- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Kazumasa Takeuchi

Font size

- S

- M

- L

4.Land Prices

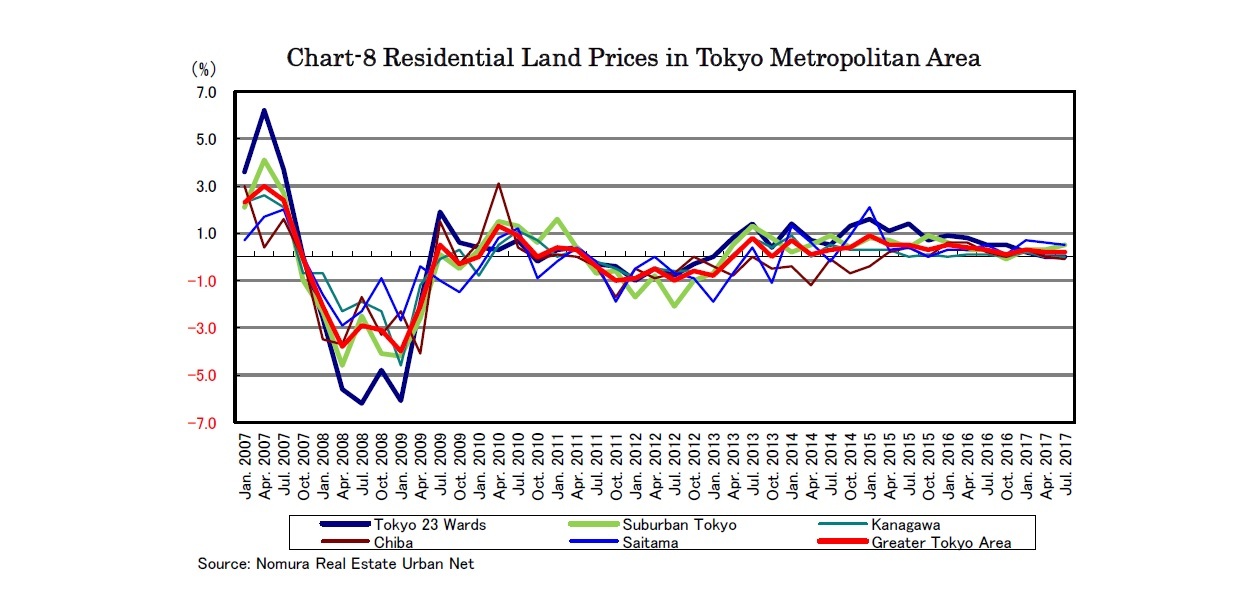

According to Nomura Real Estate Urban Net, residential land prices in the Tokyo metropolitan area rose for the fifteenth consecutive quarter since January 2014 (Chart-8). However, prices have been somewhat cooling down in parts, as Tokyo 23 wards posted 0.0% y-o-y for the second consecutive quarter.

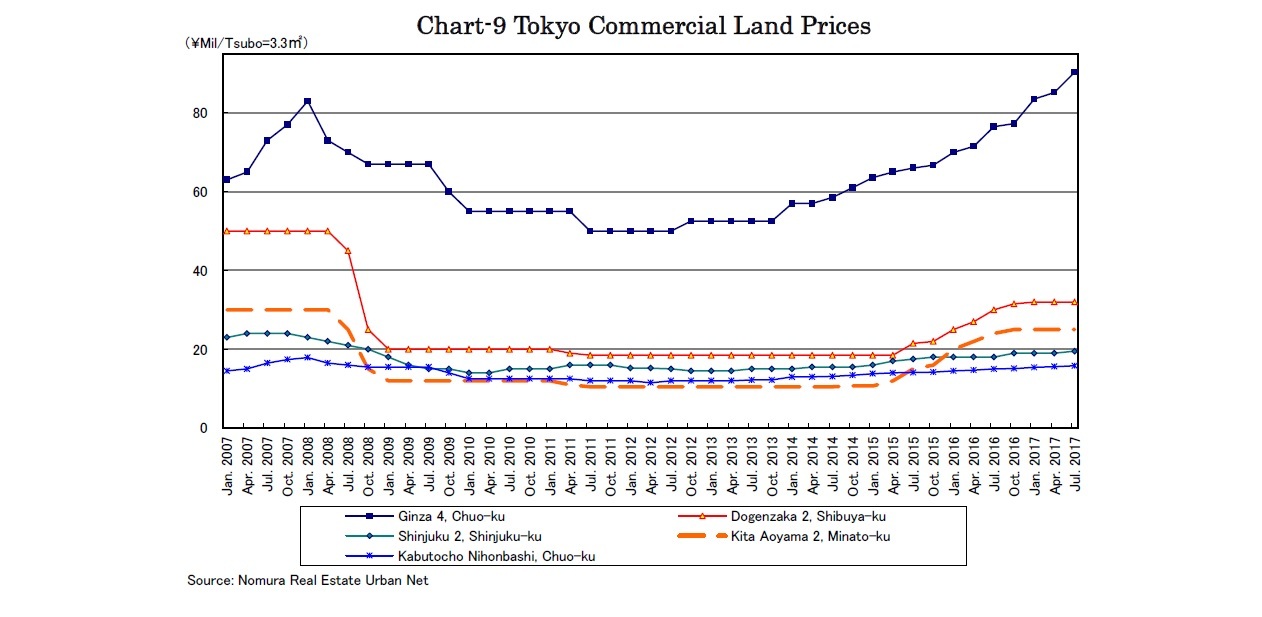

Commercial land prices in the center of Tokyo appreciated significantly in Ginza, however, those in Kita Aoyama and Shibuya have apparently leveled off (Chart-9).

5.Sub-sectors

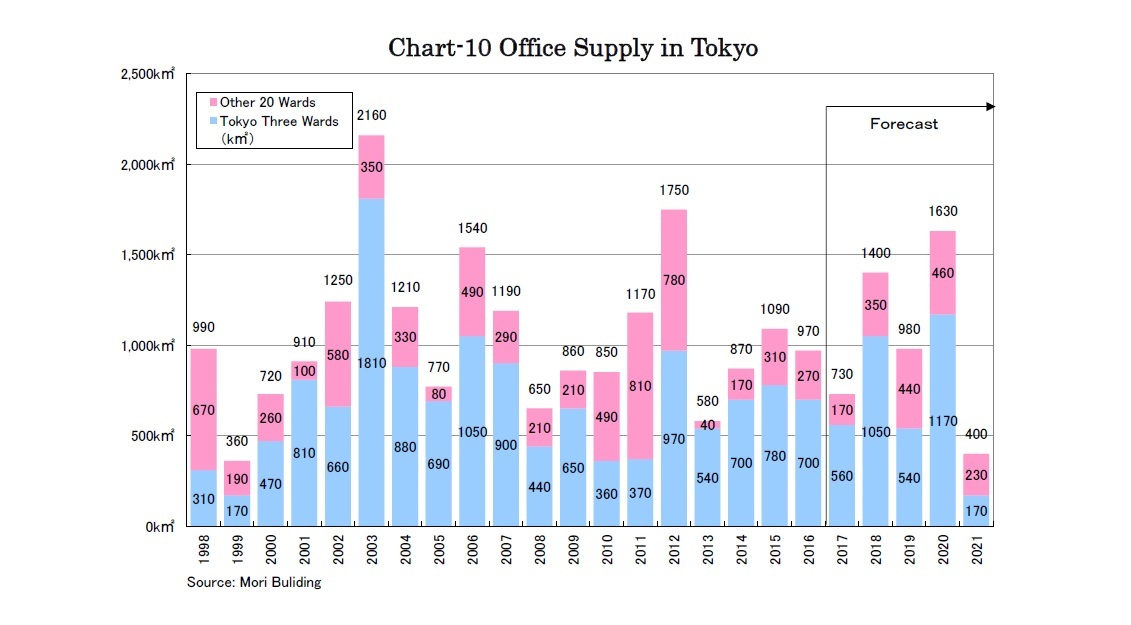

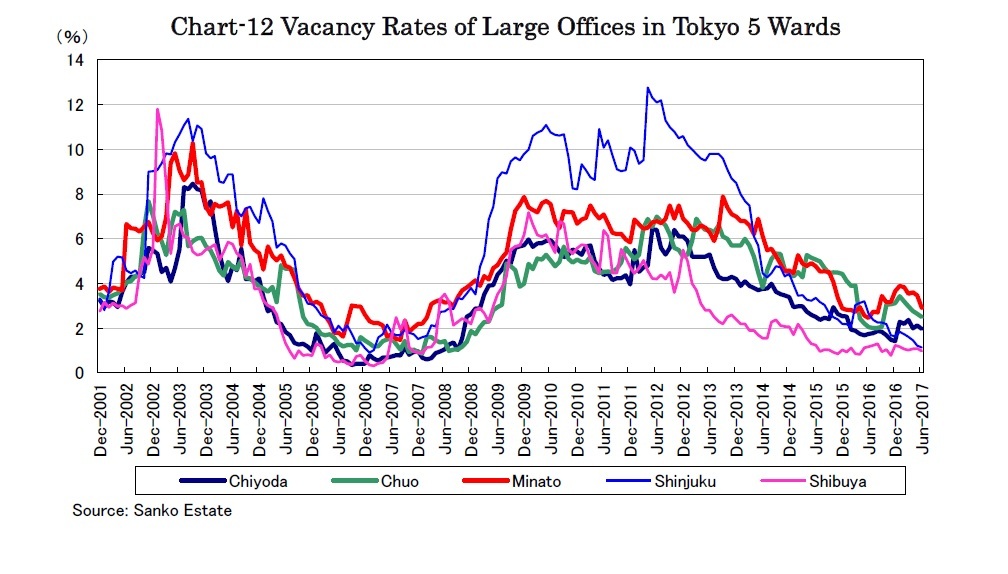

Large buildings such as Otemachi Park Building, Ginza Six and Hibiya Parkfront were completed in the first half of 2017, followed by Akasaka Intercity Air and an office tower in front of Meguro station scheduled for the latter half of 2017. These new and upcoming office buildings have smoothly secured tenants, as seen by Akasaka Intercity Air being fully occupied before completion and Amazon Japan reserving 19,000 square meters in the office tower in front of Meguro station. Thus, anxiety concerning vacancy rate hikes due to large supply has mostly disappeared for 2017. However, many office buildings with total space of 4 million square meters are under construction and scheduled to be completed in 2018, 2019 and 2020 (Chart-10).

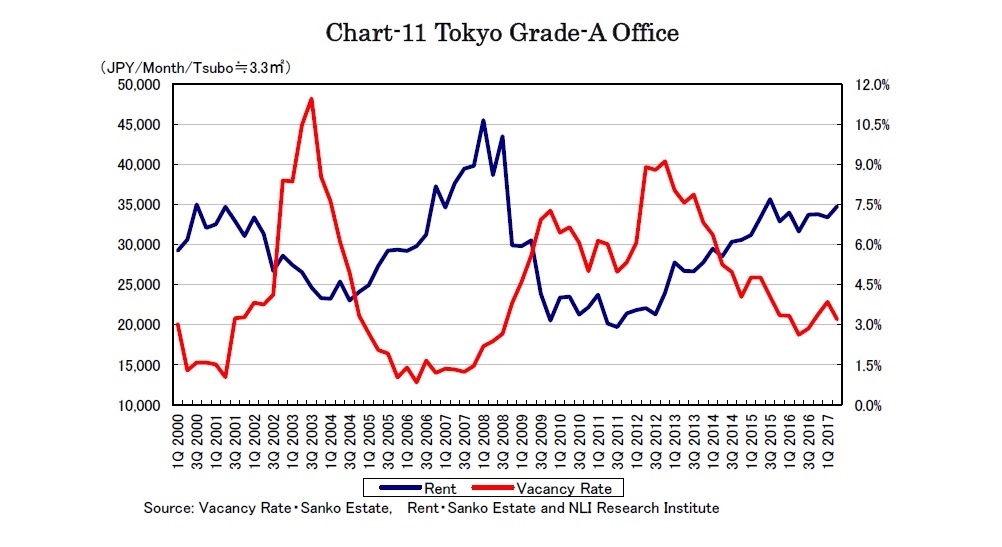

Several business trends have contributed to the current strong office demand such as consolidation of separated offices to one large building; moving from old, self-owned buildings to new, leased buildings; expanding offices by IT companies; and upgrading offices in order to recruit competitive staff amidst the current labor shortage. In addition, demolition of old office buildings being redeveloped into condominiums and hotels have also contributed to the tight office supply and demand.

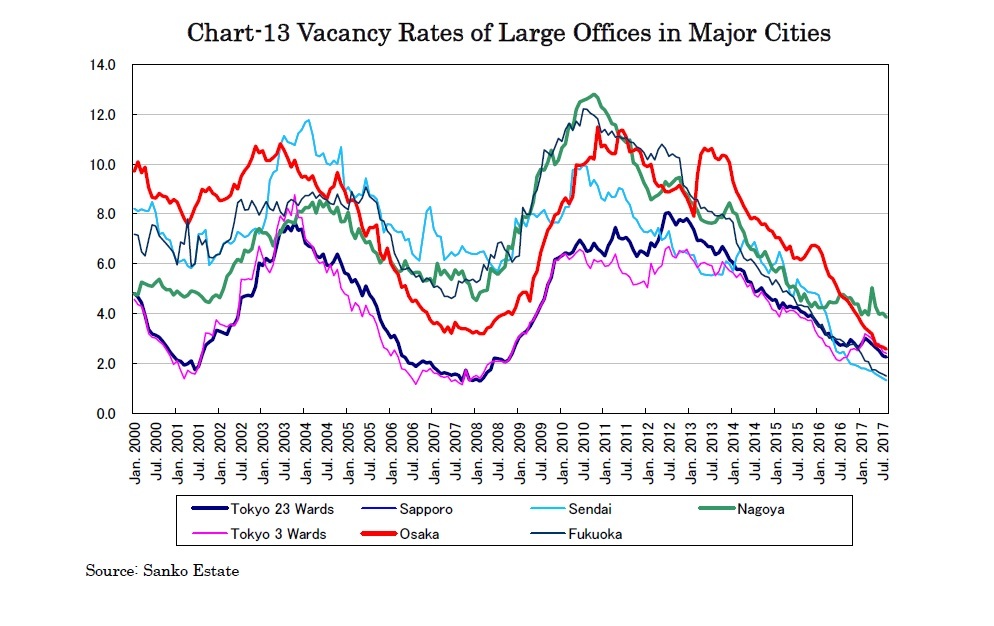

In local cities, office leasing markets have been even better than in Tokyo, as seen by very low vacancy rates such as 1.4% in Sapporo and 1.56% in Fukuoka (Chart-13). Several new buildings were completed in the first half of 2017 such as Nakanoshima Festival Tower in Osaka, JR Gate Tower and Global Gate West Tower in Nagoya, Fukoku Seimei Koshiyama Building in Sapporo and Nomura Sendai Aobadori Building in Sendai. However, no large buildings are scheduled to be completed in the second half of 2017 and the supply-demand balance will become tighter as a result.

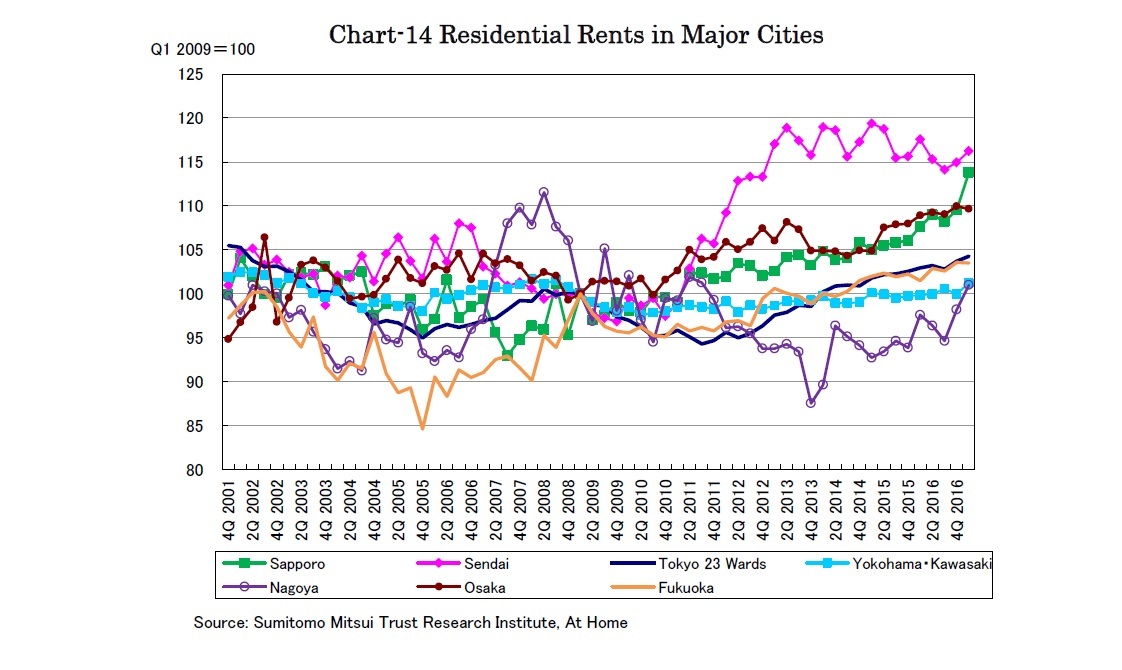

Residential rents have been rising led by those in Tokyo, Sapporo and Fukuoka (Chart-14). However, leasing demand does not appear so strong as the number of new leasing contracts has decreased for the sixteenth consecutive month. Particularly, the vacancy rates of apartments for lease have been rising, pushed by increasing housing starts.

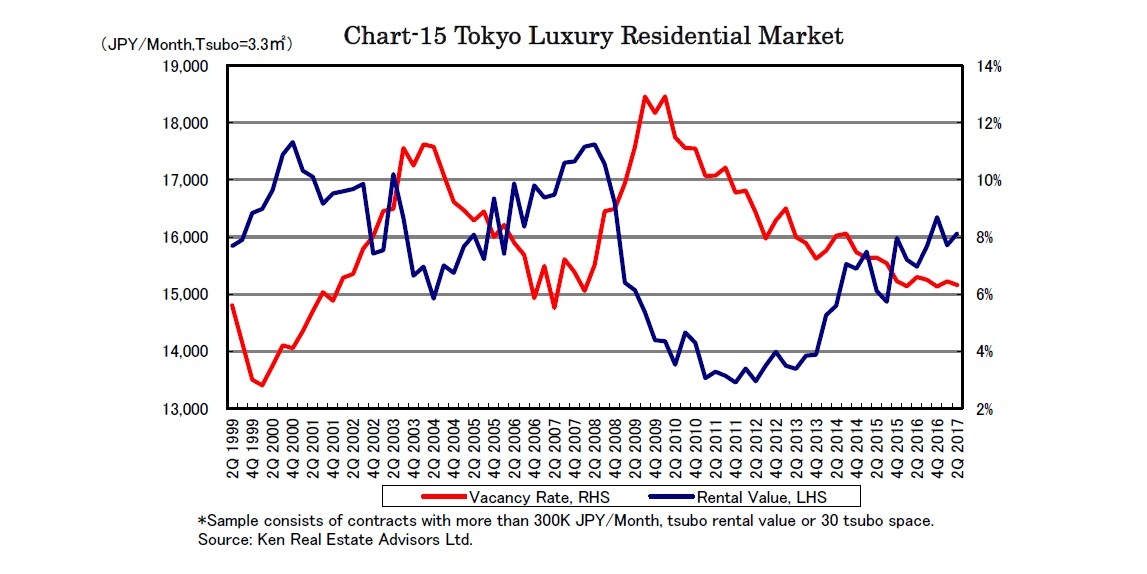

On the other hand, the Tokyo luxury residential market has been robust with improved vacancy rates and rents rising by 3.8% y-o-y in the second quarter (Chart-15).

Kazumasa Takeuchi

Research field