- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal 2022 and 2023 (May 2022)

19/05/2022

Japan’s Economic Outlook for Fiscal 2022 and 2023 (May 2022)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

(Real GDP will exceed the latest peak in FY 2023)

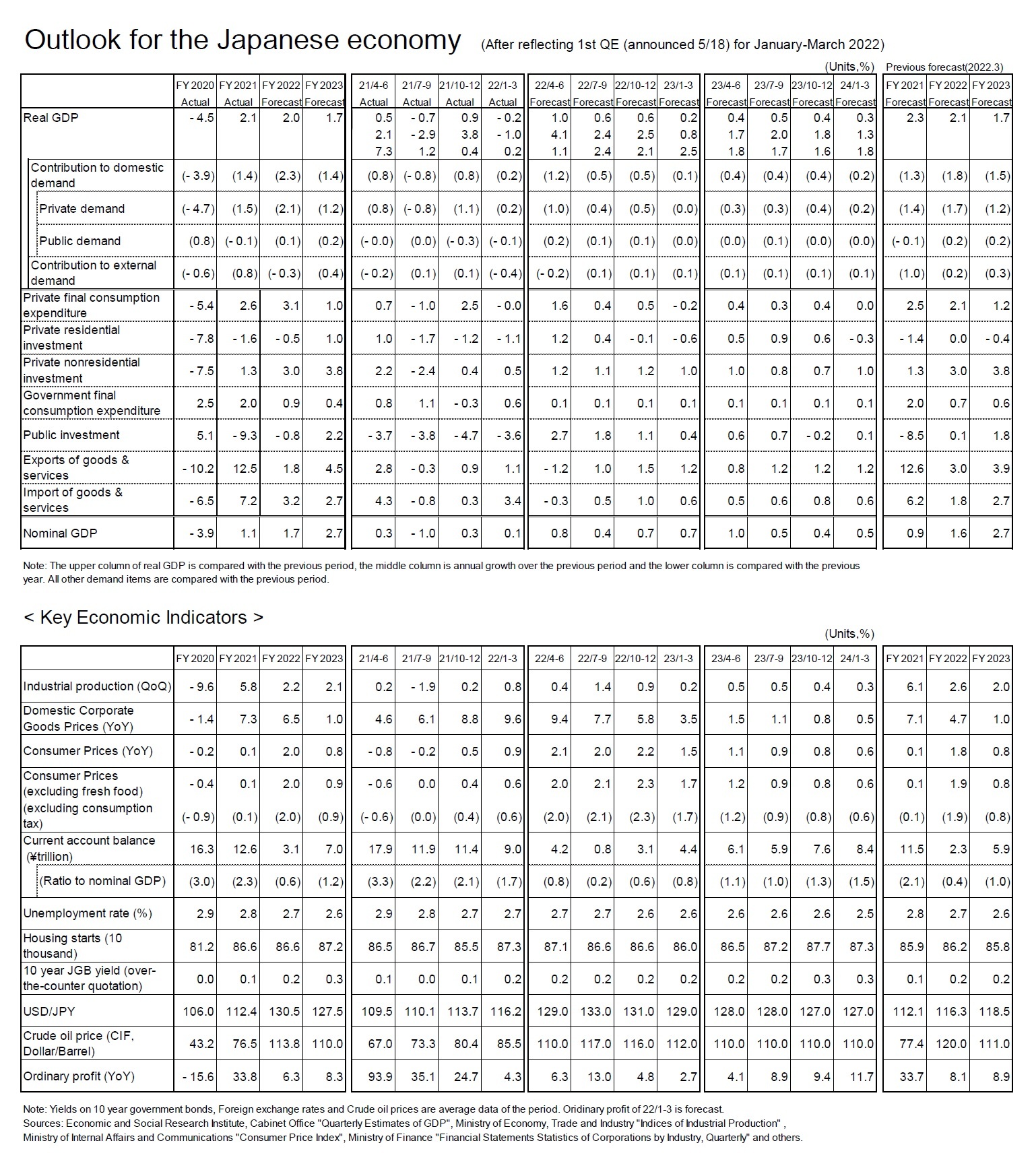

In the January-March quarter of 2022, real GDP posted negative 1.0% growth on an annualized basis, mainly due to the decline of private consumption, but in the April-June quarter of 2022, real GDP is expected to grow at an annualized rate of 4.1% due to the recovery of private consumption, particularly of face-to-face services, following the termination of priority preventative measures.

However, there are significant downside risks, such as a further rise in resource prices, the worsening situation in Ukraine, monetary tightening by the United States, China's zero-COVID-19 policy, and electricity shortages due to the disruption of energy supply from Russia. In particular, if the economy of China, which accounts for a little over 20% of Japan's exports, slows down sharply as a result of the zero-COVID-19 policy, Japan's exports may fall sharply. In addition, there are concerns that the disruption of the logistics network due to the lockdown in China will have a negative impact on production activities in Japan.

In the January-March quarter of 2022, real GDP posted negative 1.0% growth on an annualized basis, mainly due to the decline of private consumption, but in the April-June quarter of 2022, real GDP is expected to grow at an annualized rate of 4.1% due to the recovery of private consumption, particularly of face-to-face services, following the termination of priority preventative measures.

However, there are significant downside risks, such as a further rise in resource prices, the worsening situation in Ukraine, monetary tightening by the United States, China's zero-COVID-19 policy, and electricity shortages due to the disruption of energy supply from Russia. In particular, if the economy of China, which accounts for a little over 20% of Japan's exports, slows down sharply as a result of the zero-COVID-19 policy, Japan's exports may fall sharply. In addition, there are concerns that the disruption of the logistics network due to the lockdown in China will have a negative impact on production activities in Japan.

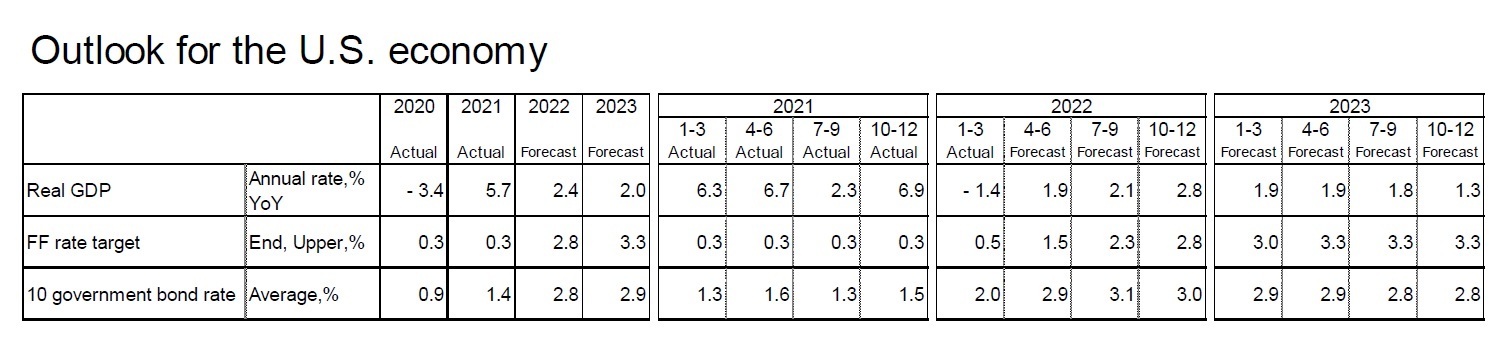

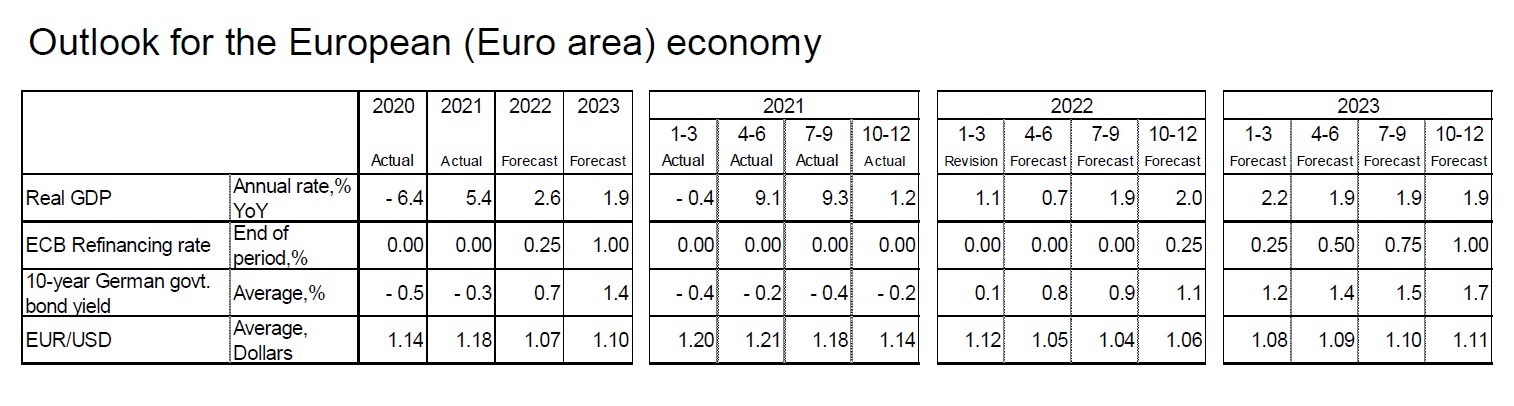

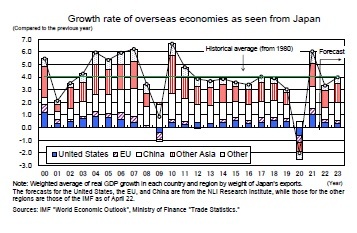

The growth rate of the overseas economy, weighted by the weight of Japan's exports, fell by about 2% in 2020 due to the impact of the new COVID-19 virus, and rose sharply by about 6% in 2021 in reaction to that, but is expected to slow sharply to the low 3% range in 2022. This is because China's growth rate is expected to slow sharply from 8.1% in 2021 to around 4%, the United States’ growth rate is expected to slow down from 5.7% in 2021 to 2.4% due to the effect of monetary tightening, and the growth rate of the Eurozone, which has strong ties to Russia, is expected to slow down from 5.4% in 2021 to 2.6%.

The growth rate of the overseas economy, weighted by the weight of Japan's exports, fell by about 2% in 2020 due to the impact of the new COVID-19 virus, and rose sharply by about 6% in 2021 in reaction to that, but is expected to slow sharply to the low 3% range in 2022. This is because China's growth rate is expected to slow sharply from 8.1% in 2021 to around 4%, the United States’ growth rate is expected to slow down from 5.7% in 2021 to 2.4% due to the effect of monetary tightening, and the growth rate of the Eurozone, which has strong ties to Russia, is expected to slow down from 5.4% in 2021 to 2.6%.

Exports rose 12.5% in FY 2021, reflecting a sharp decline of 10.5% from the previous year in FY 2020. In FY 2022, although the yen's depreciation is expected to push up the exports growth rate, it is expected to slow down significantly to 1.8% due to a slowdown in overseas economies. The growth rate is expected to increase to 4.5% in FY 2023, when the world economy is expected to recover due to the normalization of the Chinese economy.

Although a boost from exports is not expected for the time being, GDP growth exceeding the potential growth rate is expected to continue after the July-September quarter of 2022, largely due to high private consumption growth backed by high savings, in the absence of activity restrictions such those stemming from a state of emergency. However, it is difficult to completely end the spread of COVID-19 virus infections, and the number of new positive cases is expected to increase and decrease repeatedly in the future. A sustained recovery in consumption would not be possible if the government continues to tighten restrictions with each outbreak.

Although a boost from exports is not expected for the time being, GDP growth exceeding the potential growth rate is expected to continue after the July-September quarter of 2022, largely due to high private consumption growth backed by high savings, in the absence of activity restrictions such those stemming from a state of emergency. However, it is difficult to completely end the spread of COVID-19 virus infections, and the number of new positive cases is expected to increase and decrease repeatedly in the future. A sustained recovery in consumption would not be possible if the government continues to tighten restrictions with each outbreak.

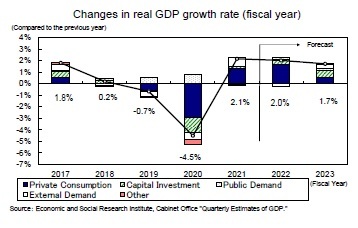

Real GDP is expected to grow 2.0% in FY 2022 and 1.7% in FY 2023. Even if restrictions on economic activities are lifted, it will take time for consumption to fully recover because a certain degree of caution about infectious diseases will curb face-to-face service consumption. Private consumption in FY 2021 increased by 2.6% from the previous year, but it failed to recover even half of the 5.4% decline in FY 2020. Although private consumption will continue to increase by 3.1% in FY 2022 and 1.0% in FY 2023 from the previous year, the growth rate is expected to be quite low after a significant decline in FY 2020. Private consumption will not exceed its most recent peak in the July-September quarter of 2019 until FY 2024.

Real GDP is expected to grow 2.0% in FY 2022 and 1.7% in FY 2023. Even if restrictions on economic activities are lifted, it will take time for consumption to fully recover because a certain degree of caution about infectious diseases will curb face-to-face service consumption. Private consumption in FY 2021 increased by 2.6% from the previous year, but it failed to recover even half of the 5.4% decline in FY 2020. Although private consumption will continue to increase by 3.1% in FY 2022 and 1.0% in FY 2023 from the previous year, the growth rate is expected to be quite low after a significant decline in FY 2020. Private consumption will not exceed its most recent peak in the July-September quarter of 2019 until FY 2024.

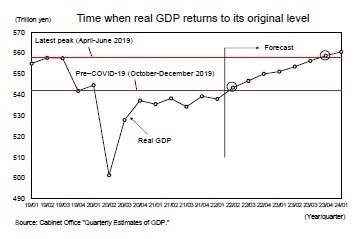

In the January-March 2022 quarter, real GDP was 0.7% below the pre-COVID-19 level (October-December 2019), but in the April-June quarter, its annual growth rate will be 4.1%, mainly due to the high growth in private consumption, and at last it will recover the pre-COVID-19 level.

However, because the level of economic activity in Japan had fallen significantly during the pre-COVID-19 period due to the effect of the increase in the consumption tax rate, simply returning to the pre-COVID-19 level would not be considered economic normalization. Real GDP is not expected to recover to its most recent peak in April-June 2019 until the October-December quarter of 2023.

However, because the level of economic activity in Japan had fallen significantly during the pre-COVID-19 period due to the effect of the increase in the consumption tax rate, simply returning to the pre-COVID-19 level would not be considered economic normalization. Real GDP is not expected to recover to its most recent peak in April-June 2019 until the October-December quarter of 2023.

(Outlook of current account balance)

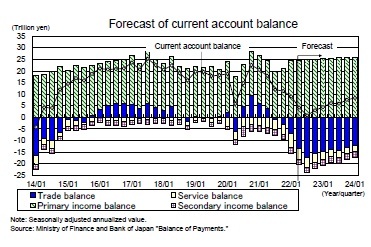

The current account balance posted a surplus of 12.6 trillion yen in FY 2021, down from 16.3 trillion yen in FY 2020. On a quarterly basis, it peaked at 22.6 trillion yen (seasonally adjusted, annualized) in the October-December quarter of 2020 and continued to decline, reaching 9 trillion yen in the January-March quarter of 2022.

Looking at the breakdown of current account balance, trade balance in FY 2021, the impact of high crude oil prices led to a 35.0% year-on-year increase in imports, posted 1.7 trillion yen deficit from a surplus of 3.8 trillion yen in FY 2020. Because of the deterioration of the travel account balance due to the sluggish inbound tourist demand, the service account also recorded a deficit of 4.8 trillion yen (compared to 3.5 trillion yen in FY 2020), but the primary income account surplus reached a high level of 21.6 trillion yen (compared to 18.8 trillion yen in FY 2020) on the back of a large amount of net foreign assets, which was the main cause of the surplus in the current account balance.

The current account balance posted a surplus of 12.6 trillion yen in FY 2021, down from 16.3 trillion yen in FY 2020. On a quarterly basis, it peaked at 22.6 trillion yen (seasonally adjusted, annualized) in the October-December quarter of 2020 and continued to decline, reaching 9 trillion yen in the January-March quarter of 2022.

Looking at the breakdown of current account balance, trade balance in FY 2021, the impact of high crude oil prices led to a 35.0% year-on-year increase in imports, posted 1.7 trillion yen deficit from a surplus of 3.8 trillion yen in FY 2020. Because of the deterioration of the travel account balance due to the sluggish inbound tourist demand, the service account also recorded a deficit of 4.8 trillion yen (compared to 3.5 trillion yen in FY 2020), but the primary income account surplus reached a high level of 21.6 trillion yen (compared to 18.8 trillion yen in FY 2020) on the back of a large amount of net foreign assets, which was the main cause of the surplus in the current account balance.

Looking ahead, it is highly likely that the current account balance’s surplus will shrink significantly through the summer of 2022, as the trade deficit will widen due to sluggish exports caused by the slowdown in overseas economies and rising imports caused by high crude oil prices. Although the service account deficit will gradually narrow due to a pickup in inbound demand, it is unlikely to improve significantly since the easing of immigration restrictions is likely to remain limited for the time being.

Looking ahead, it is highly likely that the current account balance’s surplus will shrink significantly through the summer of 2022, as the trade deficit will widen due to sluggish exports caused by the slowdown in overseas economies and rising imports caused by high crude oil prices. Although the service account deficit will gradually narrow due to a pickup in inbound demand, it is unlikely to improve significantly since the easing of immigration restrictions is likely to remain limited for the time being.On the other hand, as the value of income received from overseas increases in yen due to the depreciation of the yen, the primary income balance will continue to expand at a high level.

From the second half of 2022 onward, the trade deficit is expected to narrow because import growth will slow due to a pause in high crude oil prices and because exports will increase as overseas economies recover. However, although crude oil prices are expected to plateau, they are expected to remain high. Therefore, a trade surplus will not be realized until the end of FY 2023, and the primary income surplus will continue to make up for the trade deficit.

In FY 2023, the current account balance is expected to post a slightly larger surplus of 7 trillion yen, or 1.2% of nominal GDP, after shrinking sharply from 12.6 trillion yen, or 2.3%, in FY 2021 to 3.1 trillion yen, or 0.6%, in FY 2022

(Price outlook)

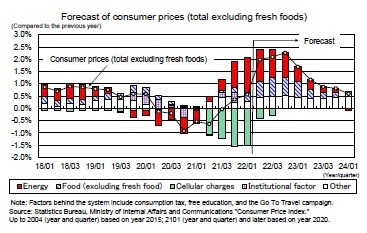

The consumer price index (total CPI excluding fresh foods; core CPI) increased to 0.1% year-on-year in September 2021, the first increase in 1 year and 6 months, and then expanded to 0.8% year-on-year in March 2022. While the sharp decline in mobile phone charges has depressed the core CPI growth rate by about 1.5%, energy and food (excluding fresh food) have pushed up the core CPI.

The price of crude oil (Dubai) remains high at 110 dollars per barrel, but the rate of increase in energy prices from the previous year is expected to slow down after peaking in March due to the mitigation measures against drastic changes in fuel oil prices (subsidies to oil wholesalers).

On the other hand, food products (excluding fresh foods) are expected to accelerate the pace of increase. Food prices rose to 0.1% year-on-year in July 2021, and then rose to 2.0% year-on-year in March 2022. Prices in the upstream stage, that is, the import prices of foods, increased by about 30% year-on-year, and food products in the domestic corporate goods price index rose by more than 3% year-on-year. Compared to the October-December quarter of 2015, when the inflation rate of food products exceeded 2%, the rate of increase in the upstream stage (import prices, domestic corporate goods price) is much higher now than it was then.

It is likely that the inflation rate of food products (excluding fresh foods) will accelerate to the 3% level in the summer of 2022 due to a further spread of the movement to pass on the price increases in the upstream stage to consumers via increased sales prices.

The core CPI growth rate in April 2022 is likely to increase to 2% due to a slightly smaller increase in energy prices, a significantly smaller decline in mobile phone charges, a further increase in food prices, and some annual price increases. Although the pace of increase in energy prices has continued to slow since then, the rate is expected to remain around 2% in 2022, as the price increase pressure from the yen's depreciation increases and moves to pass prices on to daily necessities and clothing in addition to food.

The consumer price index (total CPI excluding fresh foods; core CPI) increased to 0.1% year-on-year in September 2021, the first increase in 1 year and 6 months, and then expanded to 0.8% year-on-year in March 2022. While the sharp decline in mobile phone charges has depressed the core CPI growth rate by about 1.5%, energy and food (excluding fresh food) have pushed up the core CPI.

The price of crude oil (Dubai) remains high at 110 dollars per barrel, but the rate of increase in energy prices from the previous year is expected to slow down after peaking in March due to the mitigation measures against drastic changes in fuel oil prices (subsidies to oil wholesalers).

On the other hand, food products (excluding fresh foods) are expected to accelerate the pace of increase. Food prices rose to 0.1% year-on-year in July 2021, and then rose to 2.0% year-on-year in March 2022. Prices in the upstream stage, that is, the import prices of foods, increased by about 30% year-on-year, and food products in the domestic corporate goods price index rose by more than 3% year-on-year. Compared to the October-December quarter of 2015, when the inflation rate of food products exceeded 2%, the rate of increase in the upstream stage (import prices, domestic corporate goods price) is much higher now than it was then.

It is likely that the inflation rate of food products (excluding fresh foods) will accelerate to the 3% level in the summer of 2022 due to a further spread of the movement to pass on the price increases in the upstream stage to consumers via increased sales prices.

The core CPI growth rate in April 2022 is likely to increase to 2% due to a slightly smaller increase in energy prices, a significantly smaller decline in mobile phone charges, a further increase in food prices, and some annual price increases. Although the pace of increase in energy prices has continued to slow since then, the rate is expected to remain around 2% in 2022, as the price increase pressure from the yen's depreciation increases and moves to pass prices on to daily necessities and clothing in addition to food.

However, most of the increase in prices was caused by transferring a large increase in raw material prices to sales prices. Service prices, which account for about 50% of the prices in the consumer price index and are closely linked to wages, have remained stagnant. Although the wage increase rate will continue to improve in 2022 and 2023, the wage increase rate is expected to remain low at the 0% level. Rising service prices are not expected to significantly boost prices. In the second half of FY 2023, when the upward pressure from rising raw material prices is expected to return to normal, core CPI growth is likely to slow to less than 1%.

However, most of the increase in prices was caused by transferring a large increase in raw material prices to sales prices. Service prices, which account for about 50% of the prices in the consumer price index and are closely linked to wages, have remained stagnant. Although the wage increase rate will continue to improve in 2022 and 2023, the wage increase rate is expected to remain low at the 0% level. Rising service prices are not expected to significantly boost prices. In the second half of FY 2023, when the upward pressure from rising raw material prices is expected to return to normal, core CPI growth is likely to slow to less than 1%.

Core CPI growth is expected to be 2.0% in FY 2022 and 0.9% in FY 2023.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング