- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Kazumasa Takeuchi

Font size

- S

- M

- L

1.Economic Conditions

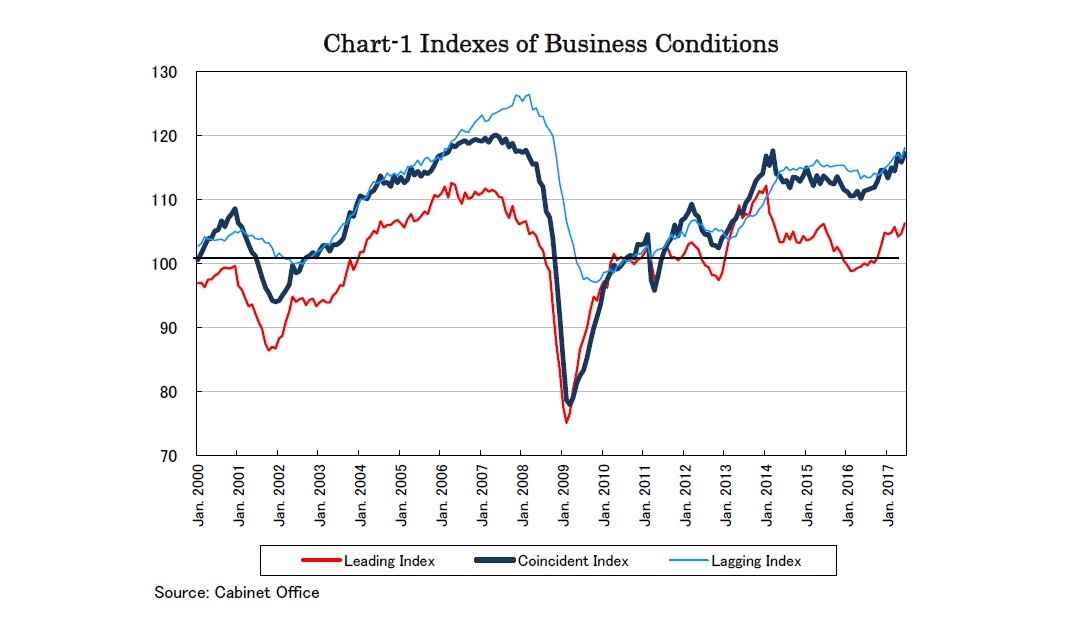

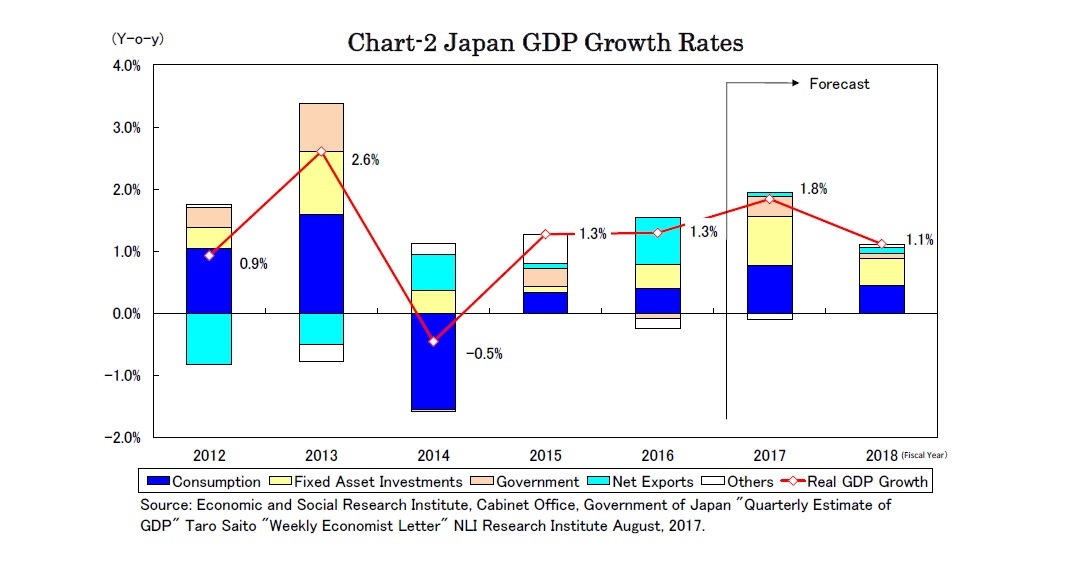

Corporate earnings marked a record high for the second consecutive quarter and private consumption is also recovering on the back of favorable employment conditions and healthy equity markets. NLI Research Institute forecasts a real GDP growth rate of 1.8% for 2017 (Chart-2), led by the corporate sector.

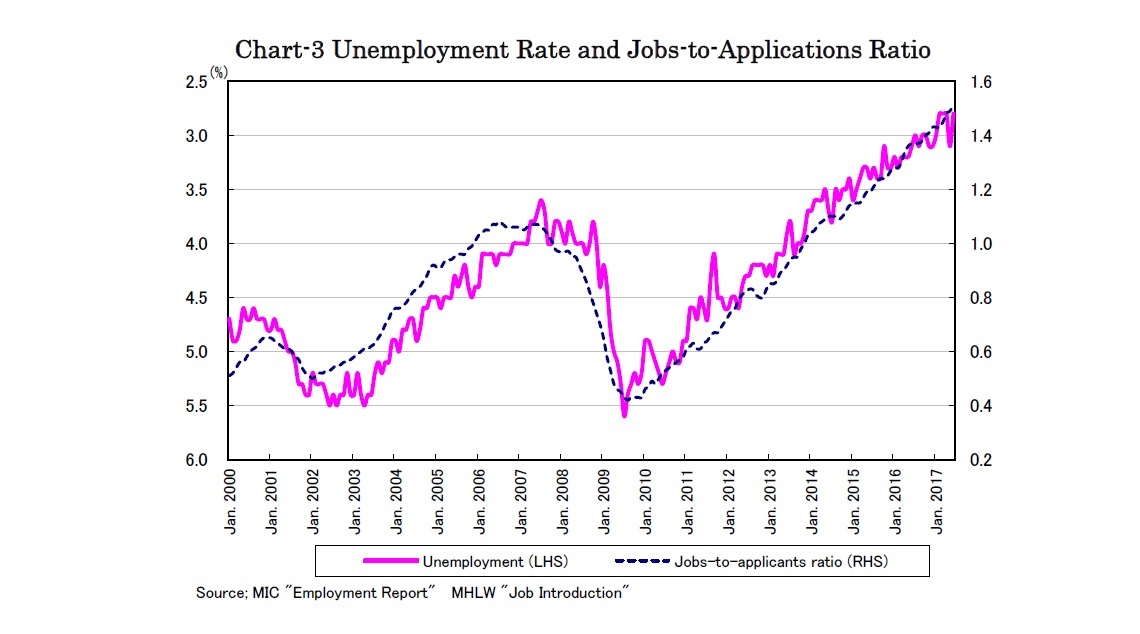

2.Labor Shortage and Population Decline

Labor shortages have spread into many industries as 60.6% of respondents answered “labor shortage” in the labor survey by The Japan Chamber of Commerce and Industry in July, particularly in industries such as lodging and restaurants at 83.8%, logistics and transportation at 74.1%, nursing and caring at 70.0% and construction at 67.7%.

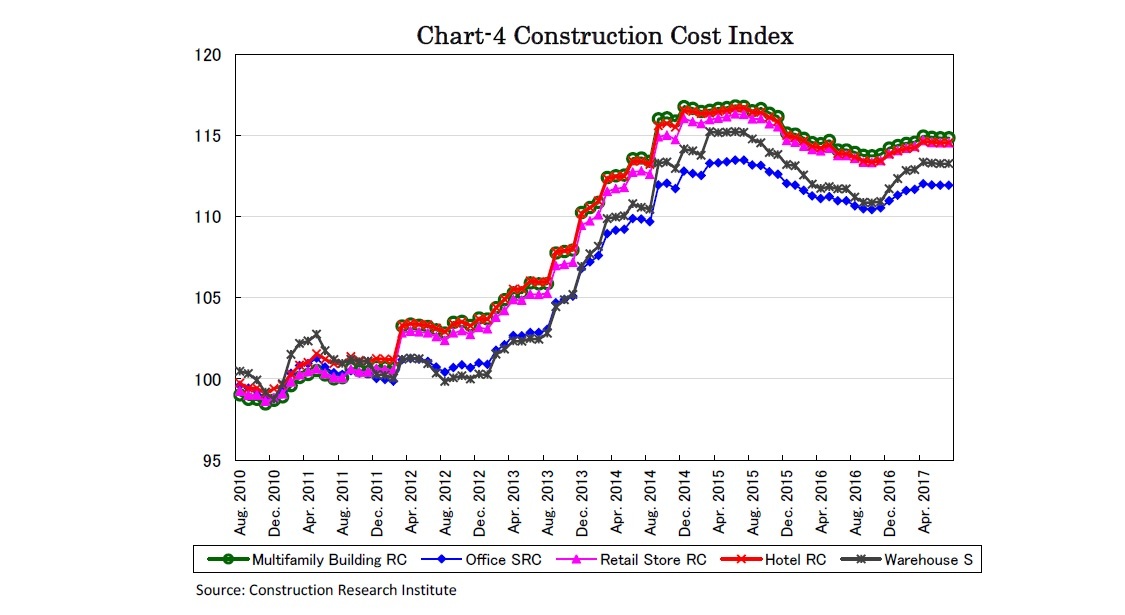

While the labor shortage in the construction industry has been gradually moderated by increasing wages since 2014, construction costs have apparently begun to rise again (Chart-4).

The aging and shrinking of Japan’s population which declined by 300,000 in 2016 is clearly a significant factor contributing to the labor shortage. On the other hand, with growth of 140,000 in 2016, the increase in foreign residents has gradually become obvious.

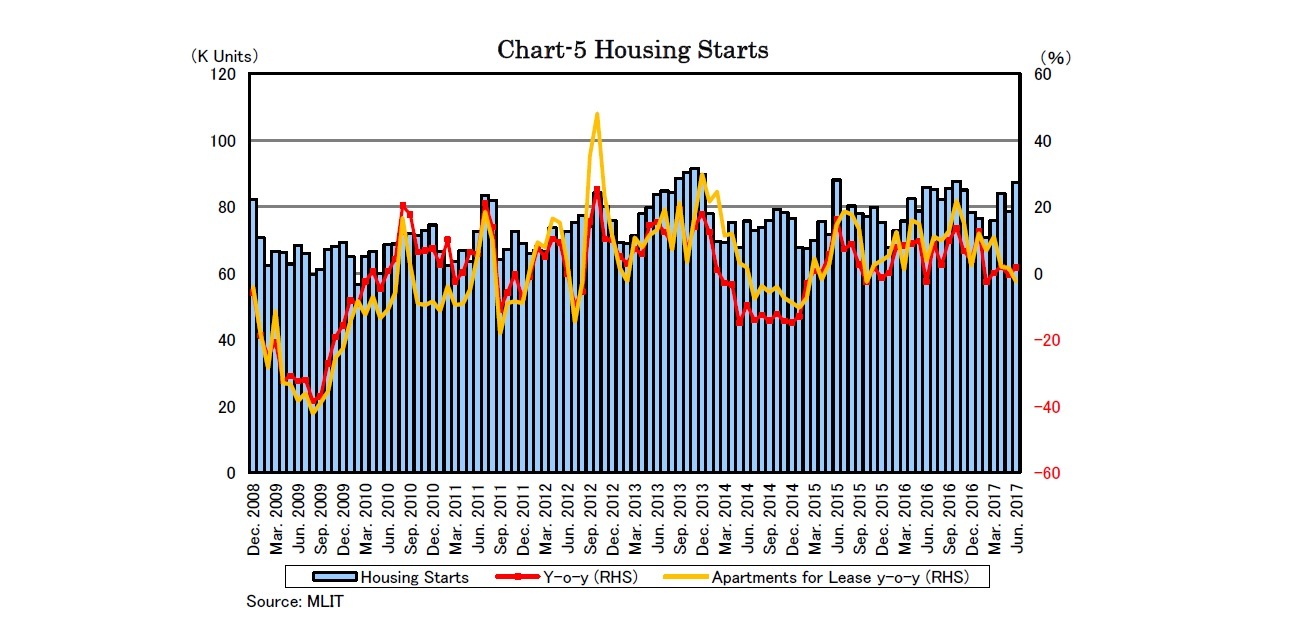

3.Housing Market

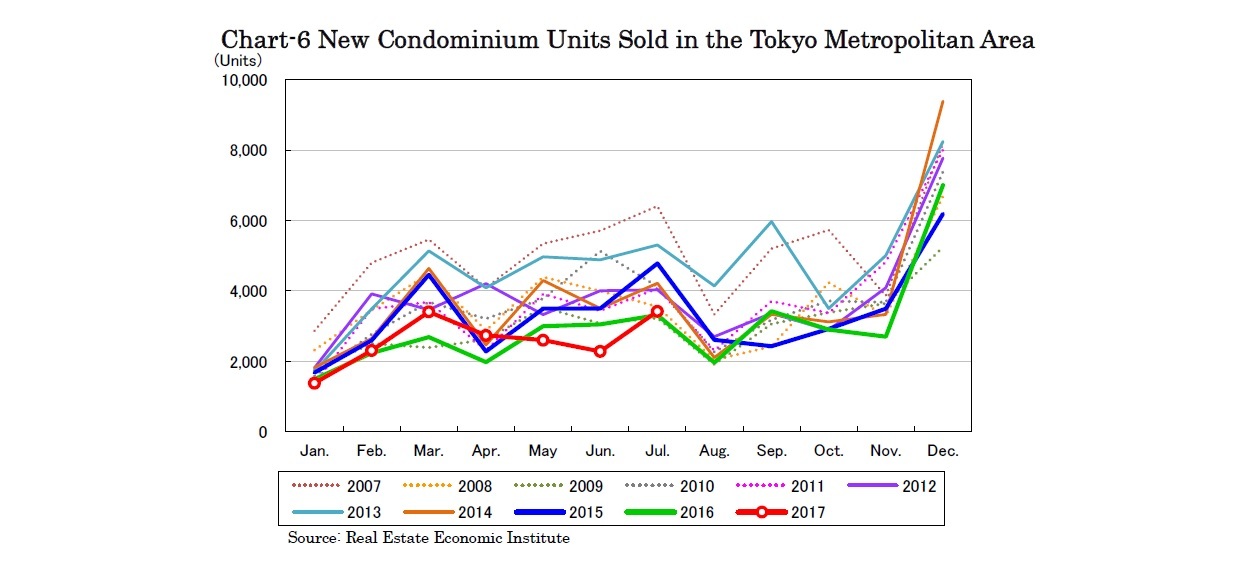

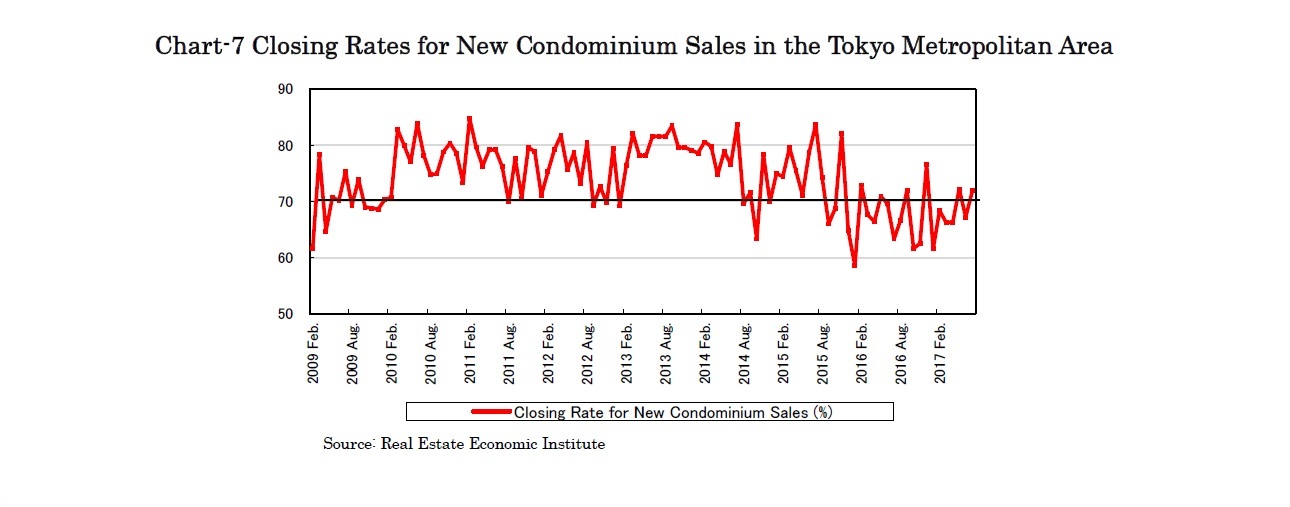

The number of new condominium units sold in the Tokyo metropolitan area was the smallest in 10 years in May and June (Chart-6). Because of expensive prices, closing rates for new condominium units have often fallen below 70%, the so-called boundary between favorable and poor sales conditions (Chart-7). While the number of contracted new units priced at less than 50 million JPY has decreased significantly in recent years, the number of luxury units at over 80 million JPY has been increasing. With rising construction costs, condominium units at less than 50 million JPY have increasingly become difficult to supply in the Tokyo metropolitan area. The closing rates for luxury units have been volatile, susceptible to changes in taxation policies and equity market trends.

Kazumasa Takeuchi

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング