yen’s purchasing power has not risen enough to offset the difference in the inflation rate between Japan and other countries (i.e., the yen has not fully appreciated). For example, under the assumption of the law of one price, if goods previously sold for 100 yen in Japan and one dollar in the United States are now sold for two dollars in the United States due to a price hike, (while remaining 100 yen in Japan), it should be possible to buy two dollars’ worth of goods for 100 yen, implying an increase in the purchasing power of the yen. If a purchasing power parity (PPP) exchange rate were calculated reflecting changes in purchasing power due to inflation differentials between Japan and the United States using the actual dollar/yen exchange rate in January 1996 as the base period, the PPP exchange rate should have fallen below ¥80 per dollar in 2008 and should have reached around ¥60 per dollar by 2022.3 Note that the level of the PPP exchange rate itself is not particularly meaningful as it depends on the base period. As a direction, however, the PPP exchange rate has been definitely moving toward a stronger yen. However, the actual market-based exchange rate shows that the yen has generally depreciated more than its PPP exchange rate. The PPP of the Big Mac is around 80 yen to the dollar, which also indicates that the actual dollar/yen exchange rate is weaker than the PPP.A "cheap Japan" itself may not be a big problem. If the same products can be produced cheaper in Japan, it should be possible to increase exports to other countries. Moreover, if Japan has the technological capability to produce goods and services at lower cost, and if workers are paid a wage commensurate with their productivity, then low prices will increase the consumer’s purchasing power and improve people’s economic welfare. Low prices may also have the advantage of increasing the number of foreign tourists and attracting foreign companies to invest in Japan.

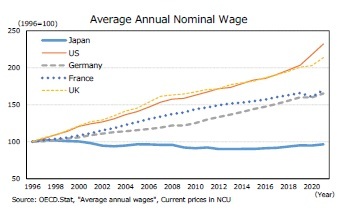

However, if "cheap Japan" is created by low productivity and a lack of competitiveness, with producers unable to raise prices and wages, then low prices are not desirable. Consider that the cost of producing a Big Mac includes goods traded with foreign countries (tradeable goods) such as beef, lettuce, and wheat, as well as goods that are not traded with foreign countries (non-tradable goods), such as tenant fees and labor costs.4 Some past analysis suggests that about 60% of the price difference between domestic and foreign prices of Big Macs is explained by the price of non-traded goods. Thus, it may be argued that Big Macs are cheaper in Japan because of lower wages.

However, if "cheap Japan" is created by low productivity and a lack of competitiveness, with producers unable to raise prices and wages, then low prices are not desirable. Consider that the cost of producing a Big Mac includes goods traded with foreign countries (tradeable goods) such as beef, lettuce, and wheat, as well as goods that are not traded with foreign countries (non-tradable goods), such as tenant fees and labor costs.4 Some past analysis suggests that about 60% of the price difference between domestic and foreign prices of Big Macs is explained by the price of non-traded goods. Thus, it may be argued that Big Macs are cheaper in Japan because of lower wages.In this sense, the "cheap Japan" phenomenon can be seen as a warning for Japan’s failure to raise productivity and increase income.

1 Nakafuji (2021), Ito (2022), Watanabe (2022), and others.

2 On January 16, 2023, the price increased to ¥450.

3 The calculation of purchasing power parity is affected by the setting of the base period. For calculation methods, see Nagayasu et al. (2015) and other international finance textbooks. Note that although February 1973 is generally used as the base period for calculations, January 1996 is used here to focus on the differences in inflation rates between Japan and other countries since the late 1990s.

4 See below for information on the countries of origin and final processing of the main Big Mac ingredients.

https://www.mcdonalds.co.jp/products/1210/

(References.)

Ito,T. (2022). Why is Japan so cheap? Project Syndicate, 2022.3.3

Nagayasu, J., Esaka, T., and Yoshida, Y. (2015). Hajimete Manabu Kokusai Kinyu Ron [Learning International Finance for the First Time]. Yuhikaku.

Nakafuji, R. (2021). Cheap Japan: Stagnation indicated by "Price." Nihon Keizai Shimbun Shuppan.

Parsley, D. C., & Wei, S. J. (2007). A prism into the PPP puzzles: The micro-foundations of Big Mac real exchange rates. The Economic Journal, 117(523), 1336-1356.

Watanabe, T. (2022). The Mystery of World Inflation. Kodansha.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング