- NLI Research Institute >

- Real estate >

- Overseas Property Investments by Asian Insurers-Chinese Insurers Emerge as Global Main Players-

Overseas Property Investments by Asian Insurers-Chinese Insurers Emerge as Global Main Players-

mamoru masumiya

Font size

- S

- M

- L

4|Overseas Property Investments by Mainland Chinese Insurers

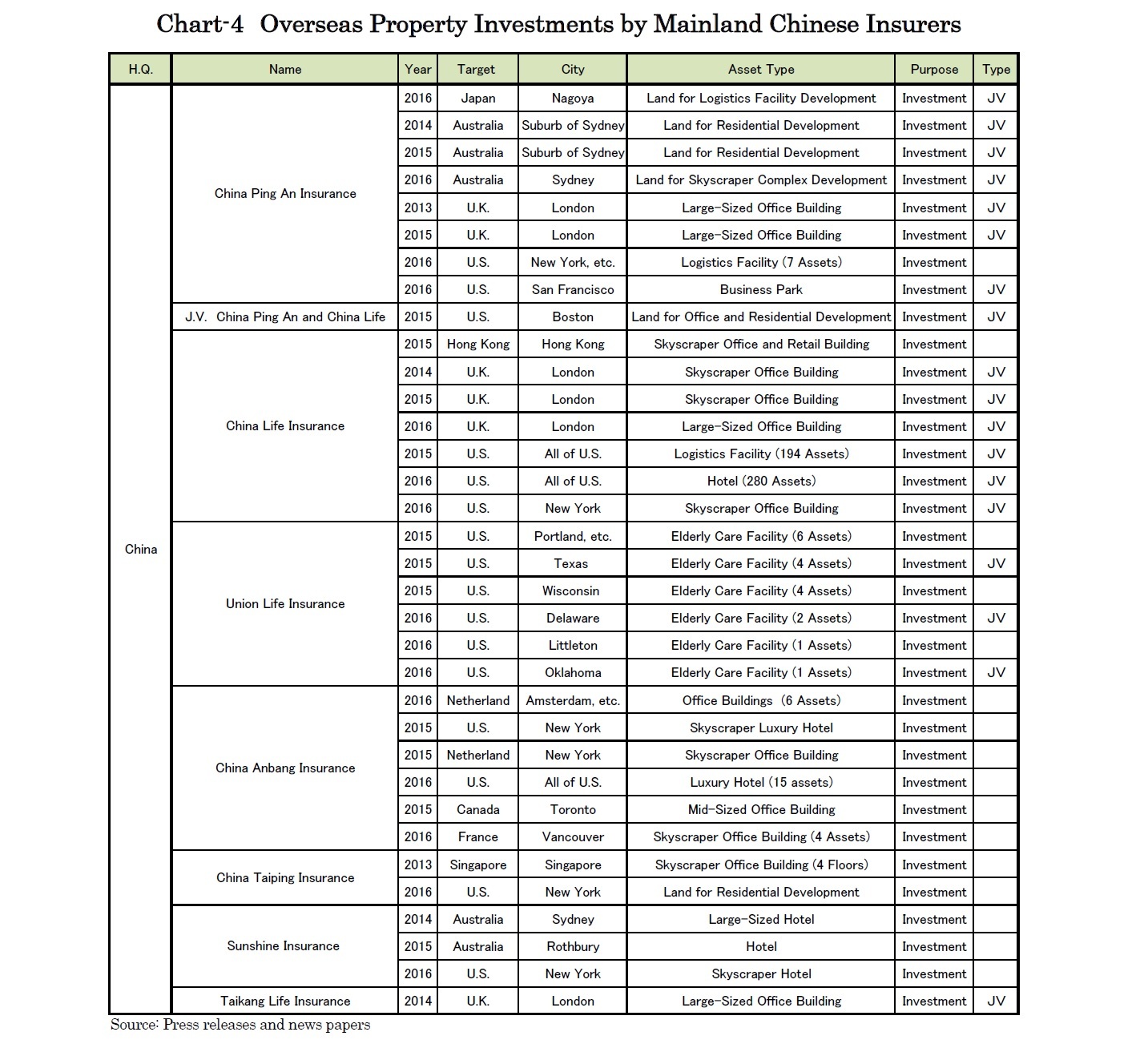

Not only leading insurers such as China Ping An Insurance and China Life Insurance, but also the following several insurers have already invested in properties overseas (Chart-4). Even when compared with those of Taiwan and South Korea, the number of insurers from mainland China investing in properties overseas is larger, and it appears that additional insurers will start investing hereafter.

Particularly, some giant deals by mainland Chinese insurers have gathered attention in the global market, such as China Life Insurance acquiring 70% of 10 Upper Bank Street, a skyscraper in Canary Wharf, London, at 795 million pounds in 2014, China Anbang Insurance acquiring Waldorf Astoria New York, a luxury skyscraper hotel, at 1.95 billion dollars in 2015 and China Life Insurance acquiring 1285 Sixth Avenue, a skyscraper office in Manhattan, at 1.65 billion dollars together with New York-based RXR in 2016.

Besides the overwhelming scale, mainland Chinese insurers have also invested in property development projects overseas. Particularly, China Ping An Insurance has aggressively invested in several property development projects overseas. For example, it has invested in 50% of a redevelopment project in Sydney with Australia-based Lend Lease and Japan-based Mitsubishi Estate, building a new landmark skyscraper complex in the city center.

5|Final Note

Reviewing the global property investment market overall, sovereign wealth funds have been regarded as representative Asian investors, consisting of public pension funds and foreign reserve managers such as GIC of Singapore and CIC of China. With the asset growth of SWFs and others, property investments outside of Asia by Asian investors have significantly increased in recent years (Chart-5).

Mainland Chinese and other Asian insurers have increasingly gathered market attention following SWFs and become one of main players in the global property investment market. It is possible that Asian insurers will become one of main players even in Japan where they have yet to make sizable property investments.

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング