- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Eriko Kato

Font size

- S

- M

- L

4.J-REIT and Property Investment Markets

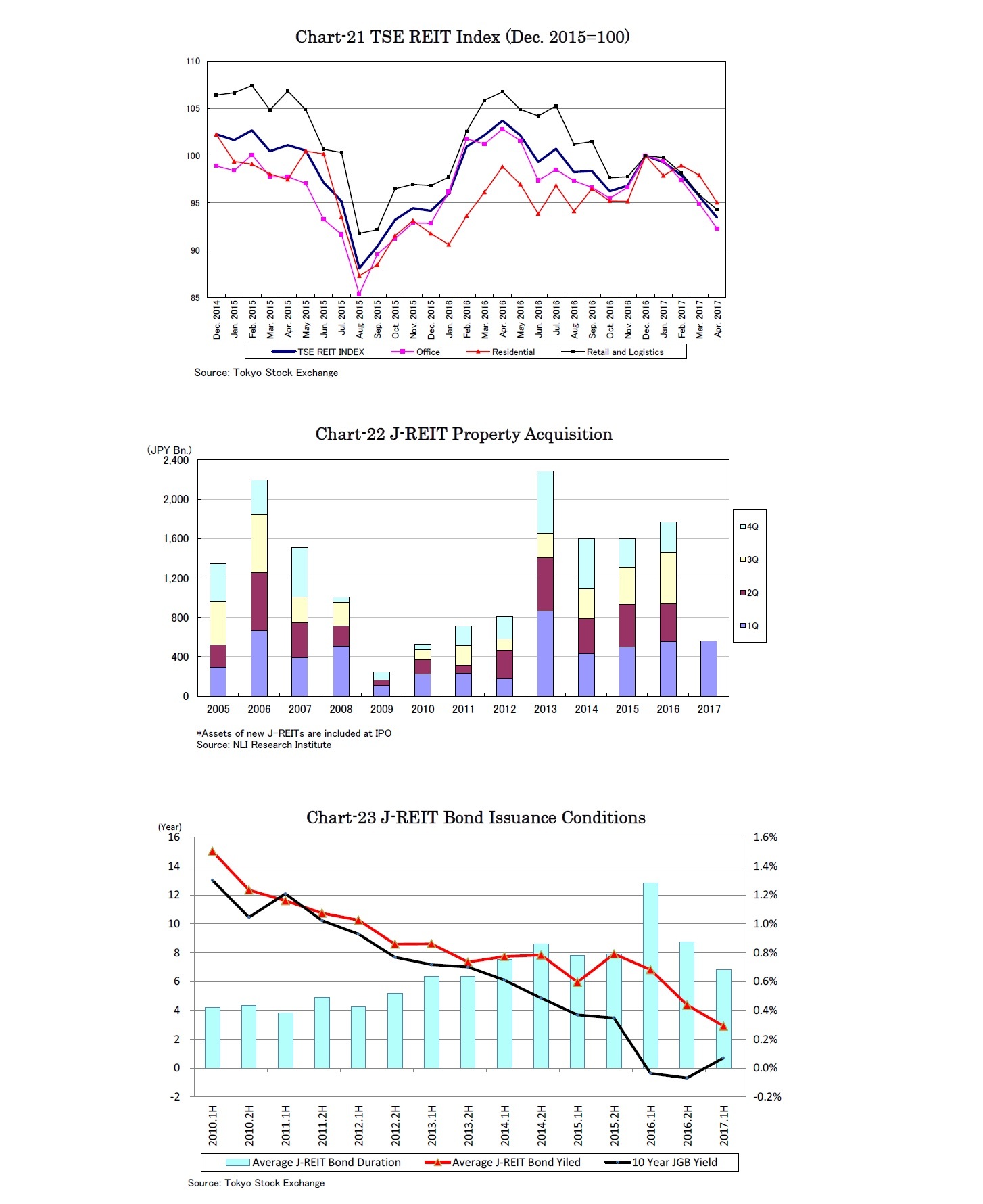

At the end of March, the value of the J-REIT market was 11.9 trillion JPY, while the price-to-NAV ratio was 1.2 times and the dividend yield was 3.7%, with a 3.7% yield spread on 0% of 10-year JGBs.

J-REITs acquired properties amounting to 561 billion JPY in the first quarter, increasing by 2% y-o-y (Chart-22). Mori Trust Hotel REIT was listed with 4 assets valued at 102 billion JPY, and the number of J-REITs increased to 58.

Though the recent interest rate hike in the U.S. has worried investors, 10-year JGB yields have remained around 0% due to the “yield curb control by Bank of Japan” while debt funding conditions have been extremely favorable.

J-REITs issued 32 billion JPY of bonds at an average yield of 0.32% in the first quarter, 0.51% lower than in the fourth quarter of 2016 (Chart-23). The current bond issuance conditions for J-REITs are 0% for 3-year, 0.2% for 5-year and 0.5% for 10-year bonds.

The average bond duration held by J-REITs was greater than 10 years under the negative interest rate environment last year. However, J-REITs have flexibly managed bond issuance conditions and the average duration has shortened to 7-8 years following introduction of “yield curb control by Bank of Japan.” The current average debt costs of J-REITs are 0.8%. In the case that debt costs are brought to 0.5%, earnings of J-REITs will increase by 5%.

Both general corporations and J-REITs disposed their assets at the current high prices with NOI yields of less than 4% of the Tokyo CBD. Even logistics facilities were disposed by not only developers but also a J-REIT.

Investors have looked for relatively high yields and have acquired large and relatively new office buildings located in fringe areas such as Tennozu Isle, Shinagawa Seaside and Yokohama Minato Mirai 21.

* This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability.

In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

Eriko Kato

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング