- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022)

16/02/2022

Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

(Price Outlook)

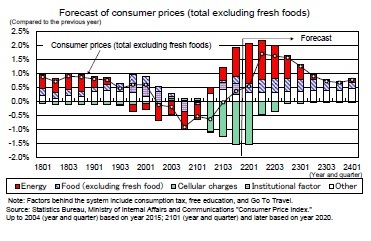

Consumer prices (total CPI excluding fresh food) increased by 0.1% year-on-year for the first time in 18 months in September 2021 and increased by 0.5% year-on-year in December 2021. The sharp decline in mobile phone service charges has pushed down the core CPI inflation rate by about 1.5%, while rising energy costs due to high oil prices and rising accommodation fees due to the suspension of Go To Travel have pushed up the core CPI.

Crude oil prices, which once fell to the 70 dollar per barrel level, have risen to the 90 dollar per barrel level due to concerns over a supply and demand crunch caused by the expansion of demand in the wake of the recovery of the global economy, the decline in production capacity due to the contraction of investment, as well as heightened tensions in Ukraine. Although the government has instituted a gasoline subsidy program [*]1, the effect of controlling gasoline prices is limited, and the pace of increase in electricity and gas prices, which will be reflected later in the impact of high oil prices, is expected to accelerate. The contribution of energy prices to core CPI inflation will rise to the mid 1% level by the end of FY 2021.

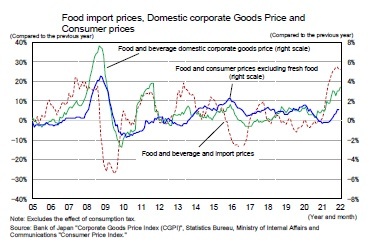

The pace of increase is likely to accelerate in the future for food products (excluding fresh foods). Food prices increased by 0.1% year-on-year in July 2021 and 1.1% year-on-year in December 2021, but the growth rate is still limited compared to the price increase rate in the upstream stage.

Consumer prices (total CPI excluding fresh food) increased by 0.1% year-on-year for the first time in 18 months in September 2021 and increased by 0.5% year-on-year in December 2021. The sharp decline in mobile phone service charges has pushed down the core CPI inflation rate by about 1.5%, while rising energy costs due to high oil prices and rising accommodation fees due to the suspension of Go To Travel have pushed up the core CPI.

Crude oil prices, which once fell to the 70 dollar per barrel level, have risen to the 90 dollar per barrel level due to concerns over a supply and demand crunch caused by the expansion of demand in the wake of the recovery of the global economy, the decline in production capacity due to the contraction of investment, as well as heightened tensions in Ukraine. Although the government has instituted a gasoline subsidy program [*]1, the effect of controlling gasoline prices is limited, and the pace of increase in electricity and gas prices, which will be reflected later in the impact of high oil prices, is expected to accelerate. The contribution of energy prices to core CPI inflation will rise to the mid 1% level by the end of FY 2021.

The pace of increase is likely to accelerate in the future for food products (excluding fresh foods). Food prices increased by 0.1% year-on-year in July 2021 and 1.1% year-on-year in December 2021, but the growth rate is still limited compared to the price increase rate in the upstream stage.

Import prices of foodstuffs have recently increased in the upper 20% range compared to the previous year, and food prices in domestic corporate goods price have increased in the 3% range compared to the previous year. Since 2000, the inflation rate of foodstuffs (excluding fresh food) has exceeded 2% two times, from April 2008 to April 2009 and from October to December 2015. Comparing the upstream inflation rate, the import price inflation rate is higher now than it was in 2008 and 2015, and the inflation rate in domestic corporate goods price is higher than it was in 2015. By the middle of 2022, the inflation rate of foodstuffs (excluding fresh foods) will reach the 2% level, and the contribution to the core CPI inflation rate will increase to about 0.5%.

Import prices of foodstuffs have recently increased in the upper 20% range compared to the previous year, and food prices in domestic corporate goods price have increased in the 3% range compared to the previous year. Since 2000, the inflation rate of foodstuffs (excluding fresh food) has exceeded 2% two times, from April 2008 to April 2009 and from October to December 2015. Comparing the upstream inflation rate, the import price inflation rate is higher now than it was in 2008 and 2015, and the inflation rate in domestic corporate goods price is higher than it was in 2015. By the middle of 2022, the inflation rate of foodstuffs (excluding fresh foods) will reach the 2% level, and the contribution to the core CPI inflation rate will increase to about 0.5%.Core CPI growth is expected to decline in January 2022, when the impact of the "Go To Travel" shutdown is expected to evaporate. However, it is expected to accelerate to the upper 1% level in April 2022, when the impact of the sharp decline in mobile phone service charges is expected to diminish, and is expected to remain at the 1% level during FY 2022.

However, most of the increase in prices was caused by passing on a substantial increase in raw material prices to sales prices, which accounted for about 50% of the total increase in the consumer price index. Service prices, which are highly linked to wages, have remained sluggish. Although the wage increase rate for spring labor negotiations is expected to continue improving in 2022 and 2023, it is expected to remain at a low level of 0% in terms of wage increases. A rise in service prices is not expected to lead to a significant increase in prices. The core CPI inflation rate is likely to slow to the upper 0% level after the start of 2023, when the upward pressure caused by rising raw material prices is expected to end.

However, most of the increase in prices was caused by passing on a substantial increase in raw material prices to sales prices, which accounted for about 50% of the total increase in the consumer price index. Service prices, which are highly linked to wages, have remained sluggish. Although the wage increase rate for spring labor negotiations is expected to continue improving in 2022 and 2023, it is expected to remain at a low level of 0% in terms of wage increases. A rise in service prices is not expected to lead to a significant increase in prices. The core CPI inflation rate is likely to slow to the upper 0% level after the start of 2023, when the upward pressure caused by rising raw material prices is expected to end.Core CPI inflation is projected to increase by 0.0% in FY 2021, 1.5% in FY 2022, and 0.8% in FY 2023.

1 Maximum of 5 yen for the portion exceeding 170 yen per liter

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836

Related Reports

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング