- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Eriko Kato

Font size

- S

- M

- L

1.Economy and Housing Market

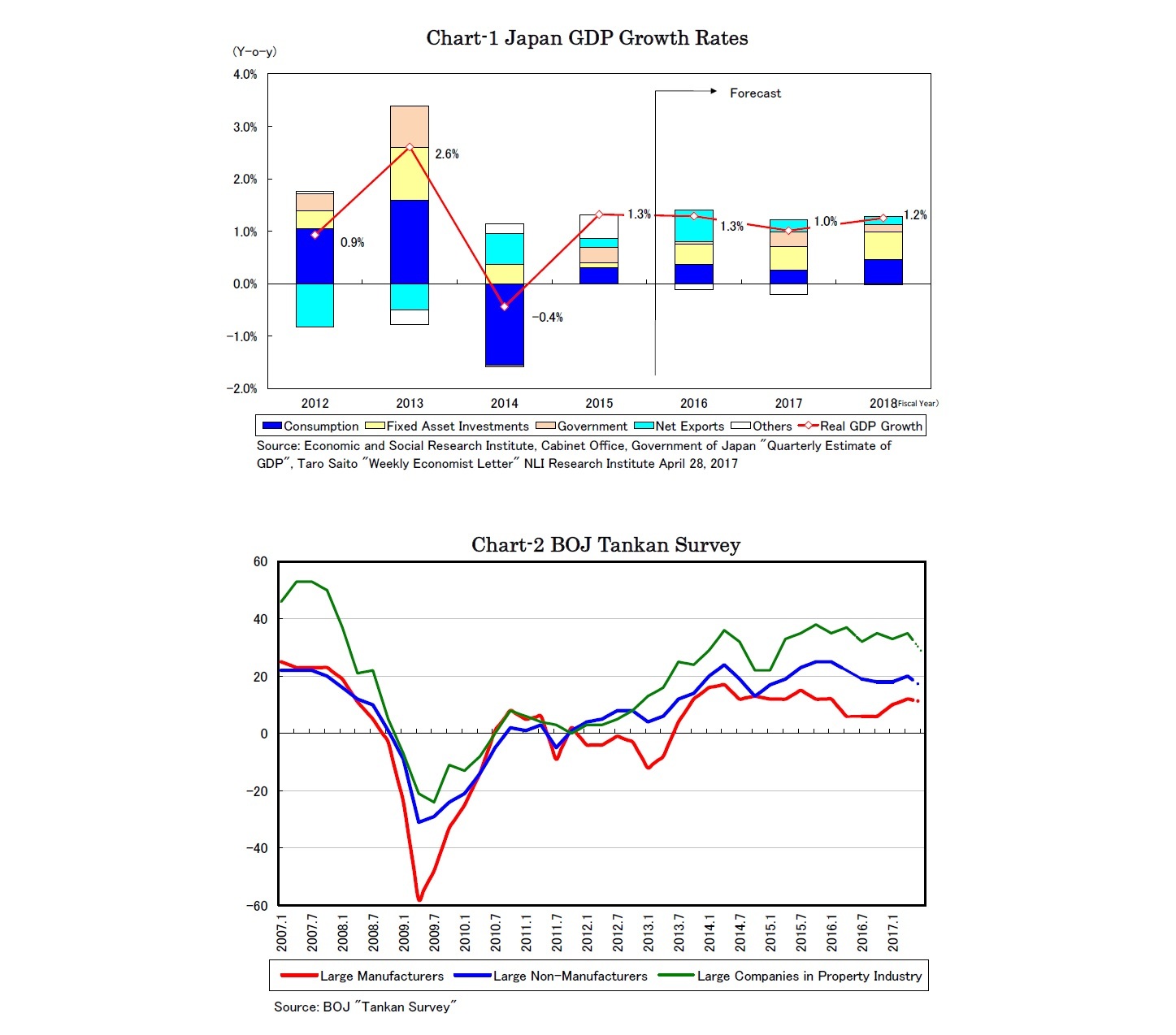

In the BOJ Tankan Survey, the current business confidence D.I. of both large manufactures and non-manufacturers improved (Chart-2). The D.I. of large companies in the property industry has remained above the 30-point level but the three-month forecast deteriorated to the 28-point level reflecting increasing uncertainty.

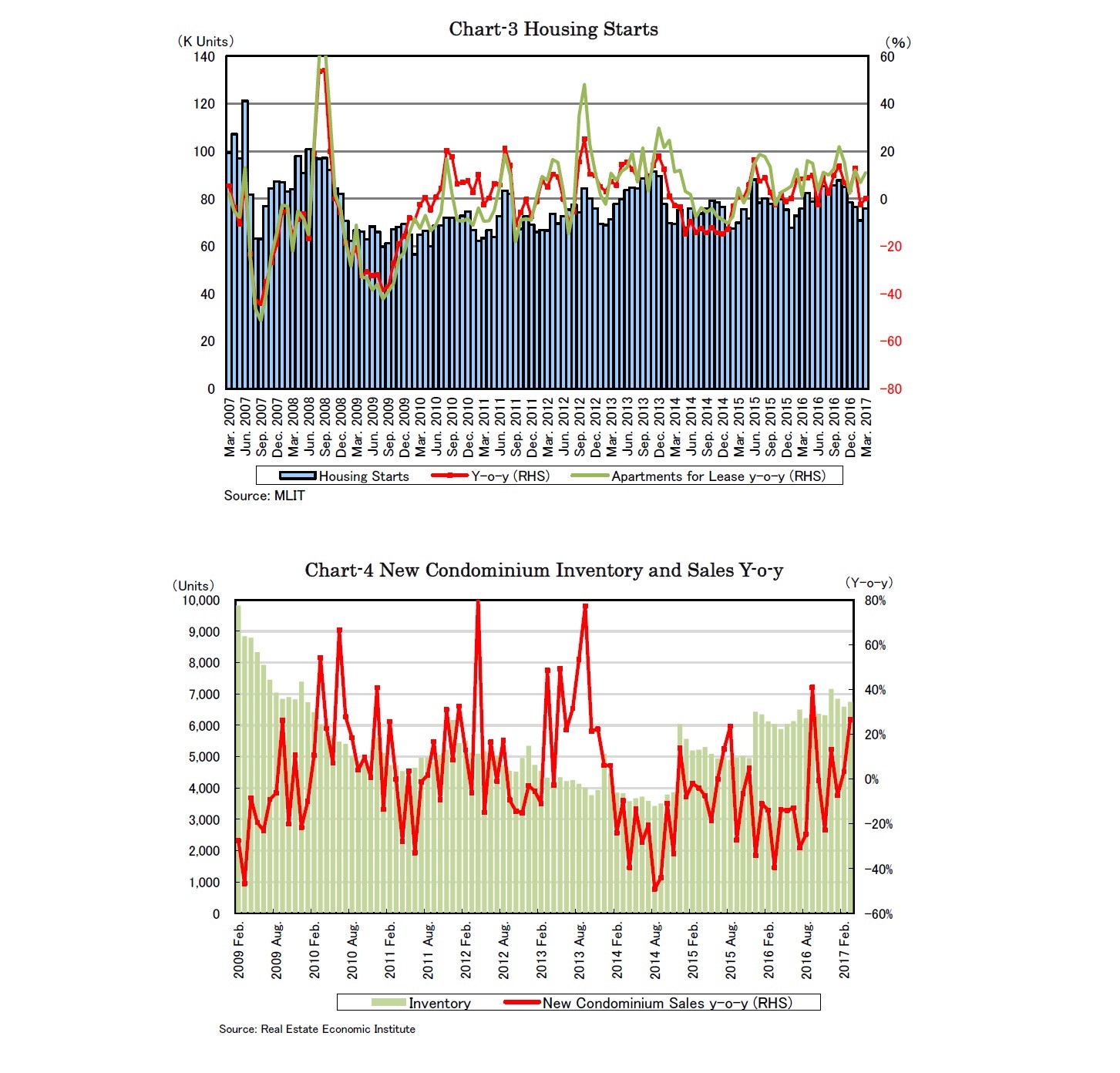

The number of new condominium units sold in the Tokyo metropolitan area increased by 10% y-o-y to 7,102 in the first quarter, however, the contracted rate dropped below 70% and inventories have accumulated (Chart-4). New condominium prices have stopped rising and leveled off. Some developers have furnished their units for free to clear their inventories, which suggest that new condominium prices are about to decline.

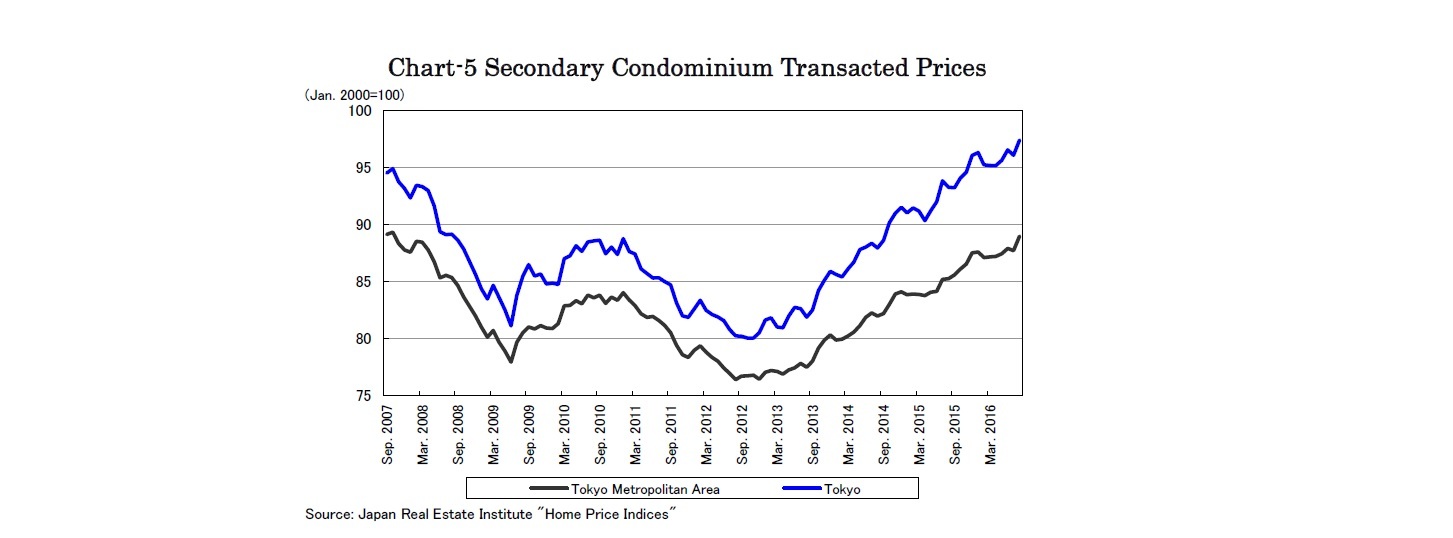

The transaction volume in the secondary condominium market in the Tokyo metropolitan area remained the same as last year. After rising for years, condominium prices have become too expensive for ordinary people looking for their own home (Chart-5), urging potential buyers to move to the residential leasing market.

2.Land Prices

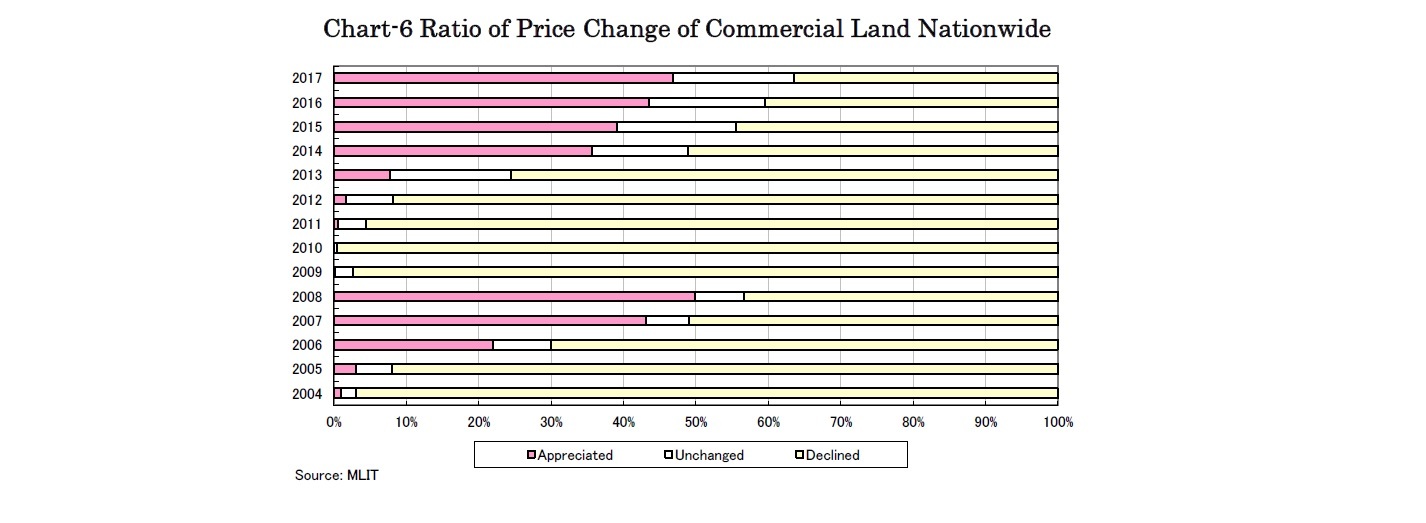

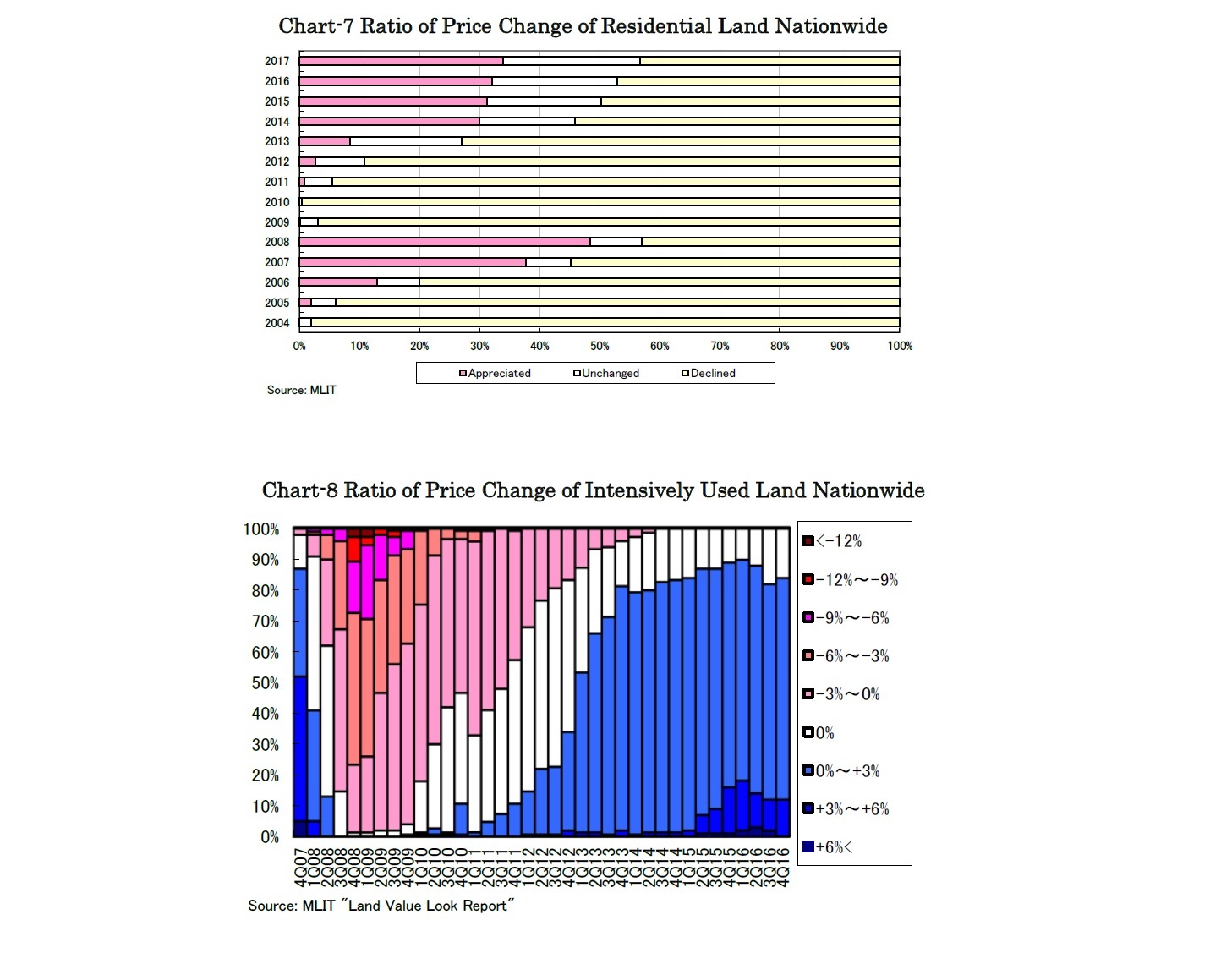

The six commercial sites that performed the best nationally all turned out to be in the Kansai area, with the top five sites located in Osaka and the sixth site in Kyoto. Strong demand for hotels and retail stores has lifted commercial land prices backed by the increase in foreign visitors, despite the noticeable shrink in spending volume per visitor. On the other hand, seven of ten residential sites that performed the best nationally turned out to be in Miyagi prefecture, suggesting a steady home demand in recovering areas affected by the Great East Japan Earthquake.

Regarding “Land Value Look Report” published quarterly by MILT, the number of sites with no land price change has increased since the third quarter of 2016 (Chart-8). It appears land price appreciation has lost steam as the land price of only one site with land price appreciation increased while sites with land price appreciation of more than 6% q-o-q disappeared in the fourth quarter.

Eriko Kato

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング