- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2020 and 2021

18/08/2020

Japan’s Economic Outlook for Fiscal Years 2020 and 2021

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

(Unemployment rises to 4% and employee compensation falls for the first time in eight years)

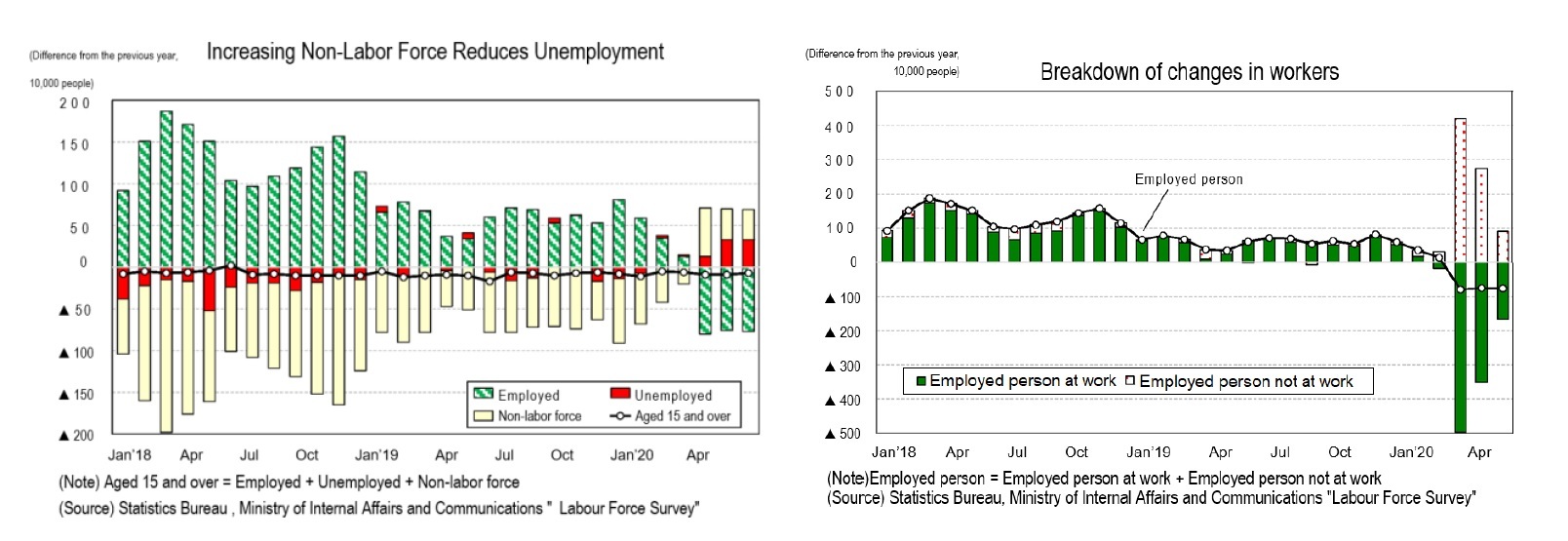

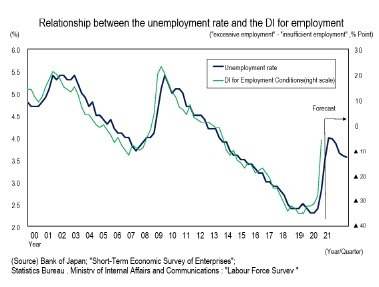

The employment situation, which had been improving, has begun to worsen in response to the rapid deterioration of the economy. The ratio of active job openings to active job applicants, which reflects the supply-demand balance in the labor market, peaked in April 2019 at 1.63. In June 2020, however, it dropped to 1.11, and the unemployment rate rose from the low 2% range to the high 2% range. At present, the rise in the unemployment rate has been limited in spite of the sharp decline in economic activity. This is partly due to an increase in the number of people who did not seek employment after losing their jobs and so were not counted as part of the labor force. If those who have left the labor market start to look for jobs again, Some of them will become unemployed , increasing the unemployment rate.

In addition, the fact that many of those who lost their jobs due to the suspension of economic activities were only those who took time off from work, which is a breakdown of the number of employees, due to the expansion of employment adjustment subsidies has also restrained the increase in the number of unemployed.In April 20, when a state of emergency was declared, the number of employed persons not at work reached a record high of 5.97 million (up 4.2 million from the previous year), gradually decreasing to 4.23 million in May (up 2.74 million from the previous year) and 2.36 million in June (up 900,000 from the previous year). In May and June, 40% of those who were not at work in the previous month reengaged in work. Less than 2% of them became unemployed. At present, the expansion of employment adjustment subsidies plays a role in preventing an increase in the number of unemployed individuals.

The employment situation, which had been improving, has begun to worsen in response to the rapid deterioration of the economy. The ratio of active job openings to active job applicants, which reflects the supply-demand balance in the labor market, peaked in April 2019 at 1.63. In June 2020, however, it dropped to 1.11, and the unemployment rate rose from the low 2% range to the high 2% range. At present, the rise in the unemployment rate has been limited in spite of the sharp decline in economic activity. This is partly due to an increase in the number of people who did not seek employment after losing their jobs and so were not counted as part of the labor force. If those who have left the labor market start to look for jobs again, Some of them will become unemployed , increasing the unemployment rate.

In addition, the fact that many of those who lost their jobs due to the suspension of economic activities were only those who took time off from work, which is a breakdown of the number of employees, due to the expansion of employment adjustment subsidies has also restrained the increase in the number of unemployed.In April 20, when a state of emergency was declared, the number of employed persons not at work reached a record high of 5.97 million (up 4.2 million from the previous year), gradually decreasing to 4.23 million in May (up 2.74 million from the previous year) and 2.36 million in June (up 900,000 from the previous year). In May and June, 40% of those who were not at work in the previous month reengaged in work. Less than 2% of them became unemployed. At present, the expansion of employment adjustment subsidies plays a role in preventing an increase in the number of unemployed individuals.

However, the unemployment rate will inevitably rise further, given that the number of workers on leave remains at a high level compared with normal times. Companies are also likely to further curb new employment amid deteriorating corporate earnings and heightened economic uncertainty.

Until now, companies have been feeling a labor shortage, which the new coronavirus has greatly reduced. The Bank of Japan’s Tankan employment index (deficiency excess) has been negative for approximately seven years since the March 2013 survey. In the June 2020 survey, however, it increased by 22 points from the March survey to -6, significantly narrowing the gap between surplus and deficit. The correlation between the employment index and unemployment rate is high, and the unemployment rate tends to fluctuate slightly behind the employment index. Although the increase in bankruptcies and unemployment will be curbed to some extent by the expanded employment adjustment subsidies, the unemployment rate is certain to rise sharply, likely increasing by 4% in the October–December quarter of 2020.

Until now, companies have been feeling a labor shortage, which the new coronavirus has greatly reduced. The Bank of Japan’s Tankan employment index (deficiency excess) has been negative for approximately seven years since the March 2013 survey. In the June 2020 survey, however, it increased by 22 points from the March survey to -6, significantly narrowing the gap between surplus and deficit. The correlation between the employment index and unemployment rate is high, and the unemployment rate tends to fluctuate slightly behind the employment index. Although the increase in bankruptcies and unemployment will be curbed to some extent by the expanded employment adjustment subsidies, the unemployment rate is certain to rise sharply, likely increasing by 4% in the October–December quarter of 2020.

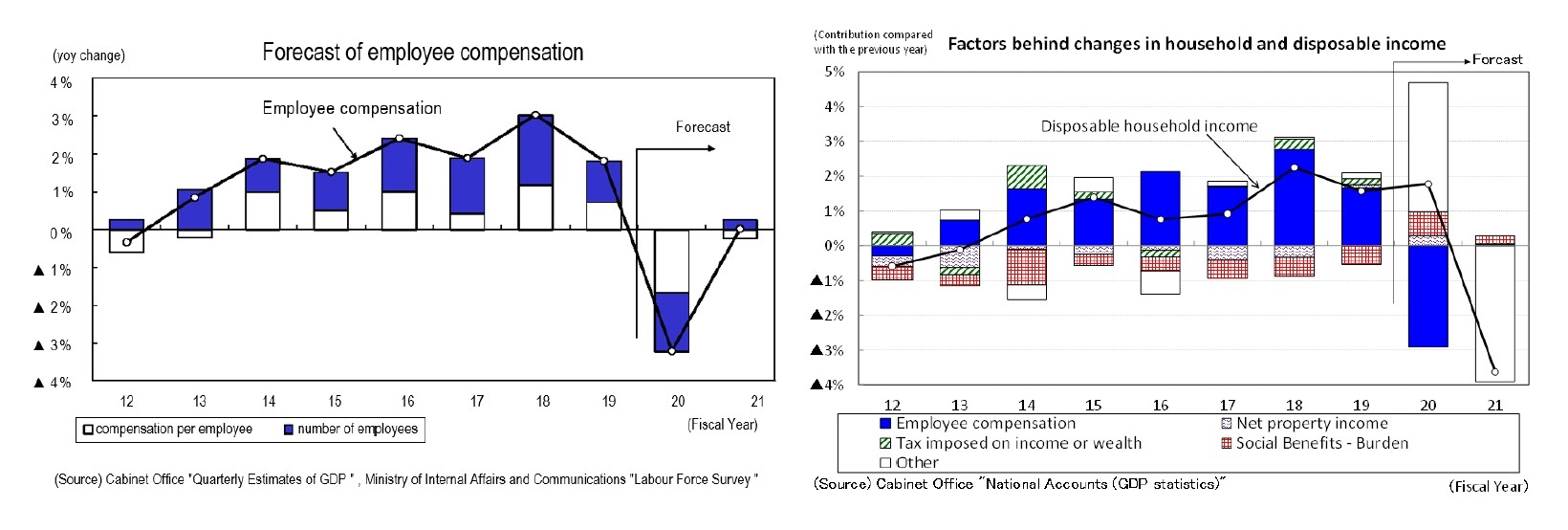

The effects of the new coronavirus are also evident in wages. The epidemic’s impact on the consumption tax hike has complicated the 2020 spring labor offensive, or wage negotiations. In 2020, the wage increase rate (“Major private-sector companies’ demand for wage increases in the spring” by the Ministry of Health, Labor, and Welfare) decreased by 0.18 percentage points from the previous year to 2.00%. Bonuses that are highly linked to business performance have declined even more severely than base salaries. According to a survey by Nihon Keizai Shimbun, bonuses in the summer of 2020 dropped by 5.37% compared to the previous year. Corporate profits had already deteriorated following the slowdown of overseas economies and the hike in the consumption tax rate. In FY 2020, however, many companies were facing a deficit due to the impact of the new coronavirus, and the margin of decrease is expected to exceed that of the world financial crisis. Bonuses are likely to fall further after the winter of 2020.

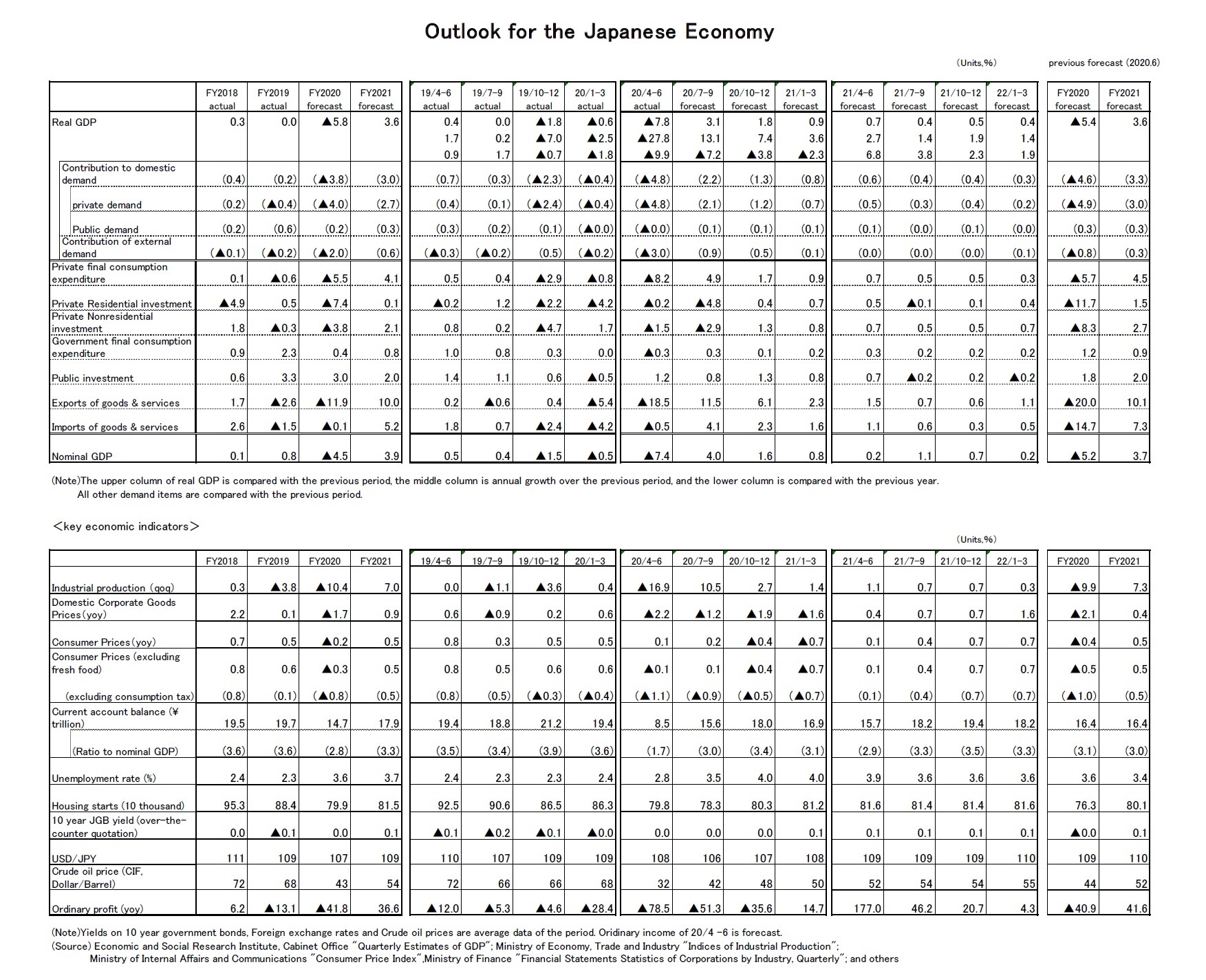

Employers’ remuneration grew steadily, mainly due to an increase in the number of employees because of labor shortages at companies. However, with a decrease in the number of employees and in wages per employee in the April–June quarter of 2020, it declined by 2.7% from the previous year, the first decline since the January–March quarter of 2013. Nominal employee compensation in FY 2020 is expected to decrease by 3.2% from the previous year, the first decrease in eight years.

Yet the provision of special flat-sum benefits will boost households’ disposable income. On a macro basis, the amount of special fixed benefits paid was 12.7 trillion yen, exceeding the decrease of 9.2 trillion yen in employee compensation. Therefore, households’ disposable income in FY 2020 will increase by 1.8% from the previous year, which will ease the decline in consumption. However, because the rise in the amount of special flat-rate benefits is only temporary, disposable income in FY 2021 is expected to decline sharply as a reaction. In the long run, the deterioration of the employment income environment is likely to delay the recovery of consumption.

Employers’ remuneration grew steadily, mainly due to an increase in the number of employees because of labor shortages at companies. However, with a decrease in the number of employees and in wages per employee in the April–June quarter of 2020, it declined by 2.7% from the previous year, the first decline since the January–March quarter of 2013. Nominal employee compensation in FY 2020 is expected to decrease by 3.2% from the previous year, the first decrease in eight years.

Yet the provision of special flat-sum benefits will boost households’ disposable income. On a macro basis, the amount of special fixed benefits paid was 12.7 trillion yen, exceeding the decrease of 9.2 trillion yen in employee compensation. Therefore, households’ disposable income in FY 2020 will increase by 1.8% from the previous year, which will ease the decline in consumption. However, because the rise in the amount of special flat-rate benefits is only temporary, disposable income in FY 2021 is expected to decline sharply as a reaction. In the long run, the deterioration of the employment income environment is likely to delay the recovery of consumption.

(Corporate revenues fall beyond the world financial crisis)

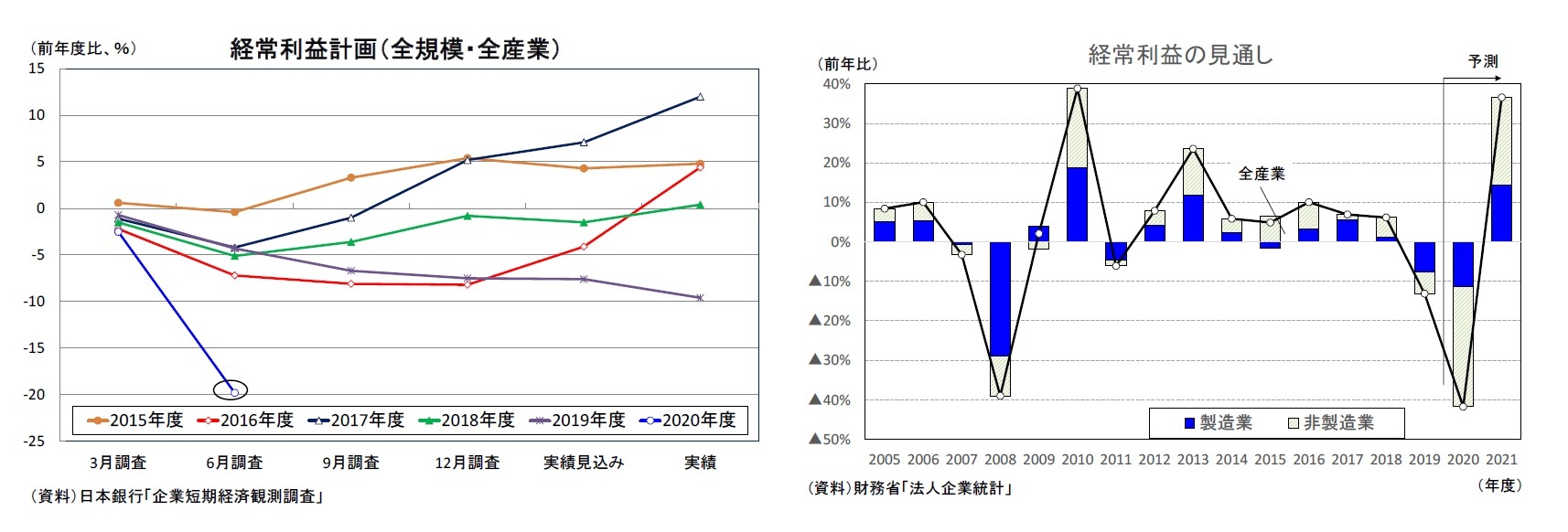

According to the Bank of Japan’s Tankan 2020 June survey, which was conducted after the effects of the new coronavirus epidemic became clear, the recurring profit plan for FY 2020 was significantly revised downward from the March survey to a year-on-year decrease of 19.8%. The June survey also showed a drop in profits exceeding those of 2009 (down 16.4%) after the world financial crisis.

In FY 2019, the Financial Statements Statistics of Corporations by Industry showed a decline in ordinary income for the first time in eight years, down by 13.1% compared to the previous year. In FY 2020, ordinary income will decrease by 41.8% from the previous year, exceeding the 39.0% decrease in FY 2008. In FY 2021, ordinary profit will increase by 36.6% from the previous year, but the declines in FY 2019 and FY 2020 have been so large that ordinary profit in FY 2021 will remain more than 30% below the FY 2018 level, which marked a record high. By comparison, in FY 2008, approximately three-quarters of decline was attributable to the manufacturing sector because the manufacturing sector experienced a sharp decline of 65.5% from the previous year,. However, because principally non-manufacturing industries, such as retail, transportation, restaurants, and lodging, are affected by the new coronavirus, it is highly likely that the non-manufacturing sector will experience a larger decline in FY 2020 than the manufacturing sector.

According to the Bank of Japan’s Tankan 2020 June survey, which was conducted after the effects of the new coronavirus epidemic became clear, the recurring profit plan for FY 2020 was significantly revised downward from the March survey to a year-on-year decrease of 19.8%. The June survey also showed a drop in profits exceeding those of 2009 (down 16.4%) after the world financial crisis.

In FY 2019, the Financial Statements Statistics of Corporations by Industry showed a decline in ordinary income for the first time in eight years, down by 13.1% compared to the previous year. In FY 2020, ordinary income will decrease by 41.8% from the previous year, exceeding the 39.0% decrease in FY 2008. In FY 2021, ordinary profit will increase by 36.6% from the previous year, but the declines in FY 2019 and FY 2020 have been so large that ordinary profit in FY 2021 will remain more than 30% below the FY 2018 level, which marked a record high. By comparison, in FY 2008, approximately three-quarters of decline was attributable to the manufacturing sector because the manufacturing sector experienced a sharp decline of 65.5% from the previous year,. However, because principally non-manufacturing industries, such as retail, transportation, restaurants, and lodging, are affected by the new coronavirus, it is highly likely that the non-manufacturing sector will experience a larger decline in FY 2020 than the manufacturing sector.

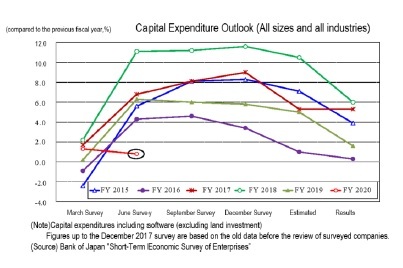

According to the Bank of Japan’s Tankan 2020 June survey, capital investment in FY 2020 (of all company sizes and for all industries, including software investments but excluding land investments) was revised downward by 3.7% from the March survey, a 0.8% increase from the previous year. Although the increase plan was maintained, the growth rate in the June survey was the lowest since FY 2009 (down 12.7% from the previous year). Although some investments in telecommuting and remote service-related businesses have been expanding, overall, there have been increasing moves to postpone or cancel investment plans due to worsening corporate profits and growing economic uncertainty. The capital investment plan is likely to be revised downward again after the September survey following further deterioration of corporate profits, and the FY 2020 results are expected to show the first decrease since FY 2010 (down 2.2% from the previous year).

According to the Bank of Japan’s Tankan 2020 June survey, capital investment in FY 2020 (of all company sizes and for all industries, including software investments but excluding land investments) was revised downward by 3.7% from the March survey, a 0.8% increase from the previous year. Although the increase plan was maintained, the growth rate in the June survey was the lowest since FY 2009 (down 12.7% from the previous year). Although some investments in telecommuting and remote service-related businesses have been expanding, overall, there have been increasing moves to postpone or cancel investment plans due to worsening corporate profits and growing economic uncertainty. The capital investment plan is likely to be revised downward again after the September survey following further deterioration of corporate profits, and the FY 2020 results are expected to show the first decrease since FY 2010 (down 2.2% from the previous year).Capital investment has remained firm, mainly in the areas of labor-saving methods to cope with labor shortages, urban redevelopment, inbound construction, and research and development (R & D), thanks to ample cash flow from increased corporate earnings. If cash flow declines significantly, reflecting a sharp downturn in corporate earnings, companies will inevitably become more cautious about capital investment, and it will take time for capital investment to recover fully even after corporate earnings turn upward.

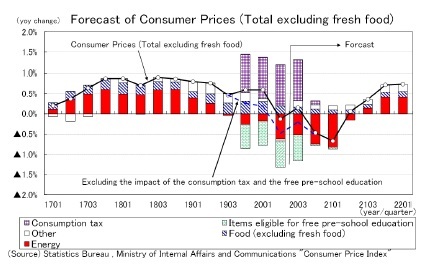

(Price outlook)

The core CPI (all items excluding fresh food), which has been rising since January 2017, declined by 0.2% in April 2020 from the previous year for the first time in three years and four months. This decline resulted from a further decrease in energy prices following the sharp drop in oil prices, as well as reductions in domestic travel, accommodation prices reflecting a heavy cutback in overseas travel, and package tours abroad. In June, CPI is expected to increase slightly in July,mainly due to a rise in energy prices. However, excluding the effects of the consumption tax rate hike and the free preschool education system, the rate of increase remains negative. Because the effects of the consumption tax rate hike (as well as free preschool education) will run their course from October, the rate of increase in headlines is likely to turn negative again.

The core CPI (all items excluding fresh food), which has been rising since January 2017, declined by 0.2% in April 2020 from the previous year for the first time in three years and four months. This decline resulted from a further decrease in energy prices following the sharp drop in oil prices, as well as reductions in domestic travel, accommodation prices reflecting a heavy cutback in overseas travel, and package tours abroad. In June, CPI is expected to increase slightly in July,mainly due to a rise in energy prices. However, excluding the effects of the consumption tax rate hike and the free preschool education system, the rate of increase remains negative. Because the effects of the consumption tax rate hike (as well as free preschool education) will run their course from October, the rate of increase in headlines is likely to turn negative again.

Although the future rate of increase in the core CPI will depend largely on the trend of crude oil prices, the underlying price trend will remain weak for the time being because the GDP gap remains negative throughout the forecast period. Downward pressure from the supply and demand side also will continue, and a fall in wages will cause a decline in service prices.

Although the future rate of increase in the core CPI will depend largely on the trend of crude oil prices, the underlying price trend will remain weak for the time being because the GDP gap remains negative throughout the forecast period. Downward pressure from the supply and demand side also will continue, and a fall in wages will cause a decline in service prices.Core CPI growth is forecast to be down by 0.3% (-0.8%) in FY 2020 and by 0.5% in FY 2021 (the figures in parentheses exclude the effects of the consumption tax hike and the free preschool education program).

Please note that the data contained in this report have been obtained and processed from various sources, and their accuracy and safety cannot be guaranteed. The purpose of this publication is to provide information. The opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング